While Merck lost out to Pfizer earlier this year in snapping up Seagen, this week the company closed a deal worth a potential $22 billion with Daiichi Sankyo—further evidence of the industry’s insatiable appetite for ADC technology.

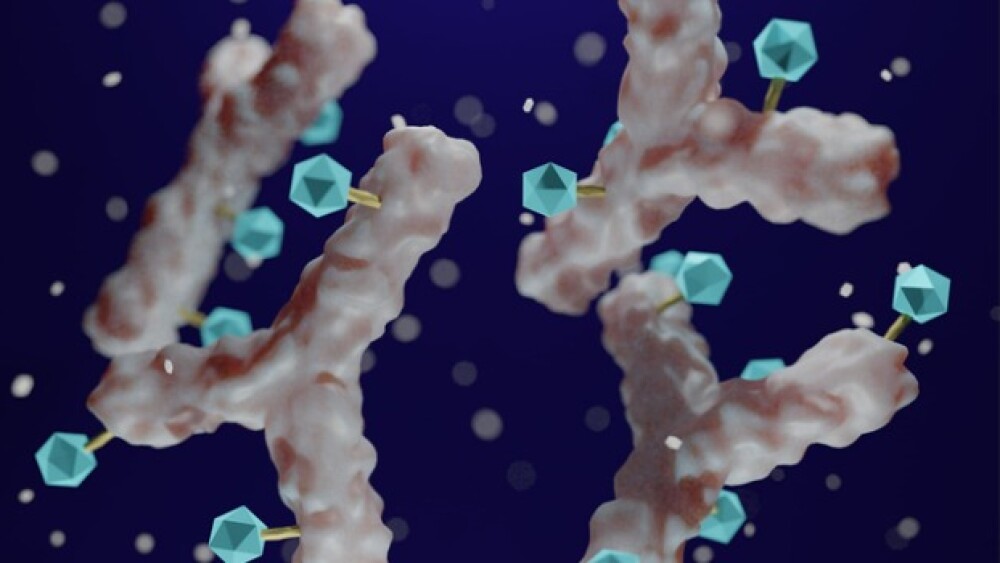

Pictured: Antibody-drug conjugate with cytotoxic payload / iStock, Love Employee

If there was any doubt about how hot the antibody-drug conjugate (ADC) market has become, we got further evidence this week of the industry’s insatiable appetite for the comeback technology. Biopharma companies are continuing to invest in ADCs in a spate of new deals.

The biggest deal was announced on Thursday between Merck and Daiichi Sankyo who will jointly develop and commercialize the Japanese company’s three DXd-based ADC candidates for a potential consideration of up to $22 billion. With a $4 billion upfront payment, Merck is looking to bolster its immuno-oncology business and portfolio to compete with AstraZeneca, Bristol Myers Squibb, Eli Lilly, Gilead, Pfizer and others in the ADC space.

On Wednesday, French ADC developer Mablink Bioscience announced an agreement to be acquired by Lilly. The preclinical biotech is partnered with Emergence Therapeutics, which Lilly purchased earlier this year. Emergence obtained the rights to develop a novel ADC using Mablink’s proprietary PSARlink drug-linker technology.

Not to be outdone, GSK also announced an ADC deal this week. The company has entered into an exclusive license agreement with Hansoh Pharma for the latter’s HS-20089, an ADC currently in Phase I clinical trials in China that targets the B7-H4 surface antigen—which is overexpressed in ovarian and endometrial cancers. Under the agreement, Hansoh will be eligible to receive up to nearly $1.5 billion in success-based milestones.

However, the mother of all ADC deals is Pfizer’s $43 billion acquisition of Seagen. The buyout announced in March 2023 got the greenlight from European Union antitrust regulators this week, clearing a key regulatory hurdle. Pfizer and Seagen are still awaiting a verdict from the U.S. Federal Trade Commission, which requested additional information on the deal in July as part of the agency’s review of the acquisition.

On the regulatory front, it was a big week for UCB, which won two FDA approvals. Following a delay and an initial rejection, UCB’s IL-17A/IL-17F blocker bimekizumab was approved for moderate-to-severe plaque psoriasis. And its complement inhibitor zilucoplan got the FDA’s green light for the treatment of generalized myasthenia gravis, a rare autoimmune disease.

The third-quarter earnings season kicked off this week, with some major companies announcing financial results negatively impacted by the COVID-19 cliff. Roche in its Q3 report said it is axing four clinical programs amid a sharp decline in demand for COVID-19 products and a strong Swiss franc that weighed on the value of overseas sales. The Swiss drugmaker expects a continued decrease in group sales and adjusted earnings per share in the low single-digit percentage range in 2023.

While Johnson & Johnson’s COVID-19 vaccine weighed on its growth in Q3, the second quarter without any U.S. sales from the product, the company raised its full-year guidance on strong pharma and medical device demand. J&J’s immune disease drug Stelara beat analyst expectations, bringing in more than $2.8 billion worldwide in Q3, while multiple myeloma medicine Darzalex snagged nearly $2.5 billion.

Greg Slabodkin is the News Editor at BioSpace. You can reach him at greg.slabodkin@biospace.com. Follow him on LinkedIn.