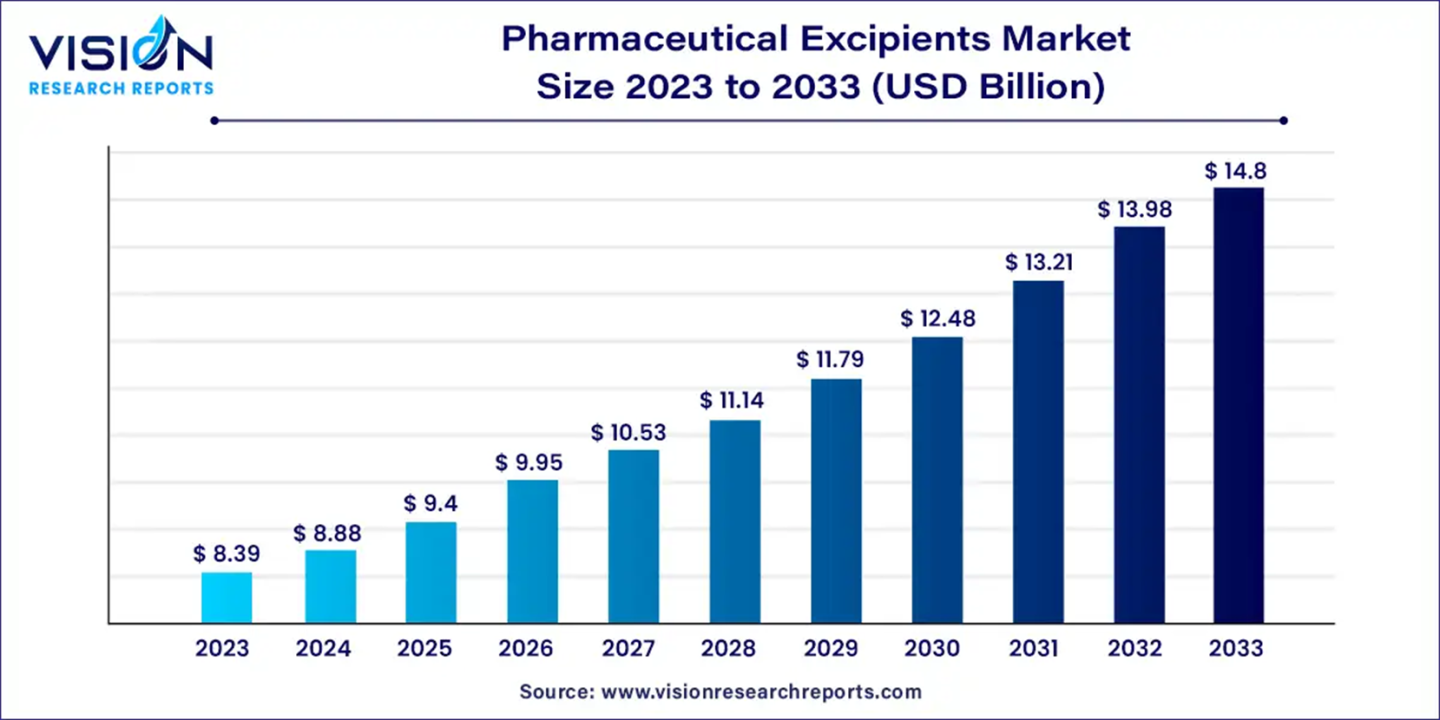

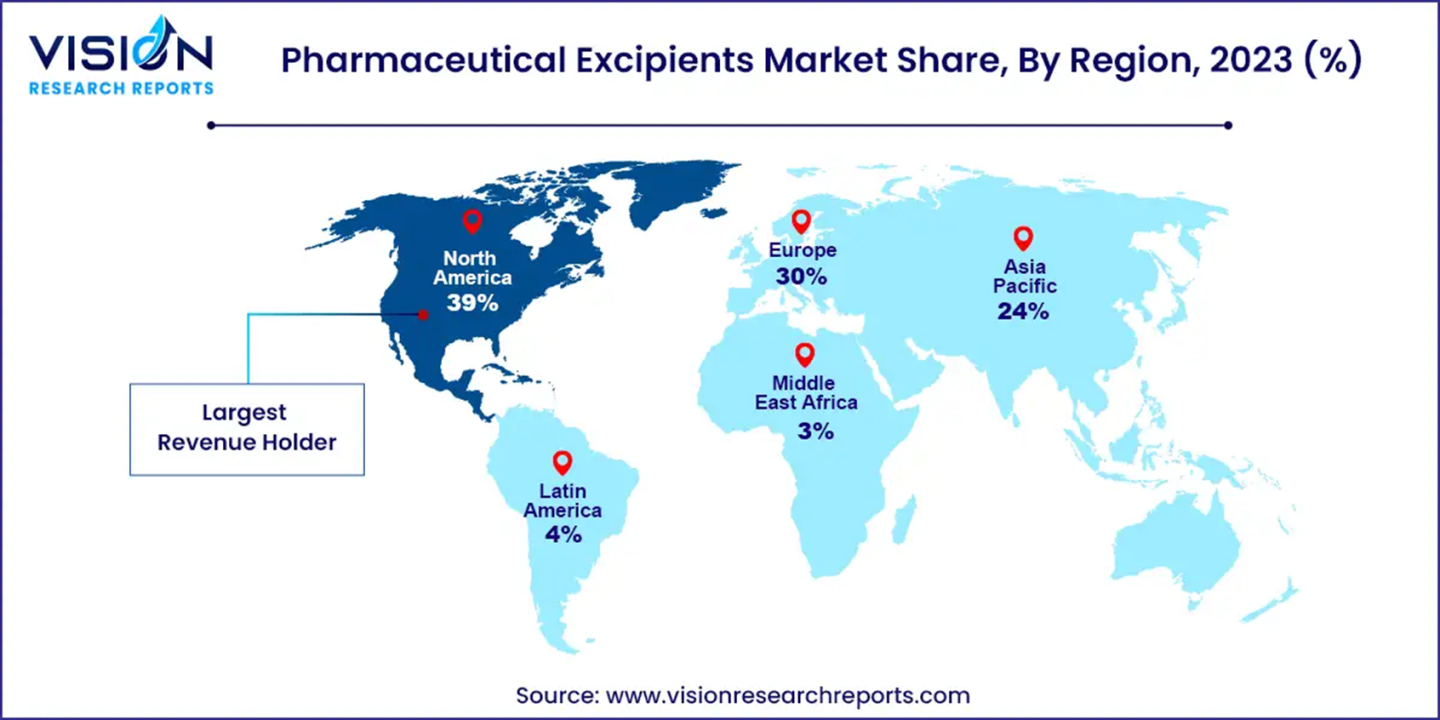

According to Vision Research Reports, the global pharmaceutical excipients market size was evaluated at US$ 8.39 billion in 2023 and is expected to set around US$ 14.80 billion by 2033, growing at a CAGR of 5.84% from 2024 to 2033. The North America pharmaceutical excipients market was accounted market share of 39% in 2023.

Excipients are most important in the formulation and formulation of dosage forms and contribute to the growth of the business. These excipients are derived from various drug classes and are manufactured in various manufacturing methods, either in batch or continuous. These excipients can be derived from synthetic as well as natural products. Their ability to perform multiple tasks based on their physical and chemical activities enhances their effectiveness in many forms, tailoring applications to exact needs. The growth of the pharmaceutical excipients market is driven by the diverse and wide-ranging sources of excipients.

FREE sample includes data points, ranging from trend analyses to estimates and forecasts@ https://www.visionresearchreports.com/report/sample/35592

What are Pharmaceutical Excipients?

Pharmaceutical excipients are inactive substances that are included in drug formulations alongside the active pharmaceutical ingredient (API). Their primary function is to aid in the drug's production, stability, and effectiveness. While they don’t have therapeutic effects themselves, excipients ensure that medications are delivered in the most effective and reliable way possible.

Report Highlights

· North America pharmaceutical excipients market size is anticipated to reach around USD 5.77 billion by 2033 and growing at a CAGR of 6.02% from 2024 to 2033.

· Europe pharmaceutical excipients market size is anticipated to reach around USD 4.44 billion by 2033 and expanding at a CAGR of 5.34% from 2024 to 2033.

· Asia Pacific pharmaceutical excipients market size is anticipated to grow at a CAGR of 6.56% from 2024 to 2033 and to reach valuation USD 3.55 billion by 2033.

· North America dominated the market with the largest market share of 39% in 2023.

· By excipient type, the lactose-based excipients registered the maximum market share of 42% in 2023.

· By functionality, the binders & fillers contributed the largest market share of 50% in 2023.

Pharmaceutical Excipients Market at a Glance

The pharmaceutical excipients market is experiencing rapid growth due to the important role these ingredients play in drug formulations. Excipients are constituents other than the active pharmaceutical ingredient (API) that are essential for the performance of the finished pharmaceutical product. They are used as lubricants, diluents, binders, flavors, coatings, and colorants and are generally inert. Their functional roles include improving API bioavailability and solubility, improving stability, controlling osmotic pressure and pH in liquid formulations, and preventing separation and aggregation. Excipients like as preservatives, dyes, sweeteners, flavor enhancers, thickeners, emulsifiers, stabilizers, and antioxidants enhance the stability, durability, and palatability of the product, thereby improving therapeutics and paving the way for commercial expansion.

· In October 2022, Roquette announced the launch of two next-generation mannitol products for direct compression: PEARLITOL CR-H and PEARLITOL 200 GT. These excipients are designed to address unique drug formulation challenges, enabling manufacturers to optimize direct compression processes and expand into new application areas, such as controlled release tablets and mini tabs.

Get Full Access of this Report@ https://www.visionresearchreports.com/report/checkout/35592

The Role of Excipients in Drug Formulation

· Enhancing Drug Stability: Excipients help in maintaining the chemical stability of the active ingredient. They can protect drugs from moisture, light, and oxygen, which might otherwise degrade the API. For instance, antioxidants and preservatives are common excipients used to extend the shelf life of medications.

· Improving Drug Bioavailability: Excipients can enhance the absorption of drugs in the body. Some excipients help in solubilizing poorly soluble APIs, which improves their bioavailability. This means that the drug is more efficiently absorbed into the bloodstream, increasing its efficacy.

· Facilitating Drug Delivery: Controlled release and targeted delivery are possible due to specific excipients. These substances can modify the drug's release profile, allowing for sustained or controlled release over time. This is particularly important for chronic conditions where consistent medication levels are required.

Importance of Excipients in Drug Development

Pharmaceutical excipients are more than just passive ingredients in drug formulations; they are pivotal in ensuring that medications are effective, safe, and stable. Their importance in drug development cannot be overstated, as they contribute to every stage of a drug's lifecycle, from formulation to patient administration. Here’s a detailed look at why excipients are crucial in drug development:

1. Ensuring Drug Stability

One of the primary roles of excipients is to enhance the stability of the drug. They help protect the active pharmaceutical ingredient (API) from environmental factors such as moisture, light, and oxygen, which can cause degradation. For instance, antioxidants and preservatives can prevent oxidation and microbial growth, respectively, thus extending the drug's shelf life and maintaining its efficacy over time.

2. Enhancing Bioavailability

Bioavailability refers to the extent and rate at which the active ingredient is absorbed into the bloodstream. Excipients play a significant role in improving bioavailability by enhancing the solubility of poorly soluble drugs. Solubilizers and absorption enhancers help in dissolving the API more effectively, ensuring that it reaches the systemic circulation in sufficient amounts for therapeutic action.

3. Facilitating Controlled Drug Release

Excipients can modify the release profile of a drug, allowing for controlled or extended release. This means that the drug can be released at a specific rate over an extended period, rather than all at once. This controlled release can lead to more consistent therapeutic effects and reduced side effects. Polymers and matrix materials are often used in formulations to achieve this controlled release.

4. Improving Patient Compliance

The palatability of a drug is crucial for patient acceptance, especially for oral medications. Excipients such as flavorings and sweeteners can improve the taste and make the drug more pleasant to consume. Additionally, coatings can mask unpleasant flavors and make tablets easier to swallow, thereby improving patient compliance with the prescribed treatment regimen.

5. Enhancing Drug Manufacturing

In drug development, excipients are used to improve the manufacturability of the drug product. They can aid in the compression of tablets, ensure smooth filling of capsules, and prevent sticking of the drug formulation to machinery. Lubricants and binders are key excipients that facilitate the manufacturing process and ensure consistent quality.

Report Scope

Advancements in Healthcare and Technology to Drive the Market’s Growth

The pharmaceutical industry is experiencing radical change driven by increasing medical needs and technological advances. Excipients play a major role in modern pharmaceutical formulations, affecting their quality, safety and efficacy. The increasing demand for better processing has led to the development of new classes of active ingredients, such as encapsulants for micro/nanoparticles and surfactants for micro/nanoemulsions. These excipients are derived from natural as well as synthetic sources and are characterized by functionally relevant properties that are important for optimizing drug delivery and performance. This change is driving the proliferation of pharmaceutical excipients.

Development Risks and Cost Barriers to Hamper the Market’s Growth

The pharmaceutical industry faces significant challenges in adopting new products due to development and risk management. Limited safety data necessitates more clinical studies in larger subjects to assess the safety of these products, which increases testing and costs. Also, the ingenuity of new products (available only from a new manufacturer) increases packaging costs and disrupts the overall market. Together, these factors limit the expansion of pharmaceutical excipients.

Enhancing Delivery and Manufacturing

The advancement of new excipients has transformed the distribution, use, and manufacturing of drugs, providing significant opportunities for the pharmaceutical excipient industry. These new excipients help improve patient compliance, alternative routes of administration, and safety, while also facilitating access to new therapies to meet medical needs. Reducing regulatory barriers further facilitates rapid and cost-effective distribution of biotechnology products. Moreover, excipients designed for continuous manufacturing processes with optimized flow rates and uniformity can streamline manufacturing and create growth opprtunity for the pharmaceutical excipient industry.

· In May 2024, IFF introduced a new controlled release platform for its portfolio of controlled release products, including METHOCEL, ETHOCEL, and POLYOX. Under the banner “Timing is Everything,” this platform offers comprehensive solutions aimed at improving patient compliance through the controlled release of active ingredients.

Why is North America dominated in the pharmaceutical market?

North America is dominated in the pharmaceutical market in which the Mexican pharmaceutical industry plays an important role. While three unresolved issues prevent effective cooperation between Mexico and the United States, Mexico has a significant opportunity to address the imbalance in the U.S. economy. The Canadian pharmaceutical industry is known for its innovation, including companies involved in the development and production of new drugs, products and over-the-counter medications. There are around 400 clinics in Mexico, in the Mexico City metropolitan area and in the Mexican states of Jalisco, Puebla, and Morelos. The Mexican pharmaceutical industry is recognised to be home to 20 of the world's 25 largest pharmaceutical companies, reflecting its huge effect and potential in the regional economy.

Why is Europe growing faster in the pharmaceutical excipient market?

Europe is fastest growing region in the pharmaceutical excipient market. With increased focus on new drug R&D, the European pharmaceutical market is expected to grow significantly during the forecast period. The project forms the backbone of the European Union (EU) economy and helps create jobs, R&D investment, and innovation. The region’s increasing to digitizing and using real-world data opens up new opportunities for the development of drugs and medicine, improves the role of industry in delivering better results, and sustains Europe’s competitive advantage in the global pharmaceutical market.

· In March 2024, Croda International Plc (Croda) and The Access to Advanced Health Institute (AAHI) signed a partnership agreement to innovate and develop adjuvant formulations. This collaboration aims to leverage their combined expertise to make novel vaccine adjuvant formulations globally accessible, advancing the development of next-generation, robust, and durable vaccines.

Recent Breakthroughs by Key Players

· In January 2024, the Competition Commission of India (CCI) approved IMCD India Private Limited’s acquisition of the remaining 30% equity stake in Signet Excipients Private Limited. This acquisition relates to IMCD India exercising a call option to acquire the outstanding stake in Signet Excipients.

· In March 2024, IFF announced that it had entered into a definitive agreement to sell its Pharma Solutions business unit to Roquette for an enterprise value of up to $2.85 billion, representing an enterprise value to EBITDA multiple of approximately 13x.

We value your investment, get customization@ https://www.visionresearchreports.com/report/customization/35592

Report Highlights

By Functionality

The pharmaceutical excipients industry is divided into multiple segments including fillers and diluents, binders, suspending and viscosity agents, sweeteners and flavorings, coating agents, colorants, disintegrants, lubricants and flow aids, preservatives, emulsifiers. Among these, fillers and diluents dominate the market and hold the largest share. Also known as fillers or excipients, these substances are significant in drug manufacturing to enhance bulk and volume to the drug. They play an important role in improving the design and performance of pharmaceutical products, thus making their products significant.

By Excipient Type

Lactose based excipients are marketed and hold the largest share due to their excellent physical and chemical characteristics such as chemical inertness, stability and non-toxicity as well as reasonable prices. While alternatives such as mannitol, fructose, trehalose and microcrystalline cellulose are available, lactose monohydrate is still one of the most widely applicable products in the pharmaceutical industry. The continued commercialization of lactose excipients reflects their important role in drug development due to their reliability and efficacy.

The cellulose-based excipients segment is expected to significant annual growth (CAGR). These excipients are derived from purified, partially depolymerized cellulose through acid hydrolysis of alpha-cellulose in high-quality wood pulp, preserving the chemical structure of native cellulose. Pharmaceutical grade cellulose is available as a white powder, free-flowing fiber. One of the most abundant biopolymers and the main structural component of plant cell walls, cellulose consists of many β-D-glucose units linked by glycosidic bonds to form cross-linked chains. The principle of this natural polymer makes it an important step in drug formulations.

Related Reports

· U.S. Pharmaceutical Filtration Market Report 2024-2033: https://www.visionresearchreports.com/us-pharmaceutical-filtration-market/41267

· U.S. Microbial Fermentation Technology Market Report 2024-2033: https://www.visionresearchreports.com/us-microbial-fermentation-technology-market/41262

· North America Life Science Tools Market Report 2024-2033: https://www.visionresearchreports.com/north-america-life-science-tools-market/41152

Key Players Pharmaceutical Excipients Market

· Bio-Rad Laboratories Inc.

· Abbott Laboratories

· Biosensors International Group Ltd.

· DuPont Biosensor Materials

· Pinnacle Technologies Inc.

· Johnson & Johnson

· Molecular Devices Corporation

· QTL Biodetection LLC

· TDK Corporation

· Zimmer & Peacock AS

Market Segmentation

· By Functionality

o Fillers and Diluents

o Suspending and Viscosity Agents

o Coating Agents

o Binders

o Disintegrants

o Colorants

o Lubricants and Glidants

o Preservatives

o Emulsifying Agents

o Flavoring Agents and Sweeteners

o Other Functionalities

· By Excipient Type

o Lactose-based Excipients

§ α-lactose monohydrate

§ Anhydrous α-lactose

§ Anhydrous β-lactose

§ Amorphous Lactose

o Cellulose-based

§ Microcrystalline Cellulose (MCC)

§ Cellulose Ethers

§ Others

o Starches

o Carboxymethylcellulose Sodium (CCS)

o Sodium Starch Glycolate (SSG)

o Fine Chemicals

o Mannitol

o Biopharma Excipients

o Others

By Geography

· North America

· Europe

· Asia Pacific

· Latin America

· Middle East & Africa (MEA)

Get Full Access of this Report@ https://www.visionresearchreports.com/report/checkout/35592

USA : +1 650 460 3308 | IND : +91 87933 22019 | Europe : +44 2080772818

Email@ sales@visionresearchreports.com

Excipients are most important in the formulation and formulation of dosage forms and contribute to the growth of the business. These excipients are derived from various drug classes and are manufactured in various manufacturing methods, either in batch or continuous. These excipients can be derived from synthetic as well as natural products. Their ability to perform multiple tasks based on their physical and chemical activities enhances their effectiveness in many forms, tailoring applications to exact needs. The growth of the pharmaceutical excipients market is driven by the diverse and wide-ranging sources of excipients.

FREE sample includes data points, ranging from trend analyses to estimates and forecasts@ https://www.visionresearchreports.com/report/sample/35592

What are Pharmaceutical Excipients?

Pharmaceutical excipients are inactive substances that are included in drug formulations alongside the active pharmaceutical ingredient (API). Their primary function is to aid in the drug's production, stability, and effectiveness. While they don’t have therapeutic effects themselves, excipients ensure that medications are delivered in the most effective and reliable way possible.

| Report Coverage | Details |

| Pharmaceutical Excipients Market Size | USD 14.8 Billion by 2033 |

| Pharmaceutical Excipients Market Growth Rate | CAGR of 5.84% |

| North America Pharmaceutical Excipients Market Share | 39% in 2023 |

| Europe Pharmaceutical Excipients Market Share | 30% in 2023 |

| APAC North America Pharmaceutical Excipients Market Share | 24% in 2023 |

Report Highlights

· North America pharmaceutical excipients market size is anticipated to reach around USD 5.77 billion by 2033 and growing at a CAGR of 6.02% from 2024 to 2033.

· Europe pharmaceutical excipients market size is anticipated to reach around USD 4.44 billion by 2033 and expanding at a CAGR of 5.34% from 2024 to 2033.

· Asia Pacific pharmaceutical excipients market size is anticipated to grow at a CAGR of 6.56% from 2024 to 2033 and to reach valuation USD 3.55 billion by 2033.

· North America dominated the market with the largest market share of 39% in 2023.

· By excipient type, the lactose-based excipients registered the maximum market share of 42% in 2023.

· By functionality, the binders & fillers contributed the largest market share of 50% in 2023.

Pharmaceutical Excipients Market at a Glance

The pharmaceutical excipients market is experiencing rapid growth due to the important role these ingredients play in drug formulations. Excipients are constituents other than the active pharmaceutical ingredient (API) that are essential for the performance of the finished pharmaceutical product. They are used as lubricants, diluents, binders, flavors, coatings, and colorants and are generally inert. Their functional roles include improving API bioavailability and solubility, improving stability, controlling osmotic pressure and pH in liquid formulations, and preventing separation and aggregation. Excipients like as preservatives, dyes, sweeteners, flavor enhancers, thickeners, emulsifiers, stabilizers, and antioxidants enhance the stability, durability, and palatability of the product, thereby improving therapeutics and paving the way for commercial expansion.

· In October 2022, Roquette announced the launch of two next-generation mannitol products for direct compression: PEARLITOL CR-H and PEARLITOL 200 GT. These excipients are designed to address unique drug formulation challenges, enabling manufacturers to optimize direct compression processes and expand into new application areas, such as controlled release tablets and mini tabs.

Get Full Access of this Report@ https://www.visionresearchreports.com/report/checkout/35592

The Role of Excipients in Drug Formulation

· Enhancing Drug Stability: Excipients help in maintaining the chemical stability of the active ingredient. They can protect drugs from moisture, light, and oxygen, which might otherwise degrade the API. For instance, antioxidants and preservatives are common excipients used to extend the shelf life of medications.

· Improving Drug Bioavailability: Excipients can enhance the absorption of drugs in the body. Some excipients help in solubilizing poorly soluble APIs, which improves their bioavailability. This means that the drug is more efficiently absorbed into the bloodstream, increasing its efficacy.

· Facilitating Drug Delivery: Controlled release and targeted delivery are possible due to specific excipients. These substances can modify the drug's release profile, allowing for sustained or controlled release over time. This is particularly important for chronic conditions where consistent medication levels are required.

Importance of Excipients in Drug Development

Pharmaceutical excipients are more than just passive ingredients in drug formulations; they are pivotal in ensuring that medications are effective, safe, and stable. Their importance in drug development cannot be overstated, as they contribute to every stage of a drug's lifecycle, from formulation to patient administration. Here’s a detailed look at why excipients are crucial in drug development:

1. Ensuring Drug Stability

One of the primary roles of excipients is to enhance the stability of the drug. They help protect the active pharmaceutical ingredient (API) from environmental factors such as moisture, light, and oxygen, which can cause degradation. For instance, antioxidants and preservatives can prevent oxidation and microbial growth, respectively, thus extending the drug's shelf life and maintaining its efficacy over time.

2. Enhancing Bioavailability

Bioavailability refers to the extent and rate at which the active ingredient is absorbed into the bloodstream. Excipients play a significant role in improving bioavailability by enhancing the solubility of poorly soluble drugs. Solubilizers and absorption enhancers help in dissolving the API more effectively, ensuring that it reaches the systemic circulation in sufficient amounts for therapeutic action.

3. Facilitating Controlled Drug Release

Excipients can modify the release profile of a drug, allowing for controlled or extended release. This means that the drug can be released at a specific rate over an extended period, rather than all at once. This controlled release can lead to more consistent therapeutic effects and reduced side effects. Polymers and matrix materials are often used in formulations to achieve this controlled release.

4. Improving Patient Compliance

The palatability of a drug is crucial for patient acceptance, especially for oral medications. Excipients such as flavorings and sweeteners can improve the taste and make the drug more pleasant to consume. Additionally, coatings can mask unpleasant flavors and make tablets easier to swallow, thereby improving patient compliance with the prescribed treatment regimen.

5. Enhancing Drug Manufacturing

In drug development, excipients are used to improve the manufacturability of the drug product. They can aid in the compression of tablets, ensure smooth filling of capsules, and prevent sticking of the drug formulation to machinery. Lubricants and binders are key excipients that facilitate the manufacturing process and ensure consistent quality.

Report Scope

| Report Coverage | Details |

| Pharmaceutical Excipients Market Size in 2033 | USD 14.80 Billion |

| North America Pharmaceutical Excipients Market Size in 2023 | USD 3.27 Billion |

| Europe Pharmaceutical Excipients Market Size in 2023 | USD 2.31 Billion |

| Asia Pacific Pharmaceutical Excipients Market Size in 2023 | USD 1.91 Billion |

| MEA Pharmaceutical Excipients Market Size in 2023 | USD 454.65 Million |

Advancements in Healthcare and Technology to Drive the Market’s Growth

The pharmaceutical industry is experiencing radical change driven by increasing medical needs and technological advances. Excipients play a major role in modern pharmaceutical formulations, affecting their quality, safety and efficacy. The increasing demand for better processing has led to the development of new classes of active ingredients, such as encapsulants for micro/nanoparticles and surfactants for micro/nanoemulsions. These excipients are derived from natural as well as synthetic sources and are characterized by functionally relevant properties that are important for optimizing drug delivery and performance. This change is driving the proliferation of pharmaceutical excipients.

Development Risks and Cost Barriers to Hamper the Market’s Growth

The pharmaceutical industry faces significant challenges in adopting new products due to development and risk management. Limited safety data necessitates more clinical studies in larger subjects to assess the safety of these products, which increases testing and costs. Also, the ingenuity of new products (available only from a new manufacturer) increases packaging costs and disrupts the overall market. Together, these factors limit the expansion of pharmaceutical excipients.

Enhancing Delivery and Manufacturing

The advancement of new excipients has transformed the distribution, use, and manufacturing of drugs, providing significant opportunities for the pharmaceutical excipient industry. These new excipients help improve patient compliance, alternative routes of administration, and safety, while also facilitating access to new therapies to meet medical needs. Reducing regulatory barriers further facilitates rapid and cost-effective distribution of biotechnology products. Moreover, excipients designed for continuous manufacturing processes with optimized flow rates and uniformity can streamline manufacturing and create growth opprtunity for the pharmaceutical excipient industry.

· In May 2024, IFF introduced a new controlled release platform for its portfolio of controlled release products, including METHOCEL, ETHOCEL, and POLYOX. Under the banner “Timing is Everything,” this platform offers comprehensive solutions aimed at improving patient compliance through the controlled release of active ingredients.

Why is North America dominated in the pharmaceutical market?

North America is dominated in the pharmaceutical market in which the Mexican pharmaceutical industry plays an important role. While three unresolved issues prevent effective cooperation between Mexico and the United States, Mexico has a significant opportunity to address the imbalance in the U.S. economy. The Canadian pharmaceutical industry is known for its innovation, including companies involved in the development and production of new drugs, products and over-the-counter medications. There are around 400 clinics in Mexico, in the Mexico City metropolitan area and in the Mexican states of Jalisco, Puebla, and Morelos. The Mexican pharmaceutical industry is recognised to be home to 20 of the world's 25 largest pharmaceutical companies, reflecting its huge effect and potential in the regional economy.

Why is Europe growing faster in the pharmaceutical excipient market?

Europe is fastest growing region in the pharmaceutical excipient market. With increased focus on new drug R&D, the European pharmaceutical market is expected to grow significantly during the forecast period. The project forms the backbone of the European Union (EU) economy and helps create jobs, R&D investment, and innovation. The region’s increasing to digitizing and using real-world data opens up new opportunities for the development of drugs and medicine, improves the role of industry in delivering better results, and sustains Europe’s competitive advantage in the global pharmaceutical market.

· In March 2024, Croda International Plc (Croda) and The Access to Advanced Health Institute (AAHI) signed a partnership agreement to innovate and develop adjuvant formulations. This collaboration aims to leverage their combined expertise to make novel vaccine adjuvant formulations globally accessible, advancing the development of next-generation, robust, and durable vaccines.

Recent Breakthroughs by Key Players

· In January 2024, the Competition Commission of India (CCI) approved IMCD India Private Limited’s acquisition of the remaining 30% equity stake in Signet Excipients Private Limited. This acquisition relates to IMCD India exercising a call option to acquire the outstanding stake in Signet Excipients.

· In March 2024, IFF announced that it had entered into a definitive agreement to sell its Pharma Solutions business unit to Roquette for an enterprise value of up to $2.85 billion, representing an enterprise value to EBITDA multiple of approximately 13x.

We value your investment, get customization@ https://www.visionresearchreports.com/report/customization/35592

Report Highlights

By Functionality

The pharmaceutical excipients industry is divided into multiple segments including fillers and diluents, binders, suspending and viscosity agents, sweeteners and flavorings, coating agents, colorants, disintegrants, lubricants and flow aids, preservatives, emulsifiers. Among these, fillers and diluents dominate the market and hold the largest share. Also known as fillers or excipients, these substances are significant in drug manufacturing to enhance bulk and volume to the drug. They play an important role in improving the design and performance of pharmaceutical products, thus making their products significant.

By Excipient Type

Lactose based excipients are marketed and hold the largest share due to their excellent physical and chemical characteristics such as chemical inertness, stability and non-toxicity as well as reasonable prices. While alternatives such as mannitol, fructose, trehalose and microcrystalline cellulose are available, lactose monohydrate is still one of the most widely applicable products in the pharmaceutical industry. The continued commercialization of lactose excipients reflects their important role in drug development due to their reliability and efficacy.

The cellulose-based excipients segment is expected to significant annual growth (CAGR). These excipients are derived from purified, partially depolymerized cellulose through acid hydrolysis of alpha-cellulose in high-quality wood pulp, preserving the chemical structure of native cellulose. Pharmaceutical grade cellulose is available as a white powder, free-flowing fiber. One of the most abundant biopolymers and the main structural component of plant cell walls, cellulose consists of many β-D-glucose units linked by glycosidic bonds to form cross-linked chains. The principle of this natural polymer makes it an important step in drug formulations.

Related Reports

· U.S. Pharmaceutical Filtration Market Report 2024-2033: https://www.visionresearchreports.com/us-pharmaceutical-filtration-market/41267

· U.S. Microbial Fermentation Technology Market Report 2024-2033: https://www.visionresearchreports.com/us-microbial-fermentation-technology-market/41262

· North America Life Science Tools Market Report 2024-2033: https://www.visionresearchreports.com/north-america-life-science-tools-market/41152

Key Players Pharmaceutical Excipients Market

· Bio-Rad Laboratories Inc.

· Abbott Laboratories

· Biosensors International Group Ltd.

· DuPont Biosensor Materials

· Pinnacle Technologies Inc.

· Johnson & Johnson

· Molecular Devices Corporation

· QTL Biodetection LLC

· TDK Corporation

· Zimmer & Peacock AS

Market Segmentation

· By Functionality

o Fillers and Diluents

o Suspending and Viscosity Agents

o Coating Agents

o Binders

o Disintegrants

o Colorants

o Lubricants and Glidants

o Preservatives

o Emulsifying Agents

o Flavoring Agents and Sweeteners

o Other Functionalities

· By Excipient Type

o Lactose-based Excipients

§ α-lactose monohydrate

§ Anhydrous α-lactose

§ Anhydrous β-lactose

§ Amorphous Lactose

o Cellulose-based

§ Microcrystalline Cellulose (MCC)

§ Cellulose Ethers

§ Others

o Starches

o Carboxymethylcellulose Sodium (CCS)

o Sodium Starch Glycolate (SSG)

o Fine Chemicals

o Mannitol

o Biopharma Excipients

o Others

By Geography

· North America

· Europe

· Asia Pacific

· Latin America

· Middle East & Africa (MEA)

Get Full Access of this Report@ https://www.visionresearchreports.com/report/checkout/35592

USA : +1 650 460 3308 | IND : +91 87933 22019 | Europe : +44 2080772818

Email@ sales@visionresearchreports.com