Like they say about the weather in Iceland, if you don’t like an action taken by the new administration, wait five minutes; it’ll probably change. The markets, it seems, don’t react kindly to that kind of policymaking.

The uncertainty that came with Donald Trump’s electoral victory in November has only compounded now that he’s in office. Similar question marks have surrounded Robert F. Kennedy Jr., whose anti-vaccine rhetoric and overall criticism of agencies within the Department of Health and Human Services he now heads were potential concerns for the biopharma industry from the first rumors that he’d be Trump’s nominee for HHS secretary.

Early on, industry analysts expected any negative market reactions to be short-lived. Jefferies, for example, speculated that the market was nearing “peak RFK negativity” back in November 2024 and “could be due for a bounce.” A few weeks later, it was more of the same. “[W]e think short term sentiment could be starting to shift with ‘peak RFK negativity’ coming into the stock,” analysts at the firm wrote in a note to investors on Dec. 10.

Four months later, it’s clear that prediction was wrong. RFK Jr.’s massive cuts to the HHS workforce, spanning the FDA, CDC and NIH and including many senior leaders, have destabilized the biopharma markets. Meanwhile, Trump’s tariff threats have further toppled Big Pharma and biotech stocks.

Most concerning, however, is not the sweeping changes being executed with little to no transparency and communication, but the fact that so many of these changes are almost immediately reversed. This flip-flopping greatly exacerbates the challenges presented by an already disrupted macro environment.

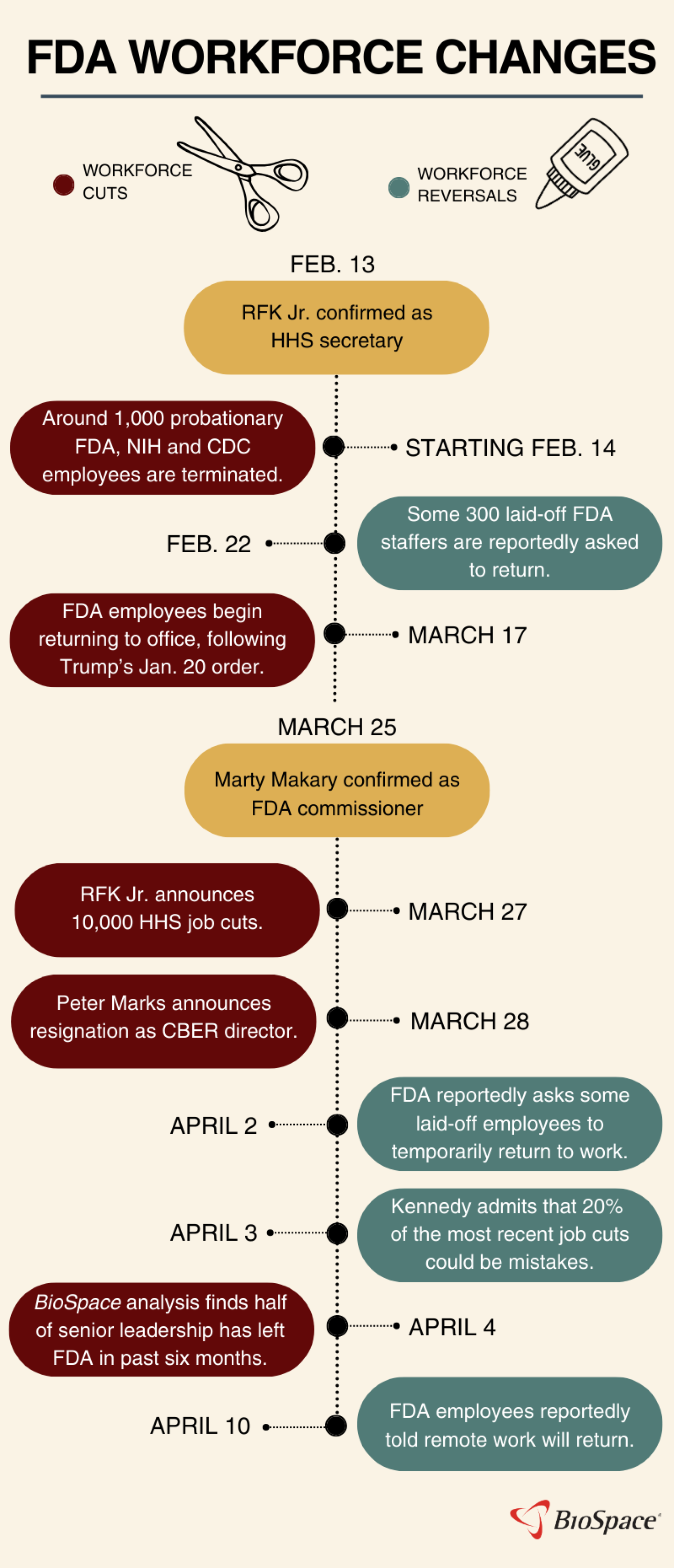

FDA Workers Riding Worst Rollercoaster in the Park

Prior to leaving his post in January, former FDA Commissioner Robert Califf told members of the media that he wanted his legacy to be the workforce he was leaving behind. Kennedy wasted no time in dismantling it. The day after he was confirmed as HHS Secretary, around 1,000 probationary employees from across the FDA, CDC and NIH received word that they were being terminated.

But as has become standard for the Trump administration, Kennedy soon changed course. Just eight days later, 300 laid off FDA staffers were asked to return.

Then in March, Kennedy moved forward with a much larger workforce cull, laying off 10,000 workers across the HHS. Chaos ensued as FDA staffers arrived at the agency’s main White Oak campus in Maryland only to discover that their badges were no longer active. Once again, however, Kennedy’s team added insult to emotional and economic injury when they reportedly asked some of these individuals to temporarily return the following week. The Secretary then admitted that 20% of the job cuts could have been a mistake.

“Personnel that should not have been cut, were cut. We’re reinstating them. And that was always the plan,” Kennedy told reporters in Virginia, according to CBS News.

Once HHS staffers manage to figure out whether or not they still have a job, they’ll need to determine where exactly that job will take place. On March 17, many FDA employees returned to the aforementioned White Oak campus in accordance with Trump’s Jan. 20 order ending remote work for federal workers. But in yet another about-face, some of those employees can now turn around and resume working from their home offices after the FDA quietly walked back that mandate last week, according to Endpoints News.

“[T]here is no good reason to treat people this way,” Califf wrote on LinkedIn April 1.

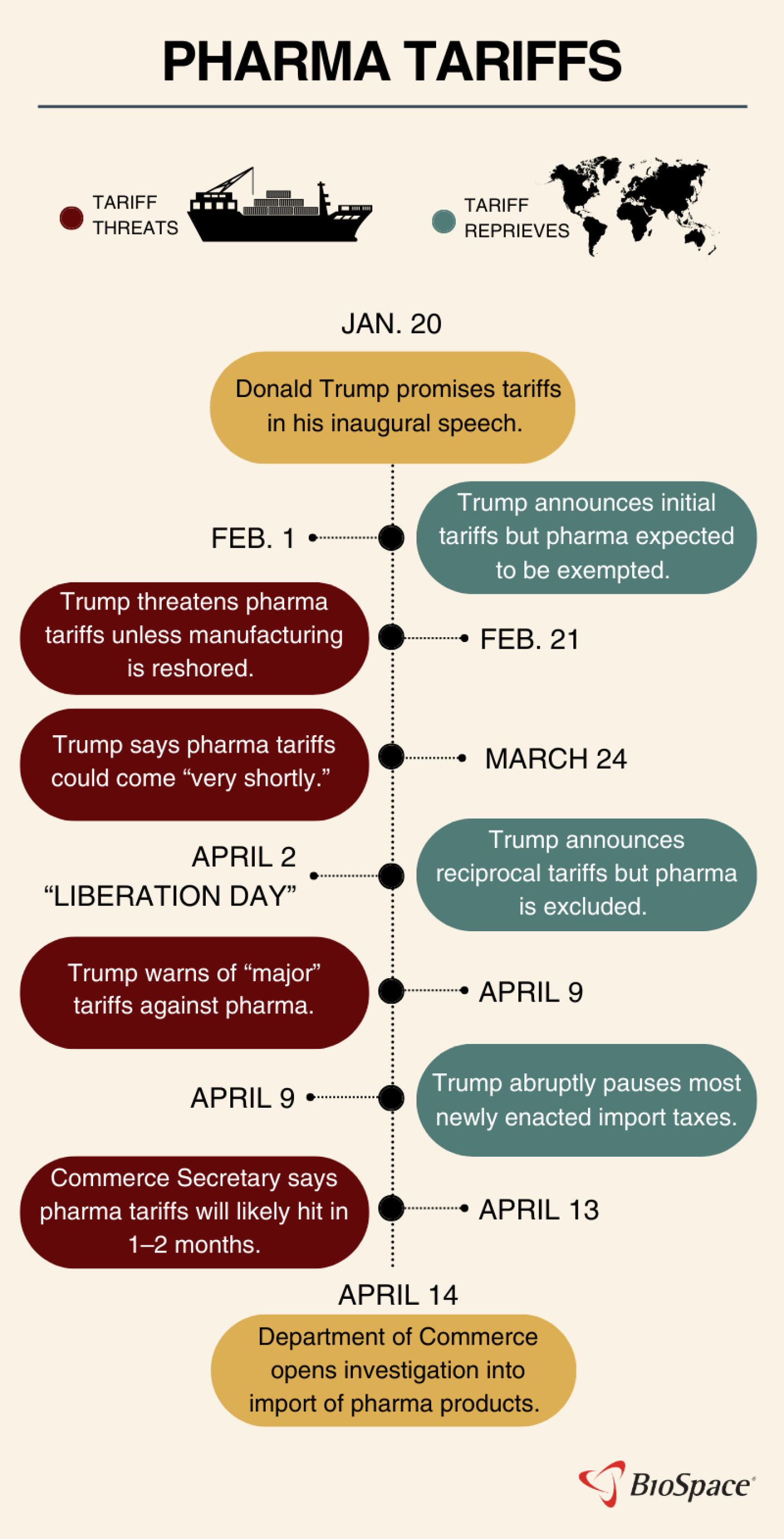

On-Again-Off-Again Tariffs Put Biopharma Markets Through Wringer

Trump’s tariff threats have damaged the overall markets, with each twist and turn of the saga sending shares plummeting or flying depending on the latest iteration of the adminstration’s plan.

Pharma has not been immune, with large companies shedding billions in value. When the first policies were announced in early February, the industry was predicted to be exempt. But despite visits from high-profile pharma executives like Pfizer’s Albert Bourla, Trump was not swayed to spare medicines from his import taxes.

On February 21, he threatened tariffs on the industry specifically. A month later he re-upped his threat, promising that the tariffs would come “very soon.” But when April 2, a.k.a. “Liberation Day” rolled around, pharma was again exempt from the steep tariffs Trump declared on imports of products from countries around the world.

The relief would not last long, however. A few days later, on April 9, he warned again that the industry was in his crosshairs. And on April 14, a Federal Register document revealed that the Department of Commerce had launched an investigation into pharma imports, with the aim of declaring tariffs in the name of national security.

And now, the industry waits.

This kind of instability in biopharma can make investors wary. A recent Pitchbook report warned that M&A activity could be suppressed as pharmas seek to build U.S. manufacturing capacity, and that this could challenge biotech fundraising. A government overhaul like the one Trump and RFK Jr. are looking to pull off will inevitably make waves through many industries, but the unpredictable new administration has come in like a tsunami.