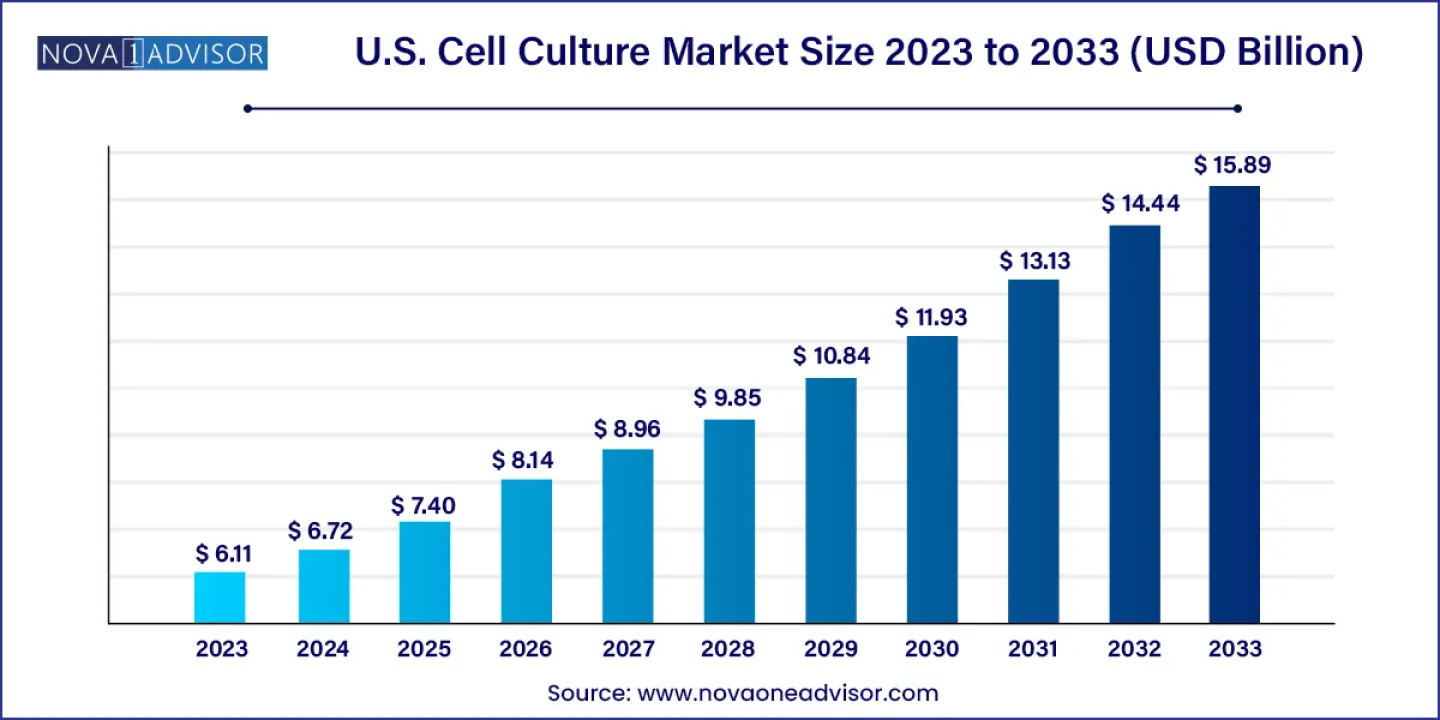

The U.S. cell culture market is anticipated to experience significant growth over the next decade. Valued at USD 6.11 billion in 2023, the market is projected to reach USD 15.89 billion by 2033, reflecting a compound annual growth rate (CAGR) of 10.03% from 2024 to 2033.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8507

The increasing frequency of chronic and infectious diseases (including COVID-19), the rapid adoption of cell culture techniques to develop substrates for safe viral vaccine manufacturing, and the expanding global demand for sophisticated therapeutic medical products have all contributed to market expansion. Furthermore, novel three-dimensional cell culture techniques and the growing need for them in biopharmaceutical development and vaccine production are likely to boost market expansion throughout the forecast period.

COVID-19 had a beneficial impact on the United States market. During the COVID-19 pandemic, many pharmaceutical and biotechnology companies have made significant investments in R&D to develop effective vaccinations, cures, and diagnostic kits. This has resulted in an increase in demand for cell culture techniques and novel cell-based models for drug development and research. Furthermore, due to the urgency of the situation, there has been an increase in the need for bioreactors and culture systems to facilitate vaccine production and drug testing.

Over the last few decades, biopharmaceutical goods such as vaccines, blood and blood components, somatic cells, gene therapy, tissues, and recombinant therapeutic proteins have grown in popularity in the life sciences industry. The need for biologics is expected to rise as specialty medications and personalized therapy become more prevalent. Furthermore, biologics play an important role in the creation of precision drugs. As a result, the US FDA authorized approximately 15 novel biologics in 2022, including cancer therapies such as Kimmtrak, Opdualag, Imjudo, and others.

The increasing demand for serum-free, specialty, and tailored media is expected to fuel market expansion. In addition, growing investment is expected to promote market growth throughout the forecast period. For example, Merck stated in July 2023 that it will expand its facilities in the United States to enhance production capacity for cell culture medium.

U.S. Cell Culture Market Key Takeaways

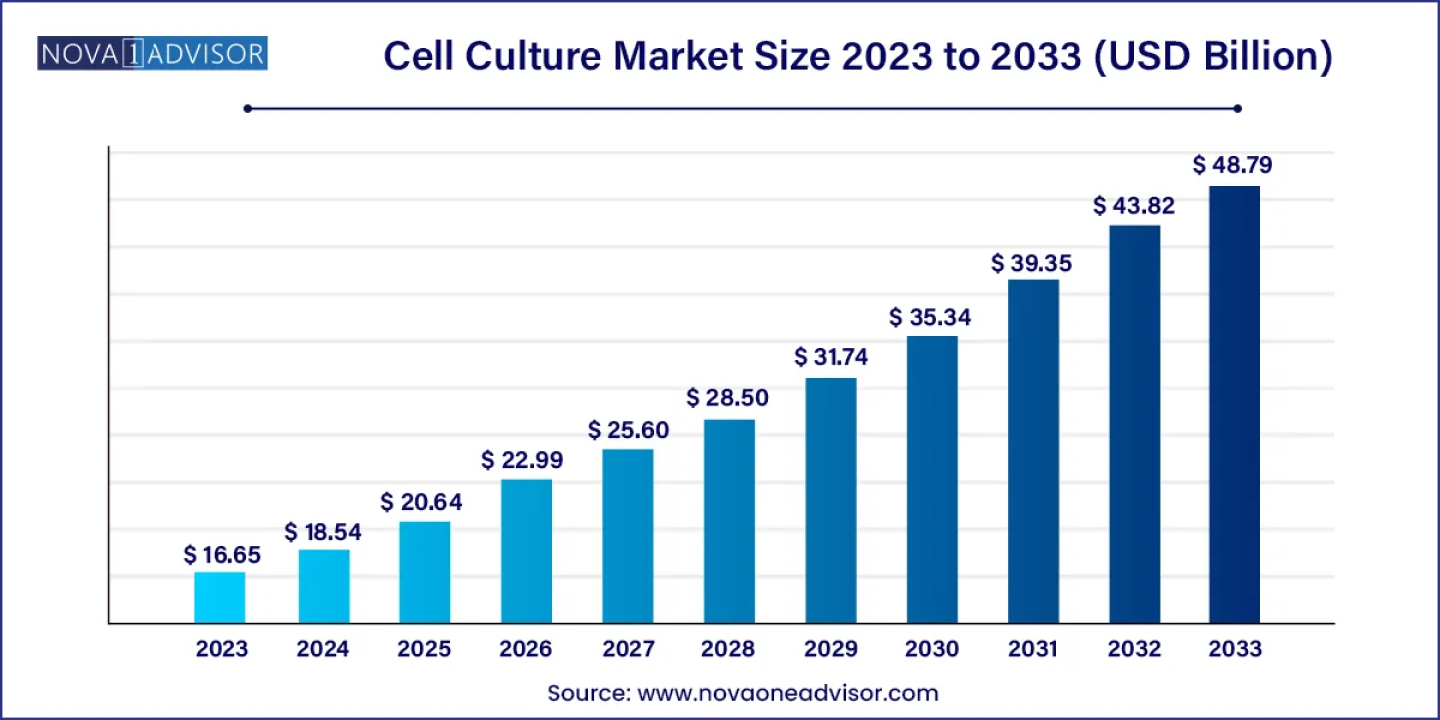

The global U.S. cell culture market size is calculated at USD 18.54 billion for 2024 and is expected to reach around USD 48.79 billion by 2033, growing at a CAGR of 11.35% from 2024 to 2033, North America held the largest market share of 40.0% in 2023.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8507

U.S. Cell Culture Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. Advancements in biotechnology and the pharmaceutical industry are driving demand for cell culture technologies, as they play a crucial role in drug discovery, biopharmaceutical production, and research applications. In addition, the emergence of innovative techniques and the growing adoption of cell-based therapies are further fueling global cell culture market growth.

In the U.S. market, partnerships and collaboration activities are high levels of engagement within the industry. Companies are engaging in strategic partnerships, acquisitions, and mergers to strengthen their portfolios, expand market presence, and harness synergies in the rapidly evolving biotechnology and pharmaceutical sectors. This heightened level of activity reflects a strategic response to the increasing demand for advanced cell culture technologies and the need for comprehensive solutions in areas such as biopharmaceutical production and regenerative medicine. For instance, in July 2021, Sartorius Stedim Biotech acquired Xell AG, based in Bielefeld, Germany. Xell AG creates, manufactures, and sells media and feed additives for cell cultures, particularly for producing viral vectors used in gene therapies and vaccinations.

Stringent regulatory standards, particularly those set forth by agencies like the FDA, govern the safety, quality, and efficacy of cell culture products and processes. Compliance with these regulations is essential for market players to ensure the approval and market acceptance of their products, driving investment in research and development as well as manufacturing infrastructure. Moreover, regulatory frameworks also influence market dynamics by shaping competitive barriers, market entry strategies, and innovation pathways. While stringent regulations may pose challenges in terms of compliance costs and timelines, they ultimately serve to uphold product quality standards, ensure patient safety, and foster trust within the industry, thereby contributing to long-term sustainability and market growth.

The market is experiencing a significant wave of product expansion, characterized by the introduction of innovative technologies, diverse product offerings, and expanded applications across various sectors, including biopharmaceuticals, regenerative medicine, and basic research. Companies are continually investing in research and development to enhance existing products, develop novel solutions, and cater to the evolving needs for the market growth. This surge in product expansion is driven by factors such as increasing demand for biologics, advancements in cell therapy, and the pursuit of more efficient and scalable manufacturing processes. As a result, the market is witnessing a proliferation of new cell culture products, tools, and services, reflecting the industry's commitment to driving forward scientific innovation and addressing emerging challenges in healthcare and life sciences. For instance, in September 2022, Thermo Fisher Scientific Inc. introduced the Thermo Scientific DynaSpin Single-use Centrifuge equipment at the BioProcess International yearly conference in Boston, Massachusetts. The equipment is intended to give an excellent single-use solution enabling large-scale cell culture extraction.

What is cell culture used for?

Cell culture has become a central pillar of life sciences, medical research and manufacturing of biopharmaceuticals. Here, we want to pick just a selected few applications of cell culture systems and briefly explain its role therein.

Human cancer cell lines are used as models to assess e g. novel chemotherapeutic drug screening or interactions between cancer cells and the immune system.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8507

U.S. Cell Culture Market By Product Insights

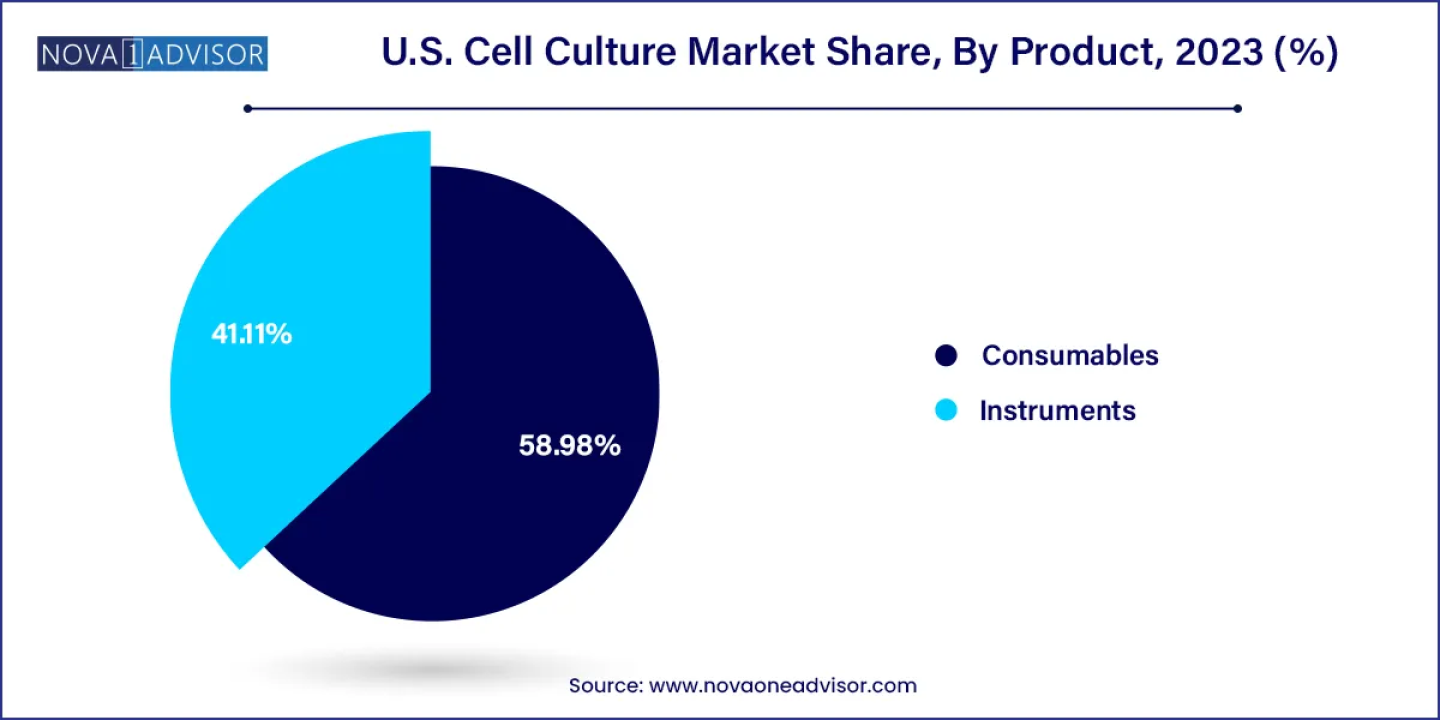

The market is segmented into consumables and instruments. The consumables segment held the market with the largest revenue share of 58.98% in 2023, due to recurring demand and purchase of consumables. Another factor propelling the sector is increased R&D expenditure by biotechnology & biopharmaceutical businesses to develop sophisticated biologics, such as monoclonal antibodies & vaccines. Consumables are expected to continue to be in high demand during the forecast period. The demand for cell culture consumables is also expected to remain high during the forecast period. The consumables segment is further categorized into reagents, media, & sera. Media held the largest market share in the consumables segment.

The instruments segment is expected to register at a significant CAGR over the forecast period. The applications engaged are vaccination, research on cancer, drug screening & development, recombinant products, toxicity testing, stem cell technology, regenerative therapies, and other areas used by end-users, such as industrial, biotechnology, & agriculture. For instance, in June 2022, FUJIFILM Corporation invested USD 1.6 billion to expand and improve its cell culture manufacturing services. This investment would boost FUJIFILM sites in Denmark and Texas.

U.S. Cell Culture Market By Application Insights

Based on application, the market is segmented into biopharmaceutical production, drug development, diagnostics, tissue culture & engineering, cell and gene therapy, toxicity testing, and other applications. The biopharmaceutical production segment led the market with the largest revenue share of 31.87% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Mammalian cell cultures are primarily used in the production of biopharmaceuticals, and the growing demand for nonconventional therapeutic options has led to a substantial increase in the bioproduction of genetically enhanced drugs. Due to this, demand for various cell culture consumables, such as media, is expected to increase.

The diagnostics segment is expected to grow at a significant CAGR over the forecast period. Cell cultures can be used in metabolomics for the identification of biomarkers of pathologically relevant conditions. Moreover, metabolic pathways that lead to the production of such biomarkers can also be identified to determine underlying metabolic disorders. Similarly, metabolites also play a crucial role in the diagnosis of cancer and its recurrence, which increases the scope of applications for cell culture products. Thus, this is expected to drive the market growth.

U.S. Cell Culture Market By Recent Developments

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Cell Culture market.

By Product

https://www.novaoneadvisor.com/report/checkout/8507

Frequently Asked Questions

https://www.novaoneadvisor.com/report/checkout/8507

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8507

The increasing frequency of chronic and infectious diseases (including COVID-19), the rapid adoption of cell culture techniques to develop substrates for safe viral vaccine manufacturing, and the expanding global demand for sophisticated therapeutic medical products have all contributed to market expansion. Furthermore, novel three-dimensional cell culture techniques and the growing need for them in biopharmaceutical development and vaccine production are likely to boost market expansion throughout the forecast period.

COVID-19 had a beneficial impact on the United States market. During the COVID-19 pandemic, many pharmaceutical and biotechnology companies have made significant investments in R&D to develop effective vaccinations, cures, and diagnostic kits. This has resulted in an increase in demand for cell culture techniques and novel cell-based models for drug development and research. Furthermore, due to the urgency of the situation, there has been an increase in the need for bioreactors and culture systems to facilitate vaccine production and drug testing.

Over the last few decades, biopharmaceutical goods such as vaccines, blood and blood components, somatic cells, gene therapy, tissues, and recombinant therapeutic proteins have grown in popularity in the life sciences industry. The need for biologics is expected to rise as specialty medications and personalized therapy become more prevalent. Furthermore, biologics play an important role in the creation of precision drugs. As a result, the US FDA authorized approximately 15 novel biologics in 2022, including cancer therapies such as Kimmtrak, Opdualag, Imjudo, and others.

The increasing demand for serum-free, specialty, and tailored media is expected to fuel market expansion. In addition, growing investment is expected to promote market growth throughout the forecast period. For example, Merck stated in July 2023 that it will expand its facilities in the United States to enhance production capacity for cell culture medium.

U.S. Cell Culture Market Key Takeaways

- The market is segmented into consumables and instruments. The consumables segment held the market with the largest revenue share of 58.98% in 2023.

- The instruments segment is expected to register at a significant CAGR over the forecast period.

- The biopharmaceutical production segment led the market with the largest revenue share of 31.87% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period.

- The diagnostics segment is expected to grow at a significant CAGR over the forecast period.

The global U.S. cell culture market size is calculated at USD 18.54 billion for 2024 and is expected to reach around USD 48.79 billion by 2033, growing at a CAGR of 11.35% from 2024 to 2033, North America held the largest market share of 40.0% in 2023.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8507

U.S. Cell Culture Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. Advancements in biotechnology and the pharmaceutical industry are driving demand for cell culture technologies, as they play a crucial role in drug discovery, biopharmaceutical production, and research applications. In addition, the emergence of innovative techniques and the growing adoption of cell-based therapies are further fueling global cell culture market growth.

In the U.S. market, partnerships and collaboration activities are high levels of engagement within the industry. Companies are engaging in strategic partnerships, acquisitions, and mergers to strengthen their portfolios, expand market presence, and harness synergies in the rapidly evolving biotechnology and pharmaceutical sectors. This heightened level of activity reflects a strategic response to the increasing demand for advanced cell culture technologies and the need for comprehensive solutions in areas such as biopharmaceutical production and regenerative medicine. For instance, in July 2021, Sartorius Stedim Biotech acquired Xell AG, based in Bielefeld, Germany. Xell AG creates, manufactures, and sells media and feed additives for cell cultures, particularly for producing viral vectors used in gene therapies and vaccinations.

Stringent regulatory standards, particularly those set forth by agencies like the FDA, govern the safety, quality, and efficacy of cell culture products and processes. Compliance with these regulations is essential for market players to ensure the approval and market acceptance of their products, driving investment in research and development as well as manufacturing infrastructure. Moreover, regulatory frameworks also influence market dynamics by shaping competitive barriers, market entry strategies, and innovation pathways. While stringent regulations may pose challenges in terms of compliance costs and timelines, they ultimately serve to uphold product quality standards, ensure patient safety, and foster trust within the industry, thereby contributing to long-term sustainability and market growth.

The market is experiencing a significant wave of product expansion, characterized by the introduction of innovative technologies, diverse product offerings, and expanded applications across various sectors, including biopharmaceuticals, regenerative medicine, and basic research. Companies are continually investing in research and development to enhance existing products, develop novel solutions, and cater to the evolving needs for the market growth. This surge in product expansion is driven by factors such as increasing demand for biologics, advancements in cell therapy, and the pursuit of more efficient and scalable manufacturing processes. As a result, the market is witnessing a proliferation of new cell culture products, tools, and services, reflecting the industry's commitment to driving forward scientific innovation and addressing emerging challenges in healthcare and life sciences. For instance, in September 2022, Thermo Fisher Scientific Inc. introduced the Thermo Scientific DynaSpin Single-use Centrifuge equipment at the BioProcess International yearly conference in Boston, Massachusetts. The equipment is intended to give an excellent single-use solution enabling large-scale cell culture extraction.

What is cell culture used for?

Cell culture has become a central pillar of life sciences, medical research and manufacturing of biopharmaceuticals. Here, we want to pick just a selected few applications of cell culture systems and briefly explain its role therein.

- Cell biology

- Cancer research

Human cancer cell lines are used as models to assess e g. novel chemotherapeutic drug screening or interactions between cancer cells and the immune system.

- Virology

- Drug discovery

- Regenerative medicine

- Manufacturing of biopharmaceuticals

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8507

U.S. Cell Culture Market By Product Insights

The market is segmented into consumables and instruments. The consumables segment held the market with the largest revenue share of 58.98% in 2023, due to recurring demand and purchase of consumables. Another factor propelling the sector is increased R&D expenditure by biotechnology & biopharmaceutical businesses to develop sophisticated biologics, such as monoclonal antibodies & vaccines. Consumables are expected to continue to be in high demand during the forecast period. The demand for cell culture consumables is also expected to remain high during the forecast period. The consumables segment is further categorized into reagents, media, & sera. Media held the largest market share in the consumables segment.

The instruments segment is expected to register at a significant CAGR over the forecast period. The applications engaged are vaccination, research on cancer, drug screening & development, recombinant products, toxicity testing, stem cell technology, regenerative therapies, and other areas used by end-users, such as industrial, biotechnology, & agriculture. For instance, in June 2022, FUJIFILM Corporation invested USD 1.6 billion to expand and improve its cell culture manufacturing services. This investment would boost FUJIFILM sites in Denmark and Texas.

U.S. Cell Culture Market By Application Insights

Based on application, the market is segmented into biopharmaceutical production, drug development, diagnostics, tissue culture & engineering, cell and gene therapy, toxicity testing, and other applications. The biopharmaceutical production segment led the market with the largest revenue share of 31.87% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. Mammalian cell cultures are primarily used in the production of biopharmaceuticals, and the growing demand for nonconventional therapeutic options has led to a substantial increase in the bioproduction of genetically enhanced drugs. Due to this, demand for various cell culture consumables, such as media, is expected to increase.

The diagnostics segment is expected to grow at a significant CAGR over the forecast period. Cell cultures can be used in metabolomics for the identification of biomarkers of pathologically relevant conditions. Moreover, metabolic pathways that lead to the production of such biomarkers can also be identified to determine underlying metabolic disorders. Similarly, metabolites also play a crucial role in the diagnosis of cancer and its recurrence, which increases the scope of applications for cell culture products. Thus, this is expected to drive the market growth.

U.S. Cell Culture Market By Recent Developments

- In May 2023, BD announced the global commercial launch of a new-to-the-world cell sorting equipment featuring two revolutionary innovations that allow researchers to reveal more comprehensive information regarding cells previously unseen in typical flow cytometry research

- In March 2023, Danaher and the University of Pennsylvania announced a strategic alliance to advance cell therapy. The multi-year partnership aims to create new technologies, reduce delays in manufacturing, and provide next generation engineered cell products to patients with more consistent clinical outcomes

- In February 2023, Thermo Fisher Scientific together with Celltrio announced a collaboration to provide clients in the biotherapeutics business with a fully controlled cell culture system

- In February 2023, Corning Incorporated showcased its latest technology in automation & 3D cell culture at Society for Laboratory Automation & Screening (SLAS) conference in San Diego, California

- Sartorius AG

- Danaher

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Corning Inc.

- Avantor, Inc.

- BD

- Eppendorf SE

- Bio-Techne

- PromoCell GmbH

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Cell Culture market.

By Product

- Consumables

- Sera

- Fetal Bovine Serum

- Other

- Reagents

- Albumin

- Others

- Media

- Serum-free Media

- CHO Media

- HEK 293 Media

- BHK Medium

- Vero Medium

- Other Serum-free Media

- Classical Media

- Stem Cell Culture Media

- Chemically Defined Media

- Specialty Media

- Other Cell Culture Media

- Serum-free Media

- Sera

- Instruments

- Culture Systems

- Incubators

- Centrifuges

- Cryostorage Equipment

- Pipetting

- Biopharmaceutical Production

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Drug Development

- Diagnostics

- Tissue Culture & Engineering

- Cell & Gene Therapy

- Toxicity Testing

- Other Applications

https://www.novaoneadvisor.com/report/checkout/8507

Frequently Asked Questions

- What geographic regions does your market research cover for the U.S. Cell Culture market?

- We have a global reach, with expertise spanning across continents, including North America, Europe, Asia-Pacific, Latin America, and the Middle East. We leverage a combination of primary and secondary research methodologies to offer country-level analysis.

- How does your firm conduct cross-sectional analysis for the U.S. Cell Culture market?

- We conduct cross-sectional analysis by examining data from different individuals at a single point in time to identify patterns and trends across diverse segments of the market.

- Can your firm customize market research solutions to meet specific client needs?

- Our experienced team works closely with clients to gain a thorough understanding of their business goals and target markets. We have the expertise and flexibility to develop bespoke research solutions.

- Do you offer ongoing support or consultation to clients after the completion of a market research project?

- Our team of experienced analysts is available to address any questions, concerns and needs that may arise following the delivery of the report.

- Can your market research firm help with competitor analysis for U.S. Cell Culture market?

- Through a combination of quantitative and qualitative research methodologies, we meticulously assess the strengths, weaknesses, strategies, and market positioning of your competitors.

https://www.novaoneadvisor.com/report/checkout/8507

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/