After reaching a record high in 2021, venture capital dollars have tailed off in the biopharma industry in 2022. That said, a few biopharma hotbeds have still seen sizeable launch rounds.

After reaching a record high in 2021, venture capital dollars have tailed off in 2022. That said, a few biopharma hotbeds have still seen sizeable launches and subsequent rounds.

When it comes to Series A funding by geographical region, the usual suspects have again cornered the market.

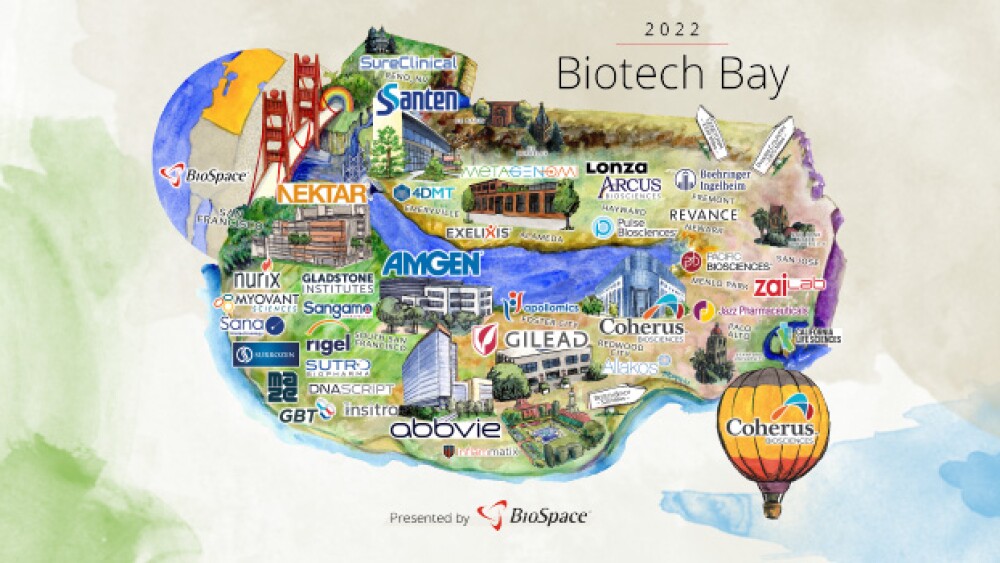

The Genetown region of Massachusetts has drawn the highest-funded new companies, while Biotech Bay (San Francisco and Northern California) has also seen a smattering of significant Series As. BioSpace highlights a few of the most lucrative launch rounds of 2022.

Genetown

Headquartered in Waltham, Mass., Upstream launched in June with $200 million and an experimental drug licensed from Astellas already to its name. The company is targeting severe asthma with its lead program, UPB-101 (formerly ASP-7266), a monoclonal antibody that inhibits the thymic stromal lymphopoietin (TSLP) receptor. TSLP is a cytokine that drives an inflammatory response in asthma and other allergic and inflammatory diseases. Upstream dosed the first patient in a Phase Ib trial in August.

IDRx arrived in Plymouth, Mass. in August with $122 million in oversubscribed Series A funds and alliances with Merck KGaA and Blueprint Medicines. IDRx is working to stop cancer mutations before they start. The company’s intelligently designed combinations approach aims to prevent “escape mutations”.

IDRx has licensing agreements with Merck KGgA and Blueprint for IDRX-42 and IDRX-73 respectively, both tyrosine kinase inhibitors (TKIs) in development to treat gastrointestinal stromal tumors. A Phase I first-in-human trial of IDRX-42 is underway.

Triana Biomedicines and Nested Therapeutics

Boston-based Triana snagged $110 million in its Series A to discover molecular glues with a target-first, rational approach. This space has been hot in 2022. Versant’s Nested Therapeutics (Cambridge, Mass.), closed a $90 million Series A round in October. The company’s lead program, NEST-1, is a non-degrading dual molecular glue targeting several components of the MAPK pathway.

Biotech Bay

In January, Hal Barron, Jennifer Doudna and other biotech luminaries came together with a common goal: to understand the cellular processes behind aging and reverse them. Altos Labs embarked on this mission with a total $3 billion ($270 million Series A) and a star-studded leadership team that includes Hans Bishop, former CEO of GRAIL and Juno Therapeutics and Rick Klausner, former director of the National Cancer Institute.

South San Fransico-based Septerna is improving on GPCR therapeutics in order to open new targets. In one of the year’s earliest launches, Septerna amassed $100 million in a Series A led by Third Rock Ventures. Septerna, along with much of its 2022 launch class, aims to unlock previously inaccessible pathways to treat diseases that are currently untreatable.

Molecular glues are alive and well in San Francisco too, and are being developed by Ambagon Therapeutics. The company celebrated the new year with an $85 million Series A led by Swiss VC firm Nextech Invest.

Ambagon is developing small molecule cancer drugs intended to stabilize the direct interaction of oncogenic proteins with the 14-3-3 class of adaptor proteins. The company has five preclinical programs and expects to field at least one development candidate by the second half of 2023, according to its website.

2022 Overview

In the first quarter, VC funding totaled $9.5 billion compared to $10.8 billion in Q1 2021, according to Scrip Pharma Intelligence. As of August, total biotech funding was down 38.6% from 2021. Between January and August, 660 startups received funding, compared to 1,034 over the same time period in 2021, per Crunchbase News.

Christiana Bardon M.D., co-managing partner at BioImpact Capital and portfolio manager at MPM Capital attributes the overall investment drop-off in part to the departure of the generalist investor.

“In 2020, we had a lot of interest from the diversified investor who was here because COVID really brought a lot of great attention to our industry,” she told BioSpace. “Now, turning to 2022, that generalist investor is gone.”

The good news, she said, is that the specialist healthcare investors are still here – and many of them spent 2020 and 2021 raising more capital. For example, MPM announced $850 million for its second Oncology Impact Fund in October last year.

In all, there have been 89 series A or early-stage VC financings in the U.S. through October, according to a LifeSci Capital overview provided to BioSpace. The majority of these (36) came in the oncology space, with ten for drug discovery engines and eight in CNS.

Additionally, the industry “continues to see interest and funding into next-generation gene editing and gene therapy companies,” said Michael Rice, founding partner at LifeSci Advisors. This includes investment in infrastructure such as vector delivery technologies, manufacturing platforms and improved gene editing and base editing, he added.

Across all rounds, there were 20 gene therapy/gene editing deals totaling more than $2 billion.

From a structural standpoint, Rice said there is “strong interest in molecule-specific and capital efficient business plans given the difficulty of raising public capital.”

In each of 2020 and 2021, there were more than 100 IPOs, according to Bardon. This year, there have been eight.

2023 Predictions

As we move into 2023, Rice expects VC rounds will generally have a larger number of syndicate members as companies will want to guarantee that they have sufficient insider backing for future rounds.

Bardon concurred, saying, “we’ll see venture capital working together because we want to make sure the people around the table have enough capital to support the company.”

Meanwhile, “a larger percentage of dry powder of VC funds will be allocated to pre-existing portfolio companies rather than to new company formations.”

Bardon said biotech will be impacted by macroeconomic factors such as interest rates, inflation, geopolitical stability and supply chain visibility. But, she said, the capital markets within biotech are working.

“Companies that do create valuable data and reach value-creating milestones are getting financed, are getting rewarded in their valuation for that accomplishment,” Bardon said. “Therefore, as soon as the world rights itself, biotech will be there, ready to perform.”