The license and option deal, for an undisclosed amount, seeks to develop potentially first-in-class antibody-drug conjugate candidates against different oncology targets.

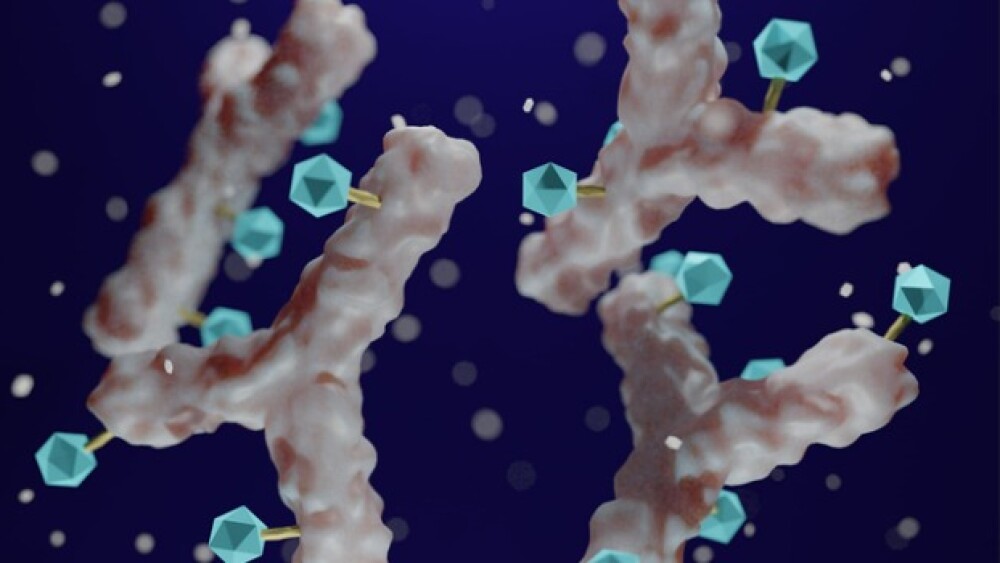

Pictured: Antibody-drug conjugate with cytotoxic payload/iStock, Love Employee

ImmunoGen has entered into a multi-target license and option partnership with privately-held ImmunoBiochem to advance novel and first-in-class antibody-drug conjugates against unique cancer targets, the companies announced Monday.

Without revealing the exact financial terms of the deal, the companies said that ImmunoBiochem would receive an upfront payment and will be entitled to milestones and royalties contingent on prespecified development, regulatory and commercial goals. In return, ImmunoGen will have an exclusive license to existing antibodies directed toward a still undisclosed oncology target.

The companies will work together on preclinical activities, while ImmunoGen will take charge of future clinical development and commercialization activities.

The deal “validates our differentiated thinking and will enable ImmunoBiochem to significantly expand its discovery platform and innovative pipeline,” ImmunoBiochem CEO Anton Neschadim said in a statement.

Under Monday’s deal, ImmunoGen can also select additional targets and antibodies for licensing, in which case ImmunoBiochem will be eligible to an option exercise payment. ImmunoGen will be responsible for all R&D of these subsequent programs.

At the core of the partnership is ImmunoBiochem’s proprietary platform, which combines high-throughput functional analyses and mass spectrometry with machine learning to better understand the tumor microenvironment. In particular, the private biotech wields this approach against the cancer secretome—which refers to the complete set of proteins that cancer cells secrete—to identify novel targets.

Identifying unique cancer targets through the secretome opens up new strategies to effectively deliver payloads while overcoming the typical challenges that biological therapeutics often face, including low tumor penetration and treatment resistance.

Monday’s deal is in line with the industry-wide trend that has seen a growing preference for leveraging antibody-drug conjugates (ADC) therapeutics against cancer.

Several other biopharma companies have joined this rising tide, including BeiGene, which earlier this month bought an exclusive license to develop, manufacture and commercialize an investigational ADC from fellow Chinese company DualityBio.

Other companies are also investing big bucks to build their ADC portfolios. In June 2023, Eli Lilly bought European cancer startup Emergence Therapeutics, whose most mature candidate ETx-22 is an ADC that targets Nectin-4, which is commonly found on cancer cells but not on healthy cells. This buyout follows Lilly’s $1.7 billion partnership with ImmunoGen in February 2022 to advance ADC candidates against Type 1 topoisomerase.

Joining Lilly is AstraZeneca, which in May 2023 signed a contract worth up to $600 million with Chinese biotech LaNova Medicines, gaining access to the latter’s preclinical ADC LM-305, a potentially first-in-class treatment for multiple myeloma.

The biggest investment in the ADC space, however, was made by Pfizer in March 2023, when it dropped $43 billion to acquire ADC leader Seagen, gaining access to four approved cancer treatments and nearly a dozen upcoming molecules for various oncology targets.

Tristan Manalac is an independent science writer based in metro Manila, Philippines. He can be reached at tristan@tristanmanalac.com or tristan.manalac@biospace.com.