Cannimed releases a new letter to shareholders highlighting the benefits of acquiring all of the issued and outstanding shares of Newstrike Resources Ltd. and warning of the risks posed by Aurora Cannabis Inc.’s hostile bid to acquire all of the common shares of the Company.

- CanniMed shares are already trading above Aurora's capped offer of $24.00 and would likely be even higher if Aurora's hostile bid was not weighing the share price down

- Aurora is offering inflated shares – shares that were worth only half as much just two weeks before its hostile bid was announced

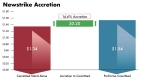

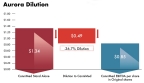

- Demonstrates Aurora is offering $0.69 or 45 per cent less than what a combined CanniMed and Newstrike offers shareholders

SASKATOON, Saskatchewan--(BUSINESS WIRE)-- Cannimed (“CanniMed” or the “Company”) (TSX:CMED) releases a new letter to shareholders highlighting the benefits of acquiring all of the issued and outstanding shares of Newstrike Resources Ltd. (“Newstrike”) and warning of the risks posed by Aurora Cannabis Inc.’s (“Aurora”) hostile bid (the “Hostile Bid”) to acquire all of the common shares of the Company.

This press release features multimedia. View the full release here: http://www.businesswire.com/news/home/20180103005664/en/

Shareholders with questions or who need help voting should contact Kingsdale Advisors at 1-888-518-1554 or by email at contactus@kingsdaleadvisors.com or visit www.NewstrikeNotAurora.com.

The full text of the letter to shareholders is below and has been filed on SEDAR and mailed to shareholders.

AURORA’S HOSTILE BID WILL LEAVE YOU WITH NOTHING.

The Aurora rip-off has already started. Question the negative impact Aurora has had on your CanniMed shares already and the currency being offered.

Aurora’s hostile bid is holding CanniMed’s share price back.

Your CanniMed shares are already trading above Aurora's capped offer of $24.00 and would likely be even higher if Aurora's hostile bid was not weighing the share price down. This is real value that you should have earned and are entitled to. Aurora’s cap means you will not benefit as the cannabis space continues to rise in value. What Aurora’s offer will do is leave you with unlimited downside risk, where you could lose the value you perceive.

Question the currency Aurora is offering.

Instead of cash, Aurora is offering you inflated shares – shares that were worth only half as much just two weeks before its hostile bid was announced. The 110% run up in Aurora’s share price is not based on anything Aurora did – just pure speculation. This run up may be good for current Aurora shareholders, but future shareholders (including CanniMed shareholders who tender into the bid) will not benefit from any part of it.

The actions of Aurora insiders demonstrate they know their share price is unsustainable.

• Four insiders, including the CEO, dumped over $17.8 million in Aurora shares just one day before the share price fell over 14%, after they made the offer to CanniMed.

• At the same time they were selling their own Aurora shares they were asking you to accept Aurora shares for your shares of CanniMed.

• Aurora’s management have sold off more than $42.9 million worth of shares in 2017.

• Locked-up shareholders have included exclusive downside protection on the share price of CanniMed shares at $16.00 and $18.00 (based on certain conditions).

There is a reason why Aurora has consistently been one of the most shorted stocks in the cannabis space.

How long until the market catches on to Aurora’s growing pattern of problems – two product recalls, signature production facility with increasing costs and behind schedule, and a reckless buying spree that has spread Aurora’s management thin?

Why would you want to be the one carrying that risk?

Aurora’s hostile bid is NOT driving CanniMed’s share price – it’s holding it back from going even higher!

AURORA KNOWS ITS OFFER IS A BAD DEAL FOR CANNIMED SHAREHOLDERS

“…it makes sense for us to grab assets in Canada [like CanniMed]… at incredibly attractive valuations and they’ll be worth two or three times those valuations in 12 months…” – Aurora’s Executive Vice President, Cam Battley

This implies a minimum value of $30 for CanniMed shares based on CanniMed’s share price at the time of the offer. Aurora is trying to grab your shares without paying you fair value for them. Don’t let them get away with it!

CANNIMED’S ACQUISITION OF NEWSTRIKE WILL MAKE YOUR SHARES MORE VALUABLE – ESPECIALLY TO AURORA.

In early 2017, CanniMed promised you we would provide an opportunity to take advantage of the soon-to-be booming $8 billion Canadian recreational market. Our acquisition of Newstrike and its Up Cannabis brand, tied to the iconic Canadian band, The Tragically Hip, will do just that.

With the advice of two independent financial advisors, external legal advisors, and the unanimous recommendation by the special committee of independent directors, your CanniMed board of directors has concluded that acquiring Newstrike presents the best opportunity for significant financial returns and recommends NOT TO TENDER TO AURORA’S HOSTILE BID THAT OFFERS PHANTOM VALUE BASED ON AN INFLATED SHARE PRICE.

The combination of CanniMed and Newstrike creates a major player across the Canadian recreational and global medical markets and will be valued as such. 2018 is the time to realize optimal value for your CanniMed shares – now is not the time to sell out! We see a clear path to $37 per CanniMed share — or more.

CanniMed is incredibly well-positioned with its industry leading oils capability which, based on current oils product pricing, will have the capacity to generate over $1 billion in annual revenue and 70+% profit margins. Based on our market experience and observation of the global medical markets and U.S. state markets, we believe oils and oil derivatives will represent 50+% of the Canadian and global markets and CanniMed’s operating results will accordingly lead the industry. The combined planned grow capacity of CanniMed and Newstrike of 45,000 kg will place it among the sector leaders. All of this points to a higher share price and real value delivered to you as a shareholder.

The Newstrike acquisition is accretive. Aurora’s offer is dilutive.

On a standalone basis CanniMed provides $1.34 EBITDA1 per share and with Newstrike you see 14.6% accretion to $1.54 EBITDA per share. Conversely, by tendering to Aurora’s hostile bid, you will see a 36.7% dilution to $0.85 EBITDA per share. This means Aurora is offering you $0.69 or 45% less than what a combined CanniMed and Newstrike offers you.

Figures 1 and 2: 2019E EBITDA per Share Accretion/Dilution

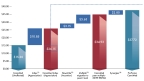

Aurora’s hostile bid is NOT driving CanniMed’s share price. It’s holding it back.

Aurora’s hostile bid is already capping your share price – without this noise CanniMed’s share price is likely to have traded well above the Aurora capped offer of $24.

Since November 14th, 2017, the last trading day before Aurora announced its intention to launch its hostile bid, the average share price in the cannabis sector has increased by 70.9%. This means that if CanniMed shares had not been constrained by the hostile actions of Aurora and the locked-up shareholders (and been allowed to trade in-line with its peers) your CanniMed shares would be worth $26.15 BEFORE accounting for the accretion from the Newstrike acquisition. This is real value that should have been earned by CanniMed shareholders that Aurora and the locked-up shareholders clearly don’t want you to have.

Furthermore, when you combine this realization with the accretion and significant strategic benefits brought by the Newstrike acquisition it becomes clear that Aurora is not offering you a premium at all. Rather, they are preventing CanniMed shareholders from realizing substantial value through a share price which has the potential to reach over $37 in the near term.

Figure 3: CanniMed’s Share Price Without Impact of Aurora’s Hostile Bid

CanniMed will be more valuable as a company that offers both medical and recreational products – expanding from patients to patients and customers.

Aurora knows this and that is why it is attempting to disrupt the Newstrike acquisition. There is significant value in CanniMed’s existing business that is not currently recognized by the market because it does not yet have access to the recreational market. The Up Cannabis brand expands CanniMed’s market from just patients to patients plus adult recreational consumers – an additional $8 billion opportunity.

Aurora’s executive vice president, Cam Battley, has tried to mislead you with his tagline “no revenue, no patients” trumpeting it everywhere he goes in relation to Newstrike. In our view this demonstrates his clear lack of understanding of the opportunity in the recreational market and is proof point number one as to why he and Aurora should not be in charge of your shares – of course there are no revenues or customers – none of the LPs have revenues or customers in the recreational market – it does not exist yet and will only be legal in Canada in July 2018.

Aurora doesn’t have any revenue or customers in the recreational space either.

The question for a recreational focused brand is not ‘who has revenue now’; the question is ‘who is best positioned to capture customers and market share when the recreational market opens’? To that the answer is clear: A combined CanniMed and Newstrike. The value in Newstrike is in its people, its strategy, and its customer focused brand, Up Cannabis.

CanniMed has an industry best 17 year track record of pharmaceutical cannabis cultivation experience with zero product recalls or product shortages. With the acquisition of Newstrike, CanniMed will increase its size and solidify its position as a global leader and position itself as a top player in Canada’s fully legalized medical and adult-use cannabis industries. LPs who are selling medical cannabis are legally obligated to provide cannabis to their patients. Conversely, 100% of Newstrike’s cannabis is dedicated for the recreational market.

In a world of similar products and new consumers, branding is critical – Up Cannabis is a premier brand

We are not surprised that Aurora does not see the value in the Up Cannabis brand. They think their big building, Aurora Sky, which has the potential for a large amount of capacity is a brand. It’s not.

Every successful consumer good in the world is based on a brand, not the factory that produces the product. Aurora is not a brand but is a mirage based on a yet-to-be completed facility. In a world where consumers have similar choices or do not know what they are looking for, brand becomes pivotal. The recreational market, like the alcohol market, will be dominated by brand leaders.

The strategic partnership that Up Cannabis has developed with iconic Canadian band The Tragically Hip means that much of the difficult and uncertain early work of building awareness in an incredibly competitive market can be deployed with relative ease, leaving Up Cannabis and The Tragically Hip to focus on the next stage efforts while most other companies are still trying to prove that they exist.

The Tragically Hip bring a highly targeted, committed market of 700,000 opt-in fan members who are open to receiving information from The Tragically Hip via Facebook, Twitter, and The Tragically Hip’s website. This represents a market opportunity that is unparalleled. Per Lighthouse Consulting, regular weekly recreational consumers spend about $100 per week on cannabis.2 Based on conservative projections and by capturing only 5% of this fan base, Newstrike estimates that the annual market opportunity of such fan base is approximately $150 million. Brand loyalty, like a combined CanniMed and Newstrike, will win the day.

The role of The Tragically Hip in this partnership is not to give “testimonials or endorsements”, as prohibited in the current draft of Bill C45. The Tragically Hip are active partners in the development of Up Cannabis’ brand and marketing plans, using their innate knowledge of Canada and Canadians to create a company and a brand with a true emotional connection with people across this country.

The Tragically Hip established their permanent place in the short list of truly iconic Canadian artists for many reasons – their love for Canada; the stories of a nation that they wove through their incredible signature sound; and a broad commitment to justice in all its forms.

Real synergies for real value.

The acquisition of Newstrike presents substantial financial, operational, and infrastructure-related synergies. With its 17 years of experience, CanniMed will be able to apply its proven sales, IT, and logistical infrastructure across both platforms. CanniMed is known for delivering a quality product. That reputation for quality will be leveraged and strengthened by joining with Up Cannabis and The Tragically Hip brand affiliation. Combining CanniMed’s national presence with a recreational producer based in Canada’s largest market, Ontario, provides an advantage as provincial regulators are likely to favour domestic products and brands.

Shareholders should take particular note of the enormous opportunity presented by CanniMed’s oil production capabilities and expertise. CanniMed is currently expanding its cannabis oil production capabilities far ahead of its competitors and is positioned to produce oils to be used in, as the law allows, vape cartridges, tinctures, edibles, capsules, infusions and all forms of concentrates. Based on our Canadian market experience, data from Colorado and California and feedback from the global medical market, we estimate that over half the recreational and medical markets will be oils and oil derivative products. Vape cartridge sales are increasing rapidly in U.S. adult use markets and CanniMed’s oil production facility will be able to supply the Canadian recreational market through Up Cannabis, expanding beyond its current medicinal offering.

By the end of 2018, CanniMed’s oil plant annual capacity will be 12 million bottles. With actual current product prices ranging from $80 to $150 per bottle, there exists a $1+ billion revenue opportunity. These are synergies that are only available through the acquisition of Newstrike, not through Aurora’s hostile bid.

Newstrike is positioned to grow its production 10-fold by 2019.

Newstrike has been producing for almost a year and already has over 970 kg of high quality product – or approximately $10 million worth – in inventory and its Brantford facility is running at full capacity in preparation for the launch of the recreational market in July. In addition, upgrades at its flagship 200,000 sq ft greenhouse – four times the size of Aurora’s current operations – continue on time and on budget to be in commercial production in time to satisfy the significant anticipated demand. The combination of these strategically located growing assets and CanniMed’s industry leading oils capability creates a powerful platform to meet the demands of customers for high quality products across Canada and drive significant revenue and EBITDA growth for shareholders.

DON’T BE FOOLED BY AURORA’S CLAIMS

As a growing number of CanniMed shareholders are rejecting Aurora’s hostile bid and supporting the acquisition of Newstrike, Aurora is becoming increasingly desperate and misleading. In fact, the Ontario Securities Commission and the Financial and Consumer Affairs Authority of Saskatchewan have ordered Aurora to correct and clarify some of its previous statements. Shareholders should question what Aurora is telling them and challenge Aurora’s pattern of poor performance.

Here are the facts Aurora doesn’t want you to know:

Aurora needs CanniMed. CanniMed does not need Aurora.

Any ‘strategic rationale’ Aurora points to is already available through CanniMed’s existing business, the Newstrike acquisition, and other opportunities available to us. As Aurora’s management has said, companies like CanniMed will be worth two or three times as much in the next 12 months.

Aurora has capped your upside but left you with significant downside risk.

The potential value offered has been capped at $24.00 per CanniMed share (based on a formula related to Aurora’s share price and payable in Aurora shares) offering you no exposure to market upside nor additional value which will be created by CanniMed or the industry prior to close. You have no downside protection at a time when Aurora has had increasing costs and delays at Aurora Sky, as well as numerous operational issues, including two product recalls in 2017. It is extremely telling that the shareholders who have entered into questionable off-market lock-up agreements have negotiated downside protection on the share price of CanniMed shares at $16.00 and $18.00 (based on certain conditions) while no protection is offered to other CanniMed shareholders.

You will own less of Aurora than you should be entitled to.

Aurora’s hostile bid only gives CanniMed shareholders minimal ownership of the combined company, even though CanniMed currently has greater production capacity, a similar number of patients, and an established and successful track record of quality in a strict government regulated environment.

Furthermore, if Aurora’s share price continues to trade above $5.30, the consideration available to you does not increase – but your ownership in the combined company is reduced. For example, if Aurora’s current share price of $9.60 (as of December 29, 2017) persists, you would only receive 2.5 Aurora shares for every CanniMed share, not the 4.5 Aurora shares that would imply a value for CanniMed in excess of $43.45 per CanniMed share or approximately 10.9% of the combined company.

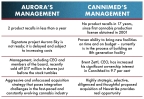

Aurora’s management can’t execute and their actions show they don’t believe they can.

You should be very wary about the risk associated with an Aurora management team who has a track record of poor execution and even more concerned that their actions demonstrate they doubt they will be able to make good on the promises they have made to the market by selling off shares.

Figure 4: Management Track Record Comparison

VOTE GREEN TO ACQUIRE NEWSTRIKE. DO NOT TENDER TO AURORA AND DO NOT VOTE BLUE.

By voting for the Newstrike acquisition you will increase the value of your CanniMed shares while preserving your ability to obtain a real premium at a later date.

CanniMed’s board and management will vote their GREEN proxies to acquire Newstrike and will not tender to Aurora’s hostile bid.

We recommend shareholders do the same, no matter how many shares are owned. Here’s how:

1. To vote FOR the Newstrike acquisition vote GREEN. Follow the instructions on the GREEN VIF or form of proxy by January 19th, 2018 at 10:00 am (EST). Shareholders with questions or who need help voting should call Kingsdale Advisors toll-free at 1.888.518.1554 or by email at contactus@kingsdaleadvisors.com.

2. Ignore and recycle any Blue proxy forms received.

3. To reject Aurora’s hostile bid, simply do nothing. Do not tender your shares. If you have tendered your shares in error or now wish to withdraw, simply ask your broker or Kingsdale Advisors at 1.888.518.1554 or contactus@kingsdaleadvisors.com to assist with this process.

Advisors

Kingsdale Advisors is acting as strategic shareholder and communications advisor. AltaCorp Capital Inc. is acting as financial advisor to the Board and Borden Ladner Gervais LLP is acting as legal advisor to the Board. Cormark Securities Inc. is acting as financial advisor to the Special Committee and Stikeman Elliott LLP is acting as legal advisor to the Special Committee.

About CanniMed Therapeutics Inc.

CanniMed is a Canadian-based, international plant biopharmaceutical company and a leader in the Canadian medical cannabis industry, with 17 years of pharmaceutical cannabis cultivation experience, state-of-the-art, GMP-compliant production process and world class research and development platforms with a wide range of pharmaceutical-grade cannabis products. In addition, the Company has an active plant biotechnology research and product development program focused on the production of plant-based materials for pharmaceutical, agricultural and environmental applications.

The Company, through its subsidiaries, was the first producer to be licensed under the Marihuana for Medical Purposes Regulations, the predecessor to the current Access to Cannabis for Medical Purposes Regulations. It was the sole supplier to Health Canada under the former medical marijuana system for 13 years, and has been producing safe and consistent medical marijuana for thousands of Canadian patients, with no incident of product diversion or recalls.

For more information, please visit our websites: www.cannimed.ca (patients) and www.cannimedtherapeutics.com (investors).

Non-IFRS Measure: Earnings before Interest, Taxes, Depreciation and Amortization (“EBITDA”)

CanniMed uses EBITDA as a supplemental financial measure of its operational performance. In addition, analysts use 2019 estimated EBITDA in their published reports. CanniMed believes EBITDA to be an important measure of its and other companies’ capacity to generate cash flow from operations as it excludes the effects of items which primarily reflect the impact of long-term investment and decisions and finance strategies, rather than the performance of CanniMed’s and other companies’ day-to-day operations. CanniMed measures EBITDA as net earnings (loss) from continuing operations plus income taxes expense (recovery), interest expense and depreciation and amortization. CanniMed believes the references to EBITDA in analysts’ reports are calculated similarly.

EBITDA is a non-IFRS financial measure which does not have a standardized meaning. Accordingly, such information should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Notice Regarding Forward Looking Statements

This document contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of CanniMed and Newstrike to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

These forward-looking statements include, but are not limited to, statements relating to our expectations with respect to: estimated earnings before interest, taxes, depreciation and amortization (EBITDA) for 2019, estimated accretion per CanniMed share of the acquisition of Newstrike; the revenue opportunity for CanniMed; projected profit margins; the market for cannabis products, including oils; fan base market opportunity; the timing and outcome of the proposed acquisition of all the issued and outstanding common shares of Newstrike; projected 2019 combined production capacity of 45,000kg of CanniMed and Newstrike; and the projected value of licensed producers. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. In respect of the forward-looking statements and information concerning the anticipated benefits and completion of CanniMed’s acquisition of Newstrike, CanniMed has provided such statements and information in reliance on certain assumptions that it believes are reasonable at this time, including assumptions as to projected 2019 results of operations for CanniMed, Newstrike and Aurora; projected profit margins on oil sales and other cannabis products; that the market price for the shares of CanniMed will be based on industry average multiple of 2019 estimated EBITDA; benefits and synergies realized from the acquisition of Newstrike by CanniMed; the legalization of the Canadian adult recreational cannabis market; the receipt of all shareholder, regulatory and court approvals for CanniMed’s acquisition of Newstrike. The combined results of CanniMed and Newstike assumes the completion of CanniMed’s acquisition of Newstrike and there is no certainty that the acquisition of Newstrike will receive all required approvals or will be completed. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this document.

Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks, including the risk that the market for cannabis products will be less than expected; the risk that 2019 operating results of CanniMed and Newstrike will be less than expected; the risks associated with the integration of the acquisition of Newstrike, including that synergies will not be as significant as anticipated; the risks associated with a delay in the legalization of the Canadian adult recreational market; and the risk that the market price of CanniMed will not be based on industry average multiple of 2019 estimated EBITDA. Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on other factors that could affect the operations or financial results of CanniMed and the completion of its acquisition of Newstrike are included in documents on file with applicable securities regulatory authorities, including the management information circular of CanniMed dated December 8, 2017, available on sedar.com.

The forward-looking statements contained in this document are made as of the date of this document and, accordingly, are subject to change after such date. CanniMed does not assume any obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time by CanniMed, except as required by applicable law.

None of the Toronto Stock Exchange, TSX Venture Exchange and their Regulation Services Providers accept responsibility for the adequacy or accuracy of this document.

1 Non-IFRS Measure: Earnings before Interest, Taxes, Depreciation and Amortization. Estimated 2019 EBITDA based on analyst consensus estimates from Capital IQ (excluding outliers where applicable)

2 http://business.financialpost.com/commodities/agriculture/half-of-canadian-pot-smokers-surveyed-spend-100-on-weekly-buzz-

View source version on businesswire.com: http://www.businesswire.com/news/home/20180103005664/en/

Contacts

Media:

Kingsdale Advisors

Ian Robertson, 416-867-2333

Executive Vice President, Communication Strategy

irobertson@kingsdaleadvisors.com

Cell: 647-621-2646

or

Shareholders:

Kingsdale Advisors

Toll free: 1-888-518-1554

contactus@kingsdaleadvisors.com

Source: CanniMed Therapeutics Inc.

Smart Multimedia Gallery

Figure 1: Aurora is offering $0.69 or 45% less than what a combined CanniMed and Newstrike offers. (Graphic: CanniMed Therapeutics Inc.)

Figure 2: Aurora is offering $0.69 or 45% less than what a combined CanniMed and Newstrike offers. (Graphic: CanniMed Therapeutics Inc.)

Figure 3: Aurora is preventing CanniMed shareholders from realizing substantial value through a share price which has the potential to reach over $37 in the near term. (Graphic: CanniMed Therapeutics Inc.)

Figure 4: Aurora's management can't execute and their actions show they don't believe they can. (Graphic: CanniMed Therapeutics Inc.)