We thought it would be insightful to look back at our previous lists to see where some of those companies are today. Here’s a look at the top 3 companies from the Top 20 Life Science Startups to Watch in the U.S. from 2017.

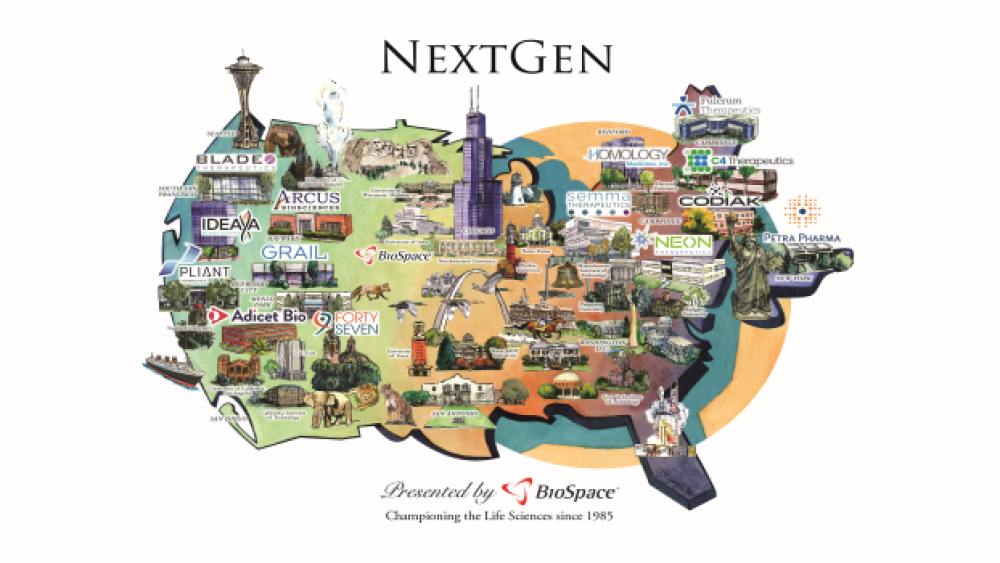

Every year, BioSpace analyzes the biotech industry, looking for the hot new biotech startups to watch. We then produce the NextGen Bio “Class of…,” twenty companies ranked based on several categories, including Finance, Collaborations, Pipeline, and Innovation. The companies were typically launched no more than 18 months before the list was created.

We thought it would be insightful to look back at our previous lists to see where some of those companies are today. Here’s a look at the top 3 companies from the Top 20 Life Science Startups to Watch in the U.S. from 2017.

#1. Denali Therapeutics. Based in South San Francisco, Denali Therapeutics was top of our list for 2017. The company originally raised $347 million in venture capital in two rounds from five investors. Early on it developed a series of high-level licensing deals, one with Genentech to develop and commercial LRRK2 inhibitors for Parkinson’s disease, and a research-and-development and licensing deal with Washington University in St. Louis for antibodies for ApoE, associated with Alzheimer’s disease. It also signed an R&D deal with Blaze Bioscience, acquired Incro Pharma for its RIP1 inhibitor program, started a Phase I trial in Europe, and inked partnerships with ALS Therapy Development Institute, Aptuit, Evotech, Massachusetts General Hospital, The Michael J. Fox Foundation, PatientsLikeMe and the UC San Diego School of Medicine.

Most recently, on November 19, 2018, Denali announced positive results from a Phase I study of DNL747, an RIPK1 inhibitor being evaluated for Alzheimer’s, amyotrophic lateral sclerosis (ALS) and multiple sclerosis. This study was in healthy volunteers to evaluate safety and dosing, as well as to evaluate target engagement measured by a blood-based biomarker of RIPK1 activity. The study is being done in partnership with Sanofi.

In October 2018, Denali announced a strategic collaboration for global identification and recruitment of Parkinson’s patients with an LRRK2 mutation with Germany’s Centogene.

It also announced this year alone, partnerships with Lonza Pharma and Takeda Pharmaceutical. It closed on its initial public offering (IPO) on December 12, 2017. It raised $250 million and had a market valuation of $1.7 billion.

#2. C4 Therapeutics. Founded in 2015 and based in Cambridge, Mass., C4 is developing a new class of targeted protein degradation (TPD) therapeutics for a broad range of diseases. It raised $73 million in Series A financing that included Roche and Novartis, as well as others. It quickly entered into a strategic collaboration deal with Roche to develop novel drugs in the field of TPD, with a potential value of more than $750 million.

In March 2017, the company announced a five-year collaboration deal with Calico to discover, develop and market therapies for diseases of aging, including cancer. The companies will leverage C4’s TPD expertise to identify small molecule protein degradation compounds. They will jointly work on preclinical research and Calico will be responsible for subsequent clinical development and commercialization.

Calico is a Google/Alphabet company focused, in as much as anyone knows about the company, on aging and longevity. Although not too many details were provided about the deal, FierceBiotech reported that the C4 executive team said it “marries C4T’s drug discovery capabilities in chemistry, biochemistry, ubiquitin proteasome system biology, and pharmacology and Calico’s expertise.”

#3. Neon Therapeutics. Headquartered in Cambridge, Mass., Neon Therapeutics landed on the number three spot in the 2017 class. The company launched in 2015 with a $55 million Series A financing led by Third Rock Ventures and joined by Clal Biotechnology Industries and Access Industries. It completed a $106 million Series B crossover in December 2017, followed by a $70 million Series B in January 2018 with an additional $36 million extension. It rapidly inked licensing agreements with the Broad Institute, Dana-Farber Cancer Institute, and Massachusetts General Hospital. In December 2015 it began a clinical trial collaboration with Bristol-Myers Squibb to evaluate NEO-PV-01 and Opdivo (nivolumab), and later signed a collaborative research agreement with the Netherlands Cancer Institute.

In May 2018, Neon treated the first patient in a Phase Ib clinical trial of its personal neoantigen vaccine, NEO-PV-01 in combination with Merck’s Keytruda (pembrolizumab) and chemotherapy in patients with untreated or advanced metastatic nonsquamous non-small cell lung cancer (NSCLC).

In June of this year, the company launched its IPO to raise $115 million. And in November, the company presented updated data from NT-001, its ongoing Phase Ib trial of NEO-PV-01 at the Society for Immunotherapy of Cancer’s (SITC) 33rdAnnual Meeting. At this time the company has three products in Phase I clinical trials, NEO-PV-01, NEO-PTC-01 and NEO-SV-01.