Even after the runaway success of mRNA vaccines against COVID-19, the pathway to approval for upcoming would-be mRNA therapeutics has yet to be laid out.

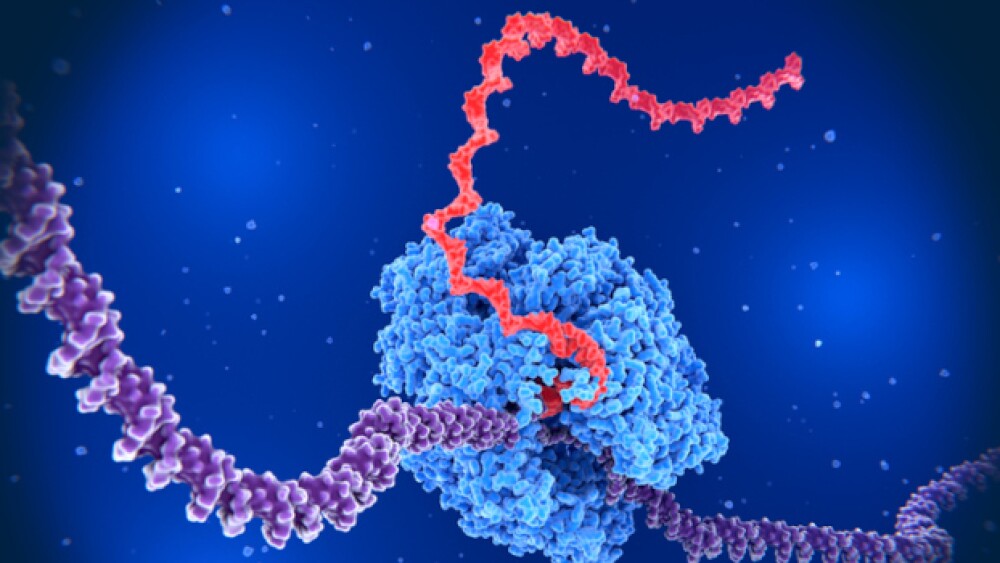

Pictured: A DNA strand being transcribed into mRNA/iStock, selvanegra

While medicines consisting of modified RNA have been decades in the making, it took the pressure of a global pandemic to push the promising technology past hurdles and onto the market. Thanks to a great deal of innovation, mRNA is now a household name and a rapidly expanding industry for the biopharma world beyond COVID-19. Over 250 potential mRNA therapies are currently being investigated in cancer, with more than 500 in other indications.

The fast rise to popularity has left some concerned that therapeutic development is outpacing regulators. The biopharma community remains uncertain about how the biologics will be classified and therefore regulated.

Is mRNA Gene Therapy?

The FDA’s Center for Biologics Evaluation and Research (CBER) is responsible for regulating cellular and human gene therapy products. The currently approved mRNA vaccines from Pfizer/BioNTech and Moderna fall under the CBER umbrella. However, they are not listed on the FDA’s “Approved Cellular and Gene Therapy Products” webpage.

Some observers contend that the mode of action of mRNA vaccines and therapeutics—although incompletely defined—should classify them as gene therapy products. This includes retired biologist Hélène Banoun, who recently published a paper arguing that the current FDA and EMA guidelines either do not apply to, do not mention or do not have a widely accepted definition for mRNA therapeutics.

But classifying the mRNA shots as a gene therapy seems “anomalous” to Tracy Meffen, head of operations at Genevant, since they do not affect the genome.

Messenger RNA is a set of instructions directing cells to make a protein; vaccines and therapies based on it harness the body’s natural mechanisms to fight off infectious disease or attack cancer cells. Unlike the therapies on the FDA’s list of gene therapy products, mRNA is broken down by the body quickly and excreted.

“I think it’s not so much that it was considered gene therapy, but it was treated like gene therapy because they didn’t really have any other way to consider it at the time,” Meffen told BioSpace.

The debate over the definition of gene therapy is hot within the scientific community, said Jake Becraft, CEO of Strand Therapeutics. Strand is readying to file an IND before the end of the year for its solid tumor-targeting mRNA therapy. While Becraft sees how mRNA vaccines could technically be labeled a gene therapy, he notes that there is a vast difference between transferring RNA to induce a short period of transgene expression and making a long-term or permanent change to a gene.

“Most people, myself included, on the mRNA side have taken to referring to mRNA more as genetic medicine,” Becraft said.

A Uniquely Situated Novel Modality

“Messenger RNA is in a space that has never been seen before,” Becraft noted. “There isn’t a single [other] novel modality that has the length and breadth of safety data across populations as messenger RNA.”

The long-term data now available on mRNA technology is massive, with more than 655.4 million doses of Pfizer/BioNTech’s and Moderna’s vaccines given as of April 2023. Never has a novel modality been administered so widely across different populations as mRNA.

This pandemic-induced scale of deployment has “de-risked the modality,” said Jory Bell, a partner at Playground Global, a venture capital firm invested in Strand. He referred to RNA therapies as “inherently safe” with the potential to treat multiple indications at low cost and with quick manufacture.

Pathway to Approval

Although Comirnaty and Spikevax made history as the first mRNA medicines on the market, their approvals did not necessarily pave a clear path for the rest of the industry.

Biopharma companies developing mRNA therapeutics are left to grapple with the lack of clarity regarding how these new medicines will be classified by regulatory agencies. Delays to approval are not only detrimental to patients, but also incredibly costly to the biopharmaceutical industry, and are reflected in higher drug prices.

Furthest down the track toward regulatory submission is the partnered mRNA cancer vaccine from Moderna and Merck. The personalized neoantigen therapy, mRNA-4157/V940, is being tested in combination with Merck’s bestseller, Keytruda. In patients with resected melanoma at high risk of return, the cancer vaccine reduced the risk of recurrence or death by 44% compared to Keytruda alone in a Phase IIb trial. A Phase III study was initiated in July to enroll over 1,000 patients in more than 25 countries. The FDA and EMA have granted Breakthrough Therapy Designation and Priority Medicines scheme, respectively. Merck declined to comment on how the cancer vaccine would be categorized by the FDA and EMA.

The FDA has worked over the years to open new pathways to speed approval of innovative medicines, particularly in areas of high unmet need through. Those include its Priority Review, Breakthrough Therapy, Accelerated Approval and Fast Track programs. However, for each new modality science presents, the FDA must develop subject matter experts just as quickly.

The FDA’s handling of the updated COVID-19 vaccines for variants is a “new parachute” being built into the regulatory framework, Becraft said, potentially creating an accelerated pathway for modifying other products in the future once an initial therapy is approved. If medicines can be adapted quickly, without developers having to start the approval process over again at square one, it will save lives and money, he said, enabling lower drug prices down the line.

One thing is clear: The new modality will cause regulatory evolution as a slew of biopharma companies target mRNA for their next products. Clear regulatory guidelines are “widely anticipated,” said Chanfeng Zhao, VP of R&D Chemistry at TriLink Biotechnologies. One of the CDMO’s specialties is mRNA. While she hasn’t seen a clear definition yet from the FDA on how mRNA therapeutics will be classified, Zhao believes there will be a “more stringent requirement for sure” compared to the COVID-19 vaccines.

Zhao’s biggest concerns revolve around purity standards for mRNA products. RNA fragments, double stranded RNA and other impurities can cause immunogenicity and safety issues.

“It’s really a must for the public health reasons that we need to improve the quality standard for the entire process,” Zhao said.

BioSpace sought comment from the FDA on regulatory guidelines and expectations for mRNA therapeutics but had not received a response at the time of publication.

Kate Goodwin is a freelance life science writer based in Des Moines, Iowa. She can be reached at kate.goodwin@biospace.com and on LinkedIn.