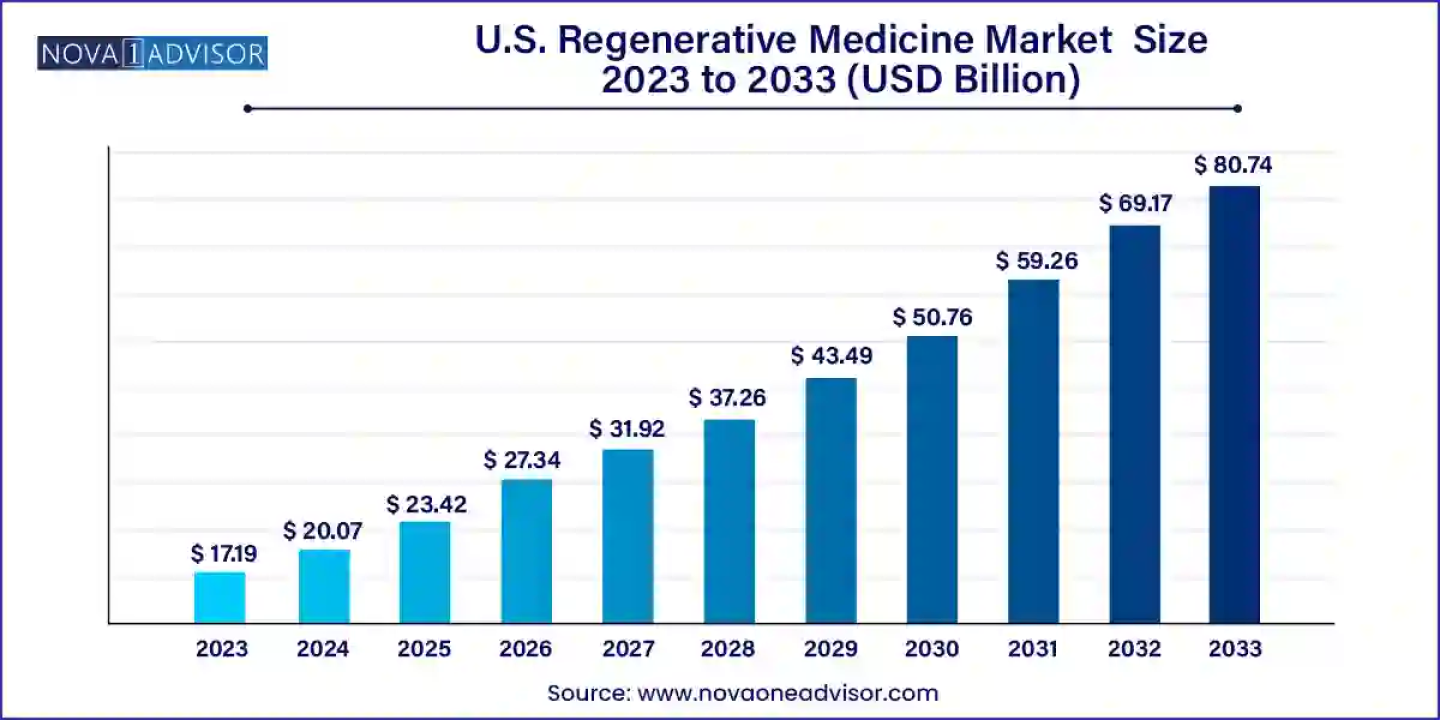

According to latest report, the U.S. regenerative medicine market size was USD 17.19 billion in 2023, calculated at USD 20.07 billion in 2024 and is expected to reach around USD 80.74 billion by 2033, expanding at a CAGR of 16.73% from 2024 to 2033. Regenerative medicine holds significant potential to revolutionize the treatment of tissues and organs damaged by age, disease, or trauma, and to correct congenital defects.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8518

The U.S. regenerative medicine market is experiencing rapid growth, driven by advancements in an interdisciplinary field that integrates engineering and life science principles to promote tissue and organ regeneration. Since its inception several decades ago, the field has achieved significant milestones, including FDA-approved therapies for wound healing and orthopedic applications that are now commercially available.

Regenerative medicine employs a variety of strategies, such as the use of materials, de novo generated cells, and their combinations to replace or heal damaged tissues both structurally and functionally. Leveraging the body's innate healing capabilities, although limited in humans compared to lower vertebrates, is another promising approach. The NIST Regenerative Medicine program collaborates closely with the FDA's Center for Biologics Evaluation and Research (FDA/CBER) and the Standards Coordinating Body to ensure the development and standardization of regenerative therapies, further propelling market growth.

Regenerative Medicine Market Size, Share and Growth 2024 to 2033

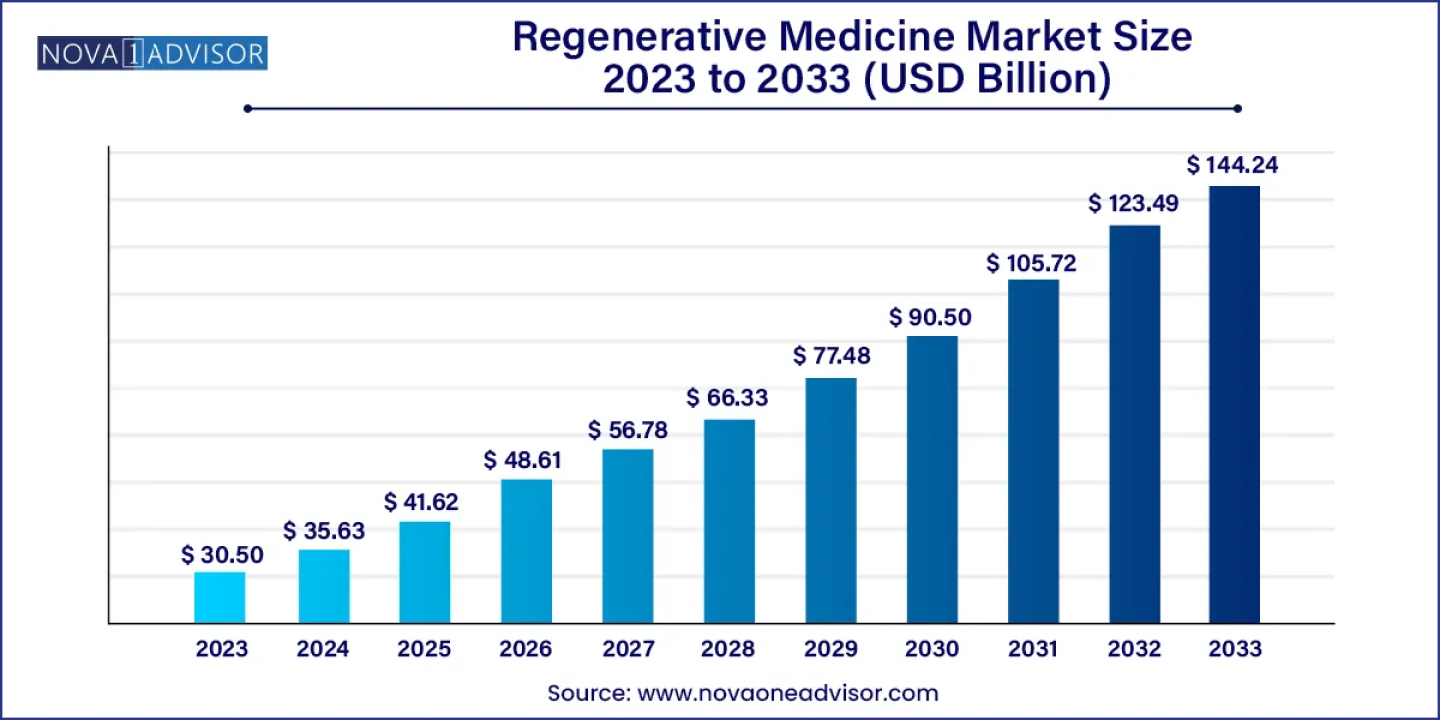

The global regenerative medicine market size was estimated at USD 35.63 billion in 2024 and is projected to hit around USD 144.24 billion by 2033, growing at a CAGR of 16.81% during the forecast period from 2024 to 2033. North America held the largest market share in the global market in 2023.

Market Dynamics

Driver

Advancements in Regenerative Medicine

The U.S. regenerative medicine market is experiencing significant growth driven by the advent of new, FDA-approved therapies designed to treat various pathologies. Intensive research has enabled the creation of advanced grafts that leverage scaffolding materials and cell manipulation technologies to control cell behaviour and repair tissues effectively. These scaffolds can be precisely melded to fit patient anatomy and allow substantial control over the spatial positioning of cells.

Innovations are being developed to enhance graft integration with the host's vasculature and nervous system, particularly through the controlled release of growth factors and vascular cell seeding. The body's healing response can be augmented through immune system modulation. The development of new cell sources for transplantation addresses the previous limitations of cell supply, further propelling the market's expansion. These advancements collectively underscore the robust growth and transformative potential of the U.S. regenerative medicine market.

High Costs and Regulatory Hurdles

One of the primary challenges facing the regenerative medicine industry is the high cost of therapies, such as CAR-T cell therapy, which can run into hundreds of thousands of dollars per patient. This financial barrier limits accessibility, particularly for patients without insurance or with restricted financial resources. The regulatory environment poses significant challenges. Regenerative medicine therapies are highly complex, often involving a combination of different technologies, complicating the regulatory approval process. Investors must be cognizant of these regulatory hurdles and collaborate closely with industry experts and regulatory agencies to ensure compliance with all relevant regulations. These financial and regulatory challenges collectively limit the growth potential of the U.S. regenerative medicine market.

Opportunity

AI Integration

The field of regenerative medicine is continuously advancing, focusing on repairing, regenerating, or substituting impaired or unhealthy tissues and organs through innovative approaches such as stem cell-based therapies, gene therapy, and tissue engineering. The incorporation of artificial intelligence (AI) technologies has unlocked new avenues for research and development in this domain. AI, which enables machines to perform tasks requiring human intelligence by learning patterns in data and applying this knowledge autonomously, has the potential to significantly enhance and expedite various aspects of regenerative medicine research.

By mimicking human cognition, AI systems can improve learning, reasoning, perception, and problem-solving, thereby optimizing complex processes inherent in regenerative medicine. The ability of AI to learn from data and prior experiences and improve over time presents a substantial opportunity for advancing the U.S. regenerative medicine market, driving innovation, and improving patient outcomes.

U.S. Regenerative Medicine Market Concentration & Characteristics

The U.S. industry is consolidated by nature, exhibiting a high growth stage and accelerated pace of the industry. Several companies, including public and private players, are investing more in bolstering the capabilities of regenerative medicine. Companies invest heavily in R&D to upgrade their products with the latest technology and fulfill the unmet needs of patients. Around 700 companies are currently working on developing cell-based therapies for various diseases. This is anticipated to increase the competition among companies to create a specific and efficient pipeline.

The U.S. is a hub for research and innovation in regenerative medicine. Leading universities, research institutions, and biotech companies are driving advancements in the field.Moreover, the players and industry participants are focusing on launching new centers for regenerative medicine, which is anticipated to boost the market competition. For instance, in May 2023, Integra LifeSciences Holdings Corporation opened a New Center of Innovation And Learning in New Jersey. This newly inaugurated facility is expected to strengthen the company's commitment to offer regenerative technologies to address unmet clinical needs.

Merger & acquisition (M&A), collaborations, and partnerships between academia, industry, & healthcare providers are expected to accelerate research and translation of discoveries into clinical applications. For instance, in July 2023, Carmell Therapeutics entered into a definitive agreement to merge with Axolotl Biologix, a regenerative medicine company that focuses on developing and marketing human amnion-based allograft products for esthetics, active soft tissue repair, and orthopedic applications. Such strategies undertaken by industry players in the U.S. are expected to propel the competition for regenerative medicine.

The country has well-established regulatory agencies such as the U.S. FDA that provide clear guidelines for the development and approval of regenerative therapies, ensuring safety & efficacy. Owing to the wide coverage of regenerative medicine it is regulated as an advanced therapy medicinal product. Advanced therapies are further classified as those regulated under Section 361 and Section 351 according to the Public Health Service Act. In the U.S., the FDA approved the commercialization of two ex vivo and two in vivo gene therapies. Furthermore, the U.S. FDA offers excellent support for innovations in the gene therapy space via several policies concerning product development.

Report Highlights

By Product

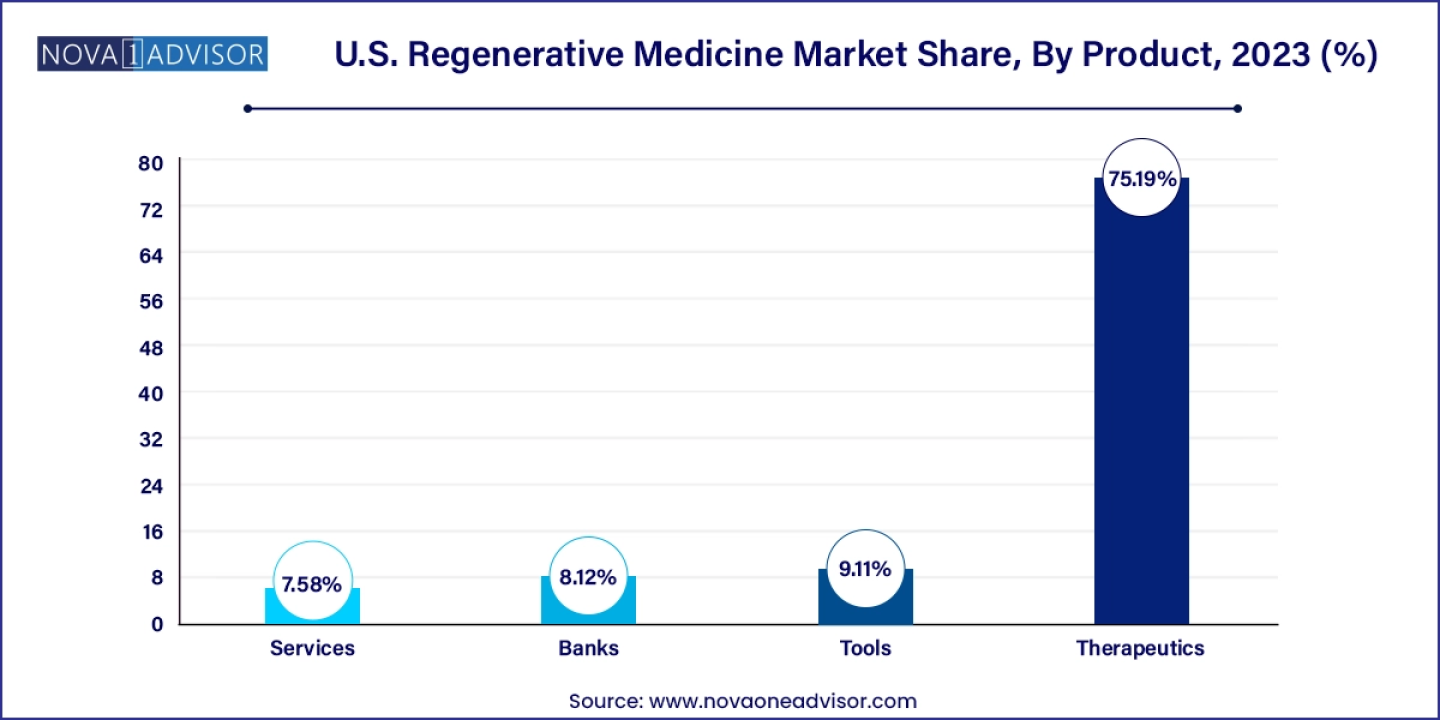

The therapeutics segment held the largest market share of 75.19% in 2023, reflecting the core objective of regenerative medicine: to replace or restore tissues and organs damaged by disease, injury, age, or congenital defects, rather than merely alleviating symptoms with medication and procedures. Regenerative medicine holds immense potential to heal or replace damaged tissues and organs, as well as normalize congenital anomalies. Robust preclinical and clinical data underscore its promise in treating both chronic diseases and acute conditions, addressing a wide range of medical issues, including dermal wounds, cardiovascular diseases, traumas, and specific cancer treatments. This transformative approach underpins the significant market share held by the therapeutics segment.

The bank segment is projected to be the fastest-growing sector during the forecast period, driven by the increasing importance of stem cell banking. This process allows for the cryogenic preservation of stem cells at their most potent state for future applications in regenerative medicine. Key sources of practical stem cells include bone marrow, umbilical cord blood and tissue, and adipose tissue, all of which can be harvested from most individuals with relative ease and cost-effectiveness. Banking autologous stem cells for future use is poised to be a crucial element in advancing regenerative and personalized medicine strategies. It is essential to bank stem cells while they are young and healthy, as older stem cells and those from individuals with chronic or inflammatory conditions exhibit diminished functionality. This strategic foresight in stem cell banking enhances the potential for effective regenerative treatments.

By Therapeutic Category

The oncology segment held the largest market share of 31.15% in 2023. within the regenerative medicine field, encompassing tissue engineering, cell therapy, and gene therapy. These cutting-edge approaches are pivotal in cancer treatment and the development of sophisticated cancer models, enhancing the understanding of cancer biology. The overarching objective is to translate fundamental and laboratory research into effective clinical treatments, effectively bridging the gap from bench to bedside. By accurately interpreting research efforts, the regenerative medicine field aims to reduce the burden of treatment and illness for patients, thereby improving therapeutic outcomes and quality of life.

The cardiovascular segment is projected to experience significant compound annual growth rate (CAGR) during the forecast period, driven by the rising prevalence of cardiovascular diseases (CVD). Regenerative medicine has increasingly been employed to treat ischemic heart disease (IHD), particularly through the use of stem cells to repair damaged heart tissue. Stem cell transplantation at infarcted sites can generate new cardiomyocytes, thereby restoring heart function. This interdisciplinary approach to regenerative medicine aims to restore, replace, or repair damaged parts of various organs, making it a critical therapeutic category in addressing cardiovascular health.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8518

Recent Developments

Pharmaceutical CDMO Market: https://www.biospace.com/article/releases/pharmaceutical-cdmo-industry-is-rising-rapidly-up-to-usd-295-95-bn-by-2033/

Cell Therapy Market : https://www.biospace.com/article/releases/cell-therapy-market-size-to-grow-at-22-67-percent-cagr-till-2033/

T-cell Therapy Market : https://www.biospace.com/article/releases/t-cell-therapy-market-size-share-and-analysis-report-2024-2033/

Gene Therapy Market : https://www.biospace.com/article/releases/gene-therapy-market-size-poised-to-surge-usd-52-40-billion-by-2033/

Clinical Trials Market : https://www.biospace.com/article/releases/clinical-trials-market-size-to-increase-usd-153-59-billion-by-2033/

Cell and Gene Therapy Market : https://www.biospace.com/article/releases/u-s-cell-and-gene-therapy-clinical-trial-services-industry-is-rising-rapidly/

Cell And Gene Therapy Manufacturing Market : https://www.biospace.com/article/cell-and-gene-therapy-manufacturing-market-is-rising-rapidly/

Cell And Gene Therapy CDMO Market: https://www.biospace.com/article/cell-and-gene-therapy-cdmo-market-size-to-reach-usd-69-11-bn-by-2033/

Cell & Gene Therapy Bioanalytical Testing Services Market : https://www.biospace.com/article/releases/cell-and-gene-therapy-bioanalytical-testing-services-market-size-to-hit-usd-1-19-bn-by-2033/

U.S. Nuclear Medicine Market : https://www.biospace.com/article/releases/u-s-nuclear-medicine-market-size-to-hit-usd-19-34-bn-by-2033/

U.S. Gene Synthesis Market : https://www.biospace.com/article/releases/u-s-gene-synthesis-market-size-to-hit-usd-3-11-billion-by-2033/

U.S. Generic Drugs Market: https://www.biospace.com/article/releases/u-s-generic-drugs-market-size-to-surpass-usd-188-44-bn-by-2032/

U.S. Clinical Trials Market : https://www.biospace.com/article/releases/u-s-clinical-trials-market-size-industry-analysis-report-2033/

U.S. Cell And Gene Therapy Manufacturing Market : https://www.biospace.com/article/u-s-cell-and-gene-therapy-manufacturing-market-size-and-growth-report-2033/

Immunotherapy Drugs Market : https://www.biospace.com/article/immunotherapy-drugs-market-size-to-reach-usd-1-30-trillion-by-2033/

Cancer Immunotherapy Market : https://www.biospace.com/article/releases/cancer-immunotherapy-market-size-to-hit-usd-296-01-billion-by-2033/

Key U.S. Regenerative Medicine Company Insights

Some prominent U.S. regenerative medicine market companies include Vitrolife; AstraZeneca; F. Hoffmann-La Roche Ltd.; Integra LifeSciences: Astellas Pharma Inc.; COOK BIOTECH; Merck KGaA; Vericel Corporation; Novartis Pharmaceuticals Corporation; bluebird bio, Inc.; and Bristol-Myers Squibb Company. Key market companies are adopting multifaceted strategies to remain in competition in the ever-evolving market setting.

They are initiating strategic M&A activities, partnerships, and collaborations with other market players and academic institutions intending to exchange knowledge and accelerate innovations. In addition, key players are undertaking various strategies, such as collaborations with Contract Manufacturing Organizations (CMOs), to sustain their market position. These companies are also prioritizing regulatory navigation, to ensure on-time approvals and access to the market.

U.S. Regenerative Medicine Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Regenerative Medicine market.

By Product

https://www.novaoneadvisor.com/report/checkout/8518

Frequently Asked Questions

https://www.novaoneadvisor.com/report/checkout/8518

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8518

The U.S. regenerative medicine market is experiencing rapid growth, driven by advancements in an interdisciplinary field that integrates engineering and life science principles to promote tissue and organ regeneration. Since its inception several decades ago, the field has achieved significant milestones, including FDA-approved therapies for wound healing and orthopedic applications that are now commercially available.

Regenerative medicine employs a variety of strategies, such as the use of materials, de novo generated cells, and their combinations to replace or heal damaged tissues both structurally and functionally. Leveraging the body's innate healing capabilities, although limited in humans compared to lower vertebrates, is another promising approach. The NIST Regenerative Medicine program collaborates closely with the FDA's Center for Biologics Evaluation and Research (FDA/CBER) and the Standards Coordinating Body to ensure the development and standardization of regenerative therapies, further propelling market growth.

- In April 2024, Abeona Therapeutics Inc. announced a regulatory update for prademagene zamikeracel (pz-cel).

- In June 2023, the FDA accepted Pfizer’s application for Hemophilia B gene therapy Fidanacogene Elaparvovec.

- The oncology segment held the largest market share of 31.15% in 2023.

- The cardiovascular segment is expected to witness a considerable CAGR during the forecast period

- The therapeutics segment held the largest market share of 75.19% in 2023.

- The bank segment is expected to witness the fastest CAGR from 2024 to 2033

Regenerative Medicine Market Size, Share and Growth 2024 to 2033

The global regenerative medicine market size was estimated at USD 35.63 billion in 2024 and is projected to hit around USD 144.24 billion by 2033, growing at a CAGR of 16.81% during the forecast period from 2024 to 2033. North America held the largest market share in the global market in 2023.

Market Dynamics

Driver

Advancements in Regenerative Medicine

The U.S. regenerative medicine market is experiencing significant growth driven by the advent of new, FDA-approved therapies designed to treat various pathologies. Intensive research has enabled the creation of advanced grafts that leverage scaffolding materials and cell manipulation technologies to control cell behaviour and repair tissues effectively. These scaffolds can be precisely melded to fit patient anatomy and allow substantial control over the spatial positioning of cells.

Innovations are being developed to enhance graft integration with the host's vasculature and nervous system, particularly through the controlled release of growth factors and vascular cell seeding. The body's healing response can be augmented through immune system modulation. The development of new cell sources for transplantation addresses the previous limitations of cell supply, further propelling the market's expansion. These advancements collectively underscore the robust growth and transformative potential of the U.S. regenerative medicine market.

- In May 2024, Andelyn Biosciences was selected as the viral vector manufacturing partner for the California Institute for Regenerative Medicine (CIRM) Accelerating Medicines Partnership (AMP) Bespoke Gene Therapy Consortium (BGTC).

High Costs and Regulatory Hurdles

One of the primary challenges facing the regenerative medicine industry is the high cost of therapies, such as CAR-T cell therapy, which can run into hundreds of thousands of dollars per patient. This financial barrier limits accessibility, particularly for patients without insurance or with restricted financial resources. The regulatory environment poses significant challenges. Regenerative medicine therapies are highly complex, often involving a combination of different technologies, complicating the regulatory approval process. Investors must be cognizant of these regulatory hurdles and collaborate closely with industry experts and regulatory agencies to ensure compliance with all relevant regulations. These financial and regulatory challenges collectively limit the growth potential of the U.S. regenerative medicine market.

Opportunity

AI Integration

The field of regenerative medicine is continuously advancing, focusing on repairing, regenerating, or substituting impaired or unhealthy tissues and organs through innovative approaches such as stem cell-based therapies, gene therapy, and tissue engineering. The incorporation of artificial intelligence (AI) technologies has unlocked new avenues for research and development in this domain. AI, which enables machines to perform tasks requiring human intelligence by learning patterns in data and applying this knowledge autonomously, has the potential to significantly enhance and expedite various aspects of regenerative medicine research.

By mimicking human cognition, AI systems can improve learning, reasoning, perception, and problem-solving, thereby optimizing complex processes inherent in regenerative medicine. The ability of AI to learn from data and prior experiences and improve over time presents a substantial opportunity for advancing the U.S. regenerative medicine market, driving innovation, and improving patient outcomes.

U.S. Regenerative Medicine Market Concentration & Characteristics

The U.S. industry is consolidated by nature, exhibiting a high growth stage and accelerated pace of the industry. Several companies, including public and private players, are investing more in bolstering the capabilities of regenerative medicine. Companies invest heavily in R&D to upgrade their products with the latest technology and fulfill the unmet needs of patients. Around 700 companies are currently working on developing cell-based therapies for various diseases. This is anticipated to increase the competition among companies to create a specific and efficient pipeline.

The U.S. is a hub for research and innovation in regenerative medicine. Leading universities, research institutions, and biotech companies are driving advancements in the field.Moreover, the players and industry participants are focusing on launching new centers for regenerative medicine, which is anticipated to boost the market competition. For instance, in May 2023, Integra LifeSciences Holdings Corporation opened a New Center of Innovation And Learning in New Jersey. This newly inaugurated facility is expected to strengthen the company's commitment to offer regenerative technologies to address unmet clinical needs.

Merger & acquisition (M&A), collaborations, and partnerships between academia, industry, & healthcare providers are expected to accelerate research and translation of discoveries into clinical applications. For instance, in July 2023, Carmell Therapeutics entered into a definitive agreement to merge with Axolotl Biologix, a regenerative medicine company that focuses on developing and marketing human amnion-based allograft products for esthetics, active soft tissue repair, and orthopedic applications. Such strategies undertaken by industry players in the U.S. are expected to propel the competition for regenerative medicine.

The country has well-established regulatory agencies such as the U.S. FDA that provide clear guidelines for the development and approval of regenerative therapies, ensuring safety & efficacy. Owing to the wide coverage of regenerative medicine it is regulated as an advanced therapy medicinal product. Advanced therapies are further classified as those regulated under Section 361 and Section 351 according to the Public Health Service Act. In the U.S., the FDA approved the commercialization of two ex vivo and two in vivo gene therapies. Furthermore, the U.S. FDA offers excellent support for innovations in the gene therapy space via several policies concerning product development.

Report Highlights

By Product

The therapeutics segment held the largest market share of 75.19% in 2023, reflecting the core objective of regenerative medicine: to replace or restore tissues and organs damaged by disease, injury, age, or congenital defects, rather than merely alleviating symptoms with medication and procedures. Regenerative medicine holds immense potential to heal or replace damaged tissues and organs, as well as normalize congenital anomalies. Robust preclinical and clinical data underscore its promise in treating both chronic diseases and acute conditions, addressing a wide range of medical issues, including dermal wounds, cardiovascular diseases, traumas, and specific cancer treatments. This transformative approach underpins the significant market share held by the therapeutics segment.

The bank segment is projected to be the fastest-growing sector during the forecast period, driven by the increasing importance of stem cell banking. This process allows for the cryogenic preservation of stem cells at their most potent state for future applications in regenerative medicine. Key sources of practical stem cells include bone marrow, umbilical cord blood and tissue, and adipose tissue, all of which can be harvested from most individuals with relative ease and cost-effectiveness. Banking autologous stem cells for future use is poised to be a crucial element in advancing regenerative and personalized medicine strategies. It is essential to bank stem cells while they are young and healthy, as older stem cells and those from individuals with chronic or inflammatory conditions exhibit diminished functionality. This strategic foresight in stem cell banking enhances the potential for effective regenerative treatments.

By Therapeutic Category

The oncology segment held the largest market share of 31.15% in 2023. within the regenerative medicine field, encompassing tissue engineering, cell therapy, and gene therapy. These cutting-edge approaches are pivotal in cancer treatment and the development of sophisticated cancer models, enhancing the understanding of cancer biology. The overarching objective is to translate fundamental and laboratory research into effective clinical treatments, effectively bridging the gap from bench to bedside. By accurately interpreting research efforts, the regenerative medicine field aims to reduce the burden of treatment and illness for patients, thereby improving therapeutic outcomes and quality of life.

The cardiovascular segment is projected to experience significant compound annual growth rate (CAGR) during the forecast period, driven by the rising prevalence of cardiovascular diseases (CVD). Regenerative medicine has increasingly been employed to treat ischemic heart disease (IHD), particularly through the use of stem cells to repair damaged heart tissue. Stem cell transplantation at infarcted sites can generate new cardiomyocytes, thereby restoring heart function. This interdisciplinary approach to regenerative medicine aims to restore, replace, or repair damaged parts of various organs, making it a critical therapeutic category in addressing cardiovascular health.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8518

Recent Developments

- n April 2023, Mount Sinai launched the Institute for regenerative medicine.

- In March 2024, the shift to regenerative medicine increased growth prospects for PHI.

- In December 2023, Medicine by Design and CCRM launched an alliance to bolster Canada’s leading position in regenerative medicine.

- In October 2023, Bayer opened its first cell therapy manufacturing facility to advance regenerative medicines on a global scale.

- In January 2024, STEMCELL Technologies announced the acquisition of Propagenix Inc.

- In January 2023, Zimmer Biomet announced plans to acquire Embody, Inc.

- In August 2022, ElevateBio partnered with the California Institute for Regenerative Medicine to accelerate the development of regenerative medicines.

- In July 2022, Mogrify and Astellas announced a collaboration to conduct research on in vivo regenerative medicine approaches to address sensorineural hearing loss.

Pharmaceutical CDMO Market: https://www.biospace.com/article/releases/pharmaceutical-cdmo-industry-is-rising-rapidly-up-to-usd-295-95-bn-by-2033/

Cell Therapy Market : https://www.biospace.com/article/releases/cell-therapy-market-size-to-grow-at-22-67-percent-cagr-till-2033/

T-cell Therapy Market : https://www.biospace.com/article/releases/t-cell-therapy-market-size-share-and-analysis-report-2024-2033/

Gene Therapy Market : https://www.biospace.com/article/releases/gene-therapy-market-size-poised-to-surge-usd-52-40-billion-by-2033/

Clinical Trials Market : https://www.biospace.com/article/releases/clinical-trials-market-size-to-increase-usd-153-59-billion-by-2033/

Cell and Gene Therapy Market : https://www.biospace.com/article/releases/u-s-cell-and-gene-therapy-clinical-trial-services-industry-is-rising-rapidly/

Cell And Gene Therapy Manufacturing Market : https://www.biospace.com/article/cell-and-gene-therapy-manufacturing-market-is-rising-rapidly/

Cell And Gene Therapy CDMO Market: https://www.biospace.com/article/cell-and-gene-therapy-cdmo-market-size-to-reach-usd-69-11-bn-by-2033/

Cell & Gene Therapy Bioanalytical Testing Services Market : https://www.biospace.com/article/releases/cell-and-gene-therapy-bioanalytical-testing-services-market-size-to-hit-usd-1-19-bn-by-2033/

U.S. Nuclear Medicine Market : https://www.biospace.com/article/releases/u-s-nuclear-medicine-market-size-to-hit-usd-19-34-bn-by-2033/

U.S. Gene Synthesis Market : https://www.biospace.com/article/releases/u-s-gene-synthesis-market-size-to-hit-usd-3-11-billion-by-2033/

U.S. Generic Drugs Market: https://www.biospace.com/article/releases/u-s-generic-drugs-market-size-to-surpass-usd-188-44-bn-by-2032/

U.S. Clinical Trials Market : https://www.biospace.com/article/releases/u-s-clinical-trials-market-size-industry-analysis-report-2033/

U.S. Cell And Gene Therapy Manufacturing Market : https://www.biospace.com/article/u-s-cell-and-gene-therapy-manufacturing-market-size-and-growth-report-2033/

Immunotherapy Drugs Market : https://www.biospace.com/article/immunotherapy-drugs-market-size-to-reach-usd-1-30-trillion-by-2033/

Cancer Immunotherapy Market : https://www.biospace.com/article/releases/cancer-immunotherapy-market-size-to-hit-usd-296-01-billion-by-2033/

Key U.S. Regenerative Medicine Company Insights

Some prominent U.S. regenerative medicine market companies include Vitrolife; AstraZeneca; F. Hoffmann-La Roche Ltd.; Integra LifeSciences: Astellas Pharma Inc.; COOK BIOTECH; Merck KGaA; Vericel Corporation; Novartis Pharmaceuticals Corporation; bluebird bio, Inc.; and Bristol-Myers Squibb Company. Key market companies are adopting multifaceted strategies to remain in competition in the ever-evolving market setting.

They are initiating strategic M&A activities, partnerships, and collaborations with other market players and academic institutions intending to exchange knowledge and accelerate innovations. In addition, key players are undertaking various strategies, such as collaborations with Contract Manufacturing Organizations (CMOs), to sustain their market position. These companies are also prioritizing regulatory navigation, to ensure on-time approvals and access to the market.

U.S. Regenerative Medicine Market Top Key Companies:

- AstraZeneca plc

- F. Hoffmann-La Roche Ltd.

- Integra Lifesciences Corp.

- Astellas Pharma, Inc.

- Cook Biotech, Inc.

- Bayer AG

- Pfizer, Inc.

- Merck KGaA

- Abbott

- Vericel Corp.

- Novartis AG

- GlaxoSmithKline (GSK)

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Regenerative Medicine market.

By Product

- Therapeutics

- Primary Cell-based Therapeutics

- Dermatology

- Musculoskeletal

- Surgical

- Dental

- Others

- Stem Cell & Progenitor Cell-based Therapeutics

- Autologous

- Allogenic

- Others

- Cell-based Immunotherapies

- Gene Therapies

- Primary Cell-based Therapeutics

- Tools

- Banks

- Services

- Dermatology

- Musculoskeletal

- Immunology & Inflammation

- Oncology

- Cardiovascular

- Ophthalmology

- Others

https://www.novaoneadvisor.com/report/checkout/8518

Frequently Asked Questions

- What geographic regions does your market research cover for the U.S. Regenerative Medicine market?

- We have a global reach, with expertise spanning across continents, including North America, Europe, Asia-Pacific, Latin America, and the Middle East. We leverage a combination of primary and secondary research methodologies to offer country-level analysis.

- How does your firm conduct cross-sectional analysis for the U.S. Regenerative Medicine market?

- We conduct cross-sectional analysis by examining data from different individuals at a single point in time to identify patterns and trends across diverse segments of the market.

- Can your firm customize market research solutions to meet specific client needs?

- Our experienced team works closely with clients to gain a thorough understanding of their business goals and target markets. We have the expertise and flexibility to develop bespoke research solutions.

- Do you offer ongoing support or consultation to clients after the completion of a market research project?

- Our team of experienced analysts is available to address any questions, concerns and needs that may arise following the delivery of the report.

- Can your market research firm help with competitor analysis for U.S. Regenerative Medicine market?

- Through a combination of quantitative and qualitative research methodologies, we meticulously assess the strengths, weaknesses, strategies, and market positioning of your competitors.

https://www.novaoneadvisor.com/report/checkout/8518

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/