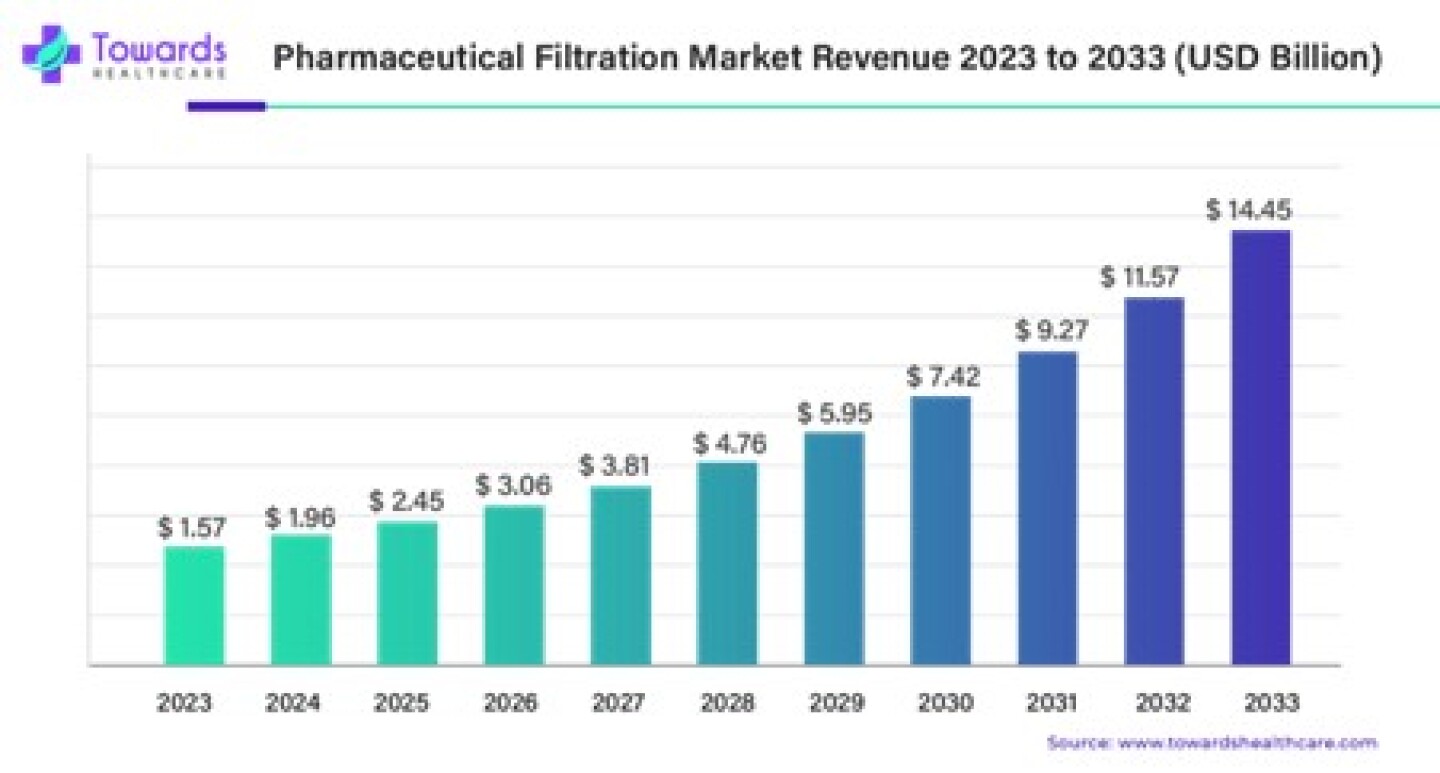

The global pharmaceutical filtration market size surpassed USD 1.57 billion in 2023 and is projected to reach around USD 14.45 billion by 2033, expanding at a CAGR of 8.08% from 2024 to 2033. The pharmaceutical filtration market is experiencing significant growth driven by advancements in biopharmaceutical production, increasing demand for biologics, and stringent regulatory requirements for drug safety and quality.

Download a short version of this report @ https://www.towardshealthcare.com/personalized-scope/5185

Key Takeaways

· North America dominated the pharmaceutical filtration market with the largest revenue share of 45% in 2023.

· Asia Pacific is expected to grow at a fastest CAGR of 14.50% during the forecast period.

· By product, the membrane filters segment has held a major revenue share of 28% in 2023.

· By technique, the microfiltration segment has contributed more than 36% of revenue share in 2023.

· By technique, the nanofiltration segment is projected to grow at a fastest CAGR of 10.24% during the forecast period.

· By type, the sterile segment has recorded more than 57% of revenue share in 2023.

· By application, the final product processing segment accounted for the largest revenue share in 43% in 2023.

· By the scale of operation, the manufacturing scale segment has captured the highest revenue share of 66% in 2023.

· By the scale of operation, the research and development scale segment is anticipated to grow at a fastest CAGR of 11.45% during the forecast period.

Pharmaceutical filtration is a critical process in the manufacturing of drugs. It involves removing unwanted particles, bacteria, and other contaminants from liquids and gases used in drug production. This ensures that the final product is pure and safe for consumption. Filters of various types, such as membrane filters and depth filters, are used to achieve this high level of cleanliness.

The pharmaceutical filtration market refers to the global industry focused on the development, production, and sale of filtration products and technologies used in the pharmaceutical industry. This market includes a wide range of products like filters, filtration systems, and related equipment. The market is growing rapidly due to increasing drug production, stricter regulatory standards, and the rising demand for biologics and vaccines.

Pharmaceutical Filtration Market at a Glance

The pharmaceutical filtration market is experiencing significant growth, driven by the increasing need for high-quality, safe medications. This growth is largely fueled by the rising prevalence of chronic diseases and a growing demand for generic drugs. Pharmaceutical filtration plays a crucial role in ensuring the purity and safety of medicines. It involves various filtration techniques to remove contaminants from pharmaceutical products, ensuring they meet stringent quality standards. Membrane filters, microfiltration, and nanofiltration are some of the key technologies used in this sector. These methods help in purifying and sterilizing products, which is essential for compliance with regulatory standards.

The market is also witnessing continuous technological advancements, which enhance the efficiency and effectiveness of filtration processes. Innovations such as new Integrity materials and automation are improving the performance of filtration systems, making them more adaptable to various pharmaceutical applications. The pharmaceutical filtration market is expanding rapidly due to the increasing demand for high-quality pharmaceuticals and continuous improvements in filtration technologies.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Rising Geriatric Population, Driver for Pharmaceutical Filtration Market

As the global population ages, there is a noticeable increase in the number of elderly individuals. This demographic shift is significant because older adults are more prone to chronic diseases such as diabetes, heart conditions, and respiratory issues. As a result, the demand for medications and healthcare solutions tailored to their needs is rising.

This growing need directly impacts the pharmaceutical industry, leading to a higher demand for various medications. Consequently, pharmaceutical companies are ramping up production, which requires efficient and reliable filtration solutions to ensure the purity and safety of their products.

For example, in recent years, countries like Japan and Germany, with notably aging populations, have seen a surge in the production and consumption of pharmaceutical products. To meet the stringent quality standards, these countries have adopted advanced filtration technologies to ensure that medications are free from contaminants.

A recent development that highlights this trend is the introduction of new filtration systems by major companies like Merck and Pall Corporation. These systems are designed to cater specifically to the pharmaceutical industry’s needs, offering enhanced filtration capabilities that can handle the increased production volumes driven by the growing geriatric population.

Increasing Demand for Biopharmaceuticals

In recent years, there has been a notable increase in the demand for biopharmaceuticals, driven by the rising prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders. Biopharmaceuticals, which include a wide range of products like monoclonal antibodies, vaccines, and recombinant proteins, offer targeted and effective treatments for these conditions. However, producing biopharmaceuticals is a complex process that requires sophisticated filtration technologies to ensure product purity and safety.

For example, the COVID-19 pandemic highlighted the importance of biopharmaceuticals, as companies rapidly developed and scaled up the production of vaccines. Filtration played a critical role in ensuring that these vaccines were free from contaminants and safe for use. Companies like Sartorius and MilliporeSigma introduced advanced filtration systems specifically designed to meet the high demands of vaccine production.

· A recent development in the sector is the launch of Merck’s Mobius® MyWay portfolio in July 2023, which includes customizable single-use filtration solutions tailored for the biopharmaceutical industry. This innovation allows for greater flexibility and efficiency in the production process, addressing the specific needs of biopharmaceutical manufacturers.

Customize this study as per your requirement @ https://www.towardshealthcare.com/customization/5185

Skilled Labor Shortage, Restraint for the Market

One significant challenge facing the pharmaceutical filtration market is the shortage of skilled professionals with the expertise required to manage and operate advanced filtration technologies. This shortage can impede the growth of the market, as the efficiency and safety of pharmaceutical filtration processes heavily rely on knowledgeable and experienced personnel.

The complexity of filtration systems used in pharmaceutical manufacturing demands a deep understanding of both the technology and the regulatory standards governing the industry. Skilled technicians and engineers are needed to design, operate, and maintain these systems to ensure the production of high-quality and safe pharmaceutical products. However, the current workforce often lacks sufficient training and experience, leading to inefficiencies and potential risks in the manufacturing process.

To address this issue, companies and educational institutions are investing in training and development programs aimed at equipping professionals with the necessary skills.

· For example, in April 2023, MilliporeSigma launched the BioContinuum™ Platform Training Program. This initiative offers comprehensive training on advanced filtration technologies and bioprocessing techniques, helping bridge the skill gap in the industry.

Focus on Sustainability, Upcoming Opportunity for the Market

As the world leans towards sustainability, the pharmaceutical filtration market is seeing new opportunities emerge. One of the key areas is energy-efficient filtration. Companies are developing filtration systems that consume less energy, reducing the overall environmental footprint. For instance, Merck’s MilliporeSigma launched an energy-efficient filtration system in 2023 that promises to cut energy use by 20%, setting a new standard in the industry.

Another promising area is the recycling and reuse of filter materials. Traditionally, used filters would end up as waste, but now, innovative solutions are making it possible to recycle these materials. In 2024, Pall Corporation introduced a new line of recyclable filters that not only perform efficiently but also help in minimizing waste. This approach not only addresses environmental concerns but also reduces costs for pharmaceutical companies. These developments underscore the industry’s commitment to sustainability. With ongoing research and development, we can expect more breakthroughs that will further enhance the environmental compatibility of pharmaceutical filtration processes.

North America Remains the Dominant force in Pharmaceutical Filtration Market

North America, particularly the United States, remains a dominant force in the pharmaceutical filtration market. The presence of major pharmaceutical companies and a strong focus on research and development drive the demand for advanced filtration systems. Recent regulatory changes aimed at ensuring higher standards of drug safety and efficacy have also boosted market growth. For instance, the FDA’s stringent guidelines on drug manufacturing processes necessitate the use of high-quality filtration systems to eliminate contaminants, thereby ensuring product purity.

Asia-Pacific Witnessing Rapid Growth in the Market

Asia-Pacific is witnessing rapid growth in the pharmaceutical filtration market, driven by increasing investments in the healthcare sector and rising demand for generic drugs. China and India are at the forefront of this growth. In India, the government’s initiatives to boost domestic pharmaceutical production, such as the ‘Make in India’ campaign, have led to a surge in demand for advanced filtration solutions. Recent developments include the establishment of new manufacturing units by multinational companies in India, aiming to leverage the country’s cost-effective production capabilities.

· For instance, in 2023, a major US-based pharmaceutical firm opened a state-of-the-art manufacturing facility in Hyderabad, significantly increasing the demand for high-quality filtration systems.

In India, the pharmaceutical filtration market is experiencing robust growth. The country’s strong pharmaceutical manufacturing base, coupled with favorable government policies, supports this expansion. Recent developments include the establishment of several new pharmaceutical plants across the country, driven by both domestic and international players. The Indian government’s focus on improving healthcare access and quality, as part of initiatives like Ayushman Bharat, further fuels the demand for reliable and efficient filtration systems. Additionally, collaborations between Indian pharmaceutical companies and global firms are leading to the adoption of advanced filtration technologies, ensuring compliance with international quality standards.

By Product, the Membrane Filters Segment Led the Market in 2023

Membrane filters are the most widely used product in pharmaceutical filtration. They are crucial for ensuring the purity of pharmaceutical products by removing contaminants and particles. Among the various types of membrane filters, PVDF (Polyvinylidene fluoride) membrane filters stand out due to their high chemical resistance, low protein binding, and excellent flow rates. These filters are particularly favored in applications requiring sterilization and high-efficiency filtration, making them a dominant choice in the pharmaceutical industry.

By Technique, the Microfiltration Segment Dominated the Market in 2023

Microfiltration is the leading technique in pharmaceutical filtration. It is widely used for removing bacteria and particulates from liquids, making it essential for producing sterile pharmaceutical products. This technique operates with pore sizes typically ranging from 0.1 to 10 micrometers, effectively ensuring the removal of unwanted particles while maintaining the integrity of the final product. Microfiltration’s versatility and reliability make it a preferred method in various pharmaceutical processes, including water purification and air filtration.

By Type, the Sterile Segment Held the Largest Share in 2023

Sterile filtration is the dominant type within the pharmaceutical filtration market. This process is critical for removing microorganisms and ensuring that products remain contamination-free. Sterile filters are extensively used in the production of injectable drugs, vaccines, and other sterile pharmaceutical formulations. The high standards required for patient safety drive the demand for sterile filtration, making it an indispensable part of pharmaceutical manufacturing.

By Application, the Final Product Processing Segment Dominated the Market

Final product processing is a key application of pharmaceutical filtration. This stage involves the final purification and filtration of pharmaceutical products before they are packaged and distributed. Ensuring the highest level of purity and safety, final product processing uses advanced filtration technologies to eliminate any remaining contaminants. This application is crucial for maintaining the efficacy and safety of pharmaceutical products, thus dominating the filtration market.

By Scale of Operation, the Manufacturing Scale Segment Held the Largest Share

Manufacturing scale operations dominate the pharmaceutical filtration market due to the large-scale production needs of pharmaceutical companies. This scale involves the mass production of drugs and vaccines, requiring robust and efficient filtration systems to maintain product quality and safety. The stringent regulatory standards for pharmaceutical manufacturing further necessitate advanced filtration technologies at this scale, ensuring compliance and high productivity.

Recent Developments

· In June 2024, Cytiva introduced its Supor Prime sterilizing grade filters, specifically designed for high-concentration biologic medications. These filters are aimed at helping drug developers improve yields, prevent blockages, and reduce cost inefficiencies.

· In April 2024, Asahi Kasei unveiled a new membrane system for the production of water for injection (WFI), which is sterile water used in injection preparations. This system was developed using the design and development expertise of the Microza™ hollow-fiber membrane, known for its efficiency in liquid product filtering and water treatment.

· In April 2024, Bavarian Nordic A/S, a fully integrated vaccine company, launched Jynneos, which is the only mpox vaccine approved by the FDA in the United States.

Browse More Insights of Towards Healthcare:

· The global AR and VR in the healthcare industry was estimated at USD 1.57 billion in 2022 and expected to hit USD 13.74 billion by 2032, expanding at a compound annual growth rate (CAGR) of 24.81% from 2023 to 2032.

· The global asthma and COPD drugs market size was valued at USD 37.22 billion in 2022 and is expected to reach USD 61.54 billion by 2032, with a 5.01% CAGR from 2023 to 2032.

· The AI in cancer diagnostics market size is estimated to grow from USD 892.23 million in 2022 at 9.35% CAGR (2023-2032) to reach an estimated USD 2,084.34 million by 2032.

· The global digital health market is estimated to grow from USD 262.63 billion in 2022 at 13.1% CAGR (2023-2032) to reach an estimated USD 939.54 billion by 2032.

· The hospital services market is estimated to grow from USD 9.29 trillion in 2022 at 9.15% CAGR (2023-2032) to reach an estimated USD 21.27 trillion by 2032.

· The newborn imaging system market size is estimated to grow from USD 277.64 million in 2022 at 4.6% CAGR (2023-2032) to reach an estimated USD 441.42 million by 2032.

· The smart bandages market size to grow from USD 648.10 million in 2022 to reach an estimated USD 1,834.45 million by 2032, at a growing CAGR of 11.5% between 2023 and 2032.

· The over-the-counter analgesics market size was valued to grow from USD 28.6 billion in 2022 to reach an estimated USD 40.93 billion by 2032, expanding at a CAGR of 3.7% between 2023 and 2032.

· The 503A U.S. compounding pharmacies market size is estimated to grow from USD 3.99 billion in 2022 at 6.11% CAGR (2023-2032) to reach an estimated USD 7.18 billion by 2032.

· The lung disease therapeutics market size reached USD 81.2 billion in 2022 and is anticipated to hit around USD 146.1 billion by 2032, expanding at a CAGR of 6.1% from 2023 to 2032.

Key Market Players

· 3M

· Amazon Filters

· Danaher Corporation

· Eaton Corporation

· General Electric

· Graver Technologies

· Meissner Filtration Products

· Merck KGaA

· Parker Hannifin

· Sartorius AG

· Thermo Fisher Scientific

Segments Covered in the Report

By Product

- Membrane Filters

- MCE Membrane Filters

- Coated Cellulose Acetate Membrane Filters

- PTFE Membrane Filters

- Nylon Membrane Filters

- PVDF Membrane Filters

- Other Membrane Filters

- Prefilters & Depth Media

- Glass Fiber Filters

- PTFE Fiber Filters

- Single-use Systems

- Cartridges & Capsules

- Filter Holders

- Filtration Accessories

- Others

By Technique

- Microfiltration

- Ultrafiltration

- Cross Flow Filtration

- Nanofiltration

- Others

By Type

- Sterile

- Non-sterile

By Application

- Final Product Processing

- Active Pharmaceutical Ingredient Filtration

- Sterile Filtration

- Protein Purification

- Vaccines And Antibody Processing

- Formulation And Filling Solutions

- Viral Clearance

- Raw Material Filtration

- Media Buffer

- Pre-filtration

- Bioburden Testing

- Cell Separation

- Water Purification

- Air Purification

By Scale of Operation

- Manufacturing Scale

- Pilot Scale

- Research & Development Scale

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Discover our detailed Table of Contents (TOC) for the XXX Industry, providing a thorough examination of market segments, material, emerging technologies and key trends. Our TOC offers a structured analysis of market dynamics, emerging innovations, and regional dynamics to guide your strategic decisions in this rapidly evolving healthcare field - https://www.towardshealthcare.com/table-of-content/pharmaceutical-filtration-market-sizing

Acquire our comprehensive analysis today @ https://www.towardshealthcare.com/price/5185

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardsautomotive.com

https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Get Our Freshly Printed Chronicle: https://www.healthcarewebwire.com