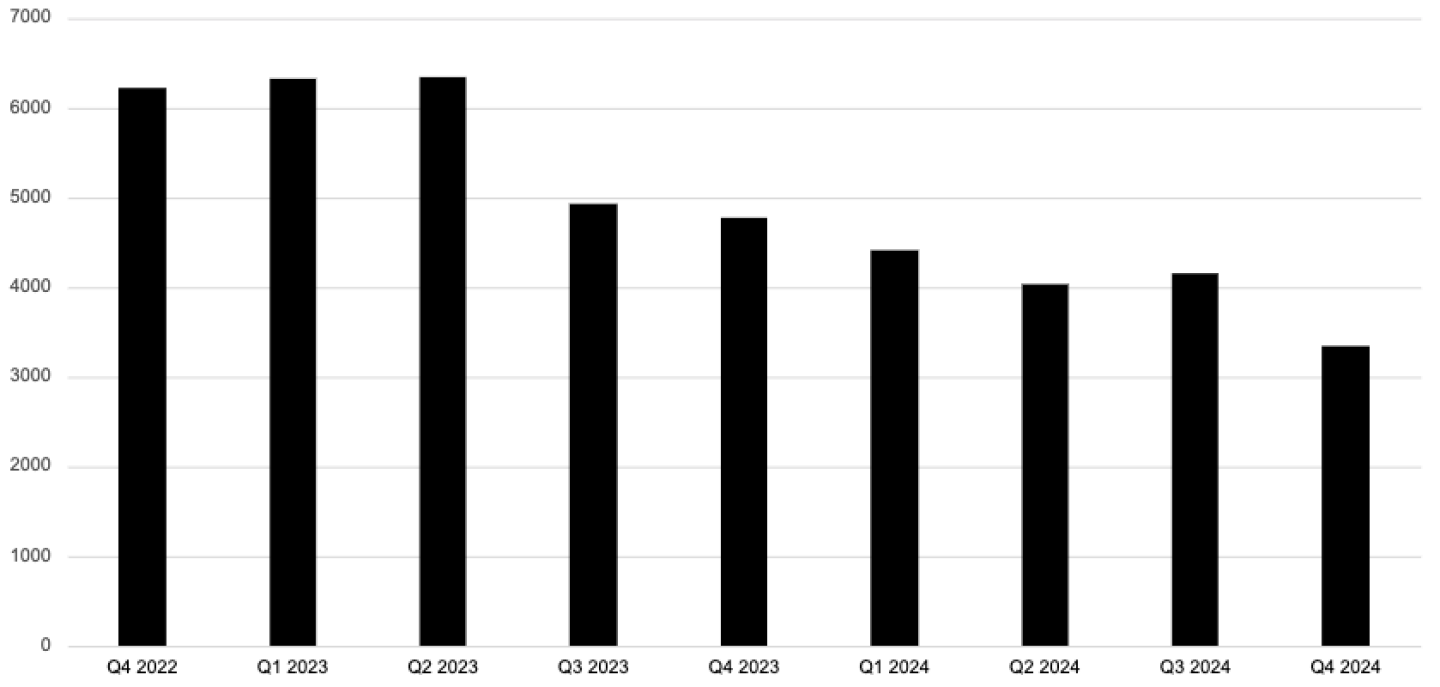

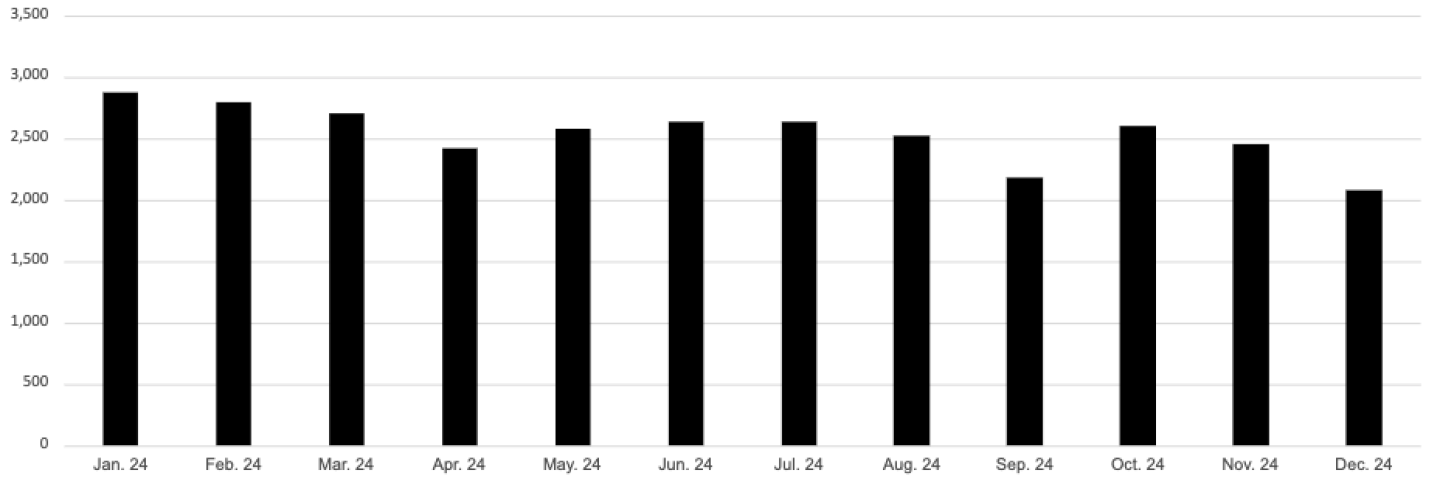

Year-over-year BioSpace data show there were fewer job postings live on the website in the fourth quarter of 2024, and the decrease was higher than the third quarter’s drop.

During the fourth quarter—and for the fourth time in 2024—quarterly job postings that were live on the BioSpace website dropped year over year. Meanwhile, layoffs continued, pushing thousands of biopharma professionals into the job market alongside their employed counterparts.

The decline in positions live on BioSpace during Q4 was higher than the drop in Q3 (16% vs. 11%). However, both quarters fared better than Q1 and Q2, when there were 25% and 24% fewer job postings live, respectively.

Also noteworthy: The number of average jobs live on BioSpace declined significantly from fourth quarter 2022 to fourth quarter 2024, a 46% drop.

AVERAGE JOBS LIVE, Q4 2022–Q4 2024

Source: BioSpace, October 2022-December 2024

The year-over-year declines in positions live on BioSpace in 2024 align with recent U.S. Bureau of Labor Statistics data. That data showed that job openings in the U.S. were down by 833,000 over the year as of the final business day of November. In more encouraging news, a subsequent BLS report found that employment increased by 256,000 jobs in December, which was above expectations. In addition, the year-over-year decline in job postings live on BioSpace from November to December was smaller in 2024 than 2023 (8% vs. 10%).

As to layoffs, over 6,000 biopharma employees were let go during the fourth quarter, according to BioSpace tallies. Those cuts include Johnson & Johnson laying off up to 2,000 people in China. That news, reported in November, landed the pharma on the BioSpace list of the five largest biopharma layoffs of 2024.

The fourth quarter’s estimated staff cuts made up a significant chunk of last year’s workforce reductions. At least 24,000 people were let go in 2024, according to BioSpace tallies.

Layoffs Continue Into the New Year

While the first quarter is typically one of the best times for hiring in biopharma, there’ll be plenty of competition for open roles given this month’s workforce reductions. Through Jan. 14, 16 companies, including a contract development and manufacturing organization, announced or disclosed layoffs affecting more than 1,000 people total, according to BioSpace tallies. That’s just over half the number of estimated cuts in January 2024, indicating that year-over-year workforce reductions aren’t slowing just yet.

The largest layoff so far was at Galapagos. The Belgium-based biotech will split into two entities and cut 40% of its employees—about 300 people—across its Europe operations. Meanwhile, other biopharmas are cutting the majority of their workforces. For example:

- Regeneron isn’t bringing Oxular employees on board after acquiring the biotech.

- Velia is shutting down and eliminating its entire staff.

- IGM Biosciences is axing 73% of its workforce.

- Barinthus Biotherapeutics plans to cut 65% of its employees.

- Passage Bio is slashing its staff by about 55%.

It’s too soon to say if this year’s layoffs will match last year’s. The numbers bear watching, though, especially given that nearly a quarter (21%) of respondents to a recent BioSpace workforce planning survey said they anticipate making layoffs in 2025.

Biopharma Funding, Deals Heat Up

As 2025 gets under way, there have been two encouraging signs for job seekers: a recent uptick in biopharma funding as well as notable deal activity at this week’s J.P. Morgan Healthcare Conference. Both are positive developments for companies looking to grow—and hire—as the industry works to emerge from its post-pandemic downturn.

Regarding funding, venture investment hit $26 billion across 416 rounds in 2024, up from $23.3 billion over 462 rounds in 2023, according to J.P. Morgan’s quarterly look-ahead, released just before the annual healthcare conference. That increase snapped a two-year trend of declining venture capital spending in biopharma.

On Jan. 13, the first day of the J.P. Morgan conference, Eli Lilly, GSK and Gilead announced deals that could be worth over $1 billion combined. Johnson & Johnson also made news, committing $14.6 billion to buy Intra-Cellular.

The deals met with positive sentiment. For example, Vir Biotechnologies CEO Marianne de Backer told BioSpace, “I hope this will be sort of the start of a rejuvenation of our industry where there’s more M&A, more IPOs happening. I would love to see us go back to the pre-pandemic times.”

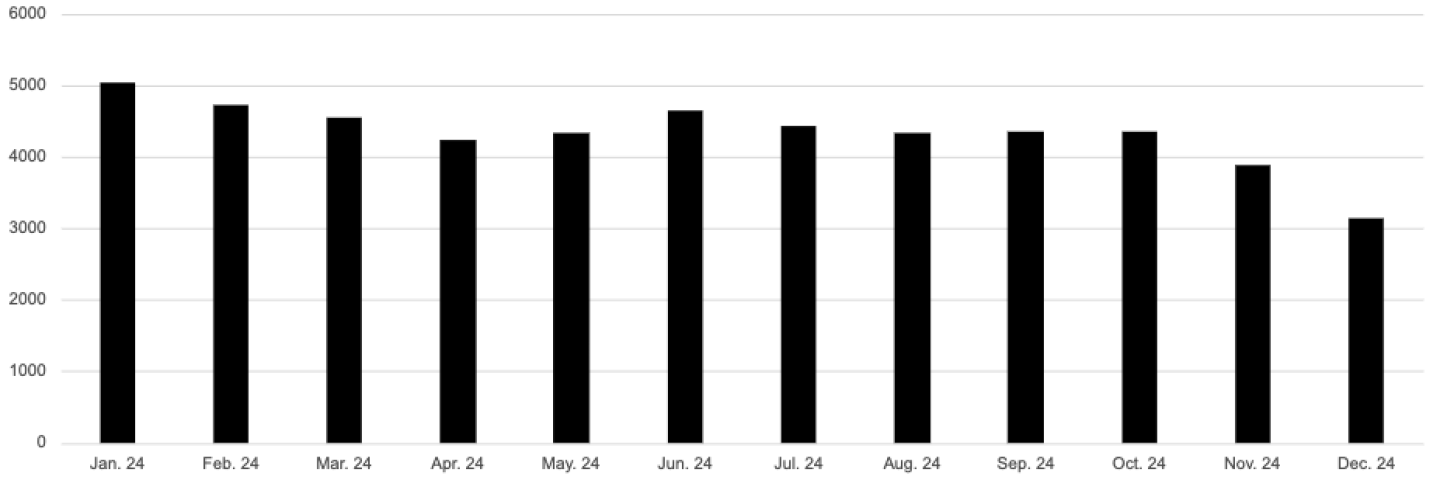

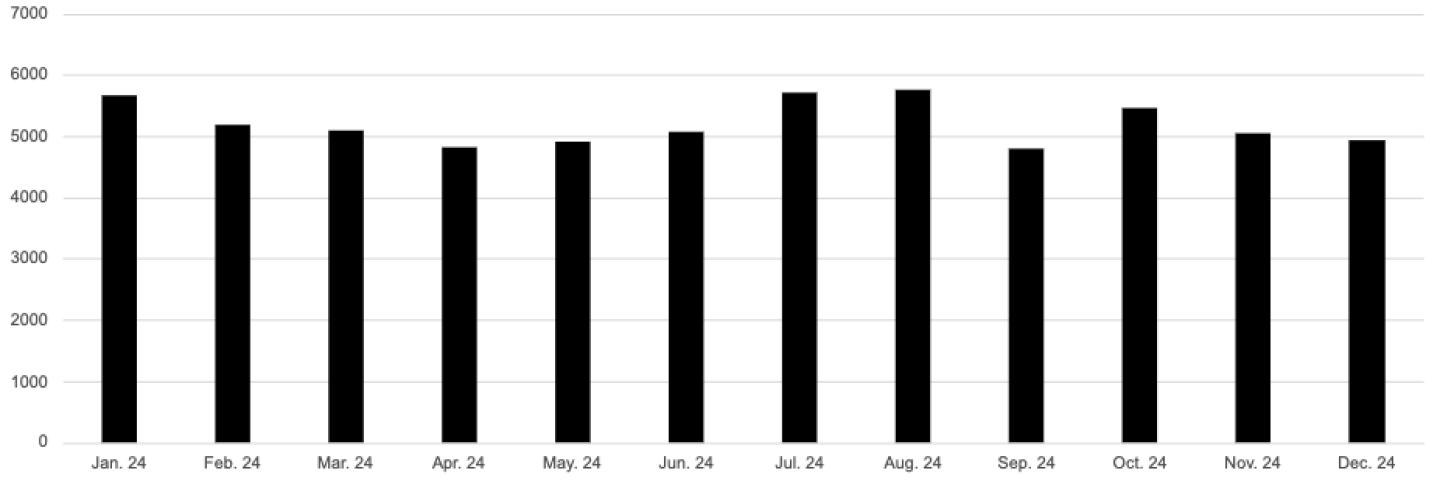

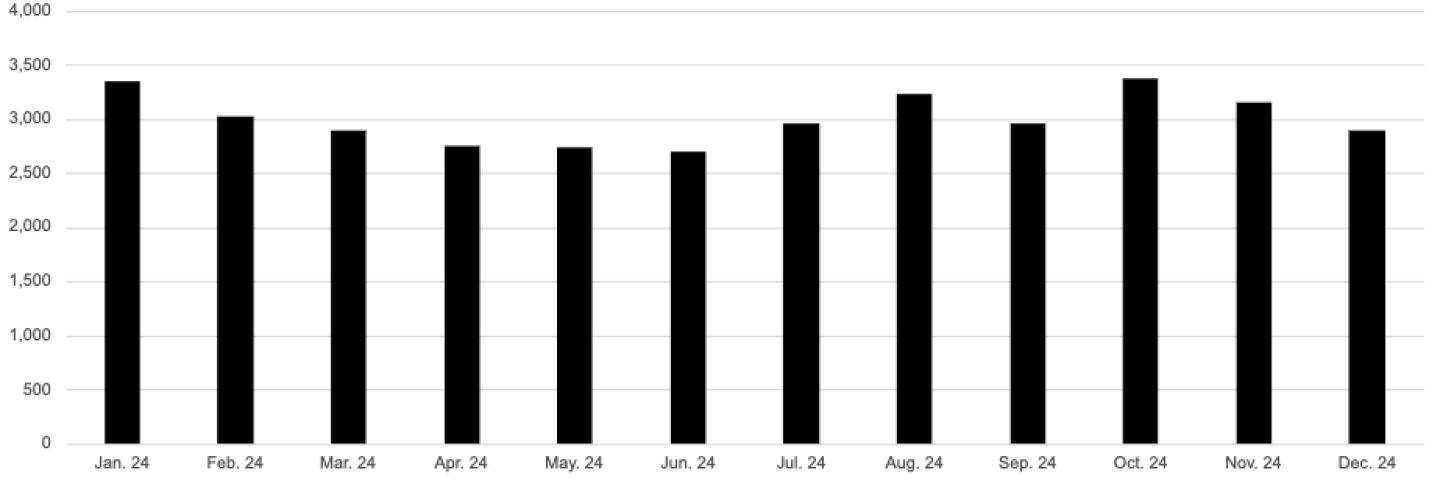

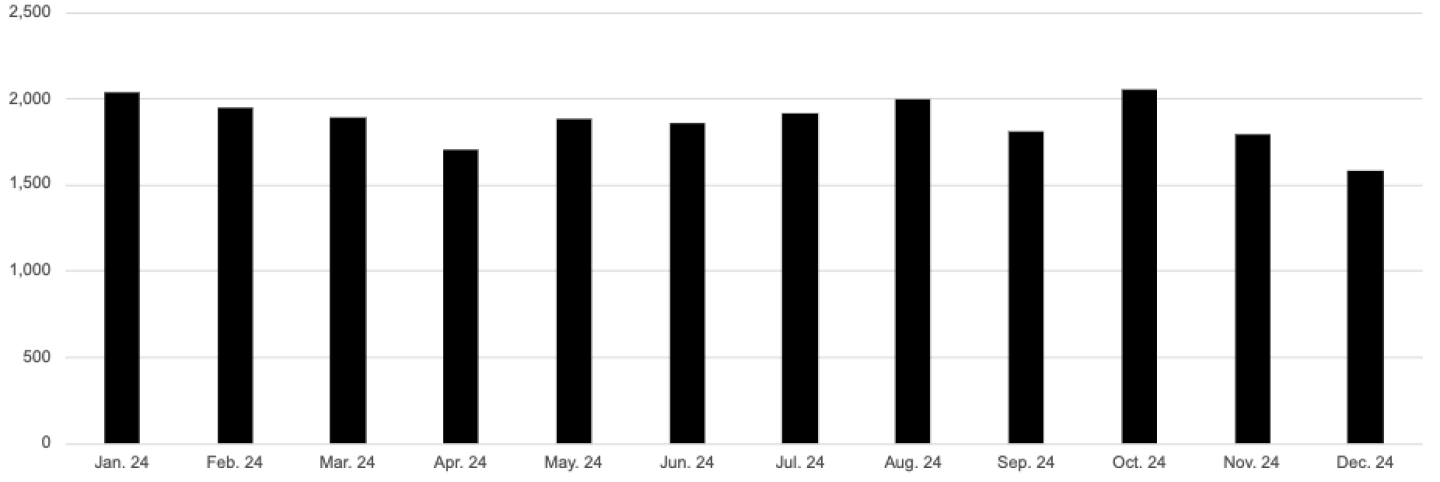

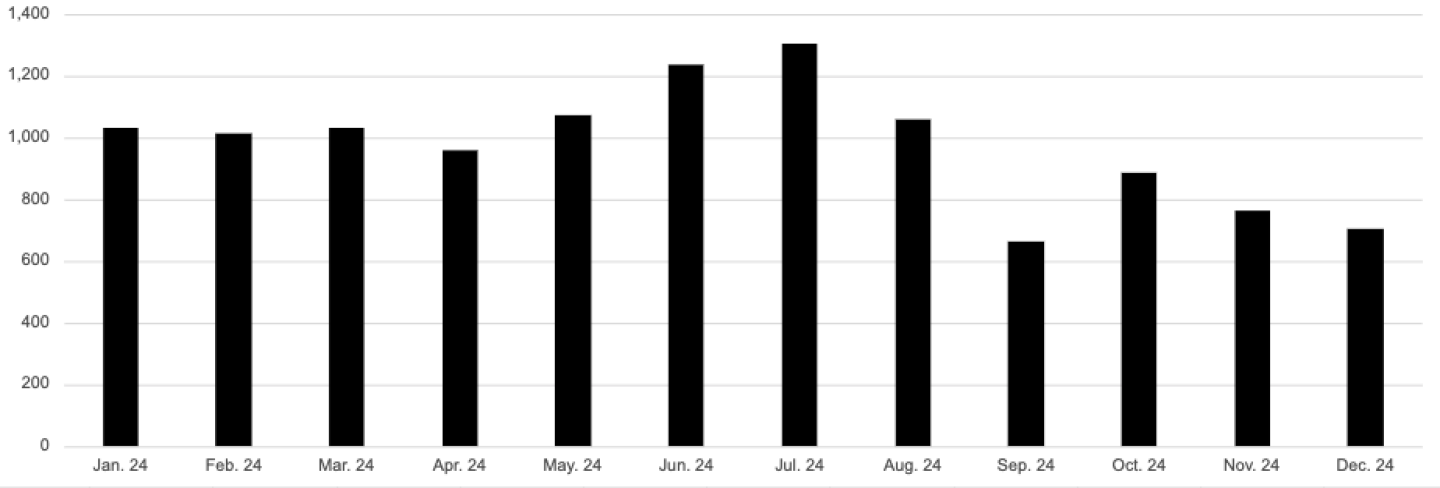

Job Activity Trends: Jobs Live on BioSpace

Industry: Biotech

Industry: Pharma

Discipline: Research and Development

Discipline: Clinical

Discipline: Manufacturing and Production

Discipline: Sales and Service

Source: BioSpace, January-December 2024, average jobs live on site

This article’s content originally appeared in a Jan. 16, 2024, special edition of Career Insider. Subscribe for the latest job market reports, job trends and career advice.