Shares of Renovacor, Inc. stock are surging in premarket trading following Rocket Pharmaceuticals’ announcement it will acquire the company in an all-stock transaction valued at $53 million.

Shares of Renovacor, Inc. are surging in premarket trading following Rocket Pharmaceuticals’ announcement it will acquire the company in an all-stock transaction valued at $53 million. The deal bolsters Rocket’s ability to treat cardiac-related maladies.

The deal will strengthen Rocket’s leadership in AAV-based cardiac gene therapies, according to the company.

Through the transaction, Rocket gains Renovacor’s technology aimed at BAG3-associated dilated cardiomyopathy (DCM), a rare, genetically-driven form of heart failure. Currently, there are no commercially available targeted treatments for this disease.

In a conference call with reporters Tuesday, Gaurav Shah, CEO of Rocket, said the merger of the businesses creates the world’s leading cardiac gene therapy company.

The BAG3-associated DCM treatment gained in the deal is complementary to Rocket’s own development programs for Danon disease, a genetic disorder characterized by the thickening and weakening of the heart muscle.

“Renovacor shares our mission to become a beacon of hope and find cures as newly-emerged leaders in cardiac gene therapy,” Shah said. “This strategic acquisition gives us what we believe is the broadest platform in the field to address these devastating rare cardiac diseases.”

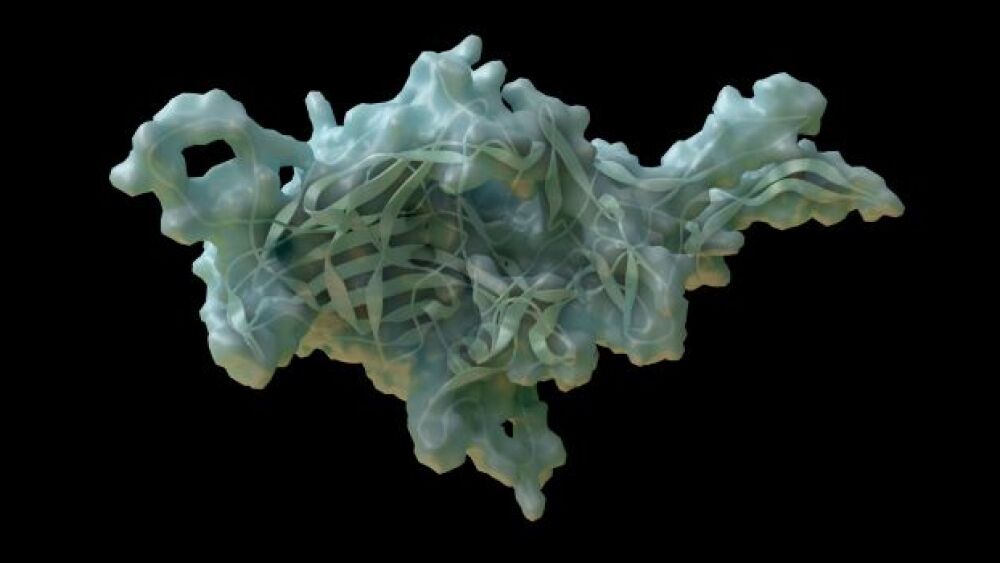

Renovacor’s lead asset is REN-001, an adeno-associated virus-based gene therapy that targets BAG3-associated DCM, a severe form of heart failure. The BAG3 protein is primarily expressed in the heart and plays a key role in multiple myocardial cell functions. REN-001 is designed to restore proper cellular function in a patient.

All programs under the umbrella of the merged companies have an on-target mechanism of action and are also expected to be first- and best-in-class therapeutics, Shah said.

Renovacor CEO Magdalene Cook also expressed excitement over the merger of the two teams and the potential to treat a broader swath of cardiac patients who currently have unmet needs.

“We look forward to combining the considerable resources and expertise of Renovacor and Rocket in creating a category leader in the precision cardiology field,” she said.

Under terms of the all-stock deal, Renovacor shareholders will receive 17% of shares of Rocket in exchange for each of their shares in the company. The value is assessed at $2.60 per share. Upon completion of the merger, Renovacor stakeholders will own 4.6% of Rocket.

When the merger is completed in the first quarter of 2023, Shah said the deal will add approximately $38 million in cash to the combined companies. That will extend the cash runway into the second quarter of 2024.