Biofrontera, Inc. (NASDAQ:BFRI), a biopharmaceutical company specializing in the commercialization of dermatological products, today announced financial results for the three and twelve months ended December 31, 2022.

WOBURN, MA / ACCESSWIRE / March 8, 2023 / Biofrontera, Inc. (NASDAQ:BFRI), a biopharmaceutical company specializing in the commercialization of dermatological products, today announced financial results for the three and twelve months ended December 31, 2022.

Highlights

- Record 2022 annual Ameluz® revenues were 12% higher than previous record in pre-COVID 2019

- Grew share in our target market in 2022 by about 12%

- Total revenues for the fourth quarter of 2022 grew 11% over the fourth quarter of 2021

- Total revenues for the year 2022 grew 19% over the year 2021

- Average revenue per sales rep grew approximately 20% over 2021

- Continued various education initiatives including seminars, medical conferences, prescriber networking and key opinion leader (KOL) engagement

- Showcased our Ameluz therapy at three conference podiums including Fall Clinical, New Frontiers in Cosmetic Medicine & Medical Dermatology Symposium and Mount Sinai 25th Winter Symposium

- 4 Poster publications in a peer reviewed dermatology journal, SKIN The Journal of Cutaneous Medicine

- Education initiatives included a 3-part webinar series for CME credit, a 3-part video series with over 1,200 views and 4-part podcast series with over 1,400 views

- Ameluz new marketing campaign earned "Relaunch/Revitalization of the Year" and "Professional Website/Online Initiative of the Year" awards

Management Commentary

"2022 was a pivotal year for Biofrontera highlighted by our record annual Ameluz revenues, up 19% over 2021 and 12% higher than our previous record in pre-COVID 2019," said Erica Monaco, Chief Executive Officer of Biofrontera Inc. "The company continues to make a measurable impact in the AK marketplace in terms of both awareness and market share, and we are pleased that we increased share in our target market by about 12%. We also completed much of the necessary investments to build out our commercial infrastructure including broadening our sales effort and growing our medical affairs, marketing and education tools. I am proud of what the Biofrontera team has accomplished in our first full year as a public company."

"Our investments have created the necessary strong foundation upon which to execute our growth strategy," continued Ms. Monaco. "We also believe there is a strong revenue growth potential with the current label for Ameluz®-PDT as we improve our sales coverage and continue to educate the market. Given our plans to expand our salesforce to 50-55 people over the next couple of years plus continued salesforce productivity improvements, we expect to grow 2023 revenues by at least 25% over last year positioning us well to be cashflow positive within approximately two years."

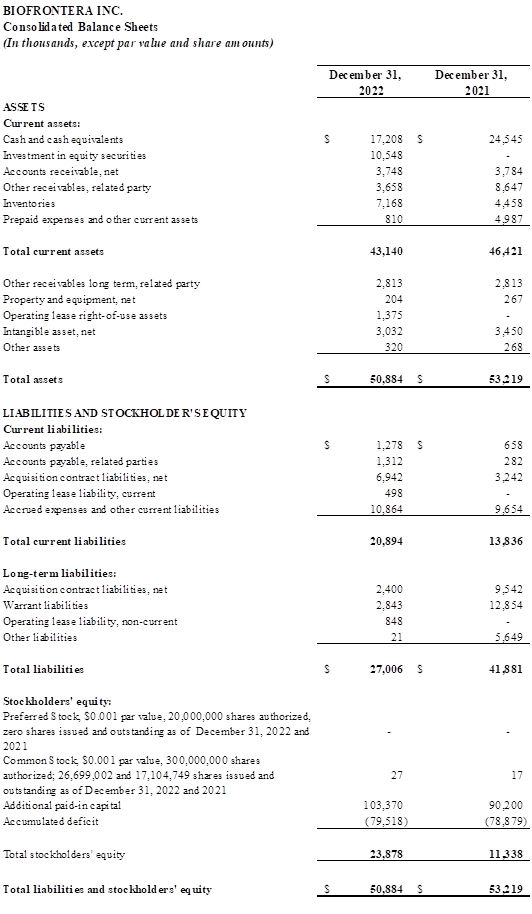

Fourth Quarter Financial Results

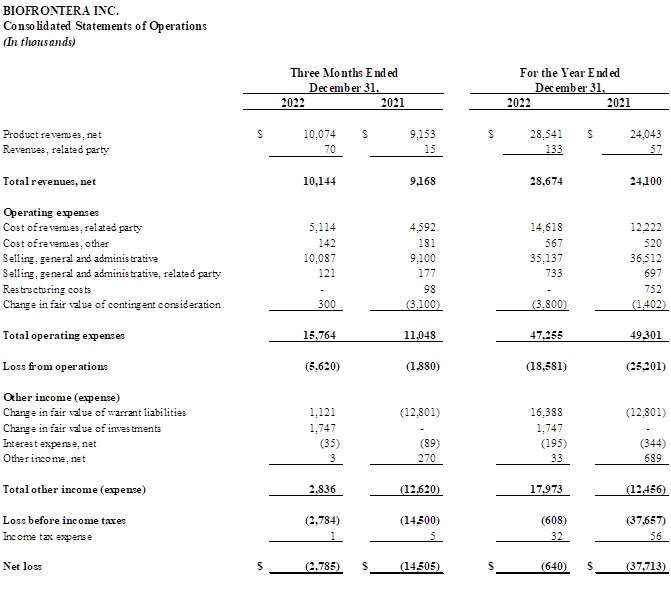

Fourth quarter 2022 total revenues of $10.1 million, compared with $9.2 million in the fourth quarter of 2021. The increase was driven by continued growth in the sales of Ameluz, partially offset by shipping delays and some sales territory vacancies.

Total operating expenses were $15.8 million for the fourth quarter of 2022, compared with $11.0 million in the same period 2021. Cost of revenues in the quarter increased by $483 thousand from the fourth quarter of 2021. The increase was primarily due to higher sales of Ameluz. Selling, general and administrative expenses increased by $931 thousand over the fourth quarter of 2021 generally in line with the increase in revenues.

Net loss for the fourth quarter of 2022 was $2.8 million compared with a net loss of $14.5 million for the fourth quarter of 2021.

Adjusted EBITDA was negative $4.4 million for the fourth quarter of 2022, compared with negative $3.2 million for the fourth quarter of 2021. Adjusted EBITDA, a non-GAAP financial measure, is defined as net income or loss excluding interest income and expense, income taxes, depreciation and amortization, and certain other non-recurring or non-cash items.

Full year 2022 Financial Results

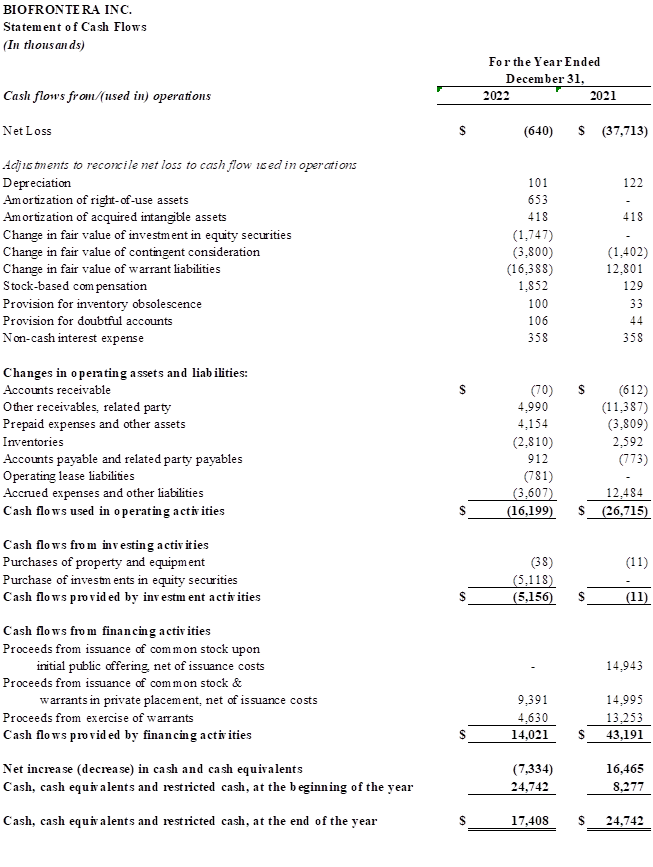

Total revenues the full year of 2022 were $28.7 million, compared with $24.1 million for full year 2021. The increase was primarily driven by higher volume of Ameluz orders as well as an Ameluz price increase, partially offset by shipping delays and some sales territory vacancies.

Total operating expenses were $47.3 million for the full year 2022, compared with $49.3 million for the same period in 2021. Cost of revenues increased by $2.4 million compared with the prior-year period primarily due to higher sales of Ameluz. Selling, general and administrative expenses decreased by $1.3 million from full year 2021. This decrease was driven by the one-time legal settlement expense of $11.3 million recognized in 2021 offset by an increase in headcount costs as a result of resumed hiring in 2022 and a broad increase in the costs associated with being a public company.

Net loss for full year of 2022 was $640 thousand compared with a net loss of $37.7 million for the full year 2021.

Adjusted EBITDA was negative $18.1 million for the full year 2022, compared with negative $12.6 million for full year 2021.

Financial Expectations

Full-year 2023 revenue growth of at least 25%

Cash flow positive within approximately two years

Other Developments

The company will no longer regularly provide preliminary, quarterly revenue results. Management believes that, while the data was helpful during the first year as a public company, the revenue results will have more meaning when accompanied by the rest of the financial results and additional context from management discussion. The company wcontinue to provide complete financial results accompanied by a management conference call at a normal quarterly cadence.

Conference Call Details

Conference call: Wednesday, March 8, 2023 at 4:30PM ET

Toll Free: 888-506-0062

International: 973-528-0011

Access Code: 990014

Webcast: https://www.webcaster4.com/Webcast/Page/2948/47545

About Biofrontera Inc.

Biofrontera Inc. is a U.S.-based biopharmaceutical company commercializing a portfolio of pharmaceutical products for the treatment of dermatological conditions with a focus on photodynamic therapy (PDT) and topical antibiotics. The Company's licensed products are used for the treatment of actinic keratoses, which are pre-cancerous skin lesions, as well as impetigo, a bacterial skin infection. For more information, visit www.biofrontera-us.com.

Contacts:

Biofrontera Investor Relations

ir@bfinc.com

Forward Looking Statements

Certain statements in this press release may constitute "forward-looking statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995, as amended to date. These statements include, but are not limited to, statements relating to the Biofrontera Inc.'s (the "Company") revenue guidance for 2023, business and marketing strategy, revenue growth, development and expansion of the Company's sales force and commercial infrastructure, sales force productivity, growth strategy, liquidity and cash flow, potential to expand the label of Ameluz®, available market opportunities for Ameluz®, ongoing clinical trials conducted by our licensing partners, and educational outreach efforts. We have based these forward-looking statements on our current expectations and projections about future events, nevertheless, actual results or events could differ materially from the plans, intentions and expectations disclosed in, or implied by, the forward-looking statements we make. These risks and uncertainties, many of which are beyond our control, including, but not limited to, the impact of any extraordinary external events; any changes in the Company's relationship with its licensors; the ability of the Company's licensors to fulfill their obligations to the Company in a timely manner; the Company's ability to achieve and sustain profitability; whether the current global disruptions in supply chains will impact the Company's ability to obtain and distribute its licensed products; changes in the practices of healthcare providers, including any changes to the coverage, reimbursement and pricing for procedures using the Company's licensed products; the uncertainties inherent in the initiation and conduct of clinical trials; availability and timing of data from clinical trials; whether results of earlier clinical trials or trials of Ameluz® in combination with BF-RhodoLED® in different disease indications or product applications will be indicative of the results of ongoing or future trials; uncertainties associated with regulatory review of clinical trials and applications for marketing approvals; whether the market opportunity for Ameluz® in combination with BF-RhodoLED® is consistent with the Company's expectations; the Company's ability to comply with public company requirements; the Company's ability to regain compliance with Nasdaq continued listing standards, the Company's ability to retain and hire key personnel; the sufficiency of cash resources and need for additional financing and other factors that may be disclosed in the Company's filings with the SEC, which can be obtained on the SEC website at www.sec.gov. Readers are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date on which they are made and reflect management's current estimates, projections, expectations and beliefs. The Company does not plan to update any such forward-looking statements and expressly disclaims any duty to update the information contained in this press release except as required by law.

SOURCE: Biofrontera Inc.

View source version on accesswire.com:

https://www.accesswire.com/742813/Biofrontera-Inc-Reports-Fourth-Quarter-and-Record-Full-year-2022-Financial-Results