A 3-judge panel questioned the legitimacy of Johnson & Johnson’s plan to form a subsidiary company with the purpose of absorbing legal liabilities from talc-related lawsuits.

A 3-judge panel questioned the legitimacy of Johnson & Johnson’s plan to form a subsidiary company with the purpose of absorbing legal liabilities from talc-related lawsuits.

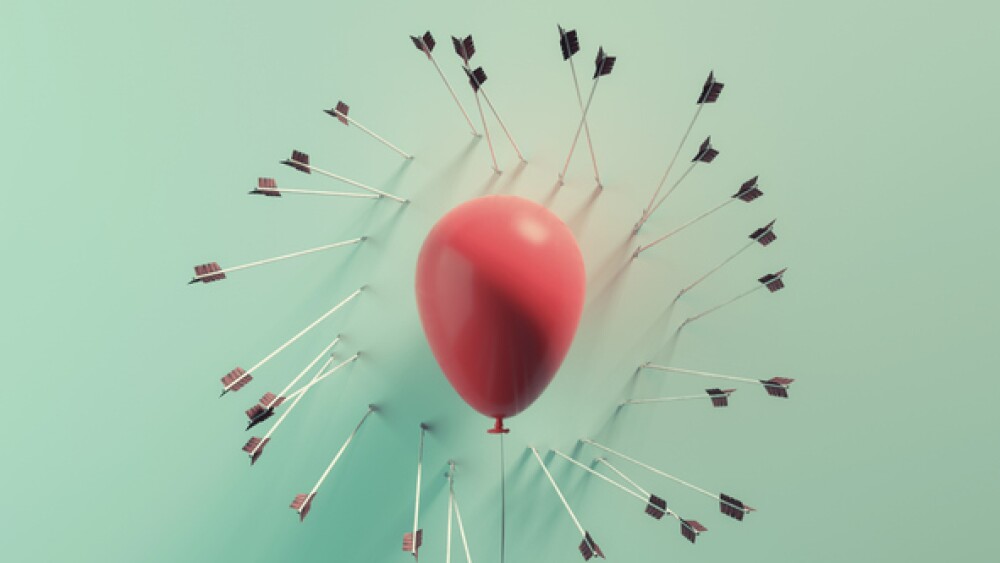

If the court panel deems J&J’s formation of LTL Management an illegitimate business move, the life sciences giant must defend itself in courtrooms across the country against allegations that its talc-based products contributed to the development of cancer in some people.

The company faces more than 30,000 lawsuits.

Following legal arguments in a Philadelphia courtroom, the panel of appellate court judges will decide whether J&J’s 2021 formation of LTL was legal, Bloomberg reported. If the panel rules against J&J, then the claims that talc sold by the company will move forward in court ending with a bankruptcy claim.

J&J formed LTL last year and shifted its talc-related business obligations under that company. Immediately following the launch of LTL, the company filed for bankruptcy under a Texas law that allows for a divisive merger, a legal maneuver used by companies that face asbestos-related litigation.

During the legal arguments, the judicial panel asked how LTL potentially gave J&J an unfairly advantageous position to negotiate a deal to settle the claims, Bloomberg reported.

Earlier this year, Judge Michael Kaplan ruled LTL’s bankruptcy was legitimate and a better solution than multiple juries weighing claims nationwide.

A spokesperson for J&J subsidiary LTL Management told BioSpace the company has “consistently and unequivocally endorsed early resolution for the benefit of all parties,” which includes current and future claimants.

“We hope the court agrees with Judge Kaplan’s well-reasoned opinion that this filing was done in good faith and is the right way to efficiently and equitably resolve these cases,” said a J&J spokesperson. “We continue to stand behind the safety of Johnson’s Baby Powder, which is safe, does not contain asbestos and does not cause cancer.”

In its natural form, some talc contains asbestos, a substance known to cause cancers when inhaled, according to the American Cancer Society.

A 2018 Reuters report showed J&J knew its talc products could contain carcinogenic asbestos. Despite that understanding, the company didn’t reveal that information to regulators and the general public.

As BioSpace has previously reported, some of the talc-related lawsuits have already gone through the courts.

Courts ordered J&J to pay $750 million in punitive damages to four people who alleged the talc led to their own cancer diagnoses in 2020.

Other verdicts include an award of more than $21 million for one mesothelioma patient.

Another jury awarded $4.7 billion in damages to 22 women and their families. The court determined J&J’s talc products contributed to the development of ovarian cancer. Six of those plaintiffs died from the disease. That award was reduced and J&J paid out about $2.5 billion.

To the Supreme Court

J&J isn’t the only pharma giant to face legal challenges this week. Novartis too, finds itself in a legal quagmire.

Three months after losing a bid to protect a patent for multiple sclerosis drug Gilenya, the Swiss company lost its appeal. Now, the company plans to appeal the case to U.S. Supreme Court.

The company will appeal after the U.S. Court of Appeals for the Federal Circuit denied its petition to rehear the patent protection bid it lost earlier this year. The patent covers a dosing regimen for .5 mg Gilenya.

Two years ago, Novartis initially won protection for this patent, but in June, the court ruled the patent was no longer valid, which opens the door for generic competition from China-based HEC Pharma, which is seeking to bring a generic version of Gilenya to the U.S. market.

If generics to Gilenya are allowed to launch in the U.S., the company anticipates a loss of approximately $300 million for the 2022 fiscal year. Gilenya generated approximately $2.8 billion in revenue last year.