In this deep dive BioSpace explores the opportunities and challenges presented by the FDA’s accelerated approval program.

Since being enacted in 1992 in response to the HIV/AIDS epidemic, the FDA’s accelerated approval pathway has helped bring more than 200 new drugs to the market based on a surrogate endpoint that is reasonably likely to predict clinical benefit. While many of these products have gone on to win traditional FDA approval, others—such as Pfizer’s sickle cell disease therapy Oxbryta and Takeda’s lung cancer drug Exkivity—have recently been withdrawn from the market, prompting questions about the overall benefit of and risks inherent in this regulatory pathway.

In this deep dive, BioSpace explores the opportunities and challenges presented by the FDA’s accelerated approval program.

The Track Record

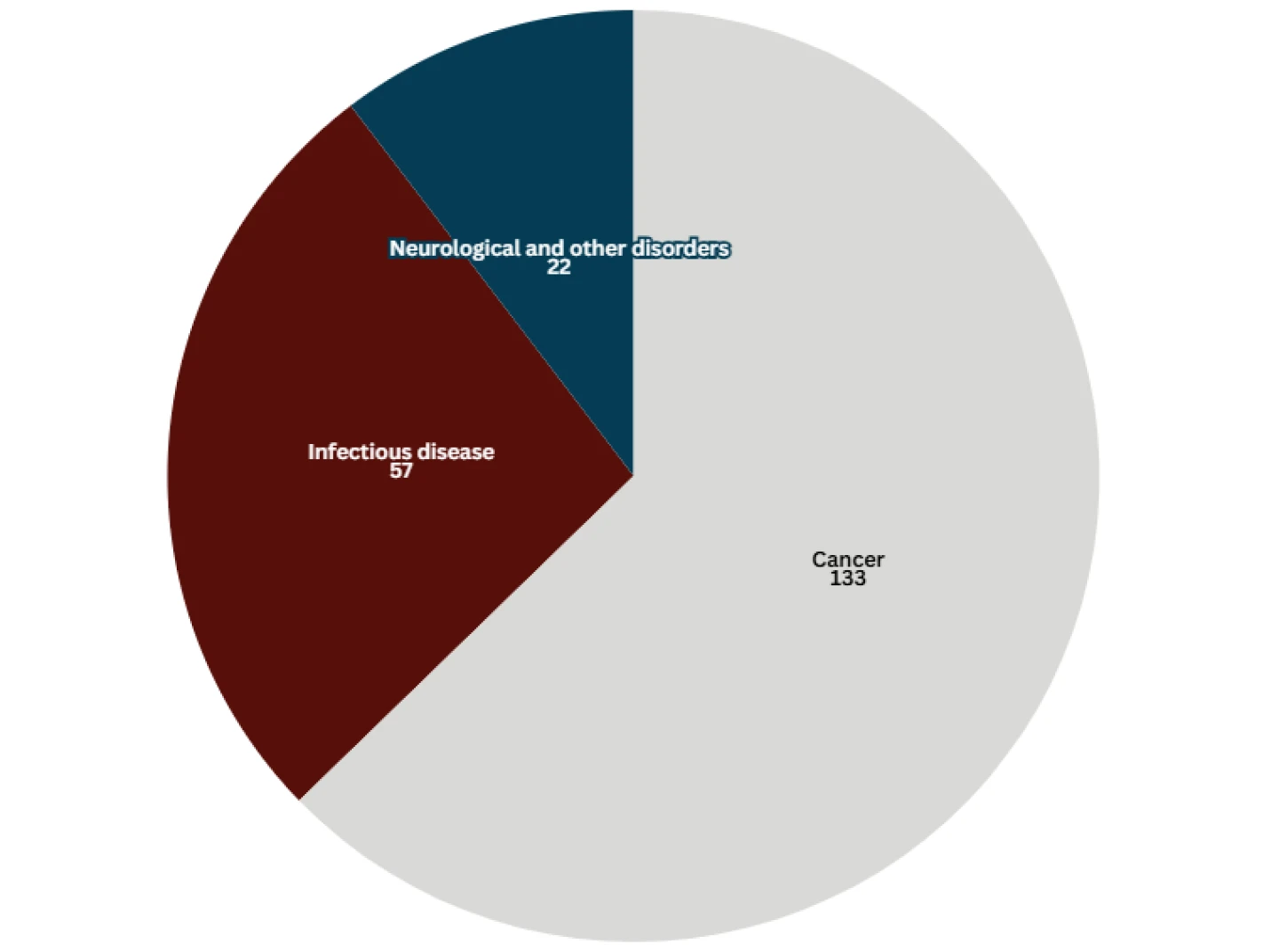

Despite recent high-profile market withdrawals, the track record of the accelerated approval program is relatively strong. Nearly 300 accelerated approvals have been granted for 210 novel drug formulations, the majority in cancer.

Number of Formulations to Receive Accelerated Approval

Data taken from the FDA on 11.12.24. “Other” cancer accelerated approvals excluded.

More than half of all accelerated approvals ultimately convert to full FDA approval.

- 121 formulations with verified clinical benefit

- 28 formulations withdrawn

History and Key Approvals

First utilized largely for infectious diseases and then for cancer therapeutics in the 2010s, accelerated approval is expanding as a regulatory pathway for neurological, rare and genetic diseases. Here, we take a look back at seminal accelerated approvals in each of these spaces.

Accelerated Approvals Under the Microscope

The accelerated approval program has come under scrutiny recently, with notable market withdrawals and failed confirmatory trials raising questions regarding the risk-benefit proposition.

Most recently, Pfizer withdrew sickle cell disease therapy Oxbryta from worldwide markets five years after its accelerated approval, after new data showed a higher risk of deaths and complications in treated patients. And earlier this year, Biogen pulled Aduhelm from the shelves after the Alzheimer’s drug failed to gain traction. Aduhelm’s accelerated approval, based on its ability to reduce amyloid in the brains of Alzheimer’s patients, was among the most controversial in recent history.

Meanwhile, Sarepta’s Elevidys, which won accelerated approval in June 2023 as the first gene therapy for Duchenne muscular dystrophy, failed its confirmatory trial four months later, adding fuel to already simmering questions over the treatment’s efficacy. Despite this setback, Elevidys won full FDA approval in June 2024.

In order to improve the program, experts recently told BioSpace that tighter completion timelines for confirmatory trials and a better understanding of which biomarkers should be used as surrogate endpoints are key.

How often should the accelerated approval pathway be used?

This deep dive was originally published as a special edition of ClinicaSpace. Subscribe here.