ADCs from BioNTech, Daiichi Sankyo and Merck are the subject of high-profile abstracts featured at the oncology meeting, along with Merck’s late-breaking Phase III non-small cell lung cancer data.

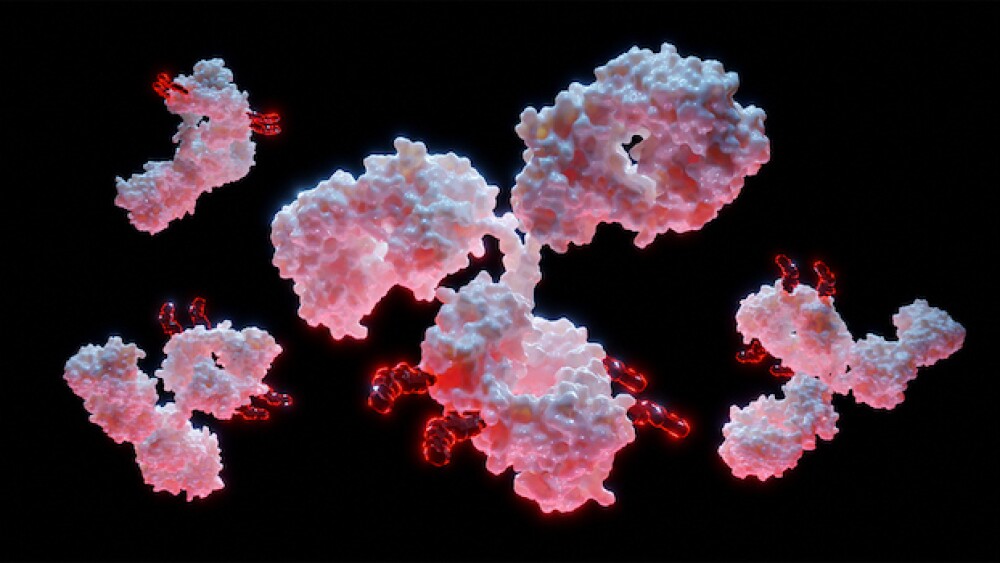

3D rendering of antibody-drug conjugate molecules with cytotoxic payload/courtesy of iStock

The American Society of Clinical Oncology 2023 annual meeting, which kicks off Friday in Chicago, will feature one of the hottest emergent areas of cancer treatment—antibody-drug conjugates. Biopharma companies are betting big on ADCs and the technology from BioNTech and Merck—among others—are the subject of several high-profile ASCO abstracts.

ASCO will showcase candidates as the standard of care is shifting from traditional chemotherapy to ADC technology, which uses an antibody to target a protein expressed on cancer cells and a toxic compound to kill them. In recent years, ADCs have made significant progress in oncology and are increasingly being used in the clinic as well as in ongoing trials.

In an oral presentation at ASCO, Daiichi Sankyo will provide updated results from the TROPION-Lung02 Phase 1b trial evaluating datopotamab deruxtecan (Dato-DXd), composed of a humanized anti-TROP2 IgG1 monoclonal antibody, in combination with Keytruda (pembrolizumab) with or without platinum-based chemotherapy in patients with advanced non-small cell lung cancer (NSCLC).

AstraZeneca’s HER2-directed ADC, Enhertu, approved for unresectable or metastatic breast cancer in 2019, was developed in conjunction with Daiichi Sankyo. The hope is that Dato-DXd will mirror Enhertu’s success. In 2020, AstraZeneca and Daiichi Sankyo inked a $6 billion deal for a TROP2-directed ADC for multiple cancer types.

More recently, ADCs got a big boost in March when Pfizer announced it was acquiring Seattle-based biotech Seagen in a $43 billion megadeal. Seagen, whose stockholders on Tuesday approved the acquisition, will provide updated Phase I data at ASCO for SGN-B6A, a vedotin ADC targeting integrin beta-6 which is highly expressed in multiple solid tumors.

“There’s no doubt that these data likely contributed in some way to Pfizer’s decision to move forward at the price they did because this looks like it’s going to be a pretty compelling asset if this early data holds out,” Joe Catanzaro, senior biotech analyst at Piper Sandler, told BioSpace.

Outside the U.S., China has emerged as a major ADC innovator.

“There are a lot, all of a sudden, of very good ADCs coming out of China,” Daina Graybosch, senior managing director and biotechnology analyst for immuno-oncology at SVB Securities, told BioSpace, noting that BioNTech and Merck recently licensed new ADC candidates from Chinese companies.

At ASCO, Graybosch said BioNTech and Merck would offer a look at ADCs from their recent China-based deals.

BioNTech’s ASCO abstract reports on the safety and efficacy of DB-1303, a humanized anti-HER2 IgG1 monoclonal antibody, in a first-in-human Phase I/IIa study in patients with advanced metastatic solid tumors. DB-1303, which has received Fast Track designation from the FDA, was one of two topoisomerase-1 inhibitor-based ADCs for solid tumors that BioNTech added to its portfolio in a deal announced in April with Shanghai-based Duality Biologics.

“DB-1303 was well tolerated with encouraging preliminary antitumor activity,” according to BioNTech’s ASCO abstract, while reporting that of 52 patients, 44% had a partial tumor response, including 50% of those with HER2-positive breast cancer.

Merck’s ASCO abstract provides efficacy and safety data from a Phase II study of SKB264, an anti-TROP2 ADC, for the treatment of patients with advanced NSCLC. In 2022, Merck exercised an option with Kelun-Biotech—a holding subsidiary of Sichuan Kelun Pharmaceutical—for worldwide rights to SKB264, except for the Greater China region.

The abstract’s data show that SKB264 shrank tumors in 44% of the 39 participants, providing what it calls “encouraging” anti-tumor activity and a “manageable” safety profile.

“The response rate data that is reported in the abstract is preliminary, but it looks pretty favorable, especially relative to what historically has been observed with Gilead’s [TROP2-directed ADC] Trodelvy,” said Piper Sandler’s Catanzaro.

SKB264 is under evaluation in a Phase III clinical trial for the treatment of metastatic triple-negative breast cancer. Kelun-Biotech and Merck plan to evaluate its potential as a monotherapy and in combination with Keytruda for advanced solid tumors.

Keytruda Lung Cancer Late-Breaker

A late-breaker to watch at ASCO will be first-time data from Merck’s Phase III KEYNOTE-671 study in NSCLC, evaluating Keytruda in the perioperative setting. The findings from KEYNOTE-671 could build the case for moving Keytruda into earlier stages of NSCLC, SVB Securities’ Graybosch said.

Graybosch contends that KEYNOTE-671 has the potential to be the “most practice-changing impact data” in lung cancer presented at ASCO.

The FDA has accepted Merck’s new supplemental Biologics License Application for Keytruda in earlier-stage NSCLC. With regulatory approval—an October 16 decision date has been set—Keytruda could move into resectable stage II, IIIA or IIIB NSCLC in combination with chemotherapy prior to surgery (neoadjuvant) and as a single agent post-surgery (adjuvant).

In March, Merck announced Phase III KEYNOTE-671 data showing that Keytruda met one of the trial’s primary endpoints—improved event-free survival (EFS)—in patients with stage II, IIIA or IIIB NSCLC.

However, Merck is facing competition.

In April, AstraZeneca provided a first look at Phase III AEGEAN data for Imfinzi (durvalumab), a similar trial to Merck’s KEYNOTE-671 study, in which the company’s PD-1/L1 inhibitor was used both before and after surgery in resectable NSCLC. That data demonstrated a statistically significant and clinically meaningful improvement in EFS, with patients treated with the Imfinzi-based regimen before and after surgery showing a 32% reduction in the risk of recurrence, progression of events or death versus chemotherapy alone.

Nonetheless, Graybosch called the results of the AEGEAN trial “good but immature” compared to the 37% EFS risk reduction that Bristol Myers Squibb reported last year for Opdivo in the Phase III CheckMate-816 trial. What remains to be seen at ASCO is if Merck’s KEYNOTE-671 data show an EFS improvement that is meaningfully higher than neoadjuvant Opdivo’s 37%, she said.

“The event rate will be the determinant, as it always is,” Mara Goldstein, managing director at Mizuho Securities, told BioSpace. “We know the trial has been successful. We just don’t know how successful.” Still, she said it’s “not as high a climb for Keytruda as it might be for other drugs.”

Greg Slabodkin is the News Editor at BioSpace. You can reach him at greg.slabodkin@biospace.com. Follow him on LinkedIn.