In the battle over drug prices, one sector of the healthcare industry has risen above all the players as the boogeyman: pharmacy benefit managers. In this special edition of BioPharm Executive, BioSpace takes a deep dive into the lens now focused on PBMs’ business practices.

What Are PBMs and Why Are They So Controversial?

PBMs negotiate prices with drug manufacturers and pharmacies through formularies and pharmacy networks. They also administer prescription drug insurance benefits and process drug claims. Essentially, PBMs are responsible for creating a list of the medicines that payers will cover and how much each party will pay.

The Federal Trade Commission began investigating PBMs in 2022, pledging to “shine a light on these companies’ practices.” This summer, the agency issued an interim report that slammed these “middlemen” for “profiting by inflating drug costs and squeezing Main Street pharmacies.”

The report could support several bills currently before Congress that would require more transparency around PBMs’ revenues, but on September 17 Express Scripts sued the FTC and demanded its withdrawal.

By the Numbers: The Big Three PBMs

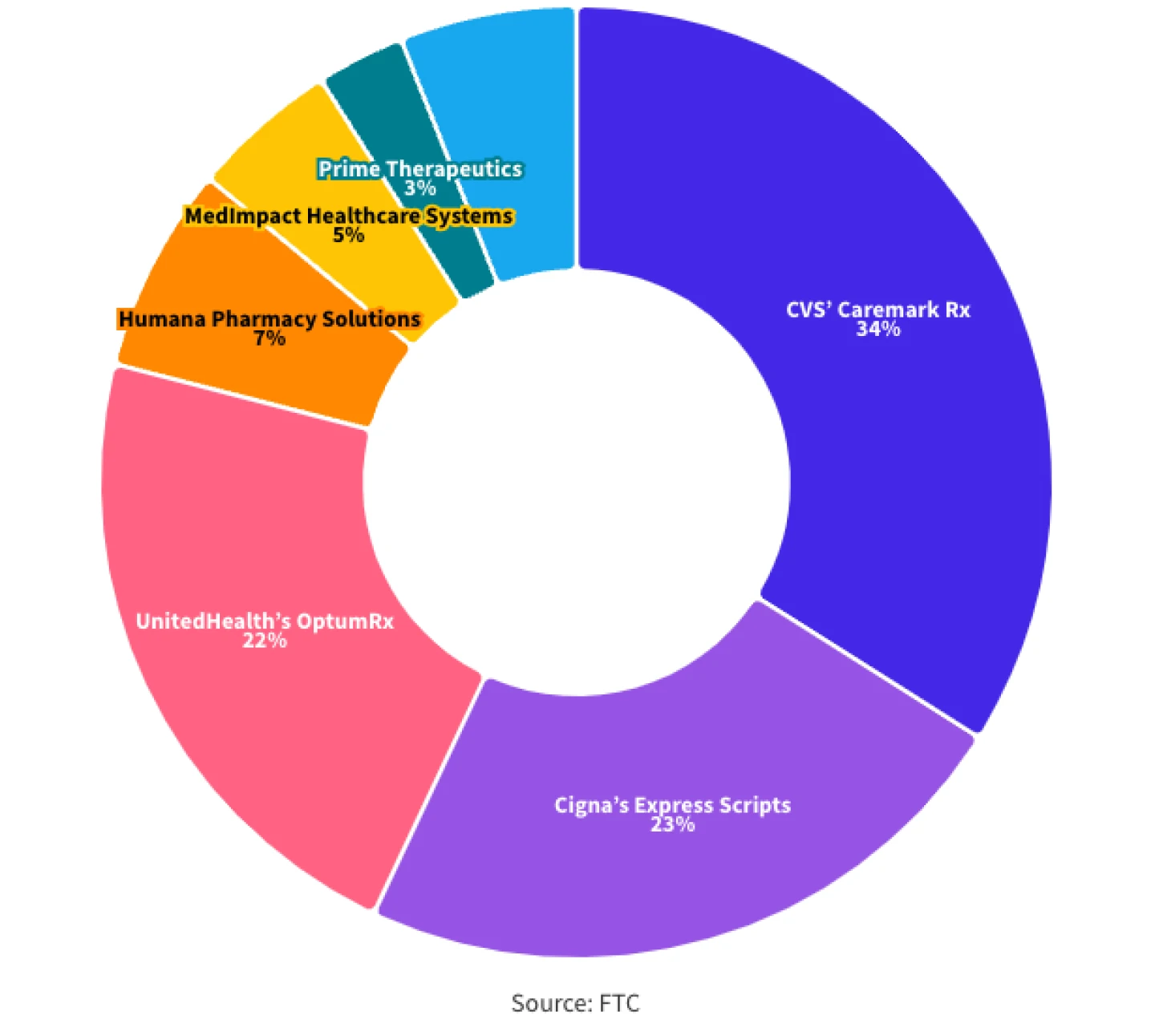

The three largest companies in the business are CVS Caremark Rx, Cigna’s Express Scripts and UnitedHealth’s OptumRx. These three PBMs combined collected $456.3 billion in revenue in 2023, collectively holding 79% of the market share. In total, these three made up 20% of the national healthcare expenditure in 2023, managing 80% of all prescriptions filled in the U.S.

$456.3 billion

Total 2023 revenue for the Big Three PBMs

Express Scripts was acquired by The Cigna Group in 2018 for $67 billion. Through 2023, the parent company grew the PBM’s revenue by $50 billion, returning $27 billion to shareholders. Those numbers are expected to grow exponentially this year, as Express Scripts snagged a massive new contract from Centene to bring the managed care provider’s 20 million customers over from CVS Caremark as of 2024. The contract is worth $35 billion and has 400 million annual prescriptions.

Market Share of PBMs

The FTC Report and the Never-Ending Blame Game

Congress has targeted the pharma companies as well, leaving no stone unturned in the effort to lower drug prices. As such, it’s no surprise that the pharma industry was quick to hail the interim FTC report released in July as validating of their finger pointing on the issue. When the CEOs of Bristol Myers Squibb, Johnson & Johnson and Merck appeared before Congress earlier this year, they argued that simply dropping the list price of a medicine doesn’t help because it will be dropped from PBM and formulary lists.

CVS Caremark President David Joyner defended the role of PBMs in testimony before Congress in July, explaining that the companies do not have any control over pharma list prices, throwing the blame right back at Big Pharma. And with its new lawsuit against the FTC, Express Scripts argued that the interim report could challenge the effort to lower drug prices.

“The FTC has taken unconstitutional actions in publishing a report that ignores the evidence provided by our company and other PBMs, demonstrates clear ideological bias and advances a false and damaging narrative,” Andrea Nelson, chief legal officer for The Cigna Group, said in a statement—“a narrative that could harm the health care system by removing essential checks and balances which would result in higher drug prices for American consumers.”

Editor‘s note: This article was originally published as a Special Edition of Biopharm Executive, BioSpace‘s weekly newsletter covering business and financial news. You can subscribe here.