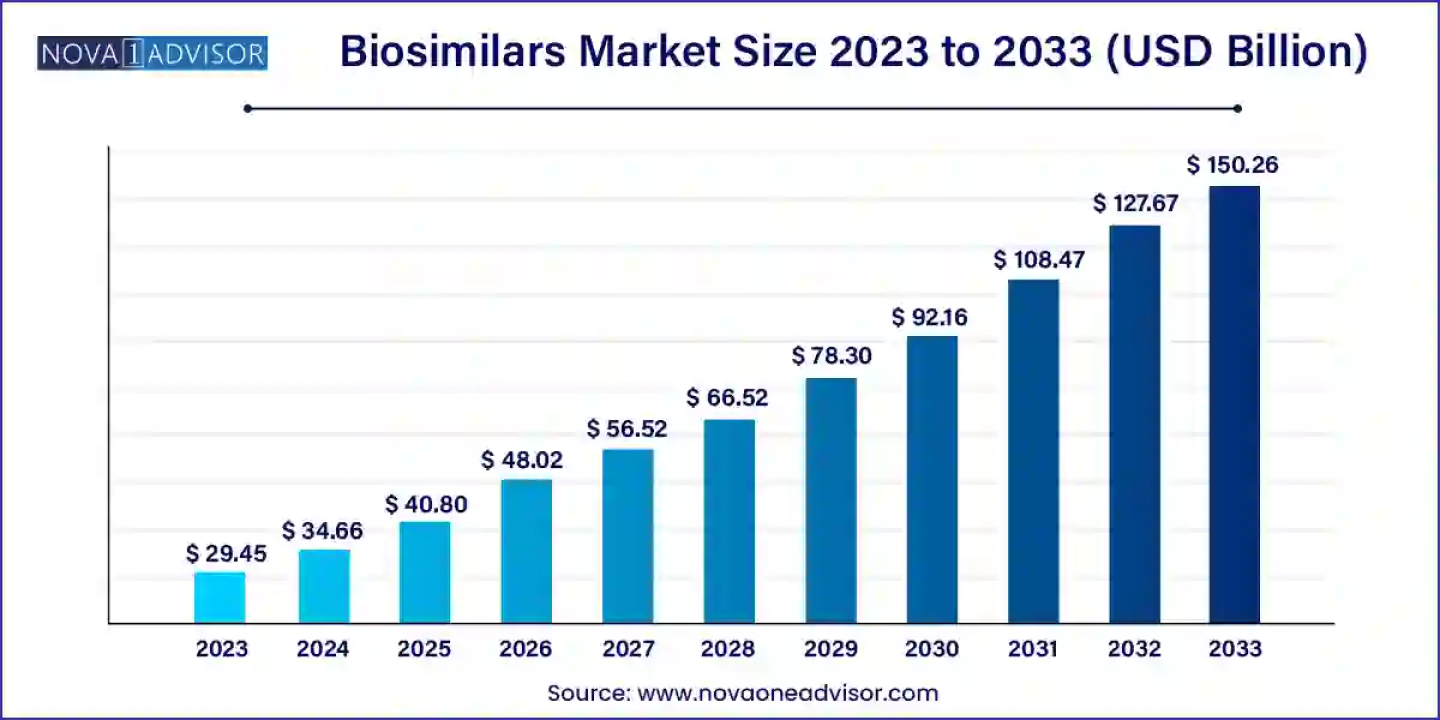

According to a new market research report, the global biosimilars market size was USD 29.45 billion in 2023, calculated at USD 34.66 billion in 2024 and is expected to reach around USD 150.26 billion by 2033, expanding at a CAGR of 17.7% from 2024 to 2033. North America dominated the market with the largest revenue share of 41.0% in 2023.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/7070

Biosimilar drugs, requiring significantly less research and development compared to their reference biologics due to their similar composition, present a cost-effective alternative that catalyzes market’s growth.

The biosimilars market is experiencing rapid growth, driven by the introduction of these cost-effective alternatives to brand name biologic drugs. Unlike generics, biosimilars are not exact copies but are derived from natural sources and must undergo rigorous clinical trials to ensure safety and efficacy, as mandated by the FDA. These trials compare the biosimilar to its reference biologic, which has already been approved and used in treating various diseases. Biosimilars offer safe and effective treatment options for conditions such as chronic skin and bowel diseases, arthritis, kidney conditions, and cancer, thereby increasing patient access to life-saving medications at potentially lower costs. The FDA's approval process ensures biosimilars exhibit no clinically meaningful differences from their reference products, allowing only minor variations in inactive components. This competitive landscape encourages manufacturers to reduce prices while maintaining high standards, significantly benefiting the healthcare system and driving market expansion. For more detailed information and educational resources, healthcare providers and patients are encouraged to explore the FDA’s dedicated website on biosimilars.

https://www.novaoneadvisor.com/report/checkout/7070

Market Dynamics

Driver

Enhanced Access and Cost Efficiency

Biosimilars possess substantial potential to enhance access to disease-modifying therapies for a broad spectrum of chronic illnesses, including certain cancers. Their more cost-efficient manufacturing processes may also facilitate increased experimentation with pharmacological therapies. By improving patient access to high-level drug therapies and alleviating the financial burden of chronic diseases on global healthcare systems, biosimilars can drive significant market growth. For this potential to be fully realized, physicians must become more comfortable prescribing biosimilars in place of reference products, and the prices of biosimilars must be considerably lower than their biological counterparts.

Restraint

Manufacturing and Analytical Challenges

Biosimilar manufacturers face significant challenges in processing and packaging due to the variability of large molecules and the stringent requirements for FDA proof of clinical safety. Variations in cell culture conditions can alter the molecular structure and clinical behavior of biosimilars, potentially introducing impurities, contaminating viruses, and traces of cell protein and DNA. The complexity of biosimilar molecular structures is compounded by a lack of advanced analytical tools needed to precisely differentiate between the original therapeutic protein and the biosimilar. These factors collectively constrain the growth of the biosimilars market.

Opportunities

Advancements in Technology

Advancements in scientific technology have significantly accelerated the research and development of biosimilars, allowing for enhancements to biologics developed approximately 15 years ago. Biosimilars represent a rapidly growing drug class intended to be used interchangeably with biologics, which are complex proteins produced in living cells with diverse therapeutic applications, including in gastroenterology for treating inflammatory bowel diseases, cancers, and endocrine disorders. The primary goal of biosimilar development is to reduce treatment costs while maintaining nearly identical efficacy, safety profiles, and immunogenicity to their reference biologics. As biosimilars require fewer clinical trials compared to their reference products but still involve production within living cells, the expiration of biologic patents presents a significant opportunity for expanding the biosimilars market. Continued manufacturing of new biosimilars as patents expire is poised to drive market growth and increase accessibility to these cost-effective treatment options.

Report Highlights

By Product Insights

The monoclonal antibodies (mAbs) segment has accounted for the largest revenue share in the biosimilars market, driven by their widespread use in cancer treatments and approvals from the EMA and FDA. Biosimilar monoclonal antibodies are rigorously tested, with data focusing heavily on their molecular characterization and randomized clinical studies confirming that any minor differences compared to the reference mAbs do not impact their efficacy or safety. mAbs are crucial biological agents used to treat malignancies such as non-Hodgkin's lymphomas and chronic lymphocytic leukemia, offering high effectiveness but often at significant cost. As patents for many mAbs expire, the development of biosimilar medicines containing versions of the original drug's active ingredient is accelerating, providing more cost-effective treatment options.

The erythropoietin segment is projected to be the fastest-growing segment in the biosimilars market during the forecast period. Recombinant human erythropoietin (rEPO) biosimilars are analogous versions of epoetin drugs, such as epoetin alfa, which is produced using recombinant DNA technology in cell culture. Epoetin alfa stimulates erythropoiesis, thereby increasing red blood cell levels, and is widely used to treat anemia associated with chronic renal failure and cancer chemotherapy. The growing demand for cost-effective treatments for anemia is driving the rapid expansion of the erythropoietin biosimilars market.

The oncology segment has dominated the global biosimilars industry, driven by the extensive use of biologic-based medicines such as trastuzumab (Herceptin), a targeted cancer drug used to treat breast cancer and advanced stomach cancer. Biologic medications, which account for about one-quarter of the worldwide pharmaceutical market, have led to significant advancements in cancer treatment and supportive care. As patents for many widely used biologics expire, biosimilars highly similar yet not identical to their reference biologic drugs offer the potential to enhance access and provide more affordable options for cancer treatment. This dynamic is propelling the growth of biosimilars in oncology, making it a key application area within the market.

The growth hormonal deficiency segment is anticipated to be the fastest-growing segment in the biosimilars market during the forecast period. A large-scale study has demonstrated that Omnitrope, a biosimilar growth hormone, is both effective and well-tolerated in treating various growth disorders in children. Omnitrope, a biosimilar somatropin and a recombinant form of human growth hormone (rhGH), has shown significant efficacy and tolerability in pediatric patients. This underscores the potential of biosimilar growth hormones to offer cost-effective and reliable treatment options for growth hormone deficiencies, driving robust growth in this application segment.

Regional Insights

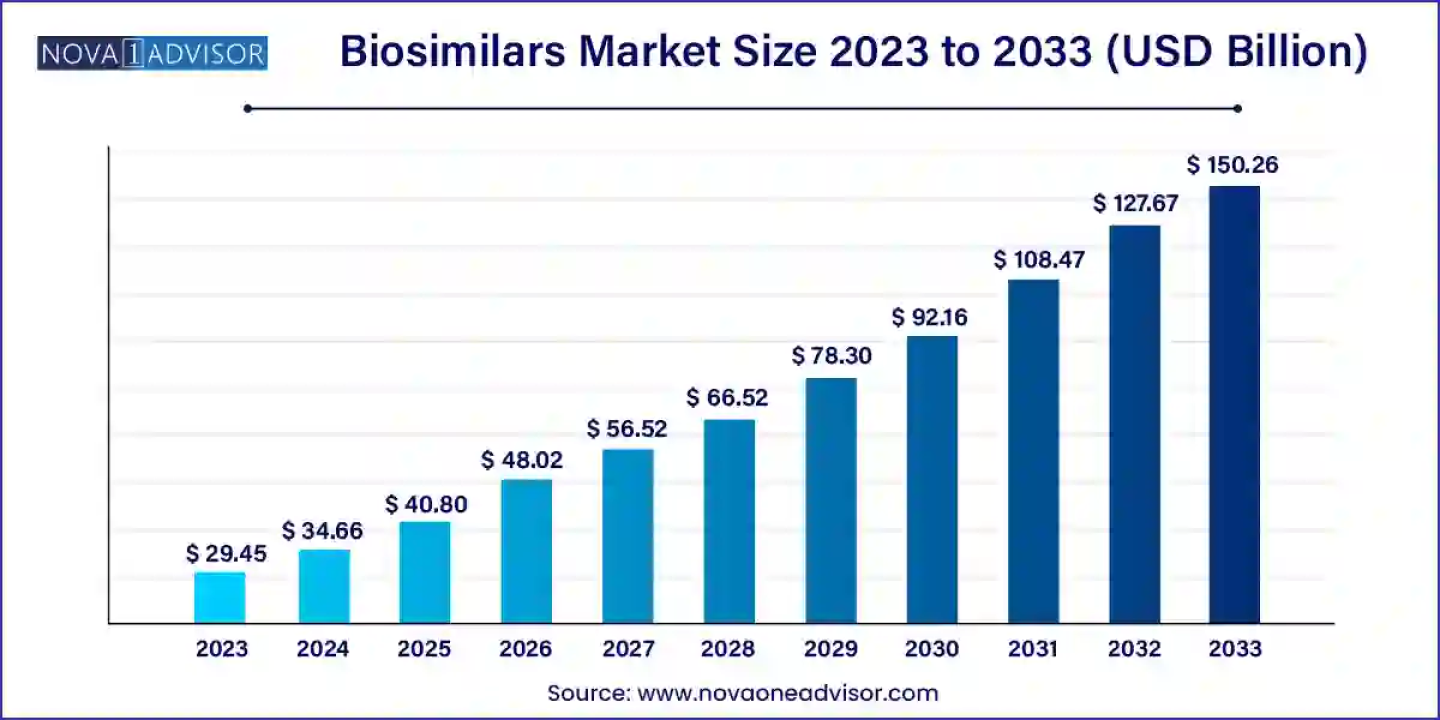

North America dominated the market with the largest revenue share of 41.0% in 2023. driven by the expiration of patents for established biologic drugs. This region has the potential to become global suppliers of affordable, safe, and effective biosimilars. With more biosimilars in development across Asia-Pacific than anywhere else, emerging Asian economies are poised to enhance their domestic biologics and biotechnology capabilities. This positions domestic and regional manufacturers in these markets to potentially assume a global leadership role in the biosimilars industry in the near future.

Biosimilars uptake varies by market and molecule

A pooled literature review of 90 studies published in 2018 indicated that switching from originator drugs to biosimilars made no difference in clinical efficacy and safety in the majority of cases.2 Many countries now encourage physician-led switching to biosimilars, and switching among pharmacies, pharmacy benefit managers, and others is also likely to increase.

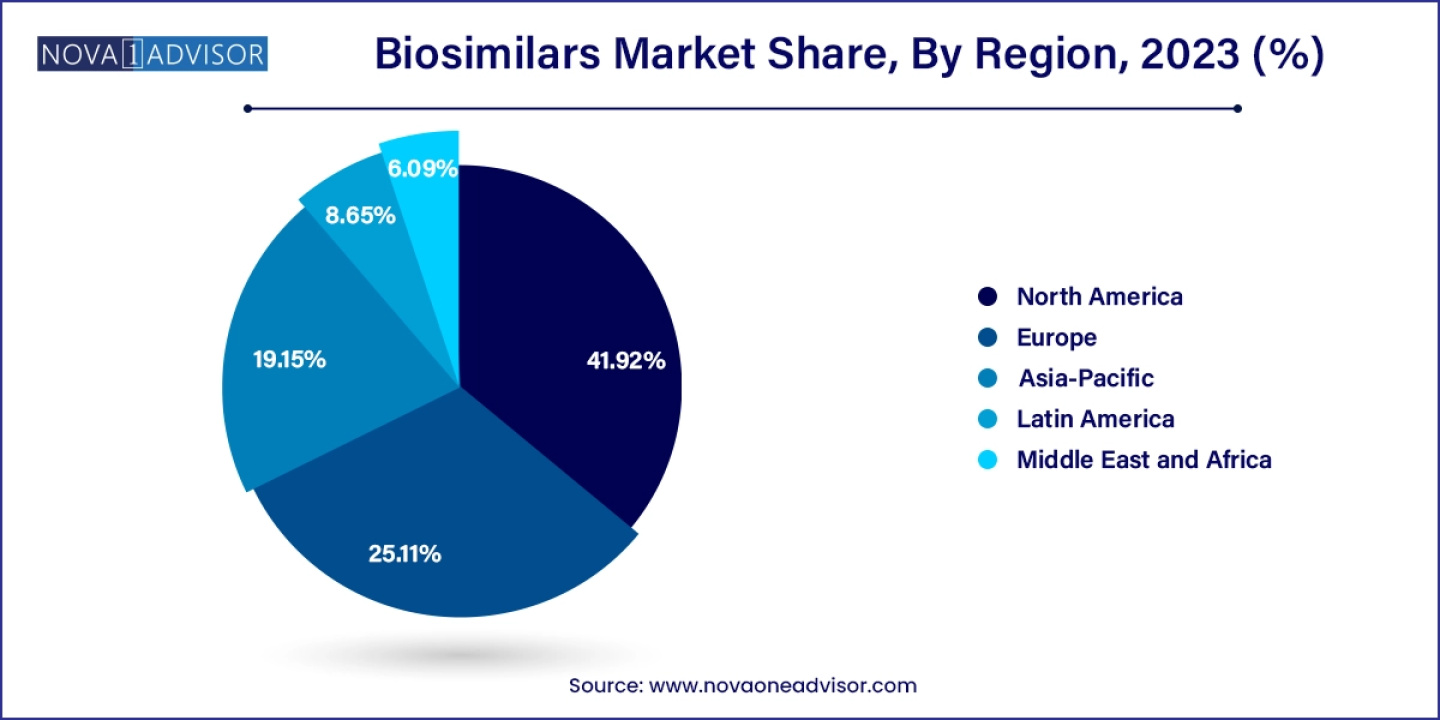

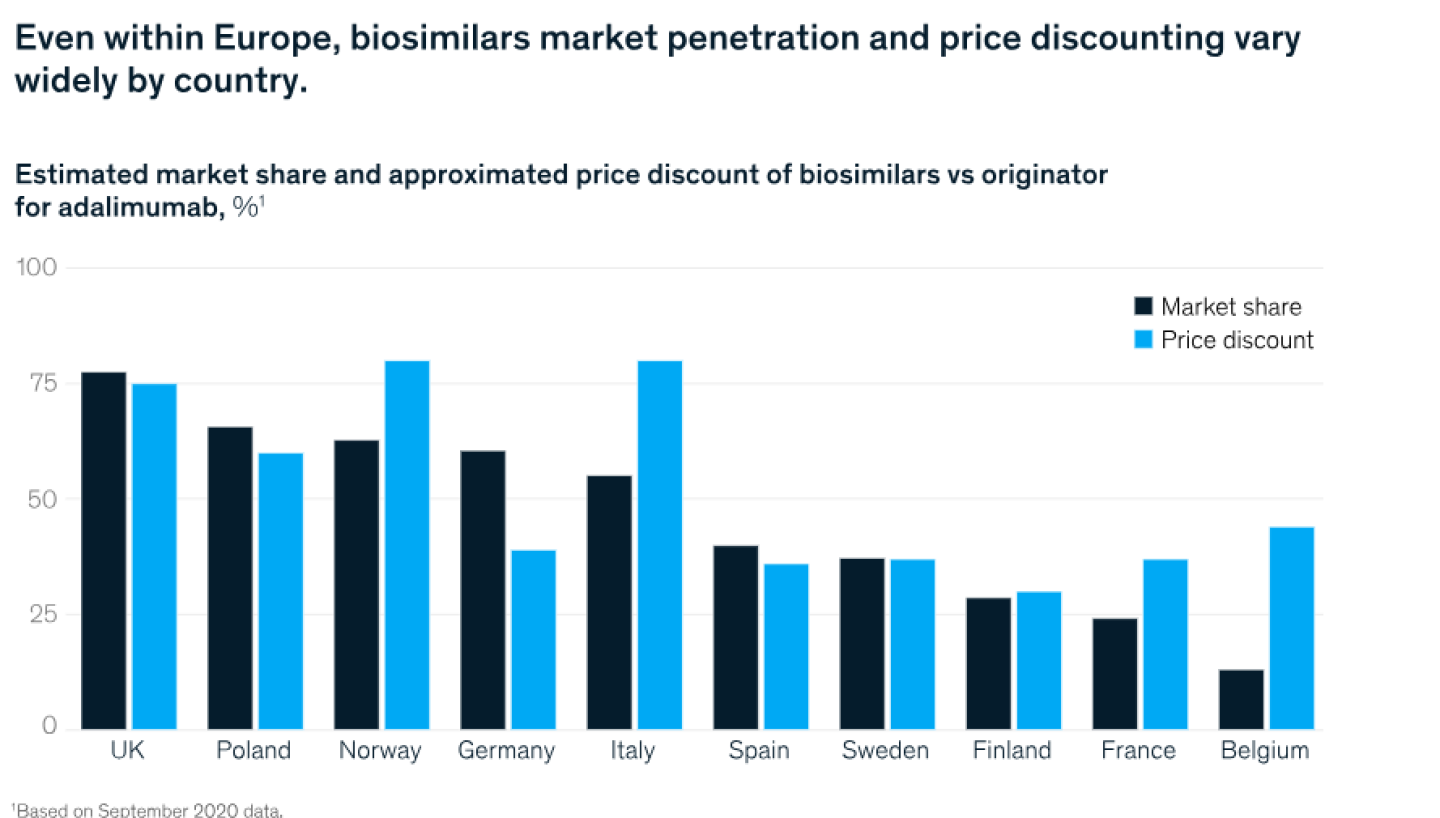

In maturing European markets, biosimilars adoption exceeds 46 percent by volume across all molecules. However, this aggregate number masks wide variations in uptake between individual markets and molecules resulting from differences in policy, utilization of tenders, pricing and reimbursement, prescriber education.

Such differences are apparent in Exhibit 2, where variable approaches, for example between tender-based procurement and physician-driven pharmacy models, might result in different penetration levels. As markets develop, pricing dynamics play out more quickly, with companies offering large discounts or rebates for specific channels or key accounts earlier in a product’s commercial life cycle. For example, initial price discounts for recently launched biosimilars such as adalimumab are much greater than they were for older products.

How Biosimilars Are Improving Access to Biologic Medicines

Despite their benefits, biologic treatments are often associated with a high price tag, which can present a challenge getting them to the patients who need them. Between research and development and clinical testing, studies have shown that the development of new biologics (including the cost of failures) can exceed $2 billion and can take 10 years or longer—and that's on top of developing and deploying the state-of-the-art technology necessary for manufacturing.

Even with insurance, cost-sharing agreements for biologics can leave patients with a hefty bill or unable to afford the treatments at all. Drug companies, doctors, and governments want to expand access the benefits of these treatments and that’s where biosimilars come in.

Drug companies can charge lower prices for biosimilars because much of the upfront development phase has been completed. While biosimilars go through testing to ensure they are as safe and effective as the original biologics, it doesn't cost billions of dollars to create this new class of drugs.

According to the Association for Accessible Medicines, biosimilars have the potential to save the US healthcare system more than $133 billion by 2025.

Reducing overall costs means more patients may be able to access these essential medicines and provide savings to the healthcare system, which can free up resources for other areas of patient care.

Biosimilars vs. Generic Medications

Biosimilars are often compared to generic medications, but there are key differences.

The active ingredient within generic versions (of drugs that aren’t biologics) are exact copies of name brand medications, made with an easily repeatable manufacturing process.

In contrast, due to the variability of biologics, biosimilars cannot be exact copies but they do have the same mechanism of action and the same expected benefits and risks as the original biologics.

Similar to generics, biosimilars provide patients with lower-cost medicines, often making these treatments more accessible and improving quality of life for patients.

Related report

Oncology Market : https://www.biospace.com/article/releases/laxman-dige-precedenceresearch-com/

Oncology Clinical Trials Market : https://www.biospace.com/article/releases/oncology-clinical-trials-market-experiencing-rapid-growth/

Clinical Trials Market : https://www.biospace.com/article/releases/clinical-trials-market-size-to-increase-usd-153-59-billion-by-2033/

Biomarkers Market: https://www.biospace.com/article/releases/biomarkers-market-size-to-hit-usd-284-76-billion-by-2033/

Genomics Market: https://www.biospace.com/article/releases/genomics-market-size-to-hit-usd-157-47-billion-by-2033/

Biologics Market: https://www.biospace.com/article/biologics-market-size-to-hit-around-usd-1-37-trillion-by-2033/

Cancer Gene Therapy Market : https://www.biospace.com/article/releases/cancer-gene-therapy-industry-is-rising-rapidly-up-to-usd-18-11-bn-by-2033/

U.S. Clinical Trials Market: https://www.biospace.com/article/releases/u-s-clinical-trials-market-size-industry-analysis-report-2033/

U.S. Cell Culture Market https://www.biospace.com/article/u-s-cell-culture-market-size-poised-for-strong-growth-usd-15-89-bn-by-2033/

Immuno-Oncology (IO) Market : https://www.biospace.com/article/immuno-oncology-io-market-size-to-hit-usd-284-29-billion-by-2033/

Biotechnology Market : https://www.biospace.com/article/biotechnology-market-size-to-reach-usd-5-68-trillion-by-2033/

Breast Cancer Drugs Market: https://www.biospace.com/article/releases/breast-cancer-drugs-market-size-to-surpass-usd-78-61-bn-by-2033/

Recent Developments

Some of the prominent players in the Biosimilars market include:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the biosimilars market

By Product

https://www.novaoneadvisor.com/report/checkout/7070

Frequently Asked Questions

https://www.novaoneadvisor.com/report/checkout/7070

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

According to a new market research report, the global biosimilars market size was USD 29.45 billion in 2023, calculated at USD 34.66 billion in 2024 and is expected to reach around USD 150.26 billion by 2033, expanding at a CAGR of 17.7% from 2024 to 2033. North America dominated the market with the largest revenue share of 41.0% in 2023.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/7070

Biosimilar drugs, requiring significantly less research and development compared to their reference biologics due to their similar composition, present a cost-effective alternative that catalyzes market’s growth.

The biosimilars market is experiencing rapid growth, driven by the introduction of these cost-effective alternatives to brand name biologic drugs. Unlike generics, biosimilars are not exact copies but are derived from natural sources and must undergo rigorous clinical trials to ensure safety and efficacy, as mandated by the FDA. These trials compare the biosimilar to its reference biologic, which has already been approved and used in treating various diseases. Biosimilars offer safe and effective treatment options for conditions such as chronic skin and bowel diseases, arthritis, kidney conditions, and cancer, thereby increasing patient access to life-saving medications at potentially lower costs. The FDA's approval process ensures biosimilars exhibit no clinically meaningful differences from their reference products, allowing only minor variations in inactive components. This competitive landscape encourages manufacturers to reduce prices while maintaining high standards, significantly benefiting the healthcare system and driving market expansion. For more detailed information and educational resources, healthcare providers and patients are encouraged to explore the FDA’s dedicated website on biosimilars.

https://www.novaoneadvisor.com/report/checkout/7070

Market Dynamics

Driver

Enhanced Access and Cost Efficiency

Biosimilars possess substantial potential to enhance access to disease-modifying therapies for a broad spectrum of chronic illnesses, including certain cancers. Their more cost-efficient manufacturing processes may also facilitate increased experimentation with pharmacological therapies. By improving patient access to high-level drug therapies and alleviating the financial burden of chronic diseases on global healthcare systems, biosimilars can drive significant market growth. For this potential to be fully realized, physicians must become more comfortable prescribing biosimilars in place of reference products, and the prices of biosimilars must be considerably lower than their biological counterparts.

Restraint

Manufacturing and Analytical Challenges

Biosimilar manufacturers face significant challenges in processing and packaging due to the variability of large molecules and the stringent requirements for FDA proof of clinical safety. Variations in cell culture conditions can alter the molecular structure and clinical behavior of biosimilars, potentially introducing impurities, contaminating viruses, and traces of cell protein and DNA. The complexity of biosimilar molecular structures is compounded by a lack of advanced analytical tools needed to precisely differentiate between the original therapeutic protein and the biosimilar. These factors collectively constrain the growth of the biosimilars market.

Opportunities

Advancements in Technology

Advancements in scientific technology have significantly accelerated the research and development of biosimilars, allowing for enhancements to biologics developed approximately 15 years ago. Biosimilars represent a rapidly growing drug class intended to be used interchangeably with biologics, which are complex proteins produced in living cells with diverse therapeutic applications, including in gastroenterology for treating inflammatory bowel diseases, cancers, and endocrine disorders. The primary goal of biosimilar development is to reduce treatment costs while maintaining nearly identical efficacy, safety profiles, and immunogenicity to their reference biologics. As biosimilars require fewer clinical trials compared to their reference products but still involve production within living cells, the expiration of biologic patents presents a significant opportunity for expanding the biosimilars market. Continued manufacturing of new biosimilars as patents expire is poised to drive market growth and increase accessibility to these cost-effective treatment options.

Report Highlights

By Product Insights

The monoclonal antibodies (mAbs) segment has accounted for the largest revenue share in the biosimilars market, driven by their widespread use in cancer treatments and approvals from the EMA and FDA. Biosimilar monoclonal antibodies are rigorously tested, with data focusing heavily on their molecular characterization and randomized clinical studies confirming that any minor differences compared to the reference mAbs do not impact their efficacy or safety. mAbs are crucial biological agents used to treat malignancies such as non-Hodgkin's lymphomas and chronic lymphocytic leukemia, offering high effectiveness but often at significant cost. As patents for many mAbs expire, the development of biosimilar medicines containing versions of the original drug's active ingredient is accelerating, providing more cost-effective treatment options.

The erythropoietin segment is projected to be the fastest-growing segment in the biosimilars market during the forecast period. Recombinant human erythropoietin (rEPO) biosimilars are analogous versions of epoetin drugs, such as epoetin alfa, which is produced using recombinant DNA technology in cell culture. Epoetin alfa stimulates erythropoiesis, thereby increasing red blood cell levels, and is widely used to treat anemia associated with chronic renal failure and cancer chemotherapy. The growing demand for cost-effective treatments for anemia is driving the rapid expansion of the erythropoietin biosimilars market.

The oncology segment has dominated the global biosimilars industry, driven by the extensive use of biologic-based medicines such as trastuzumab (Herceptin), a targeted cancer drug used to treat breast cancer and advanced stomach cancer. Biologic medications, which account for about one-quarter of the worldwide pharmaceutical market, have led to significant advancements in cancer treatment and supportive care. As patents for many widely used biologics expire, biosimilars highly similar yet not identical to their reference biologic drugs offer the potential to enhance access and provide more affordable options for cancer treatment. This dynamic is propelling the growth of biosimilars in oncology, making it a key application area within the market.

The growth hormonal deficiency segment is anticipated to be the fastest-growing segment in the biosimilars market during the forecast period. A large-scale study has demonstrated that Omnitrope, a biosimilar growth hormone, is both effective and well-tolerated in treating various growth disorders in children. Omnitrope, a biosimilar somatropin and a recombinant form of human growth hormone (rhGH), has shown significant efficacy and tolerability in pediatric patients. This underscores the potential of biosimilar growth hormones to offer cost-effective and reliable treatment options for growth hormone deficiencies, driving robust growth in this application segment.

Regional Insights

North America dominated the market with the largest revenue share of 41.0% in 2023. driven by the expiration of patents for established biologic drugs. This region has the potential to become global suppliers of affordable, safe, and effective biosimilars. With more biosimilars in development across Asia-Pacific than anywhere else, emerging Asian economies are poised to enhance their domestic biologics and biotechnology capabilities. This positions domestic and regional manufacturers in these markets to potentially assume a global leadership role in the biosimilars industry in the near future.

Biosimilars uptake varies by market and molecule

A pooled literature review of 90 studies published in 2018 indicated that switching from originator drugs to biosimilars made no difference in clinical efficacy and safety in the majority of cases.2 Many countries now encourage physician-led switching to biosimilars, and switching among pharmacies, pharmacy benefit managers, and others is also likely to increase.

In maturing European markets, biosimilars adoption exceeds 46 percent by volume across all molecules. However, this aggregate number masks wide variations in uptake between individual markets and molecules resulting from differences in policy, utilization of tenders, pricing and reimbursement, prescriber education.

Such differences are apparent in Exhibit 2, where variable approaches, for example between tender-based procurement and physician-driven pharmacy models, might result in different penetration levels. As markets develop, pricing dynamics play out more quickly, with companies offering large discounts or rebates for specific channels or key accounts earlier in a product’s commercial life cycle. For example, initial price discounts for recently launched biosimilars such as adalimumab are much greater than they were for older products.

How Biosimilars Are Improving Access to Biologic Medicines

Despite their benefits, biologic treatments are often associated with a high price tag, which can present a challenge getting them to the patients who need them. Between research and development and clinical testing, studies have shown that the development of new biologics (including the cost of failures) can exceed $2 billion and can take 10 years or longer—and that's on top of developing and deploying the state-of-the-art technology necessary for manufacturing.

Even with insurance, cost-sharing agreements for biologics can leave patients with a hefty bill or unable to afford the treatments at all. Drug companies, doctors, and governments want to expand access the benefits of these treatments and that’s where biosimilars come in.

Drug companies can charge lower prices for biosimilars because much of the upfront development phase has been completed. While biosimilars go through testing to ensure they are as safe and effective as the original biologics, it doesn't cost billions of dollars to create this new class of drugs.

According to the Association for Accessible Medicines, biosimilars have the potential to save the US healthcare system more than $133 billion by 2025.

Reducing overall costs means more patients may be able to access these essential medicines and provide savings to the healthcare system, which can free up resources for other areas of patient care.

Biosimilars vs. Generic Medications

Biosimilars are often compared to generic medications, but there are key differences.

The active ingredient within generic versions (of drugs that aren’t biologics) are exact copies of name brand medications, made with an easily repeatable manufacturing process.

In contrast, due to the variability of biologics, biosimilars cannot be exact copies but they do have the same mechanism of action and the same expected benefits and risks as the original biologics.

Similar to generics, biosimilars provide patients with lower-cost medicines, often making these treatments more accessible and improving quality of life for patients.

Related report

Oncology Market : https://www.biospace.com/article/releases/laxman-dige-precedenceresearch-com/

Oncology Clinical Trials Market : https://www.biospace.com/article/releases/oncology-clinical-trials-market-experiencing-rapid-growth/

Clinical Trials Market : https://www.biospace.com/article/releases/clinical-trials-market-size-to-increase-usd-153-59-billion-by-2033/

Biomarkers Market: https://www.biospace.com/article/releases/biomarkers-market-size-to-hit-usd-284-76-billion-by-2033/

Genomics Market: https://www.biospace.com/article/releases/genomics-market-size-to-hit-usd-157-47-billion-by-2033/

Biologics Market: https://www.biospace.com/article/biologics-market-size-to-hit-around-usd-1-37-trillion-by-2033/

Cancer Gene Therapy Market : https://www.biospace.com/article/releases/cancer-gene-therapy-industry-is-rising-rapidly-up-to-usd-18-11-bn-by-2033/

U.S. Clinical Trials Market: https://www.biospace.com/article/releases/u-s-clinical-trials-market-size-industry-analysis-report-2033/

U.S. Cell Culture Market https://www.biospace.com/article/u-s-cell-culture-market-size-poised-for-strong-growth-usd-15-89-bn-by-2033/

Immuno-Oncology (IO) Market : https://www.biospace.com/article/immuno-oncology-io-market-size-to-hit-usd-284-29-billion-by-2033/

Biotechnology Market : https://www.biospace.com/article/biotechnology-market-size-to-reach-usd-5-68-trillion-by-2033/

Breast Cancer Drugs Market: https://www.biospace.com/article/releases/breast-cancer-drugs-market-size-to-surpass-usd-78-61-bn-by-2033/

Recent Developments

Some of the prominent players in the Biosimilars market include:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the biosimilars market

By Product

https://www.novaoneadvisor.com/report/checkout/7070

Frequently Asked Questions

https://www.novaoneadvisor.com/report/checkout/7070

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/7070

Biosimilar drugs, requiring significantly less research and development compared to their reference biologics due to their similar composition, present a cost-effective alternative that catalyzes market’s growth.

The biosimilars market is experiencing rapid growth, driven by the introduction of these cost-effective alternatives to brand name biologic drugs. Unlike generics, biosimilars are not exact copies but are derived from natural sources and must undergo rigorous clinical trials to ensure safety and efficacy, as mandated by the FDA. These trials compare the biosimilar to its reference biologic, which has already been approved and used in treating various diseases. Biosimilars offer safe and effective treatment options for conditions such as chronic skin and bowel diseases, arthritis, kidney conditions, and cancer, thereby increasing patient access to life-saving medications at potentially lower costs. The FDA's approval process ensures biosimilars exhibit no clinically meaningful differences from their reference products, allowing only minor variations in inactive components. This competitive landscape encourages manufacturers to reduce prices while maintaining high standards, significantly benefiting the healthcare system and driving market expansion. For more detailed information and educational resources, healthcare providers and patients are encouraged to explore the FDA’s dedicated website on biosimilars.

- In November 2023, mAbxience and MS Pharma signed a partnership to develop a denosumab biosimilar in select MEA countries, aiming to expand their biosimilar market presence.

- North America biosimilars market size accounted for USD 6.43 billion in 2023 and is expected to reach around USD 31.71 billion by 2032, growing at a CAGR of 17.3% from 2024 to 2033.

- Asia Pacific biosimilars market size was valued at USD 8.43 billion in 2023 and is projected to surpass around USD 46.03 billion by 2033, expanding at a CAGR of 18.5% from 2023 to 2033.

- The Europe biosimilars market size was valued at USD 9.84 billion in 2023 and is estimated to reach around USD 47.30 billion by 2033, growing at a CAGR of 17% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 41% in 2023.

- Europe is the fastest growing in the market with market share of 25.11% in 2023.

- Asia Pacific is expected to expand at the fastest CAGR of 18.5% during the forecast period.

- By product, the monoclonal antibodies segment has captured around 41.19% of revenue share in 2023.

- By product, the insulin segment is projected to grow at a double-digit CAGR of 17.8% during the forecast period.

- By application, the oncology segment has contributed the largest market share of 24.51% in 2023.

- By application, the chronic and autoimmune disorders segment is growing at a CAGR of 17.9% during the forecast period.

- By manufacturer, the in-house segment accounted for the biggest market share of 84.71% in 2023.

- By manufacturer, the contract research and manufacturing services segment is poised to grow at a remarkable CAGR of 17.9% during the forecast period.

https://www.novaoneadvisor.com/report/checkout/7070

Market Dynamics

Driver

Enhanced Access and Cost Efficiency

Biosimilars possess substantial potential to enhance access to disease-modifying therapies for a broad spectrum of chronic illnesses, including certain cancers. Their more cost-efficient manufacturing processes may also facilitate increased experimentation with pharmacological therapies. By improving patient access to high-level drug therapies and alleviating the financial burden of chronic diseases on global healthcare systems, biosimilars can drive significant market growth. For this potential to be fully realized, physicians must become more comfortable prescribing biosimilars in place of reference products, and the prices of biosimilars must be considerably lower than their biological counterparts.

Restraint

Manufacturing and Analytical Challenges

Biosimilar manufacturers face significant challenges in processing and packaging due to the variability of large molecules and the stringent requirements for FDA proof of clinical safety. Variations in cell culture conditions can alter the molecular structure and clinical behavior of biosimilars, potentially introducing impurities, contaminating viruses, and traces of cell protein and DNA. The complexity of biosimilar molecular structures is compounded by a lack of advanced analytical tools needed to precisely differentiate between the original therapeutic protein and the biosimilar. These factors collectively constrain the growth of the biosimilars market.

Opportunities

Advancements in Technology

Advancements in scientific technology have significantly accelerated the research and development of biosimilars, allowing for enhancements to biologics developed approximately 15 years ago. Biosimilars represent a rapidly growing drug class intended to be used interchangeably with biologics, which are complex proteins produced in living cells with diverse therapeutic applications, including in gastroenterology for treating inflammatory bowel diseases, cancers, and endocrine disorders. The primary goal of biosimilar development is to reduce treatment costs while maintaining nearly identical efficacy, safety profiles, and immunogenicity to their reference biologics. As biosimilars require fewer clinical trials compared to their reference products but still involve production within living cells, the expiration of biologic patents presents a significant opportunity for expanding the biosimilars market. Continued manufacturing of new biosimilars as patents expire is poised to drive market growth and increase accessibility to these cost-effective treatment options.

- In September 2023, CVS introduced a new biosimilars brand, enhancing its offerings in the healthcare market.

Report Highlights

By Product Insights

The monoclonal antibodies (mAbs) segment has accounted for the largest revenue share in the biosimilars market, driven by their widespread use in cancer treatments and approvals from the EMA and FDA. Biosimilar monoclonal antibodies are rigorously tested, with data focusing heavily on their molecular characterization and randomized clinical studies confirming that any minor differences compared to the reference mAbs do not impact their efficacy or safety. mAbs are crucial biological agents used to treat malignancies such as non-Hodgkin's lymphomas and chronic lymphocytic leukemia, offering high effectiveness but often at significant cost. As patents for many mAbs expire, the development of biosimilar medicines containing versions of the original drug's active ingredient is accelerating, providing more cost-effective treatment options.

The erythropoietin segment is projected to be the fastest-growing segment in the biosimilars market during the forecast period. Recombinant human erythropoietin (rEPO) biosimilars are analogous versions of epoetin drugs, such as epoetin alfa, which is produced using recombinant DNA technology in cell culture. Epoetin alfa stimulates erythropoiesis, thereby increasing red blood cell levels, and is widely used to treat anemia associated with chronic renal failure and cancer chemotherapy. The growing demand for cost-effective treatments for anemia is driving the rapid expansion of the erythropoietin biosimilars market.

- Monoclonal antibodies segment was valued at USD 12.08 billion in 2023 and will grow at a CAGR of 18.1% during the forecast period

- Somatropin segment was valued at USD 3.95 billion in 2023 and is expected to grow at a CAGR of 17.4% during the forecast period

- Insulin segment was estimated at USD 4.88 billion in 2023 and is expanding at a notable CAGR of 17.8% over the forecast period.

- Erythropoietin antibodies segment accounted for USD 2.09 billion in 2023 and will grow at a CAGR of 17.1% during the forecast period.

The oncology segment has dominated the global biosimilars industry, driven by the extensive use of biologic-based medicines such as trastuzumab (Herceptin), a targeted cancer drug used to treat breast cancer and advanced stomach cancer. Biologic medications, which account for about one-quarter of the worldwide pharmaceutical market, have led to significant advancements in cancer treatment and supportive care. As patents for many widely used biologics expire, biosimilars highly similar yet not identical to their reference biologic drugs offer the potential to enhance access and provide more affordable options for cancer treatment. This dynamic is propelling the growth of biosimilars in oncology, making it a key application area within the market.

The growth hormonal deficiency segment is anticipated to be the fastest-growing segment in the biosimilars market during the forecast period. A large-scale study has demonstrated that Omnitrope, a biosimilar growth hormone, is both effective and well-tolerated in treating various growth disorders in children. Omnitrope, a biosimilar somatropin and a recombinant form of human growth hormone (rhGH), has shown significant efficacy and tolerability in pediatric patients. This underscores the potential of biosimilar growth hormones to offer cost-effective and reliable treatment options for growth hormone deficiencies, driving robust growth in this application segment.

Regional Insights

North America dominated the market with the largest revenue share of 41.0% in 2023. driven by the expiration of patents for established biologic drugs. This region has the potential to become global suppliers of affordable, safe, and effective biosimilars. With more biosimilars in development across Asia-Pacific than anywhere else, emerging Asian economies are poised to enhance their domestic biologics and biotechnology capabilities. This positions domestic and regional manufacturers in these markets to potentially assume a global leadership role in the biosimilars industry in the near future.

- In May 2023, Amneal launched its third biosimilar, FYLNETRA (pegfilgrastim-pbbk), in the United States, expanding its biosimilar product offerings.

- In July 2023, Sandoz entered the US immunology space with the launch of Hyrimoz (adalimumab-adaz) in a high-concentration formulation. This move aimed to strengthen Sandoz's biosimilar portfolio.

- North America biosimilars market size accounted for USD 6.43 billion in 2023 and is expected to reach around USD 31.71 billion by 2032, growing at a CAGR of 17.3% from 2024 to 2033.

- Asia Pacific biosimilars market size was valued at USD 8.43 billion in 2023 and is projected to surpass around USD 46.03 billion by 2033, expanding at a CAGR of 18.5% from 2023 to 2033.

- The Europe biosimilars market size was valued at USD 9.84 billion in 2023 and is estimated to reach around USD 47.30 billion by 2033, growing at a CAGR of 17% between 2024 and 2033.

Biosimilars uptake varies by market and molecule

A pooled literature review of 90 studies published in 2018 indicated that switching from originator drugs to biosimilars made no difference in clinical efficacy and safety in the majority of cases.2 Many countries now encourage physician-led switching to biosimilars, and switching among pharmacies, pharmacy benefit managers, and others is also likely to increase.

In maturing European markets, biosimilars adoption exceeds 46 percent by volume across all molecules. However, this aggregate number masks wide variations in uptake between individual markets and molecules resulting from differences in policy, utilization of tenders, pricing and reimbursement, prescriber education.

Such differences are apparent in Exhibit 2, where variable approaches, for example between tender-based procurement and physician-driven pharmacy models, might result in different penetration levels. As markets develop, pricing dynamics play out more quickly, with companies offering large discounts or rebates for specific channels or key accounts earlier in a product’s commercial life cycle. For example, initial price discounts for recently launched biosimilars such as adalimumab are much greater than they were for older products.

How Biosimilars Are Improving Access to Biologic Medicines

Despite their benefits, biologic treatments are often associated with a high price tag, which can present a challenge getting them to the patients who need them. Between research and development and clinical testing, studies have shown that the development of new biologics (including the cost of failures) can exceed $2 billion and can take 10 years or longer—and that's on top of developing and deploying the state-of-the-art technology necessary for manufacturing.

Even with insurance, cost-sharing agreements for biologics can leave patients with a hefty bill or unable to afford the treatments at all. Drug companies, doctors, and governments want to expand access the benefits of these treatments and that’s where biosimilars come in.

Drug companies can charge lower prices for biosimilars because much of the upfront development phase has been completed. While biosimilars go through testing to ensure they are as safe and effective as the original biologics, it doesn't cost billions of dollars to create this new class of drugs.

According to the Association for Accessible Medicines, biosimilars have the potential to save the US healthcare system more than $133 billion by 2025.

Reducing overall costs means more patients may be able to access these essential medicines and provide savings to the healthcare system, which can free up resources for other areas of patient care.

Biosimilars vs. Generic Medications

Biosimilars are often compared to generic medications, but there are key differences.

The active ingredient within generic versions (of drugs that aren’t biologics) are exact copies of name brand medications, made with an easily repeatable manufacturing process.

In contrast, due to the variability of biologics, biosimilars cannot be exact copies but they do have the same mechanism of action and the same expected benefits and risks as the original biologics.

Similar to generics, biosimilars provide patients with lower-cost medicines, often making these treatments more accessible and improving quality of life for patients.

Related report

Oncology Market : https://www.biospace.com/article/releases/laxman-dige-precedenceresearch-com/

Oncology Clinical Trials Market : https://www.biospace.com/article/releases/oncology-clinical-trials-market-experiencing-rapid-growth/

Clinical Trials Market : https://www.biospace.com/article/releases/clinical-trials-market-size-to-increase-usd-153-59-billion-by-2033/

Biomarkers Market: https://www.biospace.com/article/releases/biomarkers-market-size-to-hit-usd-284-76-billion-by-2033/

Genomics Market: https://www.biospace.com/article/releases/genomics-market-size-to-hit-usd-157-47-billion-by-2033/

Biologics Market: https://www.biospace.com/article/biologics-market-size-to-hit-around-usd-1-37-trillion-by-2033/

Cancer Gene Therapy Market : https://www.biospace.com/article/releases/cancer-gene-therapy-industry-is-rising-rapidly-up-to-usd-18-11-bn-by-2033/

U.S. Clinical Trials Market: https://www.biospace.com/article/releases/u-s-clinical-trials-market-size-industry-analysis-report-2033/

U.S. Cell Culture Market https://www.biospace.com/article/u-s-cell-culture-market-size-poised-for-strong-growth-usd-15-89-bn-by-2033/

Immuno-Oncology (IO) Market : https://www.biospace.com/article/immuno-oncology-io-market-size-to-hit-usd-284-29-billion-by-2033/

Biotechnology Market : https://www.biospace.com/article/biotechnology-market-size-to-reach-usd-5-68-trillion-by-2033/

Breast Cancer Drugs Market: https://www.biospace.com/article/releases/breast-cancer-drugs-market-size-to-surpass-usd-78-61-bn-by-2033/

Recent Developments

- In November 2022, Biocon Biologics completed the acquisition of Viatris’ global biosimilars business, solidifying its presence in the market. This strategic move aimed to bolster Biocon Biologics' portfolio and expand its reach in biosimilar development and distribution.

- In May 2022, Formycon AG and ATHOS KG finalized the acquisition of biosimilar assets FYB201 and FYB202, along with Bioeq GmbH, following approvals from relevant authorities. This transaction aimed to strengthen Formycon AG's position in the biosimilars market.

- In February 2024, Biocon Biologics partnered with Sandoz Australia to develop biosimilars for trastuzumab and bevacizumab, aiming to strengthen their presence in the Australian market.

- In February 2024, Biocon Biologics secured a US market entry date for Bmab 1200, a proposed biosimilar to Stelara, further expanding its biosimilar offerings.

- In April 2024, Alvotech and Teva announced the US FDA approval of SELARSDI (ustekinumab-aekn), a biosimilar to Stelara, marking a milestone in biosimilar development.

- In January 2024, Syneos Health supported the launch of biosimilars, contributing to advancements in the biosimilars market.

- In May 2023, Just Evotec Biologics launched a tech partnership for biosimilars development and commercial manufacturing, aiming to advance biosimilar capabilities.

Some of the prominent players in the Biosimilars market include:

- Amgen Inc.

- F Hoffman-La Roche Ltd.

- Sandoz International GmbH

- Dr. Reddy’s Laboratories Ltd.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Samsung Biopis

- Biocon

- Viatris Inc.

- Celltrion Healthcare Co.,Ltd.

- AbbVie Inc.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the biosimilars market

By Product

- Monoclonal Antibodies

- Infliximab

- Trastuzumab

- Rituximab

- Adalimumab

- Other monoclonal antibodies

- Insulin

- Granulocyte Colony-Stimulating Factor

- Erythropoietin

- Recombinant Human Growth Hormone

- Etanercept

- Follitropin

- Teriparatide

- Interferons

- Anticoagulants

- Other drug class

- Oncology

- Growth Hormonal Deficiency

- Blood Disorders

- Chronic & Autoimmune Disorders

- Infectious Disease

- Others

- Contract Research and Manufacturing Services

- In-house

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

https://www.novaoneadvisor.com/report/checkout/7070

Frequently Asked Questions

- What geographic regions does your market research cover for the Biosimilars market?

- We have a global reach, with expertise spanning across continents, including North America, Europe, Asia-Pacific, Latin America, and the Middle East. We leverage a combination of primary and secondary research methodologies to offer country-level analysis.

- How does your firm conduct cross-sectional analysis for the Biosimilars market?

- We conduct cross-sectional analysis by examining data from different individuals at a single point in time to identify patterns and trends across diverse segments of the market.

- Can your firm customize market research solutions to meet specific client needs?

- Our experienced team works closely with clients to gain a thorough understanding of their business goals and target markets. We have the expertise and flexibility to develop bespoke research solutions.

- Do you offer ongoing support or consultation to clients after the completion of a market research project?

- Our team of experienced analysts is available to address any questions, concerns and needs that may arise following the delivery of the report.

- Can your market research firm help with competitor analysis for Biosimilars market?

- Through a combination of quantitative and qualitative research methodologies, we meticulously assess the strengths, weaknesses, strategies, and market positioning of your competitors.

https://www.novaoneadvisor.com/report/checkout/7070

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

According to a new market research report, the global biosimilars market size was USD 29.45 billion in 2023, calculated at USD 34.66 billion in 2024 and is expected to reach around USD 150.26 billion by 2033, expanding at a CAGR of 17.7% from 2024 to 2033. North America dominated the market with the largest revenue share of 41.0% in 2023.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/7070

Biosimilar drugs, requiring significantly less research and development compared to their reference biologics due to their similar composition, present a cost-effective alternative that catalyzes market’s growth.

The biosimilars market is experiencing rapid growth, driven by the introduction of these cost-effective alternatives to brand name biologic drugs. Unlike generics, biosimilars are not exact copies but are derived from natural sources and must undergo rigorous clinical trials to ensure safety and efficacy, as mandated by the FDA. These trials compare the biosimilar to its reference biologic, which has already been approved and used in treating various diseases. Biosimilars offer safe and effective treatment options for conditions such as chronic skin and bowel diseases, arthritis, kidney conditions, and cancer, thereby increasing patient access to life-saving medications at potentially lower costs. The FDA's approval process ensures biosimilars exhibit no clinically meaningful differences from their reference products, allowing only minor variations in inactive components. This competitive landscape encourages manufacturers to reduce prices while maintaining high standards, significantly benefiting the healthcare system and driving market expansion. For more detailed information and educational resources, healthcare providers and patients are encouraged to explore the FDA’s dedicated website on biosimilars.

- In November 2023, mAbxience and MS Pharma signed a partnership to develop a denosumab biosimilar in select MEA countries, aiming to expand their biosimilar market presence.

- North America biosimilars market size accounted for USD 6.43 billion in 2023 and is expected to reach around USD 31.71 billion by 2032, growing at a CAGR of 17.3% from 2024 to 2033.

- Asia Pacific biosimilars market size was valued at USD 8.43 billion in 2023 and is projected to surpass around USD 46.03 billion by 2033, expanding at a CAGR of 18.5% from 2023 to 2033.

- The Europe biosimilars market size was valued at USD 9.84 billion in 2023 and is estimated to reach around USD 47.30 billion by 2033, growing at a CAGR of 17% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 41% in 2023.

- Europe is the fastest growing in the market with market share of 25.11% in 2023.

- Asia Pacific is expected to expand at the fastest CAGR of 18.5% during the forecast period.

- By product, the monoclonal antibodies segment has captured around 41.19% of revenue share in 2023.

- By product, the insulin segment is projected to grow at a double-digit CAGR of 17.8% during the forecast period.

- By application, the oncology segment has contributed the largest market share of 24.51% in 2023.

- By application, the chronic and autoimmune disorders segment is growing at a CAGR of 17.9% during the forecast period.

- By manufacturer, the in-house segment accounted for the biggest market share of 84.71% in 2023.

- By manufacturer, the contract research and manufacturing services segment is poised to grow at a remarkable CAGR of 17.9% during the forecast period.

https://www.novaoneadvisor.com/report/checkout/7070

Market Dynamics

Driver

Enhanced Access and Cost Efficiency

Biosimilars possess substantial potential to enhance access to disease-modifying therapies for a broad spectrum of chronic illnesses, including certain cancers. Their more cost-efficient manufacturing processes may also facilitate increased experimentation with pharmacological therapies. By improving patient access to high-level drug therapies and alleviating the financial burden of chronic diseases on global healthcare systems, biosimilars can drive significant market growth. For this potential to be fully realized, physicians must become more comfortable prescribing biosimilars in place of reference products, and the prices of biosimilars must be considerably lower than their biological counterparts.

Restraint

Manufacturing and Analytical Challenges

Biosimilar manufacturers face significant challenges in processing and packaging due to the variability of large molecules and the stringent requirements for FDA proof of clinical safety. Variations in cell culture conditions can alter the molecular structure and clinical behavior of biosimilars, potentially introducing impurities, contaminating viruses, and traces of cell protein and DNA. The complexity of biosimilar molecular structures is compounded by a lack of advanced analytical tools needed to precisely differentiate between the original therapeutic protein and the biosimilar. These factors collectively constrain the growth of the biosimilars market.

Opportunities

Advancements in Technology

Advancements in scientific technology have significantly accelerated the research and development of biosimilars, allowing for enhancements to biologics developed approximately 15 years ago. Biosimilars represent a rapidly growing drug class intended to be used interchangeably with biologics, which are complex proteins produced in living cells with diverse therapeutic applications, including in gastroenterology for treating inflammatory bowel diseases, cancers, and endocrine disorders. The primary goal of biosimilar development is to reduce treatment costs while maintaining nearly identical efficacy, safety profiles, and immunogenicity to their reference biologics. As biosimilars require fewer clinical trials compared to their reference products but still involve production within living cells, the expiration of biologic patents presents a significant opportunity for expanding the biosimilars market. Continued manufacturing of new biosimilars as patents expire is poised to drive market growth and increase accessibility to these cost-effective treatment options.

- In September 2023, CVS introduced a new biosimilars brand, enhancing its offerings in the healthcare market.

Report Highlights

By Product Insights

The monoclonal antibodies (mAbs) segment has accounted for the largest revenue share in the biosimilars market, driven by their widespread use in cancer treatments and approvals from the EMA and FDA. Biosimilar monoclonal antibodies are rigorously tested, with data focusing heavily on their molecular characterization and randomized clinical studies confirming that any minor differences compared to the reference mAbs do not impact their efficacy or safety. mAbs are crucial biological agents used to treat malignancies such as non-Hodgkin's lymphomas and chronic lymphocytic leukemia, offering high effectiveness but often at significant cost. As patents for many mAbs expire, the development of biosimilar medicines containing versions of the original drug's active ingredient is accelerating, providing more cost-effective treatment options.

The erythropoietin segment is projected to be the fastest-growing segment in the biosimilars market during the forecast period. Recombinant human erythropoietin (rEPO) biosimilars are analogous versions of epoetin drugs, such as epoetin alfa, which is produced using recombinant DNA technology in cell culture. Epoetin alfa stimulates erythropoiesis, thereby increasing red blood cell levels, and is widely used to treat anemia associated with chronic renal failure and cancer chemotherapy. The growing demand for cost-effective treatments for anemia is driving the rapid expansion of the erythropoietin biosimilars market.

- Monoclonal antibodies segment was valued at USD 12.08 billion in 2023 and will grow at a CAGR of 18.1% during the forecast period

- Somatropin segment was valued at USD 3.95 billion in 2023 and is expected to grow at a CAGR of 17.4% during the forecast period

- Insulin segment was estimated at USD 4.88 billion in 2023 and is expanding at a notable CAGR of 17.8% over the forecast period.

- Erythropoietin antibodies segment accounted for USD 2.09 billion in 2023 and will grow at a CAGR of 17.1% during the forecast period.

The oncology segment has dominated the global biosimilars industry, driven by the extensive use of biologic-based medicines such as trastuzumab (Herceptin), a targeted cancer drug used to treat breast cancer and advanced stomach cancer. Biologic medications, which account for about one-quarter of the worldwide pharmaceutical market, have led to significant advancements in cancer treatment and supportive care. As patents for many widely used biologics expire, biosimilars highly similar yet not identical to their reference biologic drugs offer the potential to enhance access and provide more affordable options for cancer treatment. This dynamic is propelling the growth of biosimilars in oncology, making it a key application area within the market.

The growth hormonal deficiency segment is anticipated to be the fastest-growing segment in the biosimilars market during the forecast period. A large-scale study has demonstrated that Omnitrope, a biosimilar growth hormone, is both effective and well-tolerated in treating various growth disorders in children. Omnitrope, a biosimilar somatropin and a recombinant form of human growth hormone (rhGH), has shown significant efficacy and tolerability in pediatric patients. This underscores the potential of biosimilar growth hormones to offer cost-effective and reliable treatment options for growth hormone deficiencies, driving robust growth in this application segment.

Regional Insights

North America dominated the market with the largest revenue share of 41.0% in 2023. driven by the expiration of patents for established biologic drugs. This region has the potential to become global suppliers of affordable, safe, and effective biosimilars. With more biosimilars in development across Asia-Pacific than anywhere else, emerging Asian economies are poised to enhance their domestic biologics and biotechnology capabilities. This positions domestic and regional manufacturers in these markets to potentially assume a global leadership role in the biosimilars industry in the near future.

- In May 2023, Amneal launched its third biosimilar, FYLNETRA (pegfilgrastim-pbbk), in the United States, expanding its biosimilar product offerings.

- In July 2023, Sandoz entered the US immunology space with the launch of Hyrimoz (adalimumab-adaz) in a high-concentration formulation. This move aimed to strengthen Sandoz's biosimilar portfolio.

- North America biosimilars market size accounted for USD 6.43 billion in 2023 and is expected to reach around USD 31.71 billion by 2032, growing at a CAGR of 17.3% from 2024 to 2033.

- Asia Pacific biosimilars market size was valued at USD 8.43 billion in 2023 and is projected to surpass around USD 46.03 billion by 2033, expanding at a CAGR of 18.5% from 2023 to 2033.

- The Europe biosimilars market size was valued at USD 9.84 billion in 2023 and is estimated to reach around USD 47.30 billion by 2033, growing at a CAGR of 17% between 2024 and 2033.

Biosimilars uptake varies by market and molecule

A pooled literature review of 90 studies published in 2018 indicated that switching from originator drugs to biosimilars made no difference in clinical efficacy and safety in the majority of cases.2 Many countries now encourage physician-led switching to biosimilars, and switching among pharmacies, pharmacy benefit managers, and others is also likely to increase.

In maturing European markets, biosimilars adoption exceeds 46 percent by volume across all molecules. However, this aggregate number masks wide variations in uptake between individual markets and molecules resulting from differences in policy, utilization of tenders, pricing and reimbursement, prescriber education.

Such differences are apparent in Exhibit 2, where variable approaches, for example between tender-based procurement and physician-driven pharmacy models, might result in different penetration levels. As markets develop, pricing dynamics play out more quickly, with companies offering large discounts or rebates for specific channels or key accounts earlier in a product’s commercial life cycle. For example, initial price discounts for recently launched biosimilars such as adalimumab are much greater than they were for older products.

How Biosimilars Are Improving Access to Biologic Medicines

Despite their benefits, biologic treatments are often associated with a high price tag, which can present a challenge getting them to the patients who need them. Between research and development and clinical testing, studies have shown that the development of new biologics (including the cost of failures) can exceed $2 billion and can take 10 years or longer—and that's on top of developing and deploying the state-of-the-art technology necessary for manufacturing.

Even with insurance, cost-sharing agreements for biologics can leave patients with a hefty bill or unable to afford the treatments at all. Drug companies, doctors, and governments want to expand access the benefits of these treatments and that’s where biosimilars come in.

Drug companies can charge lower prices for biosimilars because much of the upfront development phase has been completed. While biosimilars go through testing to ensure they are as safe and effective as the original biologics, it doesn't cost billions of dollars to create this new class of drugs.

According to the Association for Accessible Medicines, biosimilars have the potential to save the US healthcare system more than $133 billion by 2025.

Reducing overall costs means more patients may be able to access these essential medicines and provide savings to the healthcare system, which can free up resources for other areas of patient care.

Biosimilars vs. Generic Medications

Biosimilars are often compared to generic medications, but there are key differences.

The active ingredient within generic versions (of drugs that aren’t biologics) are exact copies of name brand medications, made with an easily repeatable manufacturing process.

In contrast, due to the variability of biologics, biosimilars cannot be exact copies but they do have the same mechanism of action and the same expected benefits and risks as the original biologics.

Similar to generics, biosimilars provide patients with lower-cost medicines, often making these treatments more accessible and improving quality of life for patients.

Related report

Oncology Market : https://www.biospace.com/article/releases/laxman-dige-precedenceresearch-com/

Oncology Clinical Trials Market : https://www.biospace.com/article/releases/oncology-clinical-trials-market-experiencing-rapid-growth/

Clinical Trials Market : https://www.biospace.com/article/releases/clinical-trials-market-size-to-increase-usd-153-59-billion-by-2033/

Biomarkers Market: https://www.biospace.com/article/releases/biomarkers-market-size-to-hit-usd-284-76-billion-by-2033/

Genomics Market: https://www.biospace.com/article/releases/genomics-market-size-to-hit-usd-157-47-billion-by-2033/

Biologics Market: https://www.biospace.com/article/biologics-market-size-to-hit-around-usd-1-37-trillion-by-2033/

Cancer Gene Therapy Market : https://www.biospace.com/article/releases/cancer-gene-therapy-industry-is-rising-rapidly-up-to-usd-18-11-bn-by-2033/

U.S. Clinical Trials Market: https://www.biospace.com/article/releases/u-s-clinical-trials-market-size-industry-analysis-report-2033/

U.S. Cell Culture Market https://www.biospace.com/article/u-s-cell-culture-market-size-poised-for-strong-growth-usd-15-89-bn-by-2033/

Immuno-Oncology (IO) Market : https://www.biospace.com/article/immuno-oncology-io-market-size-to-hit-usd-284-29-billion-by-2033/

Biotechnology Market : https://www.biospace.com/article/biotechnology-market-size-to-reach-usd-5-68-trillion-by-2033/

Breast Cancer Drugs Market: https://www.biospace.com/article/releases/breast-cancer-drugs-market-size-to-surpass-usd-78-61-bn-by-2033/

Recent Developments

- In November 2022, Biocon Biologics completed the acquisition of Viatris’ global biosimilars business, solidifying its presence in the market. This strategic move aimed to bolster Biocon Biologics' portfolio and expand its reach in biosimilar development and distribution.

- In May 2022, Formycon AG and ATHOS KG finalized the acquisition of biosimilar assets FYB201 and FYB202, along with Bioeq GmbH, following approvals from relevant authorities. This transaction aimed to strengthen Formycon AG's position in the biosimilars market.

- In February 2024, Biocon Biologics partnered with Sandoz Australia to develop biosimilars for trastuzumab and bevacizumab, aiming to strengthen their presence in the Australian market.

- In February 2024, Biocon Biologics secured a US market entry date for Bmab 1200, a proposed biosimilar to Stelara, further expanding its biosimilar offerings.

- In April 2024, Alvotech and Teva announced the US FDA approval of SELARSDI (ustekinumab-aekn), a biosimilar to Stelara, marking a milestone in biosimilar development.

- In January 2024, Syneos Health supported the launch of biosimilars, contributing to advancements in the biosimilars market.

- In May 2023, Just Evotec Biologics launched a tech partnership for biosimilars development and commercial manufacturing, aiming to advance biosimilar capabilities.

Some of the prominent players in the Biosimilars market include:

- Amgen Inc.

- F Hoffman-La Roche Ltd.

- Sandoz International GmbH

- Dr. Reddy’s Laboratories Ltd.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Samsung Biopis

- Biocon

- Viatris Inc.

- Celltrion Healthcare Co.,Ltd.

- AbbVie Inc.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the biosimilars market

By Product

- Monoclonal Antibodies

- Infliximab

- Trastuzumab

- Rituximab

- Adalimumab

- Other monoclonal antibodies

- Insulin

- Granulocyte Colony-Stimulating Factor

- Erythropoietin

- Recombinant Human Growth Hormone

- Etanercept

- Follitropin

- Teriparatide

- Interferons

- Anticoagulants

- Other drug class

- Oncology

- Growth Hormonal Deficiency

- Blood Disorders

- Chronic & Autoimmune Disorders

- Infectious Disease

- Others

- Contract Research and Manufacturing Services

- In-house

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

https://www.novaoneadvisor.com/report/checkout/7070

Frequently Asked Questions

- What geographic regions does your market research cover for the Biosimilars market?

- We have a global reach, with expertise spanning across continents, including North America, Europe, Asia-Pacific, Latin America, and the Middle East. We leverage a combination of primary and secondary research methodologies to offer country-level analysis.

- How does your firm conduct cross-sectional analysis for the Biosimilars market?

- We conduct cross-sectional analysis by examining data from different individuals at a single point in time to identify patterns and trends across diverse segments of the market.

- Can your firm customize market research solutions to meet specific client needs?

- Our experienced team works closely with clients to gain a thorough understanding of their business goals and target markets. We have the expertise and flexibility to develop bespoke research solutions.

- Do you offer ongoing support or consultation to clients after the completion of a market research project?

- Our team of experienced analysts is available to address any questions, concerns and needs that may arise following the delivery of the report.

- Can your market research firm help with competitor analysis for Biosimilars market?

- Through a combination of quantitative and qualitative research methodologies, we meticulously assess the strengths, weaknesses, strategies, and market positioning of your competitors.

https://www.novaoneadvisor.com/report/checkout/7070

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/