Johnson & Johnson has been fighting thousands of lawsuits over its now-discontinued talc products for 16 years. A pending judge’s ruling could finally put the issue to bed once and for all.

Johnson & Johnson has been fighting lawsuits related to its talcum powder tooth and nail for the better part of two decades. A key decision looms that could finally allow the healthcare giant—and potentially the thousands of victims who brought the lawsuits—to move on.

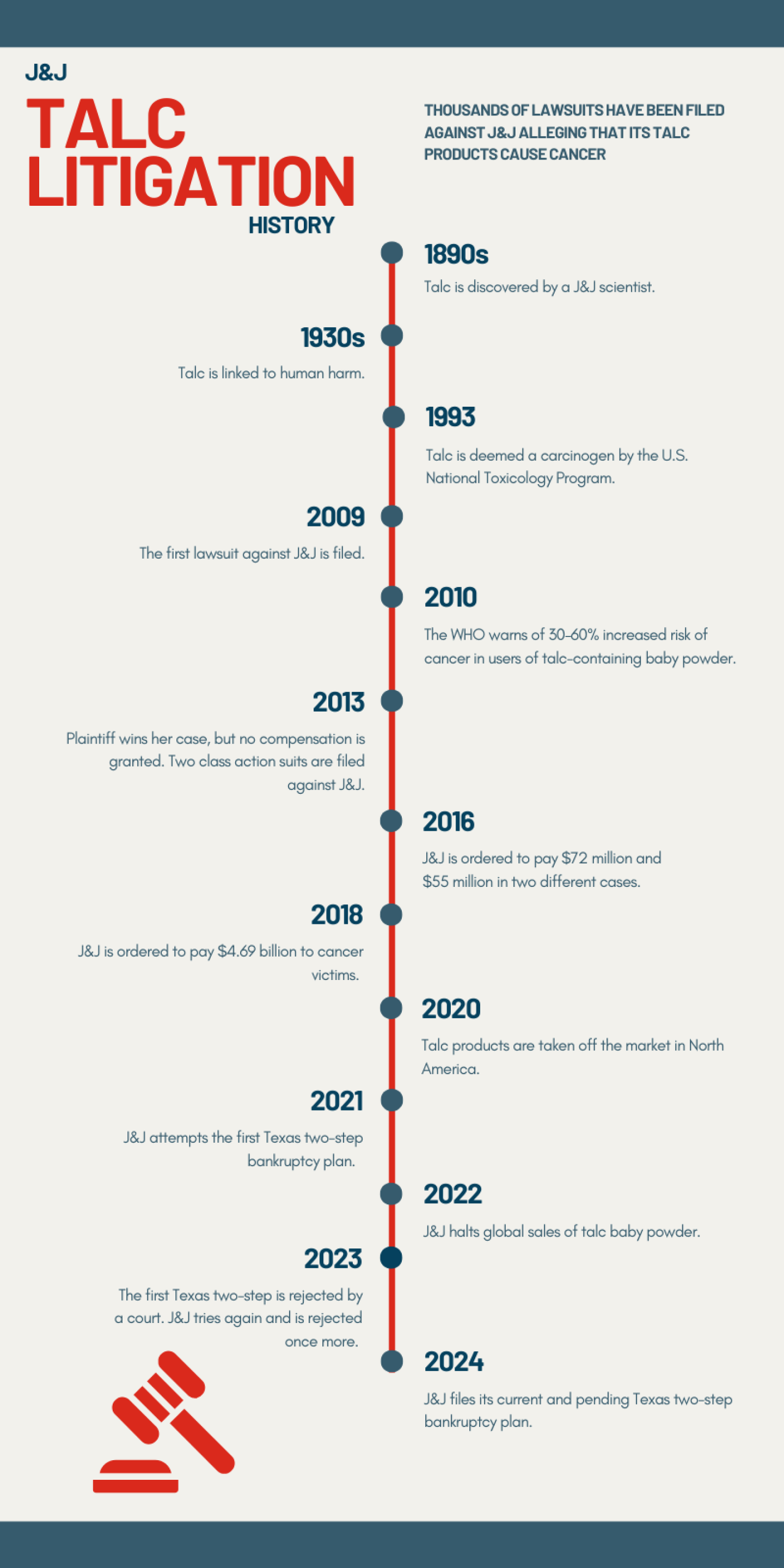

Talc, for short, was discovered by a J&J scientist in the 1890s and has been used to absorb odor and oil, reduce rashes and skin irritations, coat surgical gloves and even dust condoms, among many more uses over its history. Talc is a mined mineral made up of magnesium, silicon and oxygen and closely associated with asbestos, another naturally occurring mineral that was declared a carcinogen in 1973. Studies have been murky on whether asbestos-free talc is any safer. Manufacturers began separating talc and asbestos in the 1970s.

The product was first linked to human harm as early as the 1930s and has since been tied to ovarian and cervical tumors. Talc was officially deemed a carcinogen in 1993 by the U.S. National Toxicology Program. But J&J continued marketing its products. The World Health Organization in 2010 warned of a 30% to 60% increase in the risk of ovarian cancer among people who used baby powder that contained talc.

The first lawsuit was filed in 2009 by a 49-year-old South Dakota woman named Deane Berg who was diagnosed with ovarian cancer in 2006. J&J offered her a $1.3 million confidential settlement, but she declined and took the matter to court. In 2013, she won her case but received no compensation from J&J.

After the verdict, two class action cases were filed. In February 2016, J&J was ordered to pay $72 million to the family of a Missouri woman who died of ovarian cancer that was linked to her baby powder use. This was the first time that J&J was ordered to pay over the talc disputes, but months later, a verdict handed down in St. Louis ordered the company to pay $55 million to a different South Dakota woman. In this case, the jurors agreed that J&J’s product was to blame for the woman’s cancer.

Since then, thousands of individual and class action lawsuits have been filed against J&J. One ruling in July 2018 put J&J on the hook to pay $4.69 billion to 22 cancer victims, which in turn spurred more people to come forward.

J&J eventually bowed to the pressure and took its talc products off the market in North America in May 2020.

Then came the Texas two-step.

Third Time’s the Charm

In October 2021, J&J created a new subsidiary called LTL Management, shifting its consumer goods into one unit and the talc liabilities into the new one. The new subsidiary then filed for bankruptcy. This is known as a Texas two-step, a maneuver that can allow larger companies to shield themselves from current or future litigation by essentially spinning out the liabilities. J&J funded the unit with $61.5 billion to cover the talc claims and any bankruptcy expenses.

The bankruptcy filing created an uproar in Congress, with multiple Democratic senators denouncing J&J’s brazen move and calling for an end to the legal loophole. J&J’s bankruptcy filing was rejected by an appeals court in January 2023. J&J tried again later that year, but was rejected once more.

But third time’s the charm. J&J executed yet another Texas two-step in September 2024, creating a new subsidiary called Red River Talc LLC. This time, the company managed to gather the support of 83% of the current claimants to the litigation. J&J said the goal was “to fully and finally resolve all current and future claims related to ovarian cancer arising from cosmetic talc litigation against the Company and its affiliates in the U.S.”

How much claimants might ultimately get under the Red River offer is a bit murky. J&J originally offered $13.7 billion total to be paid out over 25 years, or $6.5 billion in today’s currency. The offer was later boosted to $8 billion in today’s value. A judge in 2023 said this would be the largest settlement in any asbestos-related bankruptcy case and the largest personal injury claim settlement in U.S. history.

A hearing to consider the bankruptcy plan for Red River Talc finished up on Feb. 28. Now, the industry awaits the decision from the Texas Bankruptcy Court.

“We are hoping for a decision in favor of JNJ, which would be positive for investor perception, but we cannot predict the outcome,” Leerink Partners wrote in a March 5 note to clients. “If the ruling favors JNJ, we would expect JNJ to move swiftly to make payments in order to try to put the litigation in the rear-view mirror.”

Either party to the lawsuit could appeal yet again if they lose and the matter could make its way to the Supreme Court if there’s no resolution. One of the law firms representing talc victims, Beasley Allen, has objected strongly to J&J’s plans, arguing that the compensation would not be enough to cover the medical bills of the people with ovarian cancer. The average cost of treatment is around $220,000 total, the firm said.

Beasley Allen also called into question the voting process used to get the 83% of claimants on board. While more than 99% of those suing J&J have ovarian cancer, Beasley Allen said that people with other types of cancer were included in the voting.

Prior to the hearing, J&J called out Beasley Allen for continuing to fight the bankruptcy plan while not securing any funds for its clients. The Big Pharma also defended its latest Texas two-step approach. “The plan constitutes one of the largest settlements ever reached in a mass tort bankruptcy case and far exceeds the 75% approval threshold required by the U.S. Bankruptcy Code,” J&J said in a statement.

If J&J does get its way and the ruling survives appeal, the bankruptcy plan would effectively shield the company from future litigation on this matter, Leerink explained. Even the claimants who voted against the Red River Talc plan would get their cut. Beasley Allen noted that the Supreme Court recently rejected a similar plan in a case against opioid maker Purdue Pharma.