Privately-held Rain Therapeutics closed a $63 million Series B financing round that will be used to advance the company’s pipeline of targeted cancer therapies, including RAIN-32, its recently acquired asset from Daiichi Sankyo.

Privately-held Rain Therapeutics closed a $63 million Series B financing round that will be used to advance the company’s pipeline of targeted cancer therapies, including RAIN-32, its recently acquired asset from Daiichi Sankyo.

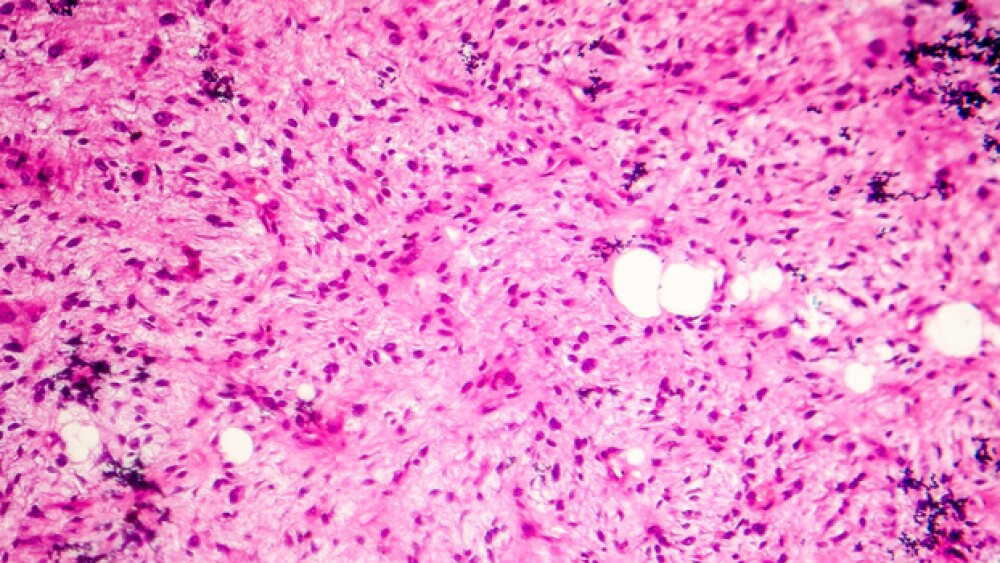

RAIN-32 is a potent and selective MDM2 inhibitor that the company intends to evaluate in late-stage clinical trials for liposarcoma, a type of cancer in which two-thirds of patients display MDM2 activity. California-based Rain licensed the drug from Daiichi Sankyo on Wednesday. In its announcement of the licensing deal, Rain said MDM2 has emerged as a potentially valuable target for cancer therapies due to its inhibitory effects on p53, a critical tumor suppressor. Rain intends to evaluate RAIN-32 in multiple indications where patients demonstrate MDM2 gene amplification or overexpression, with an initial focus on liposarcoma, where two-thirds of patients display MDM2 amplification.

When the asset was under the ownership of Daiichi Sankyo, RAIN-32 had been evaluated in patients with various solid tumors, acute myeloid leukemia (AML) and myelodysplastic syndrome (MDS). RAIN-32 also has been evaluated in continuous and intermittent dose schedules that may offer a differentiated tolerability profile as compared to other MDM2 programs, Rain said.

Rain Chief Executive Officer Avanish Vellanki said he was excited to add the MDM2 inhibitor to his company’s pipeline due to its potential in those types of cancers. He said Wednesday that Rain will build upon the extensive work already conducted by Daiichi Sankyo and complete the clinical research of the asset.

In addition to the licensing of RAIN-32, Rain Therapeutics also entered into a licensing agreement with Drexel University to progress the preclinical development of a RAD52 inhibitor. RAD52 is involved in several DDR pathways, and RAD52 inactivation is synthetically lethal in cancer cells with BRCA1/2 and other homologous recombination (HR) gene mutations. Drexel’s RAD52-targeted inhibitors have evidenced potent in vitro and in vivo activity in BRCA1-deficient xenograft models, alone and in combination with PARP inhibitors, the company said. There are currently no clinical programs in development targeting RAD52.

Rain’s initial program, tarloxotinib, a pan-HER inhibitor, is currently being evaluated in Phase II clinical trials. A hypoxia-activated pan-HER inhibitor, tarloxotinib is in clinical trials for patients with non-small cell lung cancer with EGFR exon 20 insertion mutations and HER2 activating mutations, as well as a tumor-agnostic cohort for patients with NRG1, EGFR, HER2, and HER4 fusions.

The financing announced today, will provide the company with the funding to support the development of these programs. The Series B funding was by Boxer Capital and followed by new investors Cormorant Asset Management, Samsara BioCapital, Janus Henderson Investors and Logos Capital. Existing investors BVF Partners L.P. and Perceptive Advisors, as well as other unnamed investors, also participated.

“We view this lineup of extraordinary investors as validation of the opportunity of the Rain pipeline across a range of cancers leveraging a precision oncology strategy,” Vellanki said in a statement.