As AstraZeneca looks to climb toward the top of biopharma companies by revenue by the end of the decade, smaller companies are looking to join the ranks of the unofficial Big Pharma club.

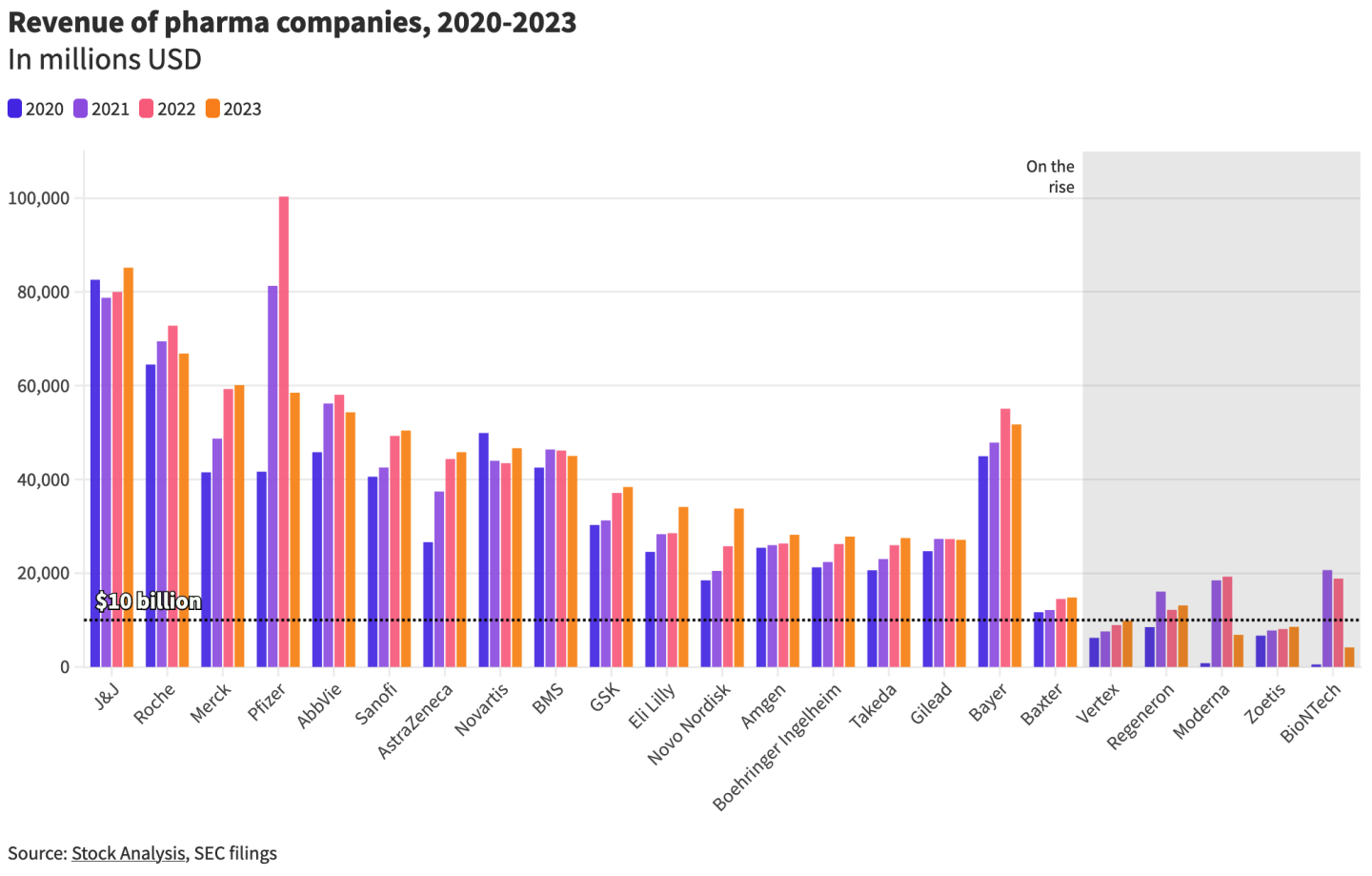

The top 20 biopharma companies by revenue all bring in well over $10 billion dollars annually. Topping the list in 2023 was Johnson & Johnson, with a grand total just north of $85 billion in sales. Last week, AstraZeneca—which ranked in the top 10 last year with nearly $46 billion in revenue—announced that it is targeting the $80 billion mark by 2030.

While there is no official definition of Big Pharma, these companies are no doubt it. So are Pfizer and Eli Lilly and Merck and Roche, among others. And it’s not just because of their revenue. A firm’s global presence is also important, Hartaj Singh, managing director and biotechnology analyst at Oppenheimer Holdings, told BioSpace.

“Most pharma companies are what you call a multinational company,” Singh said. “Pfizer is presently [in] 150 countries; J&J, 175-plus.”

However you consider Big Pharma, there are smaller biopharma firms that are jostling for a position among those ranks. Nicholas Schmitz, senior analyst at KBI Biopharma, identified several companies as emerging big pharma, including Regeneron and Vertex, plus big COVID-19 players BioNTech and Moderna. Similarly, Singh pointed to Vertex and Moderna.

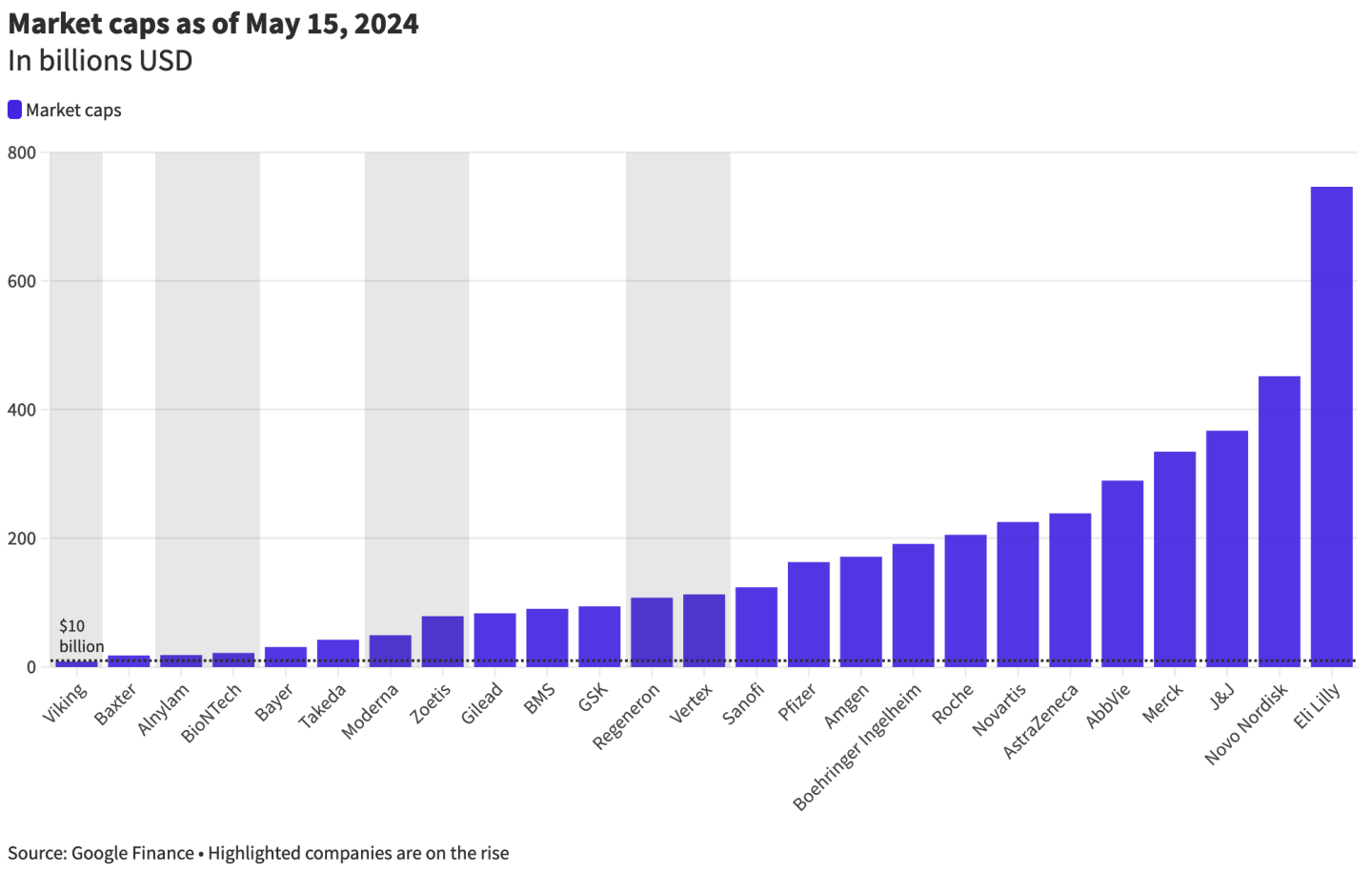

All of these companies bring in billions of dollars every year, and most have cracked GlobalData’s list of top 20 biopharma companies by market cap in Q1 2024. Gilead, Regeneron and Vertex all push or exceed $100 billion in this statistic, on par with GSK and Bristol Myers Squibb and not far behind Amgen, Sanofi and Pfizer.

In addition to revenue, market cap and geographic presence, Schmitz noted that other factors can help propel smaller biopharma firms into the elite group of Big Pharma, including product portfolio breadth, the ability to influence health policy and pricing and the capacity to “have pivotal roles in addressing global health crises.”

Big Pharma Through the Centuries

The term Big Pharma is thought to have originated in the 1990s, possibly in a 1993 San Francisco Examiner article describing the “giant drug companies” that were striking up partnerships with smaller, younger biotechnology firms. Since then, the term has been used colloquially to describe the entire pharmaceutical industry or just a handful of the largest players.

J&J, Eli Lilly, Pfizer, Merck and Roche can be thought of as the old big guns. These five companies and a handful of other undeniably big pharmaceutical companies were founded in the 1800s. These companies largely established their influence by allying with universities and medical associations to grow research efforts and the biomedical workforce. A handful of others climbed the ranks late in the 20th century and into the 21st. AbbVie was arguably the latest addition to the core Big Pharma list, launching in 2013 as a spinoff from Abbott Laboratories.

One quality that applies to all Big Pharma firms is an international presence, but the form that takes will vary by company. Singh noted that companies focused on pharmaceutical products often go “high volume, lower price,” allowing them to expand their reach in developing countries, while biotechnology-focused companies may go “low volume, high price” and end up concentrated in countries that can afford more expensive drugs.

“Amgen and Gilead probably have the largest amount of U.S. sales [among biotechnology companies]. Their sales are about 35% [in the U.S.] and the vast majority are in Europe,” Singh said. “On the other hand . . . pharma companies like AstraZeneca have sales of like 55% outside the U.S. and 45% in the U.S.”

Biopharma Companies on the Rise

Like other biotech companies, Vertex has made strides in the rare disease space. Four of its five approved drugs are used in cystic fibrosis, and the company estimates it can reach nearly 100,000 CF patients, according to its 2024 J.P. Morgan Healthcare Conference presentation. But the company also has broader goals: reaching the 90 million people impacted by acute and neuropathic pain.

“They’ve got a focus on pain . . . and by changing the paradigm in pain they could become analogous to a pharma company in that they’ll be treating hundreds of thousands if not millions of patients,” Singh said. In the company’s Q1 finance presentation, it highlighted the potential of its clinical-stage drug suzetrigine “to fundamentally reshape the treatment of acute pain in the U.S.”

Scientific strategy and understanding “the underlying biological rationale” are also key to a company’s growth, according to Singh. Vertex is an example of that. It follows the rational drug design philosophy, which focuses on specific biological targets that are validated in human health upfront.

In 2023, Vertex brought in nearly $10 billion. Then in Q1 2024, the company reported a 13% year-over-year increase in product revenue and higher-than-predicted earnings per share in the first quarter of 2024.

Many of the largest pharmaceutical companies have strategically acquired other companies to expand their portfolios, and Vertex has done the same. It acquired Alpine in April for $4.9 billion.

Other companies identified as climbing the biopharma ranks have also toed or surpassed the $10 billion revenue mark in recent years. BioNTech, Regeneron and Moderna had large spikes in revenue in 2021 following the declaration of the COVID-19 pandemic, bringing in approximately $20 billion, $16 billion and $18 billion, respectively. BioNTech and Moderna both had roles in developing COVID-19 vaccines, and Regeneron developed one of the major antibody treatments. Of the three, Regeneron was the only one still above the $10 billion threshold in 2023, while BioNTech and Moderna saw significant declines. BioNTech saw a particularly sharp drop in revenue in the first quarter of 2024.

However, Singh views Moderna as an important player because of its role in innovation with regard to mRNA and liquid nanoparticle technology.

“Antibodies were just entering the commercial mainstream in the late 90s, and Amgen and Regeneron were basically viewed as the antibody companies, and maybe Genentech also,” Singh said. “What I’m seeing with Moderna, and to a lesser extent BioNTech, is a very similar kind of story.”

Both companies saw U.S. stock prices increase in late May with H5N1 fears, according to the Wall Street Journal. Oppenheimer Holdings projected that private investment will “start catching up” and there will be more mRNA companies and drugs in the future, Singh noted.

On the other hand, Gilead Sciences crossed the $10 billion revenue threshold back in 2013, and the company more than doubled that amount the following year. It is located in 35 countries per its 2024 Q1 SEC filings and continues to expand its portfolio.

Overall, as the biopharma market continues to grow and new companies enter the fray, it remains to be seen which companies will expand their influence and become household names.

Nadia Bey is a freelance reporter from North Carolina. Her work and contact information can be found at nadiabey.com.