As the macro pressures of higher rates and fear of recession build, today’s investor is increasingly risk averse. With zero-risk options offering decent returns, only the highest-quality programs will get funding.

Courtesy of Getty Images

As the macro pressures of higher rates and fears of recession build, today’s investor is increasingly risk averse. With zero-risk options offering decent returns, only the highest quality programs with a catalyst coming soon will attract funding.

“It’s just a brutal environment when it comes to financing right now,” Mike Rice, founding partner at LifeSci Advisors, told BioSpace.

“It’s very binary... lower quality companies and programs will be shut down. The higher quality ones are going to be rewarded.”

Less Risk, More Partnerships

Collaboration could be the saving grace for a company with promising assets or tech and a depressed valuation where access to capital via the public market is inhibited.

A company can expand its potential without spending millions to expand its platform capabilities.

“Rather than Life Edit completely rebuilding an mRNA and LNP platform, and rather than Moderna completely rebuilding a gene editing platform, two well-capitalized partners can bring expertise to a partnership,” David Hallal, CEO of ElevateBio told BioSpace regarding its spinoff company’s recent collaboration with Moderna.

Collaborating to bring an asset to commercialization reduces the risk for both parties and shares the burden of R&D.

“This is what biotech ought to be: companies with their capital positions and expertise come together and own part of multiple therapeutics. Rather than try to own all have one therapeutic with a lot of binary risks associated with it,” Hallal said.

Biotech analyst Salim Syed from Mizuho agreed that strategic collaborations are becoming a more common funding source.

He said two candidates – Unity Biosciences, with its promising eye drug and Assembly Bio, a virology company – are ripe for collaboration.

Slowed Headcount Growth and Squeezed Teams

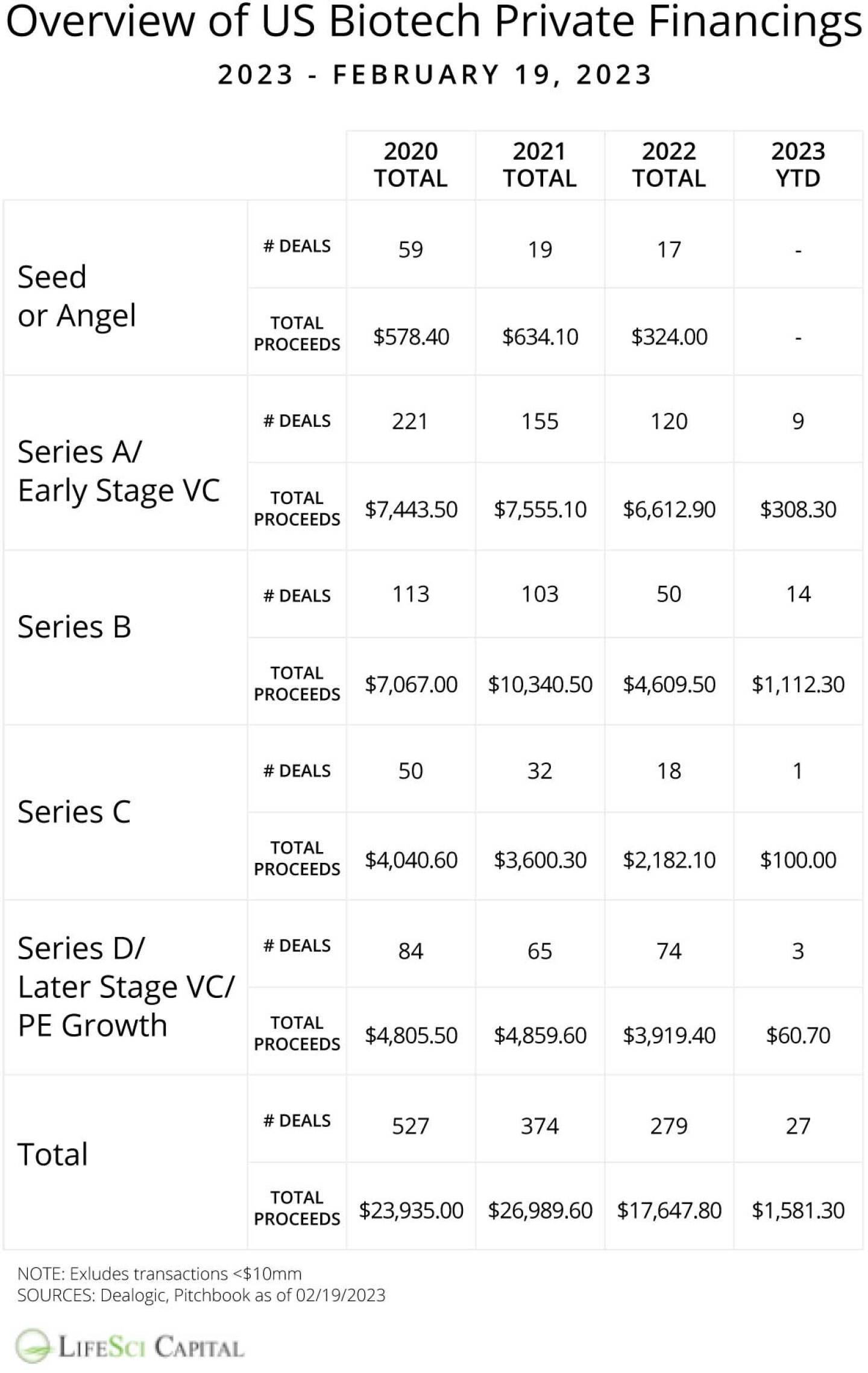

In addition to seeking partnerships to make funds stretch, many are making the tough call to economize staffing. Public and private biotechs went through a 183% increase in downsizing and shuttering from 2021 to 2022, according to a report from LifeSci.

This trend is expected to continue as companies adopt an organic growth approach. Even those who’ve snagged recent funding are playing it safe.

“We hire people when we need them. We don’t hire people in anticipation that there will be work,” Benny Sorensen, CEO of Hemab Therapeutics told BioSpace after his company closed a series B round of $135 million.

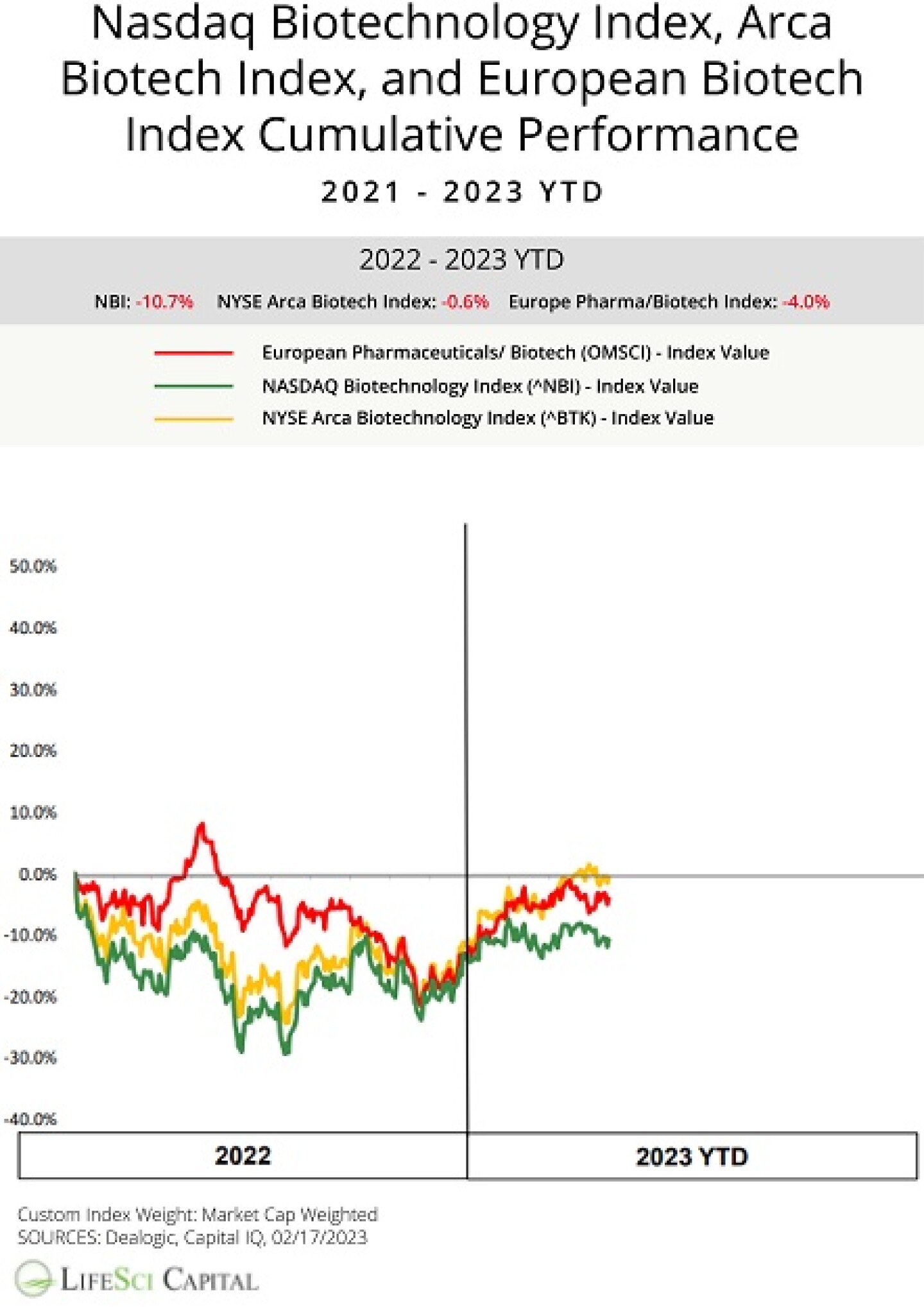

Nasdaq, Arca, European Biotech Index Cumulative Performance

Will IPOs Remain Elusive?

While IPO remains the best route for a growing company, it’s not as accessible as it once was. After 2020/2021’s surge of biotech IPO, 2022 activity fell precipitously. While the number of IPOs has been low, there is still potential for companies with solid science and assets in human trial stages.

The two biotech IPOs of this year back this up:

- Mineralys Therapeutics peaked at a $192M raise in its IPO. The FDA has cleared its in-licensed hypertension drug for a Phase II proof-of-concept.

- Structure Therapeutics went public a week before to bring in $161M, and its current pipeline with two Phase I assets ready to go.

Analysts predict this year will post better IPO numbers than last year for the right companies closer to profitability, Mineralys and Structure included.

“My guess is you’re going to see more of those, particularly because they traded so well in the aftermarket,” Rice said. “I don’t think it will be like 2020 or 2021...We’ll see more of that than in 2022.”