The biotech has acquired an exclusive global license for Shanghai-based DualityBio’s investigational antibody-drug conjugate for select solid tumors.

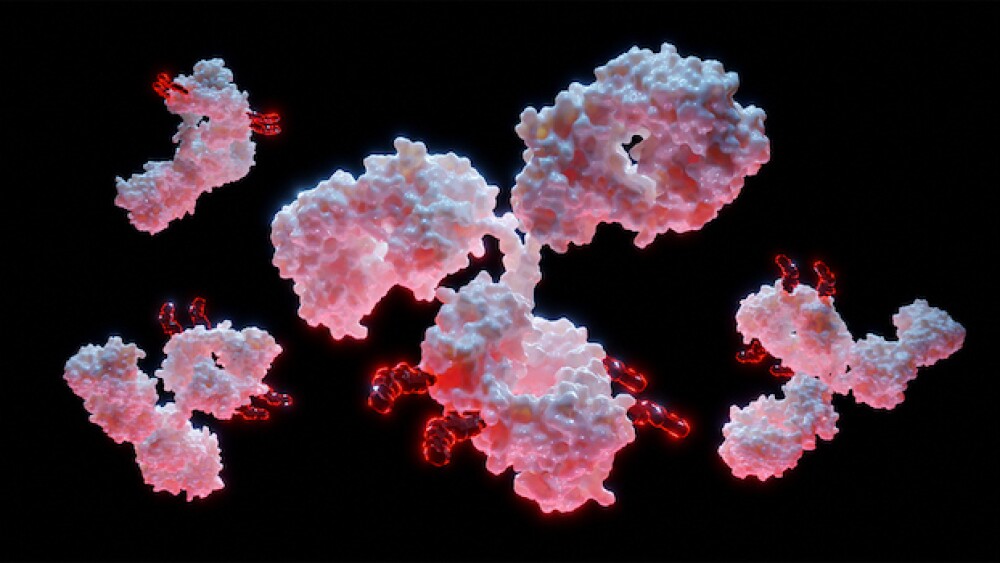

3D rendering of antibody-drug conjugate molecules with cytotoxic payload/courtesy of iStock

Chinese biotech BeiGene has acquired an exclusive license of an investigational antibody-drug conjugate for $1.3 billion from Shanghai-based DualityBio. The deal, announced Monday, provides the biotech with clinical, manufacturing, and commercial rights for the preclinical ADC therapy for select solid tumors.

The move comes not long after another agreement involving DualityBio and another global biotech. In April, BioNTech signed a $170 million licensing deal for exclusive access to two other ADCs developed by DualityBio.

Monday’s licensing deal with DualityBio isn’t BeiGene’s first foray into the ADC industry. In November 2019, the biotech inked a deal worth up to $160 million to license a preclinical ADC from Seattle Genetics for semi-global production. Seattle Genetics retained rights for the Americas, Europe, and Japan, while BeiGene licensed the ADC for the rest of the world.

In BeiGene’s latest deal, DualityBio will receive up to $1.3 billion based on the ability to hit certain developmental, regulatory, and commercial milestones, as well as potentially additional tiered royalties. Under the agreement, DualityBio will continue preclinical research activities and support future Investigational New Drug filings by BeiGene, according to the announcement.

“Through this strategic partnership with DualityBio, we are well positioned to advance this asset globally alongside our initial internally discovered ADC assets with our end-to-end ADC manufacturing capabilities,” Lai Wang, BeiGene’s global head of R&D, said in a statement.

The deal comes amid resurgent demand for ADCs in the biotech industry, with significant investments being made by large players.

Pfizer dropped $43 billion in March to acquire ADC manufacturer Seagan. In February, AstraZeneca spent $63 million for the right to continue researching a potential first-in-class ADC developed by KYM Biosciences, with an eye to eventual manufacture and commercialization. In July 2022, Merck exercised an option with Kelun-Biotech—a holding subsidiary of Sichuan Kelun Pharmaceutical—for worldwide rights to an anti-TROP2 ADC, except for the Greater China region.

ADCs combine a monoclonal antibody targeted to tumor-cell antigens, a cytotoxin such as a chemotherapy drug, and a linker to connect them. These give ADCs the precision of targeted treatments, while retaining the potent effects of chemotherapy and hopefully avoiding the worst of the side effects normally caused by the indiscriminate nature of chemotherapy.

The first ADC came to market in 2000 after receiving FDA approval. Since then, another 14 have been approved by various global regulatory agencies, though the technology took a reputational hit in August 2019 when AbbVie dropped an ADC it had acquired just three years prior for $5.8 billion. But another eight FDA approvals from 2019 to 2022 have renewed confidence, as have improvements in the underlying technology.

Connor Lynch is a freelance writer based in Ottawa, Canada. Reach him at lynchjourno@gmail.com.