Wall Street is no longer enamored with NASH drug developers.

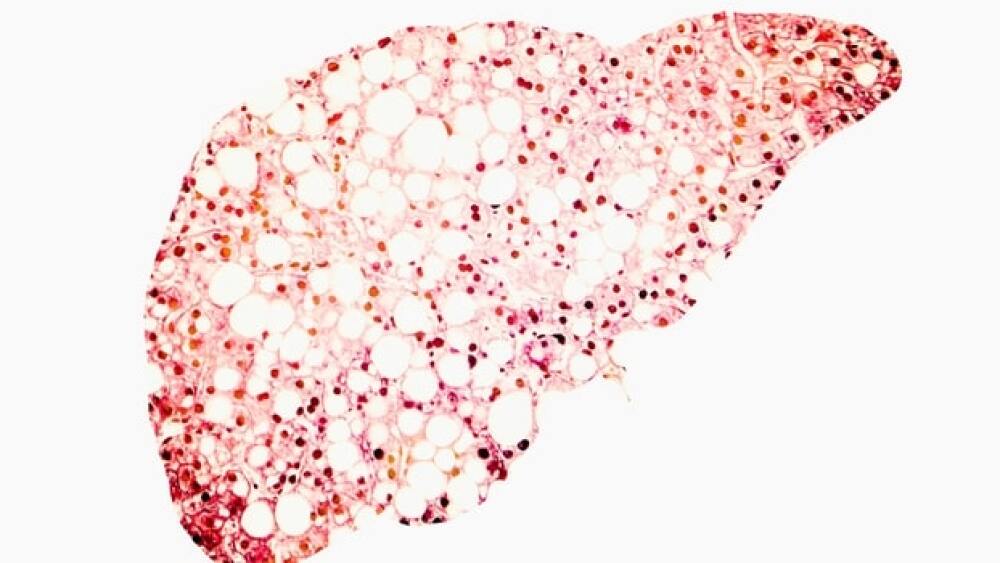

Courtesy of Getty Images

Wall Street loves a juicy value proposition. Over the course of 2014 to 2018, publicly traded drugmakers with assets in the nonalcoholic steatohepatitis (NASH) space were in vogue among retail and institutional investors alike.

NASH rose to prominence in the investing world during this period for four key reasons:

- There are no FDA-approved medications to directly treat NASH.

- NASH incidence rates are skyrocketing across the globe, thanks to the out-of-control obesity and diabetes epidemics.

- Wall Street estimated that this untapped drug market could generate annual sales in excess of $35 billion per year.

- This four-year period saw a handful of drugmakers make significant progress in the clinic with their lead NASH candidates.

Intercept Pharmaceuticals, for example, was gearing up to evaluate its selective FXR agonist, Ocaliva (obeticholic acid), in a registration-enabling Phase III study for NASH. And in mid-2018, Madrigal Pharmaceuticals announced positive Phase II results for its thyroid hormone receptor beta agonist, resmetirom, as a treatment for this serious liver ailment, thereby setting the stage for another promising compound to enter late-stage testing.

Boom-and-Bust in NASH Stocks

As a result of the industry’s steady progress in the clinic, coupled with the enormous commercial opportunity inherent in NASH, NASH stocks soared over the course of 2014 to 2018.

Keeping with this theme, Intercept’s market cap swelled to more than $8 billion at its apex, and Madrigal’s market cap jumped by 300% in a single month to $4.5 billion, following its positive mid-stage data drop for resmetirom.

Then, the bottom fell out.

Intercept and Madrigal’s stock prices have since lost 93 and 76%, respectively, from their former all-time highs. Viking Therapeutics, a company with another thyroid hormone receptor beta agonist (VK2809) in mid-stage development for NASH, shed 78% of its market cap over the prior four years.

This tale of value destruction hasn’t been limited to these four high-profile companies.

Most clinical or early commercial-stage companies developing NASH drugs lost a significant chunk of their market cap since this valuation crescendo roughly four years ago.

What Happened?

The NASH value proposition imploded for four overarching reasons:

- Since 2018, several industry giants, such as Novo Nordisk and Gilead Sciences, among others, have all posted disappointing clinical trial results in NASH.

- In 2020, the FDA rejected Intercept’s Ocaliva’s NASH treatment over its risk-to-reward ratio. The company has since stated it plans to resubmit the drug for review based on a new late-stage data analysis, but the market remains unconvinced based on Intercept’s downbeat performance in 2022 (the company’s shares fell 10.5 percent over the first 11 months of the year).

- NASH monotherapies have come under scrutiny by clinicians in recent years due to the extreme heterogeneity in co-morbidities, degree of liver fibrosis and genetic polymorphisms within this patient population. Combo therapies, which target specific disease-causing elements within the various NASH sub-populations, may be required in this setting.

- Right now, the gold standard for distinguishing NASH from simple steatosis is an invasive liver biopsy. Various biomarker diagnostics are being developed for NASH. But until less invasive diagnostics are available, any approved medications will likely have to face this onerous prescribing hurdle.

NASH Remains a Hotbed of Pharmaceutical Research

Despite Wall Street’s change of heart toward NASH drugs over the past four years, this liver ailment remains a top prize for drugmakers. Underscoring this point, there are currently 316 active clinical trials ongoing for NASH, according to clinicaltrials.gov. And within this varied space, there are five compounds presently in late-stage development (see Table 1 below).

Table 1: Late-stage compounds in development for NASH.

| Company | Therapeutic | Class/MOA | Topline Data Estimate |

| Inventiva | Lanifibranor | Pan-PPAR agonist, anti-fibrotic, anti-inflammatory | First half of 2024 |

| Intercept Pharmaceuticals | Obeticholic acid | FXR agonist, anti-fibrotic | N/A |

| Galmed Pharmaceuticals | Aramchol | SCD1 modulator, liver fat metabolism | TBA |

| Madrigal Pharmaceuticals | Resmetirom | (THR) β- agonist, liver homeostasis | Q4, 2022 |

| Novo Nordisk | Ozempic (semaglutide) | GLP-1 receptor agonist, anti-inflammatory, metabolic | Mid-2028 |

Landmark Data Readouts are Close at Hand

Madrigal’s ongoing late-stage trial, known as MAESTRO-NASH, could prove to be a turning point for experimental NASH medications at large. The key reason is that this study has both the size and scope to rigorously evaluate resmetirom as a NASH monotherapy.

Digging into the details, the late-stage MAESTRO-NASH trial enrolled 2,000 patients with biopsy-proven NASH. It included patients with a variety of liver fibrosis scores, with at least half of these patients presenting with an advanced form of fibrosis.

Wall Street will pay close attention to how resmetirom fares on the study’s dual primary surrogate endpoints of NASH resolution with ≥2-point reduction in NAS (NAFLD Activity Score), and with no worsening of fibrosis OR a 1-point decrease in fibrosis with no worsening of NASH.

What’s more, this pivotal data readout ought to have important ramifications for earlier-stage NASH compounds such as Viking Therapeutics’ VK2809.

Viking is presently trialing VK2809 in a Phase IIb trial in biopsy-confirmed NASH patients, a drug that belongs to the same therapeutic class as resmetirom.

Dr. Brian Lian, president and chief executive officer at Viking, told BioSpace that VK2809’s topline NASH data are currently on track for the second quarter of 2023.

Can These Data Readouts Reignite Investor Interest in NASH?

The NASH monotherapy hypothesis doesn’t seem to have many true believers in either the pharmaceutical industry or on Wall Street. After all, the top pharmaceutical research firm Evaluate Pharma didn’t include a single NASH medication in its recent list of most valuable research and development projects.

This omission is indicative of the industry’s sentiment toward NASH monotherapies. This advanced form of fatty liver disease is prevalent enough that it ought to easily support multiple mega-blockbuster drugs (sales in excess of $5 billion per year), and perhaps even one top 10 best-selling drugs on an annual basis.

Yet, NASH failed to land on this closely watched pharma research report.

These Madrigal data will either sharply reframe the NASH monotherapy debate or lend further support to the thesis that tailormade combination approaches might be the only way to go.