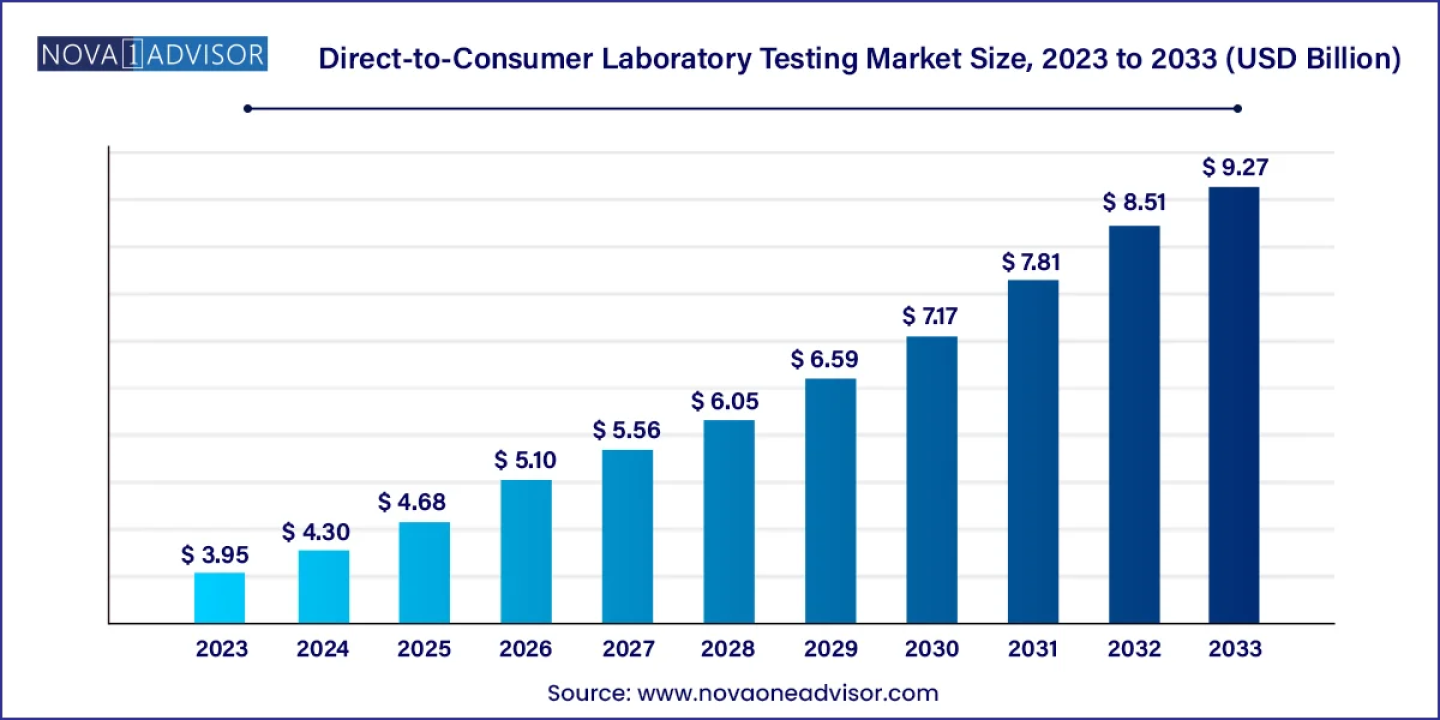

According to the latest report, the global direct-to-consumer laboratory testing market size was USD 3.95 billion in 2023, calculated at USD 4.30 billion in 2024, and is expected to reach around USD 9.27 billion by 2033, expanding at a CAGR of 8.9% from 2024 to 2033. North America dominated the market with the largest revenue share of 49.00% in 2023.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/6465

The direct-to-consumer (DTC) laboratory testing market is experiencing significant growth driven by a unique consumer-focused approach, contrasting sharply with traditional clinical laboratories. In the medical laboratory sector, marketing efforts target clinicians and laboratory administrators, with patients rarely influencing the choice of laboratory based on perceived quality or affiliation. DTC testing companies build brand loyalty directly with consumers by providing easily interpretable results tailored to the layperson, thereby cultivating a dedicated customer base. This consumer-centric model fosters repeat business and sustained market expansion, highlighting the pivotal role of strategic branding and direct consumer engagement in the burgeoning direct-to-consumer laboratory testing market.

The direct-to-consumer laboratory testing market is experiencing rapid growth, driven by the potential for patient self-empowerment and the advent of disruptive technologies such as point-of-care testing and P4-medicine. This market operates within significant regulatory loopholes, as stringent advertising and medical claims regulations in healthcare do not extend to DTCT, and quality regulations are similarly absent. The lack of medical interpretation of test results poses additional challenges. The quantitative self-movement advocates for increased data collection and analysis, arguing that it enhances individual health prediction and understanding.

DTCT data analysis utilizing swarm intelligence and big data presents new observational opportunities previously unavailable in traditional healthcare. Nevertheless, the emphasis on patient autonomy introduces potential biases, such as the exclusion of positive infectious disease results from databases due to discrimination fears, leading to an underestimation of disease prevalence. These dynamics underline both the opportunities and challenges in the expanding direct-to-consumer laboratory testing market, emphasizing the need for balanced growth strategies that address regulatory and quality concerns while leveraging technological advancements.

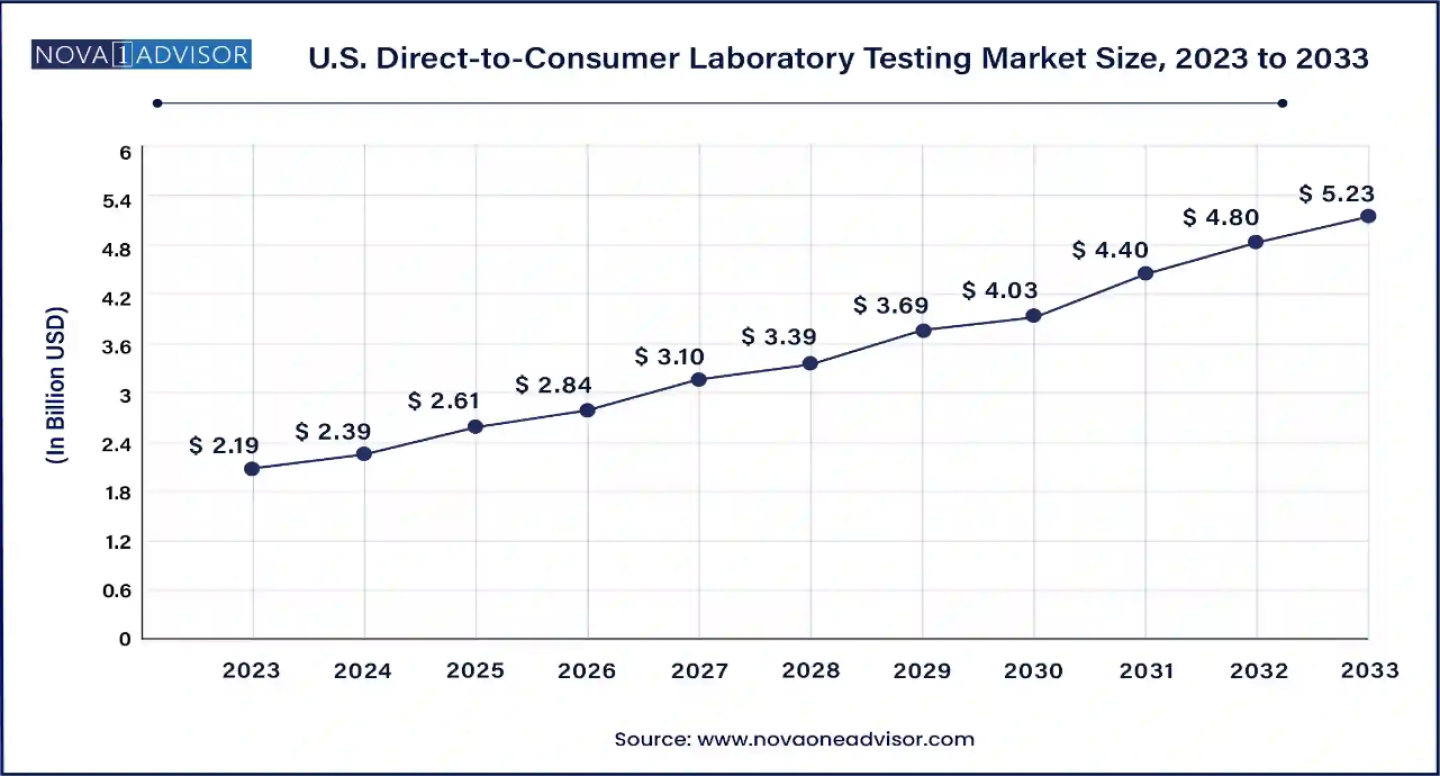

The U.S. direct-to-consumer laboratory testing market size was estimated at USD 2.19 billion in 2023 and is projected to hit around USD 5.23 billion by 2033, growing at a CAGR of 9.1% during the forecast period from 2024 to 2033.

During the projection period, North America is expected to dominate the global direct-to-consumer laboratory testing market, with a significant share of tests performed worldwide. In the United States, despite strict regulations governing medical genetic tests, the FDA permits genetic lifestyle tests. This regulatory landscape presents a complex scenario where genetic markers initially considered benign for lifestyle purposes may later reveal significant health implications. The traditional U.S. healthcare model entrusts clinicians with the authority to determine necessary screening, diagnostic, or therapeutic monitoring tests. Nonetheless, the burgeoning popularity of DTC genetic genealogy tests, with over 12 million individuals having their DNA analyzed by leading companies, highlights a shifting paradigm towards consumer-driven genetic testing. This trend underscores both the potential and the regulatory challenges within the North American direct-to-consumer laboratory testing market, emphasizing the need for vigilant oversight as the market continues to expand.

Operating at some of the lowest price points worldwide, India's diagnostics industry extends modern facilities even to remote areas, enhancing accessibility. China's DTC genetic testing market has seen exponential growth over the past five years, with a notable willingness among Chinese consumers to engage in research driven by service providers. These dynamics underscore the significant potential and unique challenges within the Asia Pacific DTC diagnostic testing market, highlighting the region's pivotal role in the global healthcare landscape.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/6465

Report Highlights

By Product

The market, traditionally dominated by regular medical lab testing, is witnessing a significant shift with the rise of direct-to-consumer (D2C) clinical labs, driven by the growing demand for personalized healthcare. The popularity of D2C clinical labs is largely attributed to their enhanced accessibility and convenience for patients. These consumer-centric labs empower individuals to proactively monitor their health, fostering autonomy and enabling early disease detection. This proactive approach not only enhances patient engagement but also contributes to improved overall well-being, positioning D2C clinical labs as a pivotal component in the evolving landscape of healthcare services.

By Test Type

The medical risk evaluation diagnostics market is further segmented into categories such as STDs, cancer, and others, with the genetic screening niche leading the market. Direct-to-consumer (DTC) genetic testing is pivotal in enabling consumers to understand the role of genetics in various phenotypes, including diseases. By identifying genetic predispositions to certain conditions, individuals can take proactive steps towards improving their health. DTC genetic testing offers easy access to genetic information without the need for clinician or insurance approval, making it more accessible. It is typically less expensive and faster compared to genetic testing conducted in hospitals, further driving its appeal and adoption in the market.

The market is projected to be dominated by the saliva sector, particularly due to the widespread adoption of products like the SalivaDirect DTC Saliva Collection Kit. This kit facilitates at-home saliva specimen collection for individuals aged 18 and older (self-collected), 14 and older (self-collected under adult supervision), and as young as 2 years old (collected with adult assistance). These specimens are then tested using an in vitro diagnostic (IVD) molecular test designed for the SalivaDirect kit. A common application is direct-to-consumer (DTC) genetic testing, which uses saliva samples for genotyping to provide ancestry information and health-related insights, including genetic health risks and pharmacogenetics. The convenience and non-invasive nature of saliva collection contribute to its dominance in the market, making it a preferred sample type for a variety of DTC diagnostic tests.

Direct-to-Consumer Laboratory Testing Market, By Sample Type, 2022-2032 (USD Million)

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/6465

Market Dynamics

Driver

Expanding Access and Convenience

Direct-to-consumer (DTC) laboratory testing is gaining traction by providing individuals with timely and convenient access to valuable health information. This market expansion is driven by the ease with which consumers can identify, order, and purchase laboratory services online, followed by sample collection at local testing locations or at home by visiting technicians. The increasing availability of laboratory services in non-traditional settings such as retail centers, pharmacies, mobile testing facilities, and wellness centers further propels market growth. Concerns from healthcare providers and policymakers regarding the quality and value of some DTC tests, particularly those offered in unconventional settings, the consumer demand for accessible and efficient health monitoring solutions continues to drive the market forward.

Restraint

IT and Regulatory Challenges

Direct-to-consumer (DTC) laboratory testing heavily relies on IT services, which poses significant challenges due to the sensitive nature of medical data and stringent regulatory restrictions on storage and access. Some countries, like Germany, impose additional regulations that limit the exclusive use of telemedicine, further complicating the landscape. Utilizing external IT service providers intensifies risks such as data theft, ownership rights of medical data, data integrity concerns, and legal complexities associated with cloud storage. The transition to essential IT services in medical processes risks diluting the traditional patient-physician relationship, as the personal touch of healthcare may be overshadowed by digital interfaces. Unlike commercial enterprises, physicians face limitations in expanding services through extensive hiring or outsourcing, which hampers the potential growth of the direct-to-consumer laboratory testing market.

Opportunities

Advancement in Genetic Testing

Direct-to-consumer testing is significantly expanding access to genetic testing, allowing more individuals to analyze their DNA and genome. Each genome comprises thousands of genes containing hereditary information on traits like eye color and height, defined by specific molecular arrangements or variants. Some variants can diagnose rare diseases, assess disease risks, or provide other health insights. Testing can also reveal whether a healthy person carries genetic variants that could affect their future children, offering valuable family planning information. For disorders requiring two copies of an abnormal gene variant to manifest, where each parent carries one copy, children face a 25% risk. The potential of direct-to-consumer laboratory testing to empower individuals with proactive health management tools, thereby driving market growth and accessibility in genetic testing services.

Recent Developments

Point Of Care Diagnostics Market : https://www.biospace.com/article/point-of-care-diagnostics-market-size-to-increase-usd-80-75-bn-by-2033/

U.S. In Vitro Diagnostics Market: https://www.biospace.com/article/releases/u-s-in-vitro-diagnostics-market-size-to-hit-usd-45-78-bn-by-2033/

U.S. Oncology Molecular Diagnostics Market: https://www.biospace.com/article/u-s-oncology-molecular-diagnostics-market-size-to-reach-usd-2-74-bn-by-2033/

U.S. Biotechnology Instruments Market : https://www.biospace.com/article/releases/u-s-biotechnology-instruments-market-size-to-reach-usd-49-11-bn-by-2033/

Biosimilars Market: https://www.biospace.com/article/releases/biosimilars-market-size-poised-to-hit-usd-150-26-billion-by-2033/

Breast Cancer Diagnostics Market: https://www.biospace.com/article/breast-cancer-diagnostics-market-size-share-and-growth-report-2033/

Diagnostic Testing Market : https://www.biospace.com/article/releases/diagnostic-testing-market-size-to-reach-usd-449-78-billion-by-2033/

Clinical Trials Market : https://www.biospace.com/article/releases/clinical-trials-market-size-to-increase-usd-153-59-billion-by-2033/

Genomics Market: https://www.biospace.com/article/releases/genomics-market-size-to-hit-usd-157-47-billion-by-2033/

U.S. Biotechnology Market : https://www.biospace.com/article/releases/u-s-biotechnology-market-size-to-increase-usd-1-79-trillion-by-2033/

U.S. Clinical Trials Market: https://www.biospace.com/article/releases/u-s-clinical-trials-market-size-industry-analysis-report-2033/

Biologics Contract Development Market : https://www.biospace.com/article/releases/biologics-contract-development-market-size-to-hit-usd-18-68-bn-by-2033-cagr-8-2-percent-/

Biotechnology Market : https://www.biospace.com/article/biotechnology-market-size-to-reach-usd-5-68-trillion-by-2033/

U.S. Point-of-Care Molecular Diagnostics Market: https://www.biospace.com/article/releases/u-s-point-of-care-molecular-diagnostics-industry-is-rising-rapidly/

Direct-to-Consumer Laboratory Testing Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Direct-to-Consumer Laboratory Testing market.

By Product

https://www.novaoneadvisor.com/report/checkout/6465

Frequently Asked Questions

https://www.novaoneadvisor.com/report/checkout/6465

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/6465

The direct-to-consumer (DTC) laboratory testing market is experiencing significant growth driven by a unique consumer-focused approach, contrasting sharply with traditional clinical laboratories. In the medical laboratory sector, marketing efforts target clinicians and laboratory administrators, with patients rarely influencing the choice of laboratory based on perceived quality or affiliation. DTC testing companies build brand loyalty directly with consumers by providing easily interpretable results tailored to the layperson, thereby cultivating a dedicated customer base. This consumer-centric model fosters repeat business and sustained market expansion, highlighting the pivotal role of strategic branding and direct consumer engagement in the burgeoning direct-to-consumer laboratory testing market.

The direct-to-consumer laboratory testing market is experiencing rapid growth, driven by the potential for patient self-empowerment and the advent of disruptive technologies such as point-of-care testing and P4-medicine. This market operates within significant regulatory loopholes, as stringent advertising and medical claims regulations in healthcare do not extend to DTCT, and quality regulations are similarly absent. The lack of medical interpretation of test results poses additional challenges. The quantitative self-movement advocates for increased data collection and analysis, arguing that it enhances individual health prediction and understanding.

DTCT data analysis utilizing swarm intelligence and big data presents new observational opportunities previously unavailable in traditional healthcare. Nevertheless, the emphasis on patient autonomy introduces potential biases, such as the exclusion of positive infectious disease results from databases due to discrimination fears, leading to an underestimation of disease prevalence. These dynamics underline both the opportunities and challenges in the expanding direct-to-consumer laboratory testing market, emphasizing the need for balanced growth strategies that address regulatory and quality concerns while leveraging technological advancements.

- In October 2022, GC LabTech launched a partnership with 1health.io to deploy innovative lab tests direct-to-consumer.

- In February 2024, Cisco and NVIDIA collaborated to help enterprises deploy and manage secure AI infrastructure.

- North America accounted for more than 49.00% of the total revenue share in 2023.

- By test type, the genetic testing segment has dominated the market in 2022.

- By sample type, the saliva segment has captured a major share of over 42% in 2023.

The U.S. direct-to-consumer laboratory testing market size was estimated at USD 2.19 billion in 2023 and is projected to hit around USD 5.23 billion by 2033, growing at a CAGR of 9.1% during the forecast period from 2024 to 2033.

During the projection period, North America is expected to dominate the global direct-to-consumer laboratory testing market, with a significant share of tests performed worldwide. In the United States, despite strict regulations governing medical genetic tests, the FDA permits genetic lifestyle tests. This regulatory landscape presents a complex scenario where genetic markers initially considered benign for lifestyle purposes may later reveal significant health implications. The traditional U.S. healthcare model entrusts clinicians with the authority to determine necessary screening, diagnostic, or therapeutic monitoring tests. Nonetheless, the burgeoning popularity of DTC genetic genealogy tests, with over 12 million individuals having their DNA analyzed by leading companies, highlights a shifting paradigm towards consumer-driven genetic testing. This trend underscores both the potential and the regulatory challenges within the North American direct-to-consumer laboratory testing market, emphasizing the need for vigilant oversight as the market continues to expand.

- In June 2022, Bureau Veritas acquired Advanced Testing Laboratory (ATL), a leader in scientific sourcing services for the North American Consumer Healthcare Products, Cosmetics & Personal Care, and Medical Device markets.

Operating at some of the lowest price points worldwide, India's diagnostics industry extends modern facilities even to remote areas, enhancing accessibility. China's DTC genetic testing market has seen exponential growth over the past five years, with a notable willingness among Chinese consumers to engage in research driven by service providers. These dynamics underscore the significant potential and unique challenges within the Asia Pacific DTC diagnostic testing market, highlighting the region's pivotal role in the global healthcare landscape.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/6465

Report Highlights

By Product

The market, traditionally dominated by regular medical lab testing, is witnessing a significant shift with the rise of direct-to-consumer (D2C) clinical labs, driven by the growing demand for personalized healthcare. The popularity of D2C clinical labs is largely attributed to their enhanced accessibility and convenience for patients. These consumer-centric labs empower individuals to proactively monitor their health, fostering autonomy and enabling early disease detection. This proactive approach not only enhances patient engagement but also contributes to improved overall well-being, positioning D2C clinical labs as a pivotal component in the evolving landscape of healthcare services.

By Test Type

The medical risk evaluation diagnostics market is further segmented into categories such as STDs, cancer, and others, with the genetic screening niche leading the market. Direct-to-consumer (DTC) genetic testing is pivotal in enabling consumers to understand the role of genetics in various phenotypes, including diseases. By identifying genetic predispositions to certain conditions, individuals can take proactive steps towards improving their health. DTC genetic testing offers easy access to genetic information without the need for clinician or insurance approval, making it more accessible. It is typically less expensive and faster compared to genetic testing conducted in hospitals, further driving its appeal and adoption in the market.

- By Test Type, the genetic testing segment size was USD 1,341.05 million in 2023 and is predicted to grow at a CAGR of 9.2% during the forecast period.

- The disease risk assessment segment size was USD 157.23 million in 2023, and it is projected to grow at the fastest CAGR of 8.7% over the projected period.

- The sexually transmitted disease testing segment size was USD 157.23 million in 2023, and it is expected to expand at the fastest CAGR of 9.5% during the projected period.

The market is projected to be dominated by the saliva sector, particularly due to the widespread adoption of products like the SalivaDirect DTC Saliva Collection Kit. This kit facilitates at-home saliva specimen collection for individuals aged 18 and older (self-collected), 14 and older (self-collected under adult supervision), and as young as 2 years old (collected with adult assistance). These specimens are then tested using an in vitro diagnostic (IVD) molecular test designed for the SalivaDirect kit. A common application is direct-to-consumer (DTC) genetic testing, which uses saliva samples for genotyping to provide ancestry information and health-related insights, including genetic health risks and pharmacogenetics. The convenience and non-invasive nature of saliva collection contribute to its dominance in the market, making it a preferred sample type for a variety of DTC diagnostic tests.

Direct-to-Consumer Laboratory Testing Market, By Sample Type, 2022-2032 (USD Million)

| Sample Type | 2022 | 2023 | 2027 | 2032 |

| Blood | 1,422.33 | 1,548.71 | 2,196.36 | 3,470.12 |

| Urine | 584.23 | 634.24 | 888.77 | 1,383.36 |

| Saliva | 404.08 | 436.04 | 596.50 | 900.95 |

| Others | 504.69 | 542.73 | 731.25 | 1,079.89 |

Market Dynamics

Driver

Expanding Access and Convenience

Direct-to-consumer (DTC) laboratory testing is gaining traction by providing individuals with timely and convenient access to valuable health information. This market expansion is driven by the ease with which consumers can identify, order, and purchase laboratory services online, followed by sample collection at local testing locations or at home by visiting technicians. The increasing availability of laboratory services in non-traditional settings such as retail centers, pharmacies, mobile testing facilities, and wellness centers further propels market growth. Concerns from healthcare providers and policymakers regarding the quality and value of some DTC tests, particularly those offered in unconventional settings, the consumer demand for accessible and efficient health monitoring solutions continues to drive the market forward.

Restraint

IT and Regulatory Challenges

Direct-to-consumer (DTC) laboratory testing heavily relies on IT services, which poses significant challenges due to the sensitive nature of medical data and stringent regulatory restrictions on storage and access. Some countries, like Germany, impose additional regulations that limit the exclusive use of telemedicine, further complicating the landscape. Utilizing external IT service providers intensifies risks such as data theft, ownership rights of medical data, data integrity concerns, and legal complexities associated with cloud storage. The transition to essential IT services in medical processes risks diluting the traditional patient-physician relationship, as the personal touch of healthcare may be overshadowed by digital interfaces. Unlike commercial enterprises, physicians face limitations in expanding services through extensive hiring or outsourcing, which hampers the potential growth of the direct-to-consumer laboratory testing market.

Opportunities

Advancement in Genetic Testing

Direct-to-consumer testing is significantly expanding access to genetic testing, allowing more individuals to analyze their DNA and genome. Each genome comprises thousands of genes containing hereditary information on traits like eye color and height, defined by specific molecular arrangements or variants. Some variants can diagnose rare diseases, assess disease risks, or provide other health insights. Testing can also reveal whether a healthy person carries genetic variants that could affect their future children, offering valuable family planning information. For disorders requiring two copies of an abnormal gene variant to manifest, where each parent carries one copy, children face a 25% risk. The potential of direct-to-consumer laboratory testing to empower individuals with proactive health management tools, thereby driving market growth and accessibility in genetic testing services.

Recent Developments

- In January 2023, Inspire Wellness@Home launched a partnership with 1health.io to deploy health and wellness lab tests direct-to-consumer.

- In March 2024, Labcorp announced the acquisition of select assets from BioReference Health's diagnostics business.

- In March 2024, Intertek strengthened its global minerals offering by acquiring a leading provider of metallurgical testing services.

Point Of Care Diagnostics Market : https://www.biospace.com/article/point-of-care-diagnostics-market-size-to-increase-usd-80-75-bn-by-2033/

U.S. In Vitro Diagnostics Market: https://www.biospace.com/article/releases/u-s-in-vitro-diagnostics-market-size-to-hit-usd-45-78-bn-by-2033/

U.S. Oncology Molecular Diagnostics Market: https://www.biospace.com/article/u-s-oncology-molecular-diagnostics-market-size-to-reach-usd-2-74-bn-by-2033/

U.S. Biotechnology Instruments Market : https://www.biospace.com/article/releases/u-s-biotechnology-instruments-market-size-to-reach-usd-49-11-bn-by-2033/

Biosimilars Market: https://www.biospace.com/article/releases/biosimilars-market-size-poised-to-hit-usd-150-26-billion-by-2033/

Breast Cancer Diagnostics Market: https://www.biospace.com/article/breast-cancer-diagnostics-market-size-share-and-growth-report-2033/

Diagnostic Testing Market : https://www.biospace.com/article/releases/diagnostic-testing-market-size-to-reach-usd-449-78-billion-by-2033/

Clinical Trials Market : https://www.biospace.com/article/releases/clinical-trials-market-size-to-increase-usd-153-59-billion-by-2033/

Genomics Market: https://www.biospace.com/article/releases/genomics-market-size-to-hit-usd-157-47-billion-by-2033/

U.S. Biotechnology Market : https://www.biospace.com/article/releases/u-s-biotechnology-market-size-to-increase-usd-1-79-trillion-by-2033/

U.S. Clinical Trials Market: https://www.biospace.com/article/releases/u-s-clinical-trials-market-size-industry-analysis-report-2033/

Biologics Contract Development Market : https://www.biospace.com/article/releases/biologics-contract-development-market-size-to-hit-usd-18-68-bn-by-2033-cagr-8-2-percent-/

Biotechnology Market : https://www.biospace.com/article/biotechnology-market-size-to-reach-usd-5-68-trillion-by-2033/

U.S. Point-of-Care Molecular Diagnostics Market: https://www.biospace.com/article/releases/u-s-point-of-care-molecular-diagnostics-industry-is-rising-rapidly/

Direct-to-Consumer Laboratory Testing Market Top Key Companies:

- 23andMe, Inc

- Ambry Genetics Corp.

- Ancestry.com LLC

- Any Lab Test Now, Inc.

- Color Genomics, Inc

- Counsyl, Inc.

- DanteLabs Inc.

- Direct Laboratory Services, LLC

- Eastern Biotech & Life Sciences

- EasyDNA

- EverlyWell, Inc.,

- Full Genomes Corporation, Inc.

- Gene by Gene, Ltd.

- Genecodebook Oy

- Genesis Healthcare Co.

- Genetrainer

- GHC Genetics UK

- HealthCheckUSA

- Home Access Health Corporation

- International Biosciences

- Laboratory Corporation of America Holdings

- LetsGetChecked, Inc.

- Mapmygenome India Limited

- Medichecks.com Ltd.

- MyHeritage Ltd.

- MyMedLab, Inc.,

- Myriad Genetics, Inc.

- Natera, Inc

- OME Care

- Pathway Genomics

- Pixel by LabCorp,

- Positive Bioscience

- Quest Diagnostics Incorporated,

- Request A Test, Ltd.

- Shuwen Biotech Co. Ltd.

- Sonora Quest Laboratories,

- Thryve Inc

- Ulta Lab Tests, LLC,

- Veritas Genetics

- Vitagene, Inc.

- Walk-In Lab, LLC.,

- WellnessFX, Inc.

- Xcode Life Sciences

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Direct-to-Consumer Laboratory Testing market.

By Product

- Medical Genetic Laboratory Testing

- Routine Clinical Laboratory Testing

- Genetic Testing

- COVID-19

- Cancer

- Diabetes Testing

- Disease Risk Assessment Testing

- Sexually Transmitted Disease Testing

- Routine Testing

- Complete Blood Count

- CNS-related/Neurological Disease

- Thyroid Stimulating Hormone Testing

- Other

- Blood

- Urine

- Saliva

- Others

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

https://www.novaoneadvisor.com/report/checkout/6465

Frequently Asked Questions

- What geographic regions does your market research cover for the Direct-to-Consumer Laboratory Testing market?

- We have a global reach, with expertise spanning across continents, including North America, Europe, Asia-Pacific, Latin America, and the Middle East. We leverage a combination of primary and secondary research methodologies to offer country-level analysis.

- How does your firm conduct cross-sectional analysis for the Direct-to-Consumer Laboratory Testing market?

- We conduct cross-sectional analysis by examining data from different individuals at a single point in time to identify patterns and trends across diverse segments of the market.

- Can your firm customize market research solutions to meet specific client needs?

- Our experienced team works closely with clients to gain a thorough understanding of their business goals and target markets. We have the expertise and flexibility to develop bespoke research solutions.

- Do you offer ongoing support or consultation to clients after the completion of a market research project?

- Our team of experienced analysts is available to address any questions, concerns and needs that may arise following the delivery of the report.

- Can your market research firm help with competitor analysis for Direct-to-Consumer Laboratory Testing market?

- Through a combination of quantitative and qualitative research methodologies, we meticulously assess the strengths, weaknesses, strategies, and market positioning of your competitors.

https://www.novaoneadvisor.com/report/checkout/6465

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/