Hemophilia A Market Overview 2024-2034:

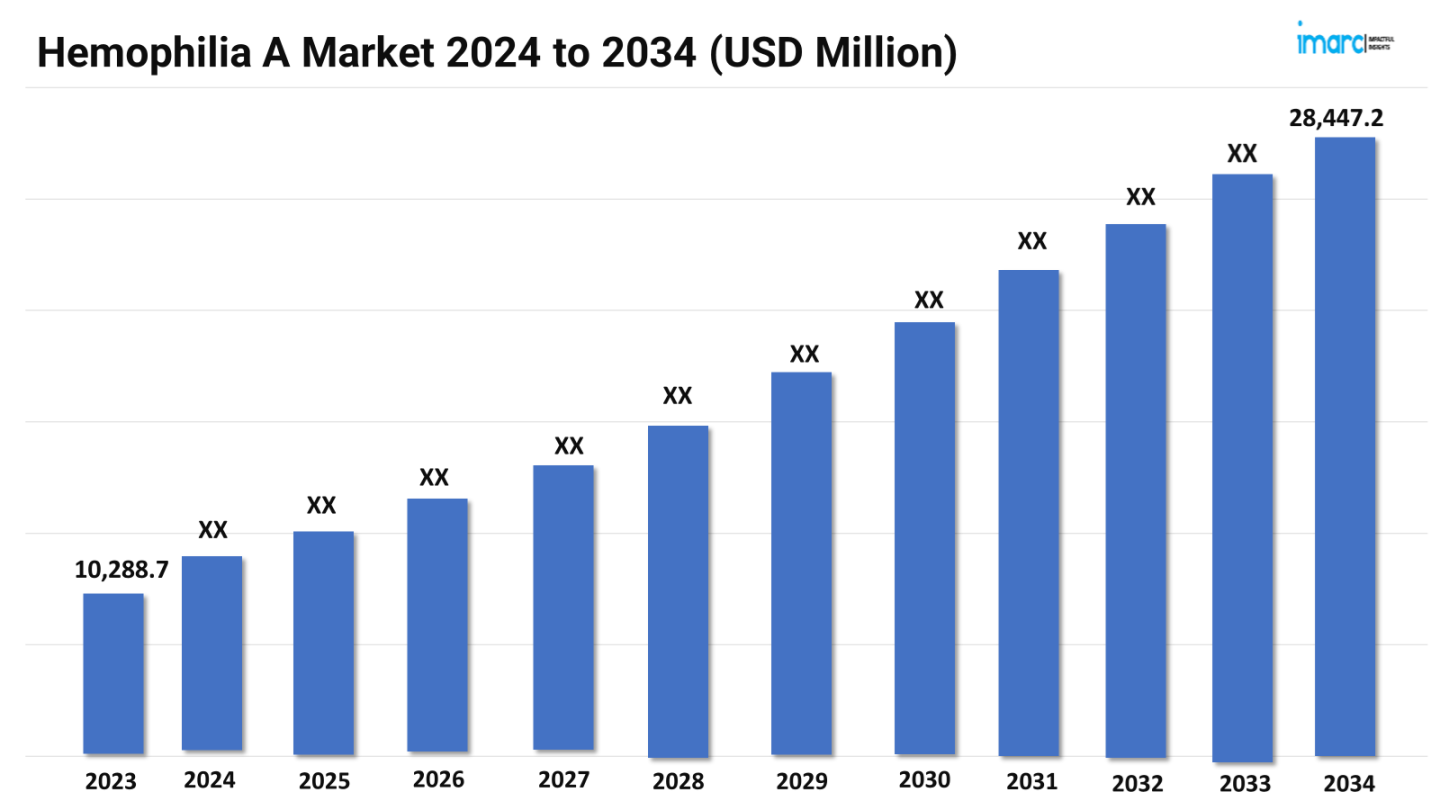

The hemophilia A market size reached a value of US$ 10,288.7 Million in 2023. Looking forward, the market is expected to reach US$ 28,447.2 Million by 2034, exhibiting a growth rate (CAGR) of 9.69% during 2024-2034. The market is driven by the development of novel therapies and gene editing technologies. Additionally, increased awareness and early diagnosis, coupled with advancements in personalized medicine, are driving the market toward more effective and tailored treatment options for Hemophilia A patients.

Advancements in Gene Therapy: Driving the Hemophilia A Market

Advancements in gene therapy are revolutionizing the Hemophilia A market, offering promising solutions that could transform patient care. Gene therapy aims to address the root cause of Hemophilia A by correcting the genetic defect responsible for the lack of factor VIII, a crucial blood-clotting protein. One of the most notable advancements is the development of adeno-associated virus (AAV) vector-based therapies. These therapies deliver a functional copy of the factor VIII gene directly to the liver cells, enabling the body to produce the missing protein. Clinical trials, such as those conducted by BioMarin with their investigational therapy valoctocogene roxaparvovec (Roctavian), have shown encouraging results. Patients treated with this therapy have demonstrated sustained production of factor VIII, leading to a significant reduction in bleeding episodes and decreased reliance on regular factor VIII infusions.

Request a PDF Sample Report: https://www.imarcgroup.com/hemophilia-a-market/requestsample

Another significant instance is the work by Spark Therapeutics with their gene therapy SPK-8011. Early phase trials have indicated that SPK-8011 can achieve stable factor VIII expression in patients, thereby reducing the annualized bleeding rates. Similarly, Sangamo Therapeutics, in collaboration with Pfizer, is developing SB-525 (giroctocogene fitelparvovec), which has shown promising preliminary results in clinical trials, with patients achieving therapeutic levels of factor VIII and experiencing fewer bleeding events. Moreover, ongoing research and collaborations are continuously enhancing the efficacy and safety profiles of gene therapies. Innovations in vector design, delivery methods, and patient selection criteria are critical areas of focus. The goal is to maximize therapeutic benefits while minimizing risks and adverse effects. As these therapies advance through clinical trials and regulatory approvals, they hold the potential to dramatically improve the quality of life for individuals with Hemophilia A, offering hope for a future where regular factor replacement therapy becomes obsolete. The success of these gene therapies could also pave the way for similar advancements in treating other genetic disorders, marking a significant milestone in medical science.

Extended Half-Life Products: Contributing to Market Expansion

Extended half-life (EHL) products are significantly advancing the Hemophilia A market by offering improved efficacy and convenience in treatment regimens. Traditional factor VIII replacement therapies require frequent infusions to maintain adequate levels of the clotting protein, often leading to patient burden and adherence challenges. EHL products, through modifications such as PEGylation, fusion with the Fc portion of immunoglobulin, or albumin fusion, extend the duration of factor VIII in the bloodstream. This reduces the frequency of infusions, allowing patients to maintain better control over their condition with fewer disruptions to their daily lives. A prime example of an EHL product is Bioverativ’s Eloctate (efmoroctocog alfa), now part of Sanofi. Eloctate is a recombinant factor VIII fused to the Fc region of immunoglobulin G (IgG1), which extends its half-life by recycling through the Fc receptor pathway. Clinical studies have demonstrated that Eloctate significantly decreases the frequency of bleeding episodes and supports extended dosing intervals, enabling patients to require less frequent injections compared to standard factor VIII therapies. This advancement has notably improved the quality of life for Hemophilia A patients by reducing the treatment burden.

Another prominent EHL product is Adynovate (rurioctocog alfa pegol), developed by Takeda. Adynovate uses PEGylation technology to increase the half-life of factor VIII. Clinical trials have shown that Adynovate provides prolonged protection from bleeding with fewer infusions needed, making it suitable for both prophylactic and on-demand treatment regimens. Its efficacy in reducing annual bleeding rates has been well-documented, offering patients more stable and sustained factor VIII levels. This product exemplifies how EHL technologies can transform hemophilia care, providing a more manageable and effective treatment option. The introduction of these EHL products marks a significant advancement in the management of Hemophilia A, offering more stable and sustained clotting factor levels. As more EHL products gain approval and become available, they are expected to set new standards in hemophilia care, providing patients with effective and convenient treatment options that enhance their overall quality of life.

Non-Factor Replacement Therapies:

Non-factor replacement therapies are a groundbreaking development in the Hemophilia A market, offering new approaches to managing the condition without relying on traditional factor VIII infusions. One of the most significant advancements in this area is Emicizumab (Hemlibra), developed by Roche. Emicizumab is a bispecific monoclonal antibody that bridges factors IXa and X, mimicking the function of factor VIII and facilitating clot formation. This innovative approach allows for subcutaneous administration, providing patients with a more convenient and less invasive treatment option compared to intravenous factor VIII infusions. Emicizumab has demonstrated remarkable efficacy in clinical trials, significantly reducing bleeding rates in both prophylactic and on-demand treatment settings. Its approval by the FDA for patients with Hemophilia A with and without factor VIII inhibitors marks a major milestone in hemophilia care. The HAVEN clinical trials showed that Emicizumab could reduce the annualized bleeding rate by up to 87% compared to previous treatments, highlighting its potential to transform patient management. Moreover, the convenience of weekly, bi-weekly, or even monthly dosing schedules makes it a highly attractive option for patients, improving adherence and overall quality of life.

Another promising non-factor replacement therapy is Fitusiran, developed by Sanofi and Alnylam Pharmaceuticals. Fitusiran is a small interfering RNA (siRNA) therapeutic that targets and reduces the production of antithrombin, thereby enhancing thrombin generation and improving hemostasis. Clinical trials have shown that Fitusiran can significantly reduce bleeding episodes in patients with Hemophilia A, offering a novel mechanism of action distinct from traditional factor replacement therapies. The potential for monthly subcutaneous administration further underscores its convenience and appeal as a long-term treatment solution. As research and development in this field continue to advance, the landscape of hemophilia treatment is set to evolve, offering hope for better patient outcomes and improved quality of life for those living with this chronic condition.

Buy Full Report: https://www.imarcgroup.com/checkout?id=7915&method=587

Leading Companies in the Hemophilia A Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global hemophilia A market, several leading companies are at the forefront of developing innovative treatments and therapies. Some of the major players include Chugai Pharmaceutical, Takeda, and Bayer HealthCare. These companies are dedicated to improving the quality of life for patients through advancements in both traditional factor replacement therapies and cutting-edge gene and non-factor therapies.

Chugai Pharmaceutical, a subsidiary of Roche, is a prominent player in the Hemophilia A market, particularly with its innovative product Hemlibra (emicizumab). Hemlibra has garnered significant attention and acclaim due to its unique mechanism of action and its transformative impact on the management of Hemophilia A, especially for patients with inhibitors to factor VIII.

Moreover, Takeda announced new data from a real-world evidence study demonstrating the effectiveness and safety of Obizur in managing acute bleeding episodes in patients with acquired hemophilia A. The study highlighted that Obizur provided rapid and sustained hemostatic control, which is crucial for managing this life-threatening condition.

Apart from this, Bayer HealthCare released results from a long-term extension study evaluating the safety and efficacy of Kovaltry in previously treated patients with severe Hemophilia A. The study demonstrated that Kovaltry continues to provide effective bleeding control with a low incidence of adverse events over extended periods.

Request for customization: https://www.imarcgroup.com/request?type=report&id=7915&flag=E

Regional Analysis:

The major markets for hemophilia A include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States leads the market, accounting for the largest hemophilia A market share. This can be attributed to substantial advancements in treatment options, significant investment in research and development, and robust support systems for patient care.

Moreover, innovative therapies, such as Bioverativ’s Eloctate and Takeda's Adynovate, provide prolonged protection against bleeding with fewer infusions compared to traditional factor VIII treatments. This advancement significantly improves the quality of life for patients by reducing the frequency of dosing and offering more consistent protection against bleeding episodes.

Besides this, companies like BioMarin and Sangamo Therapeutics are pioneering gene therapies that aim to provide long-term solutions for Hemophilia A. BioMarin’s valoctocogene roxaparvovec and Sangamo’s SB-525 are in advanced clinical trials, showing promise in potentially reducing or eliminating the need for regular factor VIII infusions. These gene therapies target the underlying genetic defect, offering the hope of a one-time treatment that could provide lasting benefits.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

· United States

· Germany

· France

· United Kingdom

· Italy

· Spain

· Japan

Analysis Covered Across Each Country

· Historical, current, and future epidemiology scenario

· Historical, current, and future performance of the hemophilia A market

· Historical, current, and future performance of various therapeutic categories in the market

· Sales of various drugs across the hemophilia A market

· Reimbursement scenario in the market

· In-market and pipeline drugs

Competitive Landscape:

This report offers a comprehensive analysis of current hemophilia A marketed drugs and late-stage pipeline drugs.

In-Market Drugs

· Drug Overview

· Mechanism of Action

· Regulatory Status

· Clinical Trial Results

· Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

· Drug Overview

· Mechanism of Action

· Regulatory Status

· Clinical Trial Results

· Drug Uptake and Market Performance

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/hemophilia-a-market

IMARC Group Offer Other Reports:

Chemotherapy-Induced Peripheral Neuropathy Market: The 7 major chemotherapy-induced peripheral neuropathy market is expected to exhibit a CAGR of 4.44% during the forecast period from 2024 to 2034.

Sly Syndrome Market: The 7 major sly syndrome market reached a value of US$ 670.1 Million in 2023, and projected the 7MM to reach US$ 934.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.07% during the forecast period from 2024 to 2034.

Corneal Dystrophy Market: The 7 major corneal dystrophy market is expected to exhibit a CAGR of 6.1% during the forecast period from 2024 to 2034.

Advanced Pancreatic Cancer Market: The 7 major advanced pancreatic cancer market is expected to exhibit a CAGR of 5.79% during the forecast period from 2024 to 2034.

Cerebral Aneurysm Market: The 7 major cerebral aneurysm market is expected to exhibit a CAGR of 7.06% during the forecast period from 2024 to 2034.

Metastatic Castration-Resistant Prostate Cancer Market: The 7 major metastatic castration-resistant prostate cancer market is expected to exhibit a CAGR of 5.44% during the forecast period from 2024 to 2034.

Krabbe Disease Market: The 7 major krabbe disease market reached a value of US$ 2.5 Billion in 2023, and projected the 7MM to reach US$ 4.7 Billion 5.81% by 2034, exhibiting a growth rate (CAGR) of 15.08% during the forecast period from 2024 to 2034.

Choroideremia Market: The 7 major choroideremia market is expected to exhibit a CAGR of 4.22% during the forecast period from 2024 to 2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

The hemophilia A market size reached a value of US$ 10,288.7 Million in 2023. Looking forward, the market is expected to reach US$ 28,447.2 Million by 2034, exhibiting a growth rate (CAGR) of 9.69% during 2024-2034. The market is driven by the development of novel therapies and gene editing technologies. Additionally, increased awareness and early diagnosis, coupled with advancements in personalized medicine, are driving the market toward more effective and tailored treatment options for Hemophilia A patients.

Advancements in Gene Therapy: Driving the Hemophilia A Market

Advancements in gene therapy are revolutionizing the Hemophilia A market, offering promising solutions that could transform patient care. Gene therapy aims to address the root cause of Hemophilia A by correcting the genetic defect responsible for the lack of factor VIII, a crucial blood-clotting protein. One of the most notable advancements is the development of adeno-associated virus (AAV) vector-based therapies. These therapies deliver a functional copy of the factor VIII gene directly to the liver cells, enabling the body to produce the missing protein. Clinical trials, such as those conducted by BioMarin with their investigational therapy valoctocogene roxaparvovec (Roctavian), have shown encouraging results. Patients treated with this therapy have demonstrated sustained production of factor VIII, leading to a significant reduction in bleeding episodes and decreased reliance on regular factor VIII infusions.

Request a PDF Sample Report: https://www.imarcgroup.com/hemophilia-a-market/requestsample

Another significant instance is the work by Spark Therapeutics with their gene therapy SPK-8011. Early phase trials have indicated that SPK-8011 can achieve stable factor VIII expression in patients, thereby reducing the annualized bleeding rates. Similarly, Sangamo Therapeutics, in collaboration with Pfizer, is developing SB-525 (giroctocogene fitelparvovec), which has shown promising preliminary results in clinical trials, with patients achieving therapeutic levels of factor VIII and experiencing fewer bleeding events. Moreover, ongoing research and collaborations are continuously enhancing the efficacy and safety profiles of gene therapies. Innovations in vector design, delivery methods, and patient selection criteria are critical areas of focus. The goal is to maximize therapeutic benefits while minimizing risks and adverse effects. As these therapies advance through clinical trials and regulatory approvals, they hold the potential to dramatically improve the quality of life for individuals with Hemophilia A, offering hope for a future where regular factor replacement therapy becomes obsolete. The success of these gene therapies could also pave the way for similar advancements in treating other genetic disorders, marking a significant milestone in medical science.

Extended Half-Life Products: Contributing to Market Expansion

Extended half-life (EHL) products are significantly advancing the Hemophilia A market by offering improved efficacy and convenience in treatment regimens. Traditional factor VIII replacement therapies require frequent infusions to maintain adequate levels of the clotting protein, often leading to patient burden and adherence challenges. EHL products, through modifications such as PEGylation, fusion with the Fc portion of immunoglobulin, or albumin fusion, extend the duration of factor VIII in the bloodstream. This reduces the frequency of infusions, allowing patients to maintain better control over their condition with fewer disruptions to their daily lives. A prime example of an EHL product is Bioverativ’s Eloctate (efmoroctocog alfa), now part of Sanofi. Eloctate is a recombinant factor VIII fused to the Fc region of immunoglobulin G (IgG1), which extends its half-life by recycling through the Fc receptor pathway. Clinical studies have demonstrated that Eloctate significantly decreases the frequency of bleeding episodes and supports extended dosing intervals, enabling patients to require less frequent injections compared to standard factor VIII therapies. This advancement has notably improved the quality of life for Hemophilia A patients by reducing the treatment burden.

Another prominent EHL product is Adynovate (rurioctocog alfa pegol), developed by Takeda. Adynovate uses PEGylation technology to increase the half-life of factor VIII. Clinical trials have shown that Adynovate provides prolonged protection from bleeding with fewer infusions needed, making it suitable for both prophylactic and on-demand treatment regimens. Its efficacy in reducing annual bleeding rates has been well-documented, offering patients more stable and sustained factor VIII levels. This product exemplifies how EHL technologies can transform hemophilia care, providing a more manageable and effective treatment option. The introduction of these EHL products marks a significant advancement in the management of Hemophilia A, offering more stable and sustained clotting factor levels. As more EHL products gain approval and become available, they are expected to set new standards in hemophilia care, providing patients with effective and convenient treatment options that enhance their overall quality of life.

Non-Factor Replacement Therapies:

Non-factor replacement therapies are a groundbreaking development in the Hemophilia A market, offering new approaches to managing the condition without relying on traditional factor VIII infusions. One of the most significant advancements in this area is Emicizumab (Hemlibra), developed by Roche. Emicizumab is a bispecific monoclonal antibody that bridges factors IXa and X, mimicking the function of factor VIII and facilitating clot formation. This innovative approach allows for subcutaneous administration, providing patients with a more convenient and less invasive treatment option compared to intravenous factor VIII infusions. Emicizumab has demonstrated remarkable efficacy in clinical trials, significantly reducing bleeding rates in both prophylactic and on-demand treatment settings. Its approval by the FDA for patients with Hemophilia A with and without factor VIII inhibitors marks a major milestone in hemophilia care. The HAVEN clinical trials showed that Emicizumab could reduce the annualized bleeding rate by up to 87% compared to previous treatments, highlighting its potential to transform patient management. Moreover, the convenience of weekly, bi-weekly, or even monthly dosing schedules makes it a highly attractive option for patients, improving adherence and overall quality of life.

Another promising non-factor replacement therapy is Fitusiran, developed by Sanofi and Alnylam Pharmaceuticals. Fitusiran is a small interfering RNA (siRNA) therapeutic that targets and reduces the production of antithrombin, thereby enhancing thrombin generation and improving hemostasis. Clinical trials have shown that Fitusiran can significantly reduce bleeding episodes in patients with Hemophilia A, offering a novel mechanism of action distinct from traditional factor replacement therapies. The potential for monthly subcutaneous administration further underscores its convenience and appeal as a long-term treatment solution. As research and development in this field continue to advance, the landscape of hemophilia treatment is set to evolve, offering hope for better patient outcomes and improved quality of life for those living with this chronic condition.

Buy Full Report: https://www.imarcgroup.com/checkout?id=7915&method=587

Leading Companies in the Hemophilia A Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global hemophilia A market, several leading companies are at the forefront of developing innovative treatments and therapies. Some of the major players include Chugai Pharmaceutical, Takeda, and Bayer HealthCare. These companies are dedicated to improving the quality of life for patients through advancements in both traditional factor replacement therapies and cutting-edge gene and non-factor therapies.

Chugai Pharmaceutical, a subsidiary of Roche, is a prominent player in the Hemophilia A market, particularly with its innovative product Hemlibra (emicizumab). Hemlibra has garnered significant attention and acclaim due to its unique mechanism of action and its transformative impact on the management of Hemophilia A, especially for patients with inhibitors to factor VIII.

Moreover, Takeda announced new data from a real-world evidence study demonstrating the effectiveness and safety of Obizur in managing acute bleeding episodes in patients with acquired hemophilia A. The study highlighted that Obizur provided rapid and sustained hemostatic control, which is crucial for managing this life-threatening condition.

Apart from this, Bayer HealthCare released results from a long-term extension study evaluating the safety and efficacy of Kovaltry in previously treated patients with severe Hemophilia A. The study demonstrated that Kovaltry continues to provide effective bleeding control with a low incidence of adverse events over extended periods.

Request for customization: https://www.imarcgroup.com/request?type=report&id=7915&flag=E

Regional Analysis:

The major markets for hemophilia A include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States leads the market, accounting for the largest hemophilia A market share. This can be attributed to substantial advancements in treatment options, significant investment in research and development, and robust support systems for patient care.

Moreover, innovative therapies, such as Bioverativ’s Eloctate and Takeda's Adynovate, provide prolonged protection against bleeding with fewer infusions compared to traditional factor VIII treatments. This advancement significantly improves the quality of life for patients by reducing the frequency of dosing and offering more consistent protection against bleeding episodes.

Besides this, companies like BioMarin and Sangamo Therapeutics are pioneering gene therapies that aim to provide long-term solutions for Hemophilia A. BioMarin’s valoctocogene roxaparvovec and Sangamo’s SB-525 are in advanced clinical trials, showing promise in potentially reducing or eliminating the need for regular factor VIII infusions. These gene therapies target the underlying genetic defect, offering the hope of a one-time treatment that could provide lasting benefits.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

· United States

· Germany

· France

· United Kingdom

· Italy

· Spain

· Japan

Analysis Covered Across Each Country

· Historical, current, and future epidemiology scenario

· Historical, current, and future performance of the hemophilia A market

· Historical, current, and future performance of various therapeutic categories in the market

· Sales of various drugs across the hemophilia A market

· Reimbursement scenario in the market

· In-market and pipeline drugs

Competitive Landscape:

This report offers a comprehensive analysis of current hemophilia A marketed drugs and late-stage pipeline drugs.

In-Market Drugs

· Drug Overview

· Mechanism of Action

· Regulatory Status

· Clinical Trial Results

· Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

· Drug Overview

· Mechanism of Action

· Regulatory Status

· Clinical Trial Results

· Drug Uptake and Market Performance

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/hemophilia-a-market

IMARC Group Offer Other Reports:

Chemotherapy-Induced Peripheral Neuropathy Market: The 7 major chemotherapy-induced peripheral neuropathy market is expected to exhibit a CAGR of 4.44% during the forecast period from 2024 to 2034.

Sly Syndrome Market: The 7 major sly syndrome market reached a value of US$ 670.1 Million in 2023, and projected the 7MM to reach US$ 934.7 Million by 2034, exhibiting a growth rate (CAGR) of 3.07% during the forecast period from 2024 to 2034.

Corneal Dystrophy Market: The 7 major corneal dystrophy market is expected to exhibit a CAGR of 6.1% during the forecast period from 2024 to 2034.

Advanced Pancreatic Cancer Market: The 7 major advanced pancreatic cancer market is expected to exhibit a CAGR of 5.79% during the forecast period from 2024 to 2034.

Cerebral Aneurysm Market: The 7 major cerebral aneurysm market is expected to exhibit a CAGR of 7.06% during the forecast period from 2024 to 2034.

Metastatic Castration-Resistant Prostate Cancer Market: The 7 major metastatic castration-resistant prostate cancer market is expected to exhibit a CAGR of 5.44% during the forecast period from 2024 to 2034.

Krabbe Disease Market: The 7 major krabbe disease market reached a value of US$ 2.5 Billion in 2023, and projected the 7MM to reach US$ 4.7 Billion 5.81% by 2034, exhibiting a growth rate (CAGR) of 15.08% during the forecast period from 2024 to 2034.

Choroideremia Market: The 7 major choroideremia market is expected to exhibit a CAGR of 4.22% during the forecast period from 2024 to 2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800