During the first quarter, 22 rounds of biopharma layoffs in California affected about 995 employees total, while 17 rounds in Massachusetts impacted around 410 people, based on BioSpace estimates. Meanwhile, competition for jobs in those states increased year over year, according to BioSpace data.

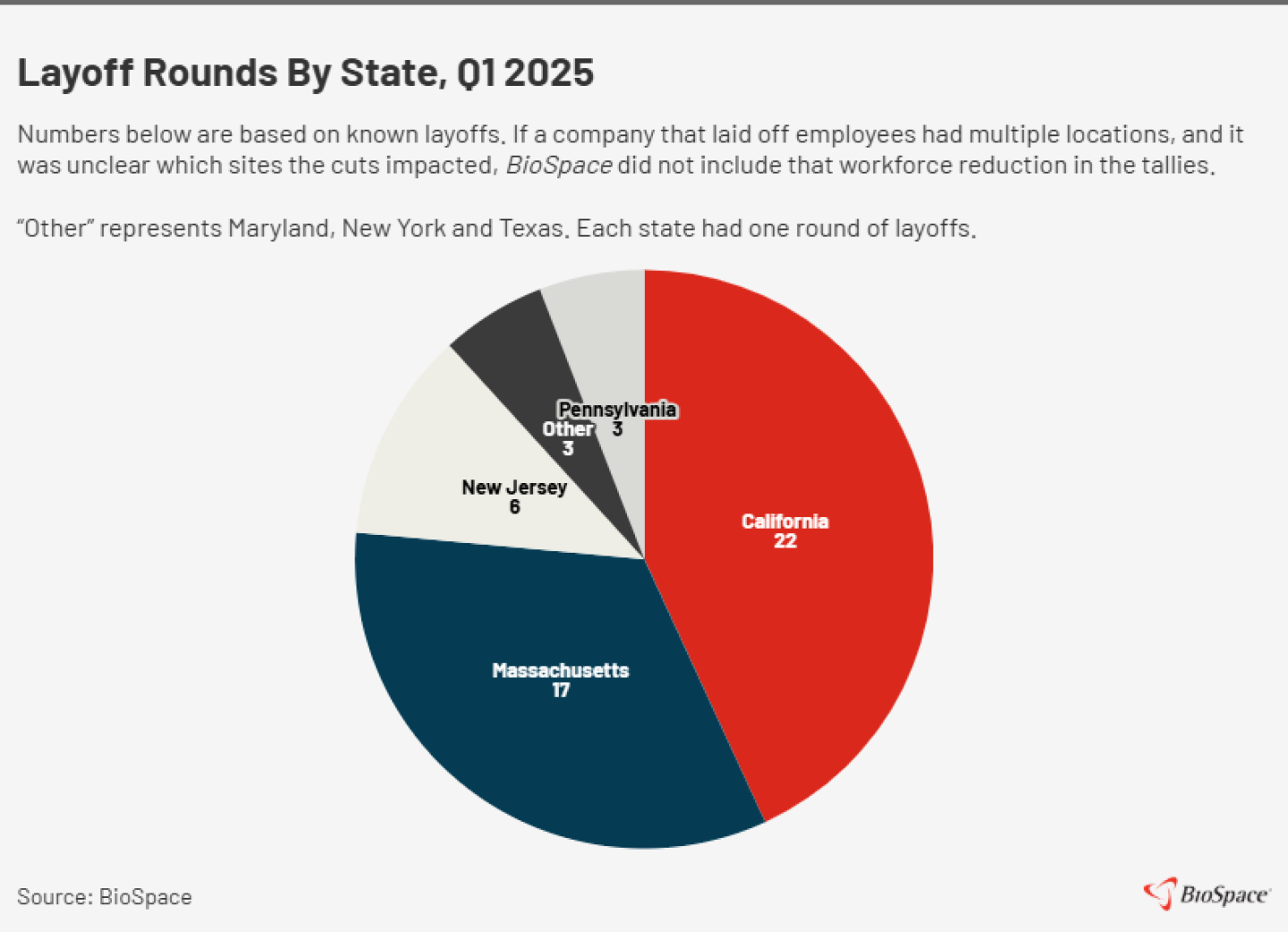

The majority of the first quarter’s biotech and pharma layoffs hit employees in the two most notable states for biopharma business—California and Massachusetts—according to BioSpace data. There were 22 rounds of layoffs in California and 17 in Massachusetts, compared to six in New Jersey, three in Pennsylvania and one each in Maryland, New York and Texas.

Those numbers exclude contract development and manufacturing organizations, contract research organizations, tools and services businesses and medical device firms. If a company that laid off employees had multiple locations, and it was unclear which sites the downsizing impacted, BioSpace did not include that workforce reduction in the tallies.

To tally first-quarter cuts, we compiled data for known layoffs and identified—or sometimes estimated—the number of employees affected. We made those determinations primarily through information in company press releases, Worker Adjustment and Retraining Notification Act (WARN) notices, SEC filings and other media outlets’ reports or via confirmation from company officials.

Based on BioSpace estimates, the 22 layoffs in California affected about 995 employees in total, while the 17 in Massachusetts involved around 410 people. Added together, that figure represents over a quarter of the staff let go in the first quarter. The actual percentage is probably higher given BioSpace could not identify locations for some layoffs that likely involved employees in California and Massachusetts.

The cuts came at a tough time for those affected, as the job market has not picked up just yet. During the first quarter, job postings live on the BioSpace website dropped 20% year over year, while applications for positions on the site spiked 91%. This resulted in more competition for fewer roles. The same year-over-year trend held true for California and Massachusetts in the first quarter:

- In California, jobs live fell 26%, while applications rose 17%.

- In Massachusetts, jobs live dipped 8%, while applications jumped 45%.

Positions live on BioSpace also fell quarter over quarter in those states. From Q4 2024 to Q1 2025, they dropped 16% in California and 14% in Massachusetts.

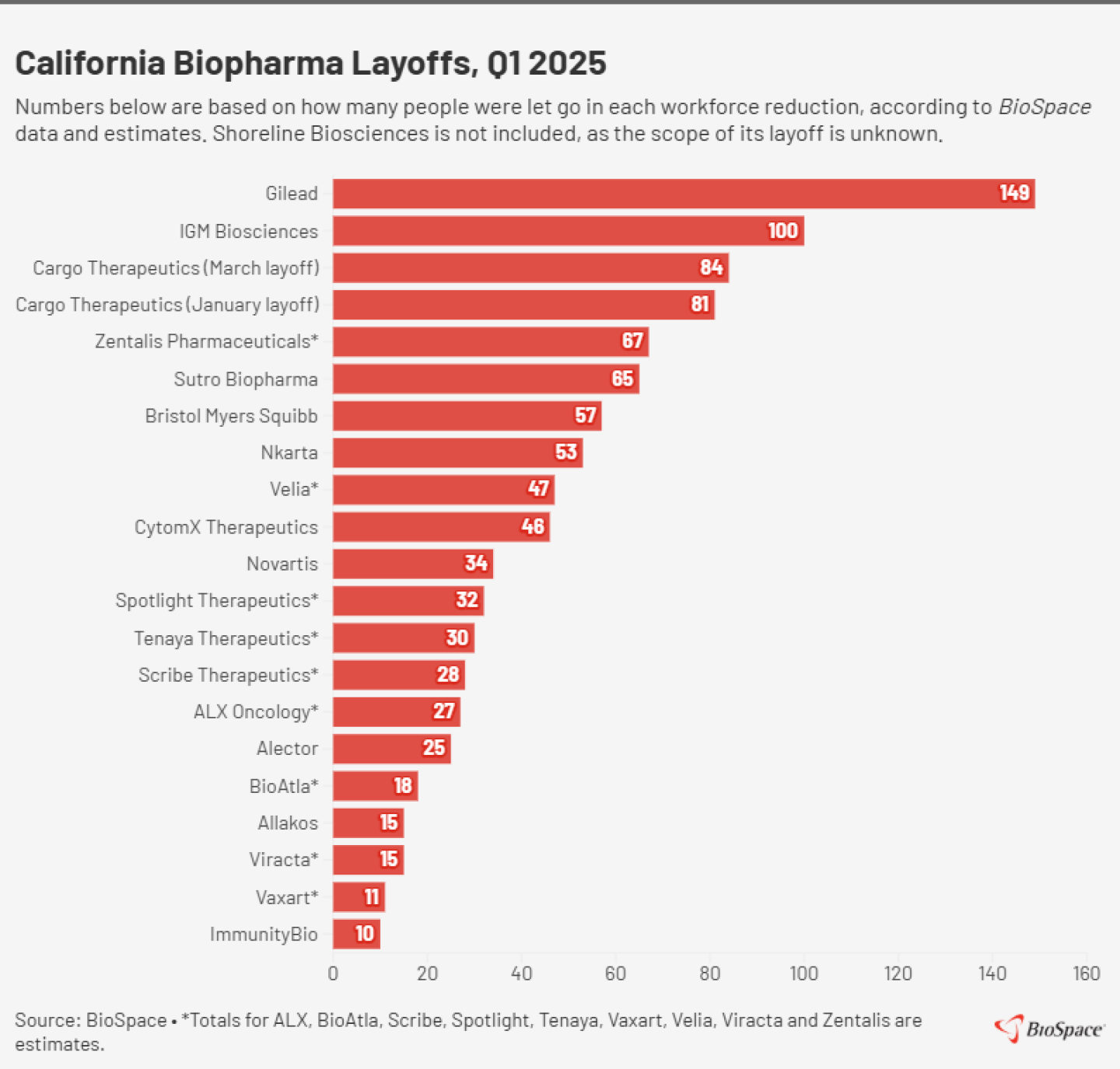

Following is an overview of layoffs in California and Massachusetts. The largest cuts mentioned for those locations are based on the number of people affected in each workforce reduction.

California Layoffs Mostly Affect San Francisco, San Diego

Of the 22 workforce reductions in California, eight were in San Francisco and five were in San Diego. Added together, those 13 cuts represented over half of the state’s layoff rounds. The only other city with multiple workforce reductions was San Carlos, with four.

Companies that laid off employees in San Francisco were Alector, ALX Oncology, CytomX Therapeutics, Nkarta, Spotlight Therapeutics, Sutro Biopharma (as part of layoffs primarily affecting employees in San Carlos), Tenaya Therapeutics (as part of cuts also affecting staff in Union City) and Vaxart.

In San Diego, BioAtla, Novartis, Shoreline Biosciences, Velia and Zentalis Pharmaceuticals let go of employees. Spotlight and Velia’s layoffs were due to company closures.

Also noteworthy: Cargo Therapeutics had two rounds of cuts in San Carlos.

The largest layoff was at Gilead. In March, the company divulged it would let go of 149 employees at its Foster City headquarters, effective May 27, according to a WARN notice. Those cuts landed Gilead on the BioSpace list of the first quarter’s five largest biopharma layoffs. They followed a November disclosure that the company would let go of 104 people in Foster City, effective March 14.

Regarding the latest layoffs, a Gilead spokesperson told BioSpace the pharma is “continuing to further align our resources as we prepare for the upcoming launch of twice-yearly lenacapavir for HIV prevention and other near-term launches.”

Mountain View, California–based IGM Biosciences had the second-largest staff cut. In January, the company announced it would let go of 73% of its workforce and stop development of two autoimmune drug candidates. The layoffs affected 100 employees in Mountain View effective March 10, according to a WARN notice.

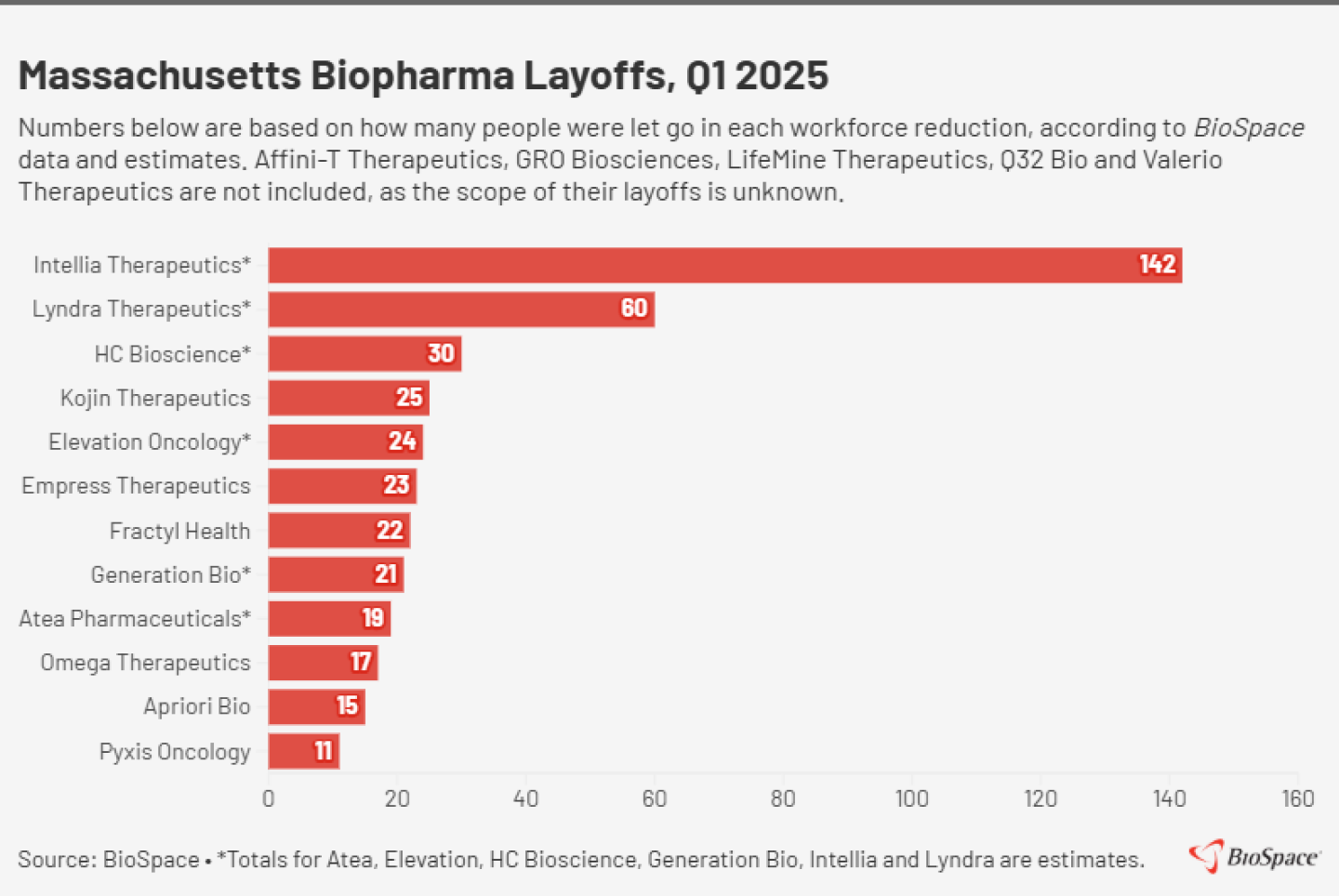

Massachusetts Layoffs Center Around Boston, Cambridge

Of the 17 workforce reductions in Massachusetts, five were in Boston and at least five were in Cambridge. (It was unclear if Intellia Therapeutics’ downsizing involved both its Cambridge and Waltham locations, so it wasn’t included in the Cambridge count.) Added together, those 10 cuts represented over half of the state’s layoff rounds. The only other city with multiple workforce reductions was Watertown, with three. That said, if Intellia’s layoffs included its Waltham site, Waltham had two rounds of cuts.

Companies that let go of employees in Boston were Atea Pharmaceuticals, Elevation Oncology, HC Bioscience, Kojin Therapeutics and Pyxis Oncology.

In Cambridge, Apriori Bio, Generation Bio, GRO Biosciences, LifeMine Therapeutics and Omega Therapeutics laid off staff. Kojin and HC’s cuts were due to company closures.

The largest workforce reduction in Massachusetts was at Cambridge, Massachusetts–based Intellia. In January, the company announced it was cutting about 27% of its employees “over the course of 2025” as part of a reorganization program. Based on employment data available at the time of the layoffs, BioSpace estimated the cuts could have affected about 140 people.

Regarding the reorganization, Intellia said in its announcement that it would focus its efforts and resources on high-value programs, specifically its investigational gene editors NTLA-2002 for hereditary angioedema and nexiguran ziclumeran (nex-z) for transthyretin amyloidosis.

Watertown, Massachusetts–based Lyndra Therapeutics, which was developing long-acting oral therapies, had the second-largest layoff. In March, the Boston Business Journal reported that the biotech was winding down operations after running out of cash, a move that would affect about 60 employees.

Early April Continues Trend of Increased Job Competition

Those who are looking for biopharma employment in California and Massachusetts are likely finding the job market challenging, based on BioSpace data. The first two weeks of April reflect a year-over-year trend of increased competition for fewer roles, with a sharp upturn in applications for jobs posted on the website.

- In California, there were 10% fewer job postings live and 97% more applications.

- In Massachusetts, there were 6% fewer jobs live and 167% more applications.

The increased competition is likely due in part to continued layoffs. There have already been several workforce reductions in California and Massachusetts this month, affecting at least 345 employees, according to BioSpace tallies. In addition, the Department of Health and Human Services began cutting 10,000 employees April 1, which could have prompted some longtime government workers to apply for jobs at biopharma companies.

Interested in more career insights? Subscribe to Career Insider to receive our quarterly life sciences job market reports, career advice and more.