While achieving FDA approvals in rare cancers such as multiple myeloma and diffuse large B-cell lymphoma, Karyopharm’s cancer drug has a variety of scientific and market hurdles to clear.

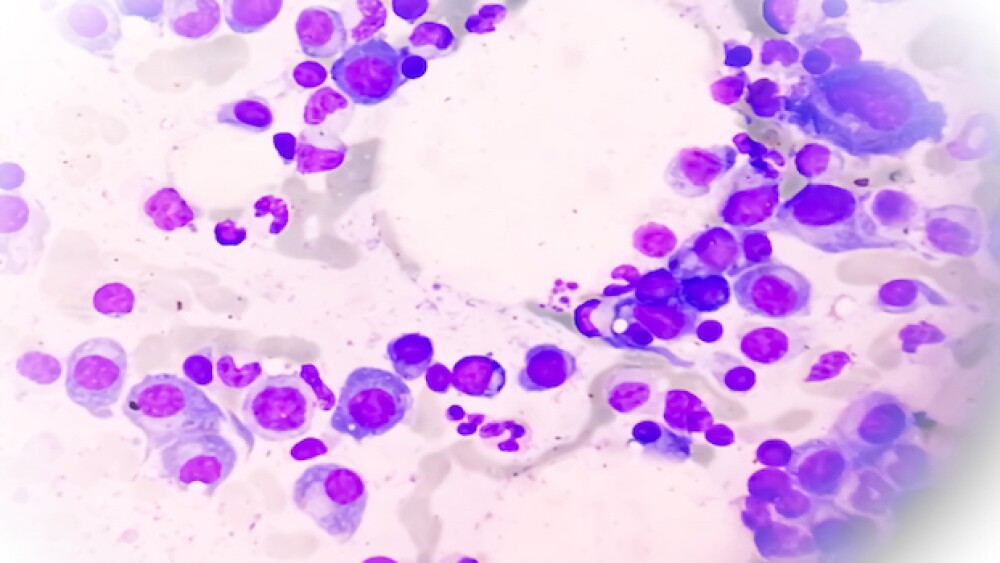

Pictured: a bone marrow slide showing multiple myeloma/iStock, Md Saiful Islam Khan

Ever since Karyopharm Therapeutics gained accelerated FDA approval for selinexor combined with dexamethasone in relapsed or refractory multiple myeloma, the Massachusetts–based company has been conducting clinical trials with an eye toward increasing its market share, primarily in the oncology space. But multiple hurdles are hindering its chances of success.

When selinexor was first approved in July 2019 for relapsed or refractory multiple myeloma (RRMM), several clinical trial obstacles limited its use even within the multiple myeloma space. While the 8.6-month median overall survival (OS) rate for those treated with the selinexor regimen in the Phase IIb STORM trial was enough to secure FDA approval, when compared to the approximately 9-month median overall survival rates for RRMM with existing treatments, this efficacy may not be enough for uninterrupted success in the market.

Selinexor’s original approval was for adults with RRMM who have unsuccessfully tried at least four prior therapies and have disease that is refractory to at least two proteasome inhibitors, at least two immunomodulatory agents and an anti-CD38 monoclonal antibody. This leaves Karyopharm with a smaller patient pool than treatments approved in the first-line multiple myeloma setting.

As of 2019, there were nine drugs approved for RRMM in the United States. In a 2018 meta-analysis on RRMM treatment, some of these regimens showed more efficacy than selinexor in terms of median OS. For instance, in the POLLUX trial, Janssen and Genmab’s daratumumab and Bristol Myers Squibb’s lenalidomide combined with dexamethasone led to a median OS rate of 67.6 months, compared to lenalidomide and dexamethasone alone, which led to a median OS of 51.8 months in patients treated with one or more previous lines of therapy.

In 2020, Karyopharm received further approvals for selinexor in multiple myeloma—with bortezomib and dexamethasone—after at least one prior therapy, and relapsed or refractory diffuse large B-cell lymphoma (DLBCL). The company is also looking for alternative selinexor regimens to treat these indications and is investigating the drug in other disease states including endometrial cancer and myelofibrosis.

When looking at the rate of new cases for these four cancers, endometrial cancer has the most promising patient pool based on incidence alone. At 35.7 cases per 100,000 people, the incidence rate would far eclipse the other three indications, with relapsed or refractory multiple myeloma affecting 4.4 per 100,000 people in 2016; diffuse large B-cell lymphoma 4.68 people per 100,000 in 2021; and myelofibrosis 0.47 per 100,000 in 2014. But endometrial cancer is considered a solid tumor and this is still unprecedented territory for selinexor, which has primarily demonstrated proof of efficacy in hematologic malignancies. Most of Karyopharm’s trials have been conducted in hematologic cancers.

Though Karyopharm’s pivotal SIENDO trial for endometrial cancer failed to yield clinically meaningful results, the company stated in its Q2, 2023 financial report that a subgroup of patients with TP53 wild-type cancer could potentially see more significant results. Still, this trial update could limit selinexor’s patient population reach and market share even more.

While Karyopharm’s successes with selinexor have proven to be newsworthy, there is still much to consider when analyzing the company’s future trajectory. Therefore, the final endometrial cancer trial results will be pivotal in determining Karyopharm’s direction over the next two to three years.

Jia Jie Chen writes analyses focusing on drug development in the biotech and pharma industries for BioSpace. He has a doctorate degree in pharmacy and experiences ranging from biotech equity research to business intelligence analysis. Follow him on LinkedIn.