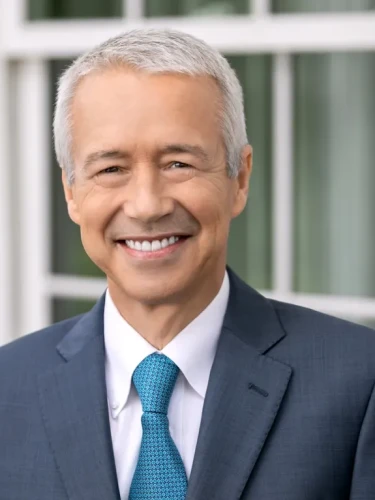

In the company’s first-quarter earnings call Tuesday, J&J CEO Joaquin Duato said there’s a better way to encourage drug manufacturing in the U.S. than President Donald Trump’s threatened pharma tariffs.

Johnson & Johnson CEO Joaquin Duato urged President Donald Trump to consider tax policy changes to encourage more U.S. manufacturing of pharmaceuticals—rather than enacting tariffs that could greatly cut into the company’s profits.

“If what you want is to build manufacturing capacity in the U.S., both in medtech and in pharmaceuticals, the most effective answer is not tariffs, but tax policy,” Duato told investors on J&J’s first-quarter earnings call Tuesday morning. “As a matter of fact, since President Trump’s 2017 tax reform, the investment in manufacturing, both in medtech and in pharmaceuticals, has significantly increased.”

Duato highlighted the company’s four-year $55 billion investment into U.S. manufacturing that was announced in March. J&J followed peer Eli Lilly, which announced a similar $27 billion investment into onshoring manufacturing.

“At the completion of this investment plan, essentially all our advanced medicines that are used in the U.S. will be manufactured in the U.S.,” the CEO said.

CFO Joe Wolk said the company expects about $400 million in tariff impacts, particularly to J&J’s medtech business, based on what is known today, but it’s unclear over what time period that impact might be felt. Wolk declined to provide a full-year estimate.

“It would be way too speculative at this point, as we know, these tariffs are very fluid,” Wolk said.

The $400 million includes any tariffs on Canadian and Mexican imports, including steel and aluminum that is used in some of the medtech products, plus tariffs on China and that country’s retaliatory charges. Wolk said the impact will be the greatest from China.

“That $400 million, I don’t want to be cavalier about that,” Wolk said. J&J cannot simply pass that cost onto consumers on the medtech side, as those products are subject to long-term contracts.

Beyond the financial burden, Duato explained that tariffs can exacerbate drug shortages. “There’s a reason . . . why pharmaceutical tariffs are zero,” he said.

On Monday, news broke that the U.S. Department of Commerce has formally launched an investigation into the importation of pharmaceutical products as a matter of national security. This could support Trump’s plan to levy tariffs on the industry. While Trump himself and other officials from the administration have dropped various numbers and timelines, the full breadth and timing of the tariffs remains unknown.

Duato agreed that there is room to bolster U.S. manufacturing to address vulnerabilities in the healthcare supply. Duato promised to work with the administration to determine whether there is adequate manufacturing capacity to address several scenarios.

“To be clear, we want to be deferential to the administration and their process,” Wolk said.

J&J’s executives were asked for their thoughts on the company’s ability to weather a recession. Wolk said the company looks to U.S. job reports for an idea of the health of the economy.

“The reason we look at that is because it’s a precursor as to who may have benefits and coverage for prescription medications, as well as procedures,” Wolk said. “We have seen in times past, when there’s been a little bit of recession, that some of those elective procedures get delayed.”

Healthcare is not recession-proof, but it is resistant, Wolk noted, echoing analysts.

“But right now, we feel good about the standards of care that we’re elevating on both the innovative medicine and medtech side of the house,” Wolk said. “Healthcare demand remains solid, and we feel good about the rest of the year regarding procedures and use of pharmaceuticals.”

Duato also addressed the recent talc litigation setback. The U.S. Bankruptcy Court in Houston rejected the company’s bankruptcy efforts seeking to shift lawsuits and liability for lawsuits related to its talc products to a new subsidiary. J&J and its subsidiary, Red River Talc, had proposed a $9 billion bankruptcy package to settle cancer claims. It would have been one of the biggest mass tort settlements in history and was J&J’s third attempt to execute what’s called a “Texas Two-Step” legal bankruptcy maneuver.

The CEO said J&J will now return to the tort system to fight the “meritless claims.” For example, he said, the company will likely work to exclude certain plaintiffs and expert witness testimony.