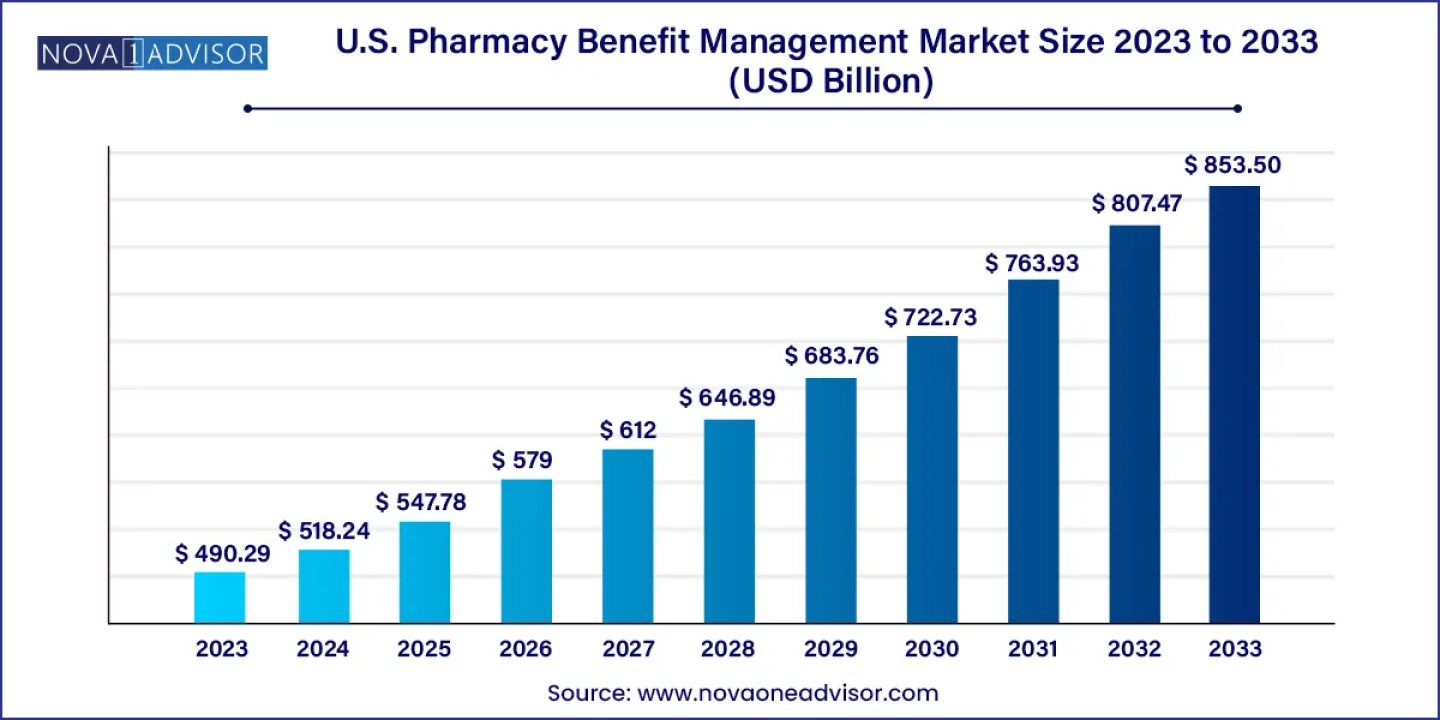

According to latest study, the U.S. pharmacy benefit management market size is calculated at USD 518.24 billion for 2024 and is expected to reach around USD 853.50 billion by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8147

Pharmacy Benefit Managers (PBMs) play a crucial role in the U.S. healthcare system, facilitating safe, efficient, and affordable access to prescription drugs for over 260 million Americans.

The U.S. pharmacy benefit management market is experiencing rapid growth, driven by the pivotal role PBMs play as third-party administrators of prescription drug programs. PBMs are integral in formulary development, pharmacy contracting, negotiating discounts and rebates with drug manufacturers, and processing and paying prescription drug claims. Catering primarily to self-insured companies and government programs, PBMs strive to contain or reduce pharmacy expenditures while enhancing healthcare outcomes. The market is characterized by a diverse range of PBM companies, varying from small to large entities.

Pharmacists employed by PBMs allocate a significant portion of their time to data management and project/case management. Currently approaching $500 billion annually, the U.S. pharmacy benefit management market boasts a substantial reach, with approximately two-thirds of adults utilizing PBMs and nearly 300 million individuals participating in prescription-drug insurance plans

- In March 2023, Comer initiated an investigation into the role of pharmacy benefit managers (PBMs) in the rising healthcare costs.

- By Business Model, the standalone PBM segment dominated the market with the largest market share of 60% in 2023.

- By Business Model, the healthcare insurance provider segment is expected to generate significant revenue throughout the forecast period.

- By Services, the specialty pharmacies segment dominated the market in 2022.

- By Services, the retail services segment is expected to witness significant growth during the predicted timeframe.

- By End-user, the commercial segment projected the highest market growth in 2022.

- By End-user, the federal segment is expected to dominate the market during the anticipated time.

U.S. Pharmacy Benefit Management Market Dynamics

Driver

Innovative Tools and Strategies

Pharmacy Benefit Managers (PBMs) leverage a diverse array of technological tools, such as drug utilization reviews and adherence programs, to mitigate drug interactions, prevent errors, and enhance medication adherence. Over the next decade, PBMs are projected to avert billions of medication errors, resulting in substantial cost savings for the healthcare system. With over 60 PBMs fiercely competing in the U.S. pharmacy benefit management market, clients benefit from a wide range of services and competitive pricing, fostering a culture of constant innovation to meet individual client needs. PBMs offer tailored solutions, advising clients on plan design options to optimize prescription drug benefits and promote cost-effective choices, including the utilization of generic drugs and preferred brands. Plan sponsors retain flexibility in distributing cost savings across member drug benefits, fueling the growth trajectory of the U.S. pharmacy benefit management market driven by technological advancements and strategic innovations.

- In March 2023, a House committee also launched an investigation into PBMs.

- In May 2023, Comer announced the first hearing on PBMs' role in rising healthcare costs.

Complex Challenges

Pharmacy Benefit Managers (PBMs) face intricate challenges, exacerbated by the scale of patient populations they serve. Issues such as the imperative for accuracy and transparency in PBM revenue streams, potential conflicts of interest arising from PBM-owned mail-order and specialty pharmacies, and ambiguity surrounding generic drug pricing and maximum allowable cost payment calculations pose significant hurdles. These complexities underscore the necessity for policymakers and legislators to grasp the nuances of the PBM industry, particularly as they deliberate on the need for additional oversight. Over the past decade, the expansion of coverage under Medicare Part D and the Affordable Care Act, coupled with surges in prescription drug spending, have led commercial health plans and self-insured employers to entrust the management of their outpatient prescription drug spending to PBMs. However, the presence of these challenges restrains the growth potential of the U.S. pharmacy benefit management market, highlighting the imperative for proactive solutions to address technological restraints and foster industry advancement.

Opportunity

E-Prescribing Technology

E-prescribing tools offer a transformative opportunity for the U.S. pharmacy benefit management market. By seamlessly connecting to patient health plans or PBMs, these tools provide prescribers with real-time feedback on medication formulary coverage and suggest alternatives, streamlining the prescription process and reducing formulary-related inquiries from patients and pharmacists. E-prescribing enhances prescription accuracy, boosts patient safety, and lowers costs by facilitating secure, bi-directional electronic connectivity between clinicians and pharmacies. This technology enables prescribers to access health plan formulary, patient eligibility, and medication history at the point of care, and transmit prescriptions securely to pharmacy computer systems. The integration of e-prescribing solutions presents a significant opportunity for the market to optimize workflow efficiencies, enhance patient care, and drive overall industry advancement.

Immediate Delivery Available, Get Full Access@

https://www.novaoneadvisor.com/report/checkout/8147

Report Highlights

By Business Model Insights

The standalone Pharmacy Benefit Manager (PBM) segment commands the highest market share, characterized by its dominance in administering prescription drug benefits and negotiating discounts for insurers. There are regulatory discussions surrounding PBMs, with considerations ranging from regulating them under third-party administrator laws to establishing a standalone license specifically for PBMs. Conversations within regulatory circles lean towards favoring a standalone PBM license, as it provides more robust enforcement mechanisms compared to other regulatory approaches like registration requirements. PBMs operate independently as standalone plans, serving various sectors such as Medicare Part D standalone plans, commercial plans including Medicare Advantage (MA), Medicaid Managed Care Organizations, and employer-sponsored health plans. This business model underscores the significant role and influence of standalone PBMs within the U.S. pharmacy benefit management market landscape.

The health insurance provider segment is poised for significant growth in the forecast period. Health insurance operates on a model where individuals pay a monthly premium, and in return, the insurance plan covers a portion of their healthcare expenses when needed. Typically, health insurance covers various medical services such as doctor visits, prescription drugs, and medical and surgical procedures. Healthcare costs in the United States can be substantial, with a single doctor's visit costing several hundred dollars and a hospital stay spanning over a few days potentially amounting to tens of thousands of dollars, depending on the type of care required. This business model underscores the crucial role of health insurance providers in mitigating healthcare expenses and ensuring access to essential medical services for individuals.

The specialty pharmacies segment asserts dominance in the market, commanding the highest market share. In 2023, an exclusive analysis by DCI revealed 1,749 distinct pharmacy locations accredited by either or both of the leading accreditation bodies for specialty pharmacies, namely the Accreditation Commission for Health Care (ACHC) and URAC. Only approximately 3% of all pharmacy locations across the United States hold accreditation as specialty pharmacies. Further analysis indicates that healthcare providers contribute an additional 14% to the accredited specialty pharmacy landscape, encompassing medical practices and physician-owned clinics. This underscores the significance of specialty pharmacies in catering to specialized healthcare needs and their substantial presence within the market by service.

The retail pharmacies segment is poised for growth in the market throughout the forecast period. In the US, there are currently 45,311 businesses categorized as retail pharmacies and drug stores, marking a 3.7% increase from the previous year. The significance of retail pharmacies extends beyond mere distribution of medications, as they play a vital role in ensuring nondiscriminatory access to healthcare services. This includes support for individuals with disabilities, women experiencing miscarriages or early pregnancy loss, and those seeking access to contraceptives and fertility treatments.

Such guidance underscores the essential role pharmacies play in adhering to federal civil rights laws concerning nondiscrimination obligations. With the majority of Americans living within a five-mile radius of a pharmacy, they serve as the most accessible healthcare provider for millions across the nation. This highlights the substantial potential for growth within the retail pharmacies segment, emphasizing its pivotal role in providing accessible healthcare services.

By Technology Insights

The commercial segment has established dominance in the market by technology. Commercial pharmacies, commonly perceived as standard pharmacies, play a pivotal role in the modern medication distribution system. They specialize in dispensing mass-produced medications from pharmaceutical companies, typically in standardized dosages and forms. Serving as the backbone of medication distribution, commercial pharmacies offer access to a diverse range of medications, including standard Testosterone Replacement Therapy (TRT) treatments. For patients undergoing TRT, commercial pharmacies provide convenience and familiarity, particularly when utilizing widely recognized and standardized TRT products. This underscores the significant influence of commercial pharmacies within the U.S. pharmacy benefit management market by technology, emphasizing their integral role in medication distribution and patient care.

By end-user Insights

The commercial segment led the pharmacy benefit management market in 2023. The commercial segment encompasses a significant portion of employer-sponsored health plans, which cover a large number of individuals. Companies often partner with PBMs to manage prescription drug benefits for their employees, leading to a high volume of transactions and substantial revenue generation for PBMs. Commercial health plans typically offer comprehensive prescription drug coverage as part of their benefits package. This includes a wide range of medications, both generic and brand-name, which PBMs manage. The extensive coverage leads to increased utilization of PBM services.

Related report:

- U.S. Generic Drugs Market: https://www.biospace.com/article/releases/u-s-generic-drugs-market-size-to-surpass-usd-188-44-bn-by-2032/

- global Generic Drugs Market : https://www.biospace.com/article/releases/generic-drugs-market-size-to-worth-around-usd-779-68-bn-by-2033/

- U.S. Nuclear Medicine Market : https://www.biospace.com/article/releases/u-s-nuclear-medicine-market-size-to-hit-usd-19-34-bn-by-2033/

- U.S. Compounding Pharmacies Market: https://www.biospace.com/article/u-s-compounding-pharmacies-market-size-to-hit-usd-10-76-bn-by-2033/

- Diagnostic Testing Market : https://www.biospace.com/article/releases/diagnostic-testing-market-size-to-reach-usd-449-78-billion-by-2033/

- U.S. Clinical Trials Market: https://www.biospace.com/article/releases/u-s-clinical-trials-market-size-industry-analysis-report-2033/

- U.S. mRNA Therapeutics Market : https://www.biospace.com/article/releases/u-s-mrna-therapeutics-market-size-to-worth-usd-12-18-bn-by-2033/

- U.S. Precision Medicine Market: https://www.biospace.com/article/releases/u-s-precision-medicine-market-size-to-hit-usd-76-12-billion-by-2033/

- Antibiotics Market: https://www.biospace.com/article/releases/antibiotics-market-size-to-reach-usd-85-80-billion-by-2033/

- In June 2022, the FTC launched an inquiry into the prescription drug middlemen industry.

- In June 2022, the FTC initiated an investigation into PBMs, requesting data from CVS, UnitedHealth, Cigna, and others.

- In September 2023, GoodRx and MedImpact announced a program to ensure seamless access to affordable prescriptions.

- In March 2022, WTW’s Rx Collaborative added Capital Rx as a new PBM partner.

- CVS Health

- Cigna

- Optum, Inc.

- MedImpact

- Anthem

- Change Healthcare

- Prime Therapeutics LLC

- HUB International Limited.

- Elixir Rx Solutions LLC

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Pharmacy Benefit Management market.

By Business Model

- Standalone PBM

- Health Insurance Providers

- Specialty Pharmacy

- Retail Pharmacy

- Commercial

- Federal

https://www.novaoneadvisor.com/report/checkout/8147

Frequently Asked Questions

- What geographic regions does your market research cover for the U.S. Pharmacy Benefit Management market?

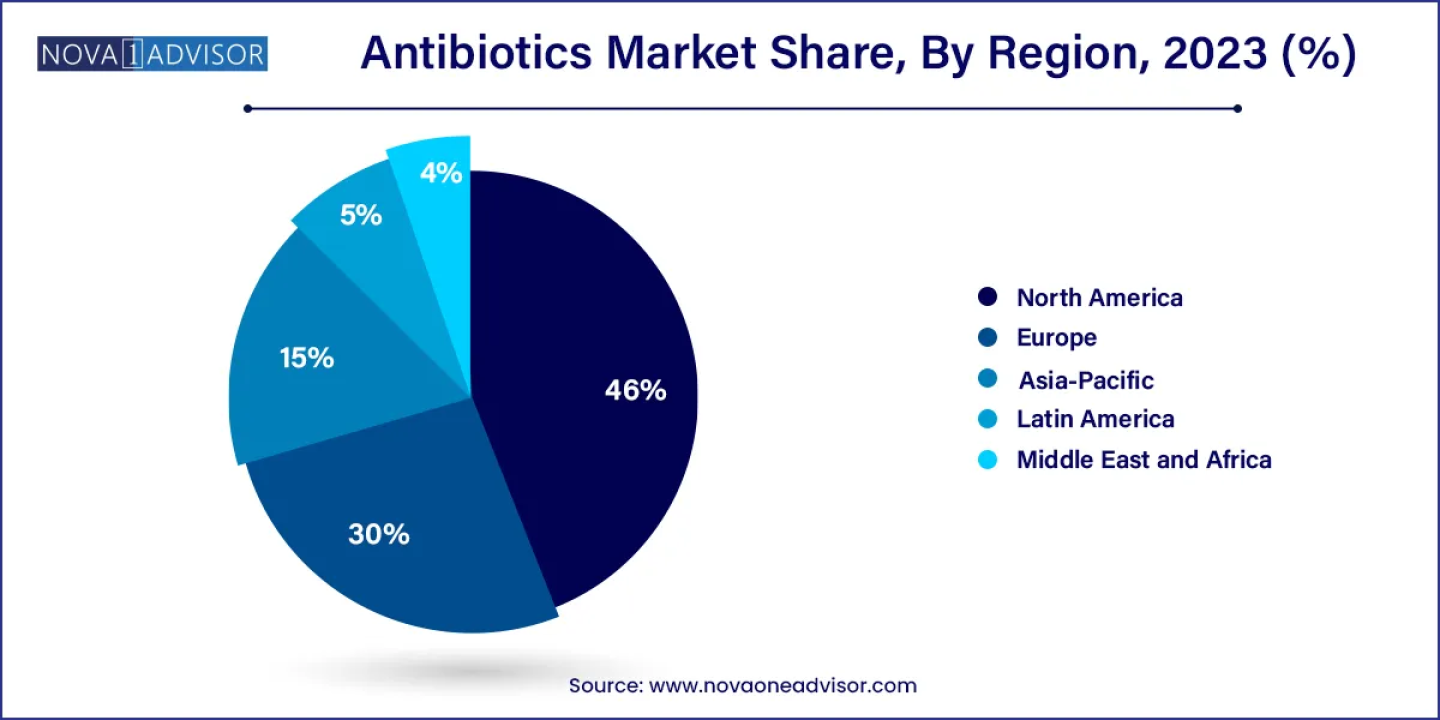

- We have a global reach, with expertise spanning across continents, including North America, Europe, Asia-Pacific, Latin America, and the Middle East. We leverage a combination of primary and secondary research methodologies to offer country-level analysis.

- How does your firm conduct cross-sectional analysis for the U.S. Pharmacy Benefit Management market?

- We conduct cross-sectional analysis by examining data from different individuals at a single point in time to identify patterns and trends across diverse segments of the market.

- Can your firm customize market research solutions to meet specific client needs?

- Our experienced team works closely with clients to gain a thorough understanding of their business goals and target markets. We have the expertise and flexibility to develop bespoke research solutions.

- Do you offer ongoing support or consultation to clients after the completion of a market research project?

- Our team of experienced analysts is available to address any questions, concerns and needs that may arise following the delivery of the report.

- Can your market research firm help with competitor analysis for U.S. Pharmacy Benefit Management market?

- Through a combination of quantitative and qualitative research methodologies, we meticulously assess the strengths, weaknesses, strategies, and market positioning of your competitors.

https://www.novaoneadvisor.com/report/checkout/8147

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/