In this deep dive, BioSpace explores the diverse therapeutic modalities now in development, as well as the opportunities and battles for market dominance in this emerging space.

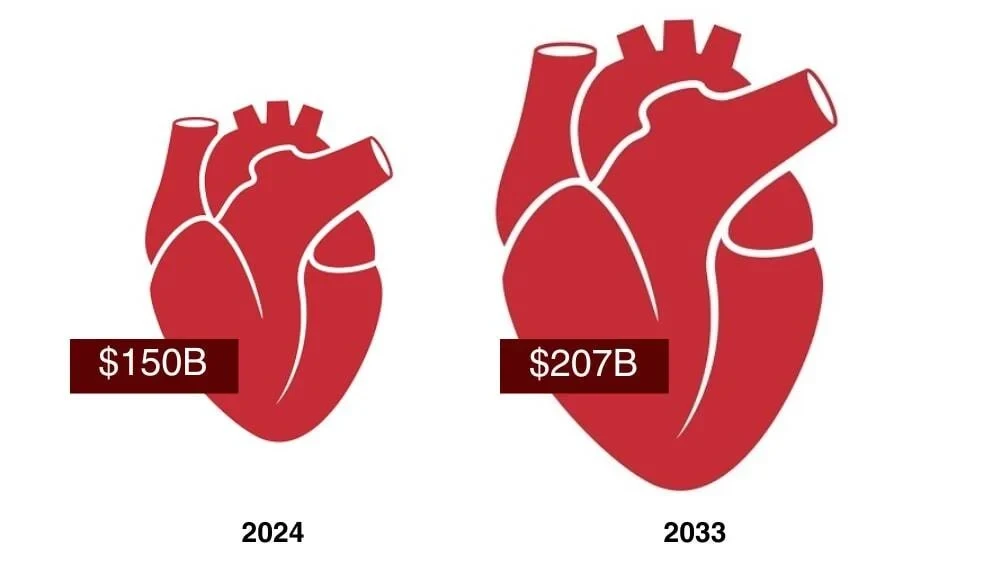

The cardiovascular drug development space is experiencing a renaissance. With the recent approval of BridgeBio’s Attruby in transthyretin amyloid cardiomyopathy (ATTR-CM), the $300 million January launch of heart disease–focused Kardigan and numerous novel gene therapies in development, a new era is dawning in the battle against the world’s leading cause of death. Countless companies, from big pharmas like Pfizer and Novartis to smaller biotechs including BridgeBio and Regenxbio, are looking for a piece of the pie, and the market for cardiovascular drugs is projected to grow from around $150 billion in 2024 to $207 billion by 2033.

Projected Cardiovascular Market Growth

DATA SOURCE: PRECEDENCE RESEARCH

ATTR-CM: Alnylam Eyes Approval

A decade ago, ATTR-CM, a disease of the heart muscle, was “basically . . . a death sentence,” BridgeBio CEO Neil Kumar told BioSpace in November. Since then, two novel treatments have been approved—Pfizer’s tafamidis, marketed as Vyndaqel and Vyndamax, in 2019, and BridgeBio’s Attruby in November 2024. These transthyretin stabilizers could be joined this year by Alnylam’s Amvuttra (vutrisiran), which the FDA has accepted for review in ATTR-CM with a target action date of March 23. An RNAi therapy, Amvuttra is already approved to treat polyneuropathy of hereditary transthyretin-mediated (hATTR) amyloidosis and would add a differentiated mechanism to the ATTR-CM treatment toolbox.

Also contending in the ATTR-CM space are AstraZeneca and Ionis Pharmaceuticals, who are working together on Wainua (eplontersen), an antisense RNA silencing therapy. Like Amvuttra, Wainua is approved for hATTR amyloidosis. The candidate is currently being studied in the Phase III CARDIO-TTRansform study, which is expected to read out in 2026. The companies are competing for a share of the global transthyretin amyloidosis treatment market, which is projected to hit $9.35 billion by 2030.

GLP-1s’ Next Gambit?

GLP-1 agonists—biopharma’s hottest commodity—are making headway in cardiovascular disease, in addition to obesity, diabetes and other indications. In March 2024, the FDA approved a label expansion for Novo Nordisk’s Wegovy (semaglutide) to reduce the risk of cardiovascular death, heart attack and stroke in adults with cardiovascular disease and obesity or overweight. Not to be outdone, Eli Lilly’s tirzepatide, marketed as Mounjaro and Zepbound, in August showed significant therapeutic benefit in patients with heart failure with preserved ejection fraction. Several other companies including Amgen and Structure Therapeutics are also conducting trials studying the cardiovascular benefits of GLP-1s.

Cardio Gene Therapies

Cardiovascular disease is also a target of precision therapeutics, with companies including Renova Therapeutics, XyloCor and Tenaya Therapeutics developing gene therapies for congestive heart failure, chronic refractory angina and hypertrophic cardiomyopathy, respectively. This space has been buoyed by early clinical successes, including Rocket Pharmaceuticals reporting clinical benefit in a Phase I trial and Lexeo Therapeutics making progress in Friedreich’s ataxia cardiomyopathy.

Editor’s note: This article was originally published as a special edition of ClinicaSpace, BioSpace’s weekly newsletter covering clinical trial results and research news on Feb. 10. You can subscribe here.