After a brief slump, interest in ADCs is at an all-time high, highlighted by a handful of recent multi-million- and billion-dollar acquisitions.

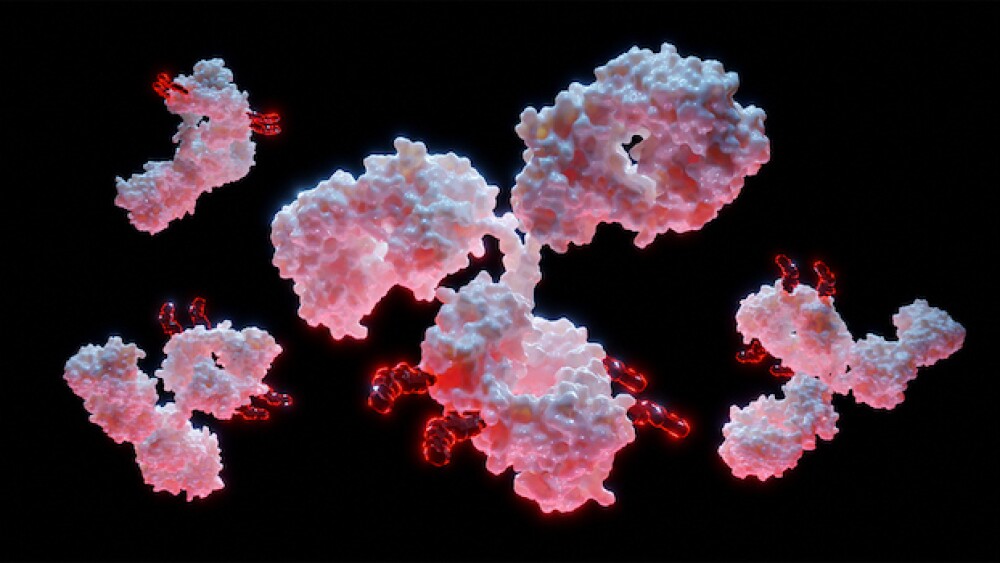

3D rendering of antibody-drug conjugate molecules with cytotoxic payload/courtesy of iStock

In March, Pfizer announced it would spend $43 billion to acquire antibody-drug conjugate pioneer Seagen. After a brief slump in popularity, other biopharma giants like AstraZeneca, BioNTech and Bristol-Myers Squibb are betting big on ADCs.

In February, AstraZeneca dropped $63 million upfront to obtain the global rights to an ADC from KYM Biosciences. And in April, BioNTech signed a $170 million licensing deal with China-based Duality Biologics for exclusive access to two ADCs, while BMS nabbed the rights to an ADC technology developed by German biotech Tubulis.

This recent spate of deals is just one of the signs that biotech giants and pharma companies are betting big on ADCs. Last year was a record year for new clinical-stage ADCs, according to Beacon by Hanson Wade analytics. Fifty-seven ADCs entered Phase I clinic trials in 2022, an increase of more than 20 from the previous year. And it’s no wonder why: drugs such as Gilead’s Trodelvy (Sacituzumab govitecan-hziy), designed to treat HER2-negative metastatic breast cancer, raked in $222 million during Q1, 2023, an increase of 52% from last year, the company announced in its first-quarter earnings report.

“What’s transpiring is companies now have more confidence if they were to pursue a strategy leveraging antibody-drug conjugates,” Andy Hsieh, a business analyst at William Blair & Company, told Biospace. Technological developments in ADCs and profit potential have both led to significant investment and interest, he said. “Those are the two main reasons for the recent renaissance in ADCs.”

Pfizer has 24 approved cancer medicines, including two ADCs, “but would gain four more with Seagen,” including three ADCs, a Pfizer spokesperson told Biospace in an e-mail. “ADCs are showing immense potential as the next emerging pillar of cancer treatment, across both solid tumors and blood cancers,” the spokesperson wrote.

Making a Comeback

ADC technology is not new. The first ADC to come to market, Mylotarg, received FDA approval in 2000. Since then, more than 14 other ADCs have received market approval worldwide and almost 1000 drugs are either clinically or preclinically active.

“ADCs are designed to combine the benefits of targeted therapy with the cytotoxicity of chemotherapy,” William D. Figg, an oncologist at the National Institutes of Health, told BioSpace.

ADCs are composed of a monoclonal antibody (mAb) targeted to antigens on tumor cells, a potent cytotoxic payload such as a chemotherapeutic drug and a linker between the two. The idea is that the ADC will, like a guided missile, specifically target cancer cells while leaving normal surrounding tissue untouched. The target antigens of approved ADCs are mainly proteins overexpressed in cancer cells, such as HER2 or Trop2.

The technology took a reputation hit in 2019 when AbbVie scrapped Rova-T, an ADC in development for small cell lung cancer, which it had acquired from Stemcentrx in 2016 for just shy of $6 billion. But between 2019 and 2022, eight ADCs received FDA approval, according to Beacon by Hanson Wade analytics.

The steady surge of approvals boosted the industry’s confidence in ADCs, Hsieh said, and several acquisitions followed. “Having a lower-risk development path has really encouraged more funding and investment into the field.”

The technology has also improved, Hsieh added. So-called third-generation ADCs show less off-target toxicity and avoid kickstarting the body’s immune response, research has shown. This is due in part to advancements in protein engineering, Figg said, which have created more stably linked ADCs that are able to make it to the tumor before releasing their payload. Newer ADCs can also be site-specific, meaning their cytotoxic payload molecules are attached to a precise location on the antibody molecule.

A prime example of third-generation ADC technology is AstraZeneca and Daiichi Sankyo’s Enhertu (fam-trastuzumab deruxtecan-nxki), which won approval in December 2019 under the FDA’s accelerated pathway to treat HER2-positive metastatic breast cancer. Phase III trial data showed Enhertu reduced the risk of disease progression or death by 72% in patients previously treated with other targeted cancer drugs. “That just goes to show how far the technology has come,” Hsieh said.

From a clinical standpoint, “This a complex modality,” he added. “As we developed different tools to optimize the toxin and develop new targeted antibodies . . . the field has learned ways to maximize the effect of these drugs.”

This complexity is another motivation for companies to invest in and develop ADCs, Hsieh noted, as it reduces the chances that other companies will create biosimilars and allowing developers to keep ADC prices high for consumers for longer periods of time than conventional drugs.

“It’s really hard to make a copycat version of antibody-drug conjugates,” he said. “You can’t really make any tweaks and changes in the ADC space, because these drugs are so complex.”

The Limitations of Complexity

Despite their success in clinical trials, ADCs are not a magic bullet. The main drawback is that tumors develop resistance to them over time. Toxicity is also a concern, especially as cytotoxic payloads become more and more potent.

“The clinical pharmacology of ADCs highly complex,” Figg said. “Given that payloads are cytotoxic, a relatively small increase in the systemic exposure of the payload can cause significant side effects.” Understanding the drug’s pharmacology to optimize the dose is crucial from a safety perspective, he added. Although ADCs can be combined with other therapies such as chemotherapy, they can sometimes have adverse drug interactions with other cancer treatments.

To optimize ADC therapy, Figg said researchers will have to understand and overcome the development of resistance, design more-stable linkers and identify more-specific therapeutic targets. But, he added, perhaps improved ADC technology will usher in an era of precision medicine.

“As ADC technology advances even further, personalized ADCs may be possible in the future, where we can construct the most appropriate antibody, linker and payload based on the patient’s tumor antigens and other characteristics.”

On the business side, Hsieh said that the field is getting really crowded and is starting to see a lot of stacking of biological targets.

“That’s a risk from an investor perspective.” Still, he said, “The field will continue to grow. New research is pouring in.”

Natalia Mesa is a freelance science writer based in Seattle. Reach her at natalia.mesa.v@gmail.com.