The drug combination did not hit the co-primary endpoint of recurrence-free survival in patients whose tumors expressed PD-L1 greater than 1%.

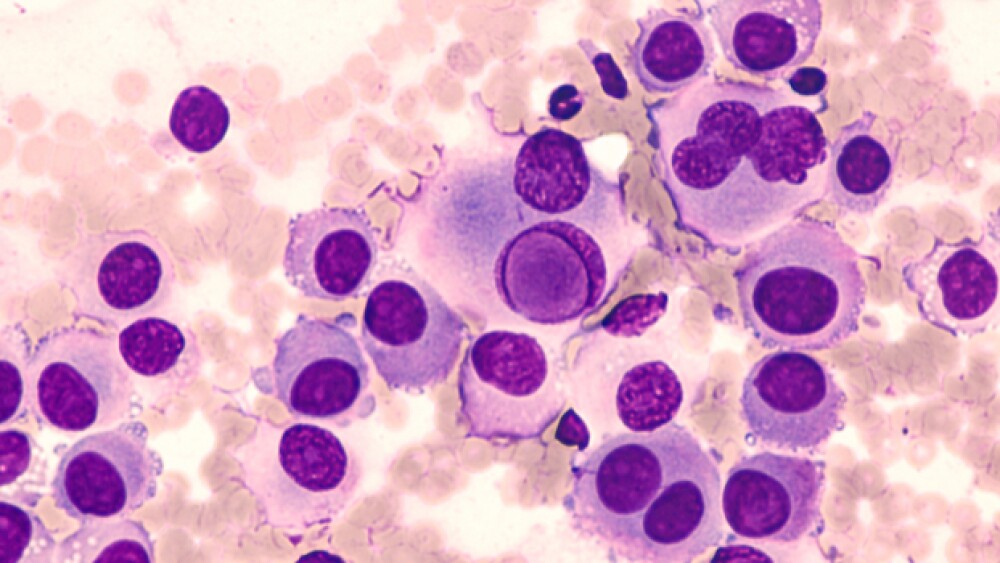

Although Bristol-Myers Squibb’s cancer drugs Opdivo (nivolumab) and Yervoy (ipilimumab) are remarkably success, they don’t work in every cancer. The company announced results from one of the co-primary endpoints from its Phase III CheckMate -915 clinical trial looking at Opdivo and Yervoy in combination compared to Opdivo alone for the adjuvant treatment of complete surgical removal of stage IIIb/c/d or stage IV melanoma. The drug combination did not hit the co-primary endpoint of recurrence-free survival (RFS) in patients whose tumors expressed PD-L1 greater than 1%.

However, the Data Monitoring Committee recommended the company continue the study with no changes. It will remain double-blinded and continue to investigate the other co-primary endpoint of RFS in the all-comer, intent-to-treat population.

Company shares traded lower, down 1.03% at $55.89 in premarket trading today after the announcement.

The CheckMate -915 trial investigated 1,943 patients. Melanoma is a type of skin cancer, the deadliest type of the disease. According to the World Health Organization, by 2035 there are expected to be 424,102 melanoma diagnoses around the world, with 94,308 related deaths.

In the U.S., patients diagnosed with advanced melanoma classified as Stage IV typically have a five-year survival rate of 15% to 20% and a 10-year survival rate of 10% to 15%.

In separate news, the U.S. Federal Trade Commission (FTC) approved Bristol-Myers Squibb’s acquisition of Celgene Corporation. The original deal was announced on January 3, 2019, but was met by opposition from one of its biggest shareholders, Wellington Management Company LLP. Wellington owns about an 8% stake in Bristol-Myers. Another BMS shareholders, Starboard Value, also opposed the deal.

Despite the opposition, in April, Bristol-Myers shareholders voted to approve the deal for about $74 billion.

It’s been a lengthy pathway to approval by the FTC due to some overlap in the two companies’ portfolios and pipelines. For example, Bristol-Myers earlier this year announced plans to divest Celgene’s psoriasis and psoriatic arthritis drug Otezla (apremilast). Bristol-Myers Squibb has a rival TYK2 psoriasis drug in Phase III trials called BMS-986165. Otezla brought in $1.6 billion in 2018, up from $1.28 billion in 2017. Since the pipeline drug is experimental and not approved, many industry watchers were surprised the FTC was insisting on the divestiture, since if the companies sell off Otezla and BMS-986165 fails to be approved, they will be at a loss.

But now, Bristol-Myers has met all the FTC’s regulatory requirements to complete the deal. It expects to close the deal today. It also indicates it expects the Otezla divestiture to be wrapped up shortly after the merger is closed.

“Today’s news is an exciting milestone in our company’s history as we look forward to officially combining with Celgene to create a leading biopharma company,” said Giovanni Caforio, chairman and chief executive officer of Bristol-Myers Squibb. “Together we will be well positioned to discover, develop and deliver innovative medicines, and to transform the lives of more patients through science.”

One of the surprising aspects of the FTC decision is that it was not unanimous. The five current FTC commissioners, all chosen by President Trump, voted 3-2, with a split along party lines.

The FTC alleged that the deal “would harm consumers in the U.S. market for treatments taken orally for moderate-to-severe psoriasis” if approved as it was. They noted that BMS-986165 would compete directly with Otezla. In a statement last Friday, the FTC said, “While many injectable and infused products are approved to treat moderate-to-severe psoriasis, some patients object to them or find them inconvenient.”

At least one member challenged the FTC’s approach to only evaluating product overlap. A dissenting statement by Commissioner Rohit Chopra noted, “I am deeply skeptical that this approach can unearth the complete set of harms to patients and innovation, based on the history of anticompetitive conduct of the firms seeking to merge and the characteristics of today’s pharmaceutical industry when it comes to innovation.”

Celgene is selling Otezla to Amgen for $13.4 billion, which the FTC says is the largest divestiture that it or the U.S. Department of Justice has ever required in a merger deal. However, that deal has not been finalized and the FTC has kept the right to rewind the deal and sell the product to another competitor if Amgen’s marketing efforts don’t meet their expectations.