Within the next six years, the multiple myeloma market is projected to be $37.5 billion – an incredible growth of $30 billion since 2015, when the market was valued at about $7.5 billion.

Within the next six years, the multiple myeloma market is projected to be $37.5 billion – an incredible growth of $30 billion since 2015, when the market was valued at about $7.5 billion.

Market drivers are expected to include the “constant introduction of newer and effective therapeutic options and high adoption rates of the same,” according to an analysis conducted by Grand View Research. Celgene’s blockbuster drug Revlimid is one of the biggest drugs in the multiple myeloma space, bringing in about $2 billion in annual revenue for the company. But more medications could soon be available to treat patients with various forms of the disease.

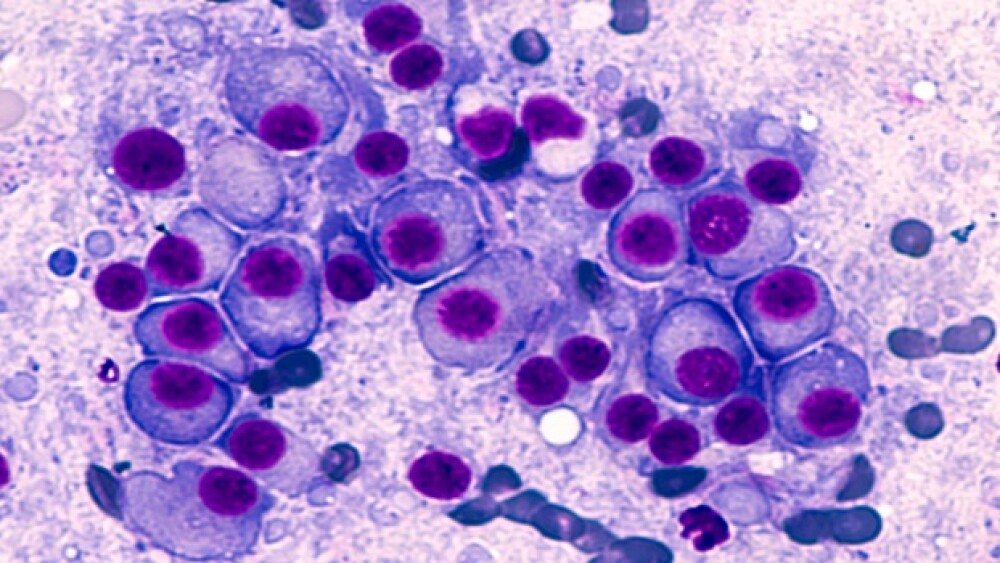

Multiple myeloma is an incurable cancer found in bone marrow. There are more than 118,000 people living with, or in remission from, multiple myeloma in the United States. Approximately 30,280 Americans are diagnosed with multiple myeloma each year and 12,590 patient deaths are reported on an annual basis, according to the American Cancer Society.

In the last three years the U.S. Food and Drug Administration (FDA) has approved several new therapies aimed at treating multiple myeloma, including Novartis’ Farydak, which was approved in 2015, Janssen’s Darzalex, a CD38-directed antibody that picked up a new indication for multiple myeloma earlier this month; Takeda’s Ninlaro, which was approved by the FDA in 2015; and Empliciti, co-developed by AbbVie and Bristol-Myers Squibb. The new drug approvals have provided some therapeutic benefit to multiple myeloma patients but there are more treatments in development, with some near to seeking FDA approval.

Earlier this month Newton, Mass.-based Karyopharm Therapeutics announced it will seek FDA approval for its investigational drug selinexor following strong top-line results from a Phase IIb trial. Karyopharm said 25.4 percent of refractory multiple myeloma patients on the drug achieved an overall response during the mid-stage trial. Karyopharm said that strong response included two complete responses and 29 partial or very good partial responses. The median duration of response was 4.4 months. With the strong results in hand, as well as the FDA’s Fast-Track designation, the company is aiming to seek approval later this year. Karyopharm said it will request an expedited review in order to potentially make the treatment more readily available for patients. The company also intends to seek regulatory approval in Europe from the European Medicines Agency in early 2019.

Also this month Janssen announced Darzalex in combination with Takeda’s Velcade and prednisone snagged FDA approval for the treatment of patients with newly diagnosed multiple myeloma who are ineligible for autologous stem cell transplant (ASCT). Approval was granted based on clinical studies that showed the combination treatment reduced the risk of disease progression or death by 50 percent. Andrzej Jakubowiak, a study investigator and director of the Multiple Myeloma Program at University of Chicago Medical Center, hailed the FDA approval. Jakubowiak said the treatment is the first antibody-based regimen for those transplant-ineligible multiple myeloma patients.

New Jersey-based Celgene is also eying approval for its late-stage multiple myeloma drug. In February the company said its combination treatment of Pomalyst/Imnovid (pomalidomide) plus bortezomib and low-dose dexamethasone met its primary endpoint in progression-free survival in patients with relapsed/refractory multiple myeloma. Celgene said at the time that its triple-combination treatment was the only late-stage drug for patients who have previously been treated with Revlimid (lenalidomide) and had their cancer return. In the late-stage trial the triple combination therapy demonstrated a statistically significant and clinically meaningful improvement in progression-free survival, Celgene announced. Paul Richardson, the director of Clinical Research at the Jerome Lipper Multiple Myeloma Center at the Dana Farber Cancer Institute and lead investigator of the Celgene trial, said researchers “see the PVd combination as an important step in improving care, and especially for patients previously treated with lenalidomide in this setting.”

Amgen is also banking on securing a new indication for its multiple myeloma drug Kyprolis. In October 2017 the company released late-stage data that a stronger weekly dose of Kyprolis combined with dexamethasone had a greater progression-free survival benefit of 3.6 months than a twice-weekly dose of the drug at the approved dosing level. The median progression-free survival in the once-per-week group was 11.2 months, compared to the 7.6 months for patients taking the twice-per-week dose combined with dexamethasone.

In addition to the late-stage drugs, there are multiple early and mid-stage drugs that look to be promising. In December 2017 Celgene and bluebird bio released data for an early stage CAR-T therapy for patients with late-stage relapsed/refractory multiple myeloma that yielded promising results. Seattle Genetics, launched a Phase I study in March for SGN-CD48A, an antibody-drug conjugate that has the potential to be used as a monotherapy treatment. The experimental SGN-CD48A targets the CD48 protein, which is highly expressed on multiple myeloma cells. Both of these treatments though are a long way away from becoming a reality for patients. There is a chance that neither one could ever make it to the FDA.