The company plans to use the funds raised to advance the ARC-T and sparX programs, including development of a bivalent BCMA-targeted therapy in multiple myeloma and a CD123-targeted treatment in acute myeloid leukemia.

Gaithersburg, Maryland-based Arcellx closed on an oversubscribed $85 million Series B financing. New investors Aju IB and Quan Capital co-led the round, joined by Mirae Asset Venture Investment, Mirae Asset Capital, LG Technology Ventures, JVC Investment Partners and funds managed by Clough Capital Partners. The financing also included existing investors Novo Holdings, SR One Limited, NEA and Takeda Ventures.

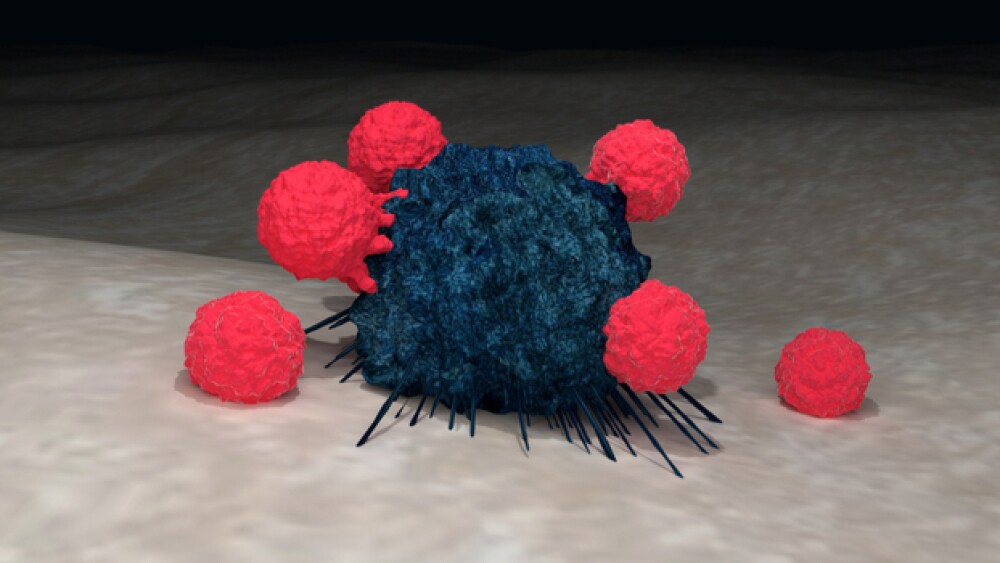

Arcellx refers to itself as having an intelligent cell therapy technology platform. It focuses on cell therapies and has developed Antigen Receptor Complex T cells (ARC-T) that are silenced, activated, and reprogrammed in vivo using a tumor-targeting antigen protein called sparX. The goal is to improve the safety of immunotherapies by better controlling the engineered immune cells and improving their efficacy. They also believe the technology will expand the utility of immune cell therapies into solid tumors and autoimmune indications.

The company plans to use the funds raised to advance the ARC-T and sparX programs, including development of a bivalent BCMA-targeted therapy in multiple myeloma and a CD123-targeted treatment in acute myeloid leukemia.

“The financial and strategic support from our investors allows Arcellx to accelerate development of a robust pipeline of ARC-T + sparX programs for patients in need,” said David Hilbert, Arcellx’ president and chief executive officer.

He went on to say, “As impressive as conventional CAR-T therapies have been, their safety and efficacy profiles are challenged by severe toxicities, high rates of relapse, and challenging target selection in the solid tumor setting. The ARC-T + sparX platform addresses these concerns by placing ARC-T cells under the control of one or more sparX proteins that uniquely determine how the ARC-T cells recognize tumor, and the speed with which ARC-T cells kill tumor. In the coming months we will begin clinical testing of our lead BCMA-targeted therapy in multiple myeloma.”

On August 1, 2019, Arcellx entered into a development, evaluation and license deal with San Diego-based Pfenex to gain access to Phenex’s Pfenex Expression Technology. Arcellx paid Pfenex development funding as well as various milestones ranging from $2.6 million to $18 million for each product utilizing a SparX protein expressed using the Pfenex platform. The agreement also included royalties on global sales of any resulting products.

“Our collaboration with Arcellx fits our strategy of leveraging the Pfenex protein production platform to advance our products and those of our collaborators,” stated Eef Schimmelpennink, Pfenex’ chief executive officer. “Pfenex’s success with the first sparX program further validates the versatility of our proprietary protein expression platform and the quality of our development capabilities. We look forward to collaborating with Arcellx through the combination of our respective platforms in support of developing new therapies for patients in need.”

As part of the Series B round, Hugo Beekman, Partner at AJu IB, and Lewis (Rusty) Williams, Venture Partner at Quan Capital, are coming into the Arcellx board of directors.

Williams stated, “Arcellx has reached a positive inflection in its novel platform and pipeline with the potential to improve efficacy and safety. We are excited to support the company as it advances new cell therapies with the potential to deliver better outcomes for patients.”