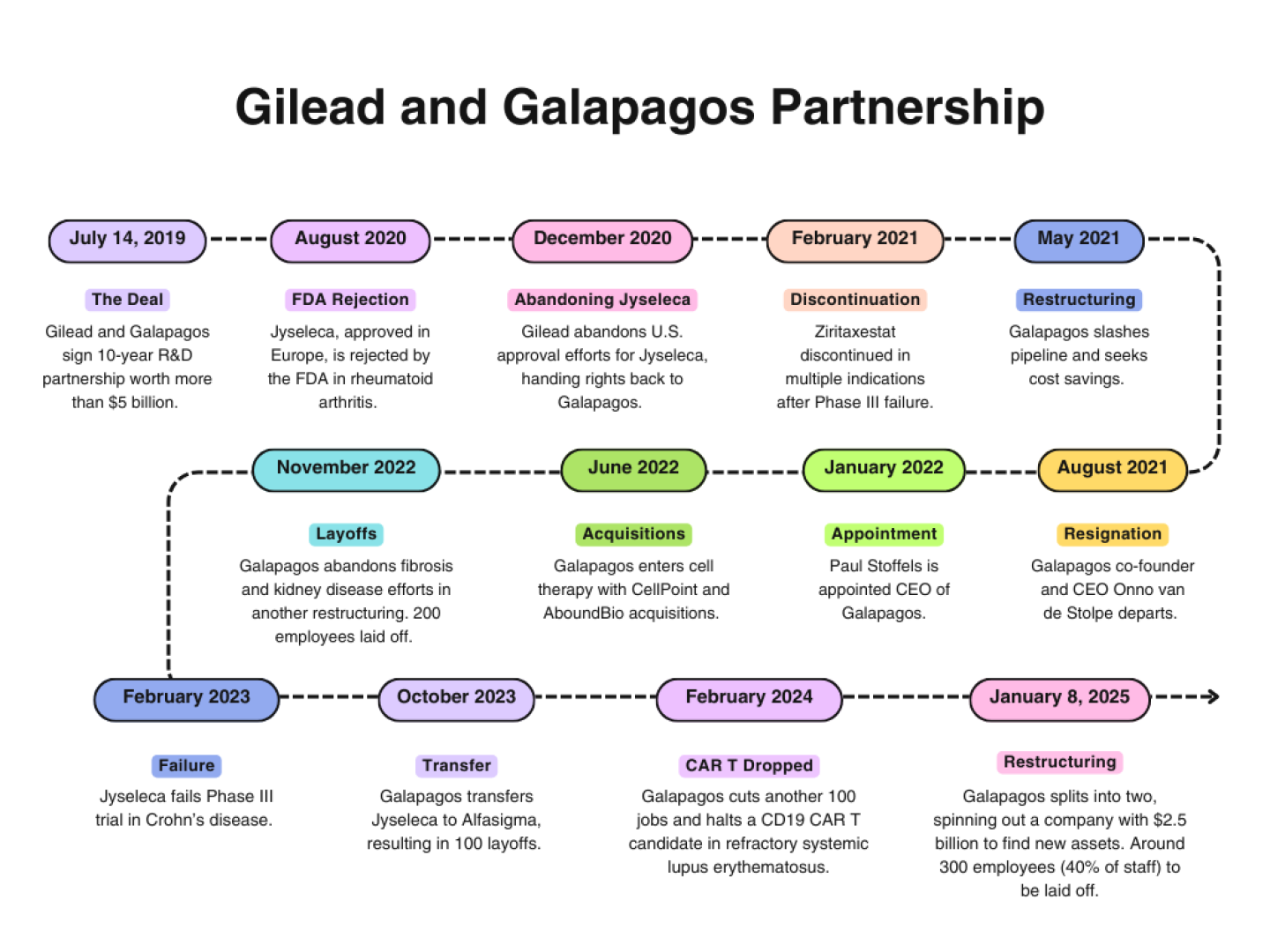

Five years ago, Gilead signed a massive deal with Galapagos. After a restructuring, the pharma is still hunting for the potential it saw at the original signing.

Gilead had reached an inflection point with Galapagos. The original assets that had attracted the Big Pharma to sign a deal worth more than $5 billion in 2019 had failed. A new leadership team helmed by Johnson & Johnson alum Paul Stoffels was entrenching Galapagos into cell therapy, but Gilead already had this space covered with Kite Pharma, which it acquired in 2017 for nearly $12 billion. So a decision had to be made on how to move forward.

The long-term partners announced on January 8 the intention to separate Galapagos into two, leaving the emerging cell therapy pipeline in the hands of the original company and creating a new one with €2.45 billion ($2.5 billion) in capital to find new areas to pursue. Gilead is calling itself a “collaboration partner” with the new entity and will retain a 25% share in both companies.

“At the time, we were intrigued by their scientific platform,” Gilead CEO Daniel O’Day said of the original Galapagos deal at a reporter roundtable at the J.P. Morgan Healthcare Conference. “And like a lot of things that happen in the industry, many of their lead targets, you know, were not successful. We were at a stage with the new management in Galapagos where we needed to decide how to create the most opportunity for patients moving forward.”

Which leaves a key question. What has Gilead achieved for its money after four and a half years with Galapagos? The original option, license and collaboration agreement (OLCA) was split between a whopping $3.95 billion upfront and a $1.1 billion equity investment for 25% of the biotech.

Negotiating the split from the Gilead side was Chief Financial Officer Andy Dickinson, who said the goal was to use Galapagos’ remaining capital to create value for its shareholders—Gilead included. Dickinson contended that there is $2.5 billion in capital that isn’t being used to its fullest potential as Galapagos pursues its new pipeline.

“We really needed to have a focused management team and a separate board that is looking at driving additional acquisitions and partnerships, and by separating the companies, we can accomplish both of those,” Dickinson said at the JPM event. As for Gilead’s relationship with the spinoff company (referred to for now as SpinCo), the original partnership terms from the OLCA apply. As the new company brings on assets, the partnership will need to be renegotiated, the CFO explained.

“The simple takeaway is, it is a unique structure, we think elegant. It fits the circumstances and should allow us to drive additional value creation for both sets of shareholders over time.”

Put plainly, Gilead didn’t need what Galapagos was cooking up in cell therapy. When asked if there could have been some synergies between the two program, Kite Executive Vice President Cindy Perettie said the manufacturing strategy being pursued by Galapagos was not a match for what Gilead is doing with its approved products. Galapagos is using “point of care” production, which means setting up manufacturing hubs close to hospitals to improve turnaround time. But Kite is already getting Yescarta to patients in 14 days, which Perettie said is the fastest in the industry.

“We feel like right now we’ve got a situation where our turnaround times are nicely on par, and so we haven’t moved into the point of care space,” Perettie told reporters at the roundtable.

Gilead is giving up its rights to the cell therapy programs but still has a stake in those efforts with its 25% ownership, Dickinson clarified.

The Unknowns of the Split

Presenting at the J.P. Morgan conference, Galapagos’ management team described the complex transaction as a way to allow the original company to focus on its manufacturing platform and next-generation cell therapies. Galapagos will come away with enough cash runway to last into 2028, while SpinCo, expected to formally launch in mid-2025, will have enough capital to invest in one or more assets, CEO Stoffels said in his remarks, according to a transcript of the speech.

“Over the last few years, there have been significant advances in science, technology, clinical development of new medicines. But unfortunately, the capital markets have been very tight over this time period, leaving many companies struggling for financing,” said Galapagos CFO Thad Huston. “This has led some companies to have to sell off promising assets or search for strategic alternatives to further the development of their clinical programs.”

SpinCo emerges as a company with the funds to pick up those orphaned assets, Huston explained. “SpinCo, together with Gilead as our collaboration partner, will have significant cash to support the development of new biotech companies to help bring innovative therapies to patients all over the world facing high unmet medical needs.”

There’s a lot that is yet to be revealed about SpinCo—beyond its name—such as the management team and board that will lead it. Gilead will offer two representatives to the board, which is expected to have nine seats total with five independent members. Huston promised that the team in charge of the new company will be “very, very experienced in business development, obviously, drug development, and they’ll look for acquiring assets.”

Huston did suggest that “oncology, immunology and virology in other areas of high unmet need” will be the focus of the asset hunt, perhaps even “Phase II and beyond.” Pressed for more detail on what kind of transactions SpinCo could execute, Huston said gaining ownership of the assets through royalties or other means would be the goal.

“The team, I think, has with this capital, in this market condition, a tremendous opportunity to find more late-stage opportunities in the clinic,” Huston said.

Flashing back to 2019, O’Day had been CEO for just four months when the Galapagos partnership was announced. He professed confidence at the time that the partners would create value, describing this as a “one plus one equals three” kind of transaction. When asked why Gilead didn’t just buy Galapagos outright, O’Day explained that the goal was to keep Galapagos and its scientists independent but also, “We want to make sure that Gilead shareholders are protected with our investment.”

Executing on that protection in 2025 by helping to revamp the biotech it partnered with but did not acquire—along with its financial relationship with the resulting pair of companies—Gilead’s hunt for value goes on.