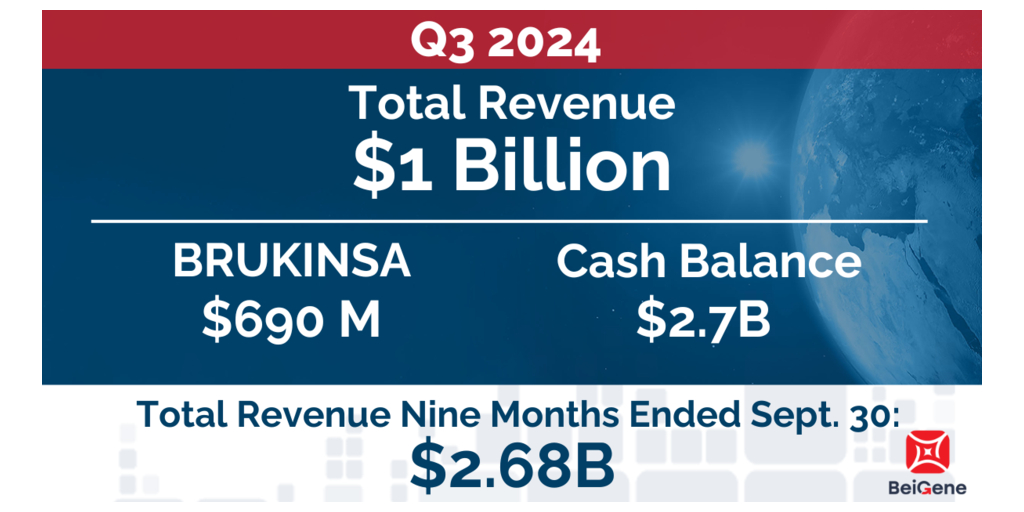

- Continued financial progress with $1 billion in quarterly total revenue, reduced GAAP loss and second consecutive quarter of positive non-GAAP operating income

- Strengthened franchise leadership in chronic lymphocytic leukemia (CLL) with foundational therapy BRUKINSA global revenue of $690 million, rapidly progressing pivotal programs for late-stage hematology pipeline

- Expanded oncology pipeline with four new molecular entities (NMEs) entering the clinic this quarter (eight year-to-date); reaffirmed on track to achieve goal to enter 10+ by end of year; in-house innovative “Fast to Proof of Concept” strategy quickly explores the clinical potential of molecules in parallel, with industry leading speed of execution

SAN MATEO, Calif.--(BUSINESS WIRE)--$BGNE #BeiGene--BeiGene, Ltd. (NASDAQ: BGNE; HKEX: 06160; SSE: 688235), a global oncology company, today announced financial results and corporate updates from the third quarter of 2024.

“Our exceptional third-quarter results underscore the Company’s global oncology leadership driven by our unique R&D and clinical advantages as well as the tremendous launch trajectory of BRUKINSA,” said John V. Oyler, Co-Founder, Chairman and CEO at BeiGene. “In the U.S., BRUKINSA, with the broadest label of any BTK inhibitor, is now the leader in new patient starts in both frontline and relapsed/refractory (R/R) CLL in addition to all other approved B-cell malignancies. As the cornerstone of our hematology franchise, BRUKINSA shows tremendous promise for patients as a monotherapy and as a backbone for best-in-class combinations with our late-stage BCL2 inhibitor, sonrotoclax, and BTK degrader BGB-16673. In the solid tumor area, we’re expanding access to our PD-1 inhibitor, TEVIMBRA, for patients worldwide and building global commercial capabilities to support our prolific pipeline of exciting potential cancer medicines. We are laying the foundation for future franchises in breast, lung, and gastrointestinal cancers across three signature platform technologies including multi-specific antibodies, protein degraders, and antibody-drug conjugates. This progress not only highlights our achievements but also emphasizes our commitment to positively impacting patients' lives globally, fostering hope and advancements in the fight against cancer.”

Third Quarter 2024 Financial Snapshot

(Amounts in thousands of U.S. dollars and Unaudited)

|

| Three Months Ended September 30, |

|

|

| Nine Months Ended September 30, |

|

| ||||||||||||||

(in thousands, except percentages) |

| 2024 |

| 2023 |

| % Change |

| 2024 |

| 2023 |

| % Change | ||||||||||

Net product revenues |

| $ | 993,447 |

|

| $ | 595,290 |

|

| 67 | % |

| $ | 2,661,511 |

|

| $ | 1,559,326 |

|

| 71 | % |

Net revenue from collaborations |

| $ | 8,152 |

|

| $ | 186,018 |

|

| (96 | )% |

| $ | 20,906 |

|

| $ | 265,044 |

|

| (92 | )% |

Total Revenue |

| $ | 1,001,599 |

|

| $ | 781,308 |

|

| 28 | % |

| $ | 2,682,417 |

|

| $ | 1,824,370 |

|

| 47 | % |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

GAAP loss from operations |

| $ | (120,265 | ) |

| $ | (133,968 | ) |

| (10 | )% |

| $ | (488,774 | ) |

| $ | (823,941 | ) |

| (41 | )% |

Adjusted income(loss) from operations* |

| $ | 65,630 |

|

| $ | (16,339 | ) |

| 502 | % |

| $ | (33,247 | ) |

| $ | (485,249 | ) |

| (93 | )% |

* For an explanation of our use of non-GAAP financial measures refer to the "Use of Non-GAAP Financial Measures" section later in this press release and for a reconciliation of each non-GAAP financial measure to the most comparable GAAP measures, see the table at the end of this press release.

Key Business Updates

BRUKINSA® (zanubrutinib) is an orally available, small molecule inhibitor of BTK designed to deliver complete and sustained inhibition of the BTK protein by optimizing bioavailability, half-life, and selectivity. With differentiated pharmacokinetics compared with other approved BTK inhibitors, BRUKINSA has been demonstrated to inhibit the proliferation of malignant B cells within a number of disease-relevant tissues. BRUKINSA has the broadest label globally of any BTK inhibitor and is the only BTK inhibitor to provide the flexibility of once or twice daily dosing. The global BRUKINSA clinical development program includes about 6,000 patients enrolled in 30 countries and regions across more than 35 trials. BRUKINSA is approved in more than 70 markets, and more than 100,000 patients have been treated globally.

- U.S. sales of BRUKINSA totaled $504 million in the third quarter of 2024, representing growth of 87% over the prior-year period, with more than 60% of the quarter over quarter demand growth coming from expanded use in CLL as BRUKINSA continued to gain share in CLL new patient starts; BRUKINSA sales in Europe totaled $97 million in the third quarter of 2024, representing growth of 217%, driven by increased market share across all major markets, including Germany, Italy, Spain, France and the UK;

- Five-year follow-up results from cohort 1 of the Phase 3 SEQUOIA study showed sustained progression-free survival (PFS) benefit (54-month PFS rate of 80%) with BRUKINSA in patients with treatment-naïve (TN) CLL or small lymphocytic lymphoma (SLL), with no new safety signals observed; detailed data will be presented at the annual American Society of Hematology (ASH) 2024 conference; and

- Five-year follow-up data of BOVen (zanubrutinib, obinutuzumab, venetoclax) study in TN CLL demonstrates frequent unmeasurable minimal residual disease (uMRD) in peripheral blood (96%) and bone marrow (92%), and uMRD was durable with a median MRD-free survival of 34 months; detailed data will be presented at the ASH 2024 conference.

TEVIMBRA® (tislelizumab) is a uniquely designed humanized immunoglobulin G4 (IgG4) anti-programmed cell death protein 1 (PD-1) monoclonal antibody with high affinity and binding specificity against PD-1; it is designed to minimize binding to Fc-gamma (Fcγ) receptors on macrophages, helping to aid the body’s immune cells to detect and fight tumors. TEVIMBRA is the foundational asset of BeiGene’s solid tumor portfolio and has shown potential across multiple tumor types and disease settings. The global TEVIMBRA clinical development program includes almost 14,000 patients enrolled to date in 34 counties and regions across 66 trials, including 20 registration-enabling studies. TEVIMBRA is approved in 42 countries and regions, and more than 1.3 million patients have been treated globally.

- Sales of tislelizumab totaled $163 million in the third quarter of 2024, representing growth of 13% compared to the prior-year period;

- Announced commercial availability in the U.S. for second-line esophageal squamous cell carcinoma (ESCC) and in the first European countries for second-line ESCC and first- and second-line non-small cell lung cancer (NSCLC);

- Received positive opinions from the European Medicines Agency Committee for Medicinal Products for Human Use (CHMP) as a first-line treatment for advanced/metastatic gastric or gastroesophageal junction cancer and ESCC;

- Received China National Medical Products Administration approval for neo-adjuvant/adjuvant NSCLC; and

- Further expanded global footprint with new approvals in Brazil (second-line NSCLC, second-line ESCC), Singapore (first- and second-line NSCLC, second-line ESCC), Thailand (first- and second-line NSCLC, first- and second-line ESCC and first-line gastric cancer) and Israel (second-line ESCC).

Key Pipeline Highlights

BeiGene’s portfolio strategy emphasizes rapid generation of early-stage clinical proof-of-concept data enabled by its speed- and cost-advantaged (“Fast to Proof of Concept”) approach to global clinical operations. The Company’s in-house clinical operations team of 3,600 colleagues conducts trials across five continents, ensuring rigorous data quality through collaborations with regulators and investigators in over 45 countries. This strategic approach maximizes resources by channeling data-gated investments into the most promising clinically differentiated candidates quickly and de-prioritizing others. With one of the largest oncology research teams in the industry, BeiGene has demonstrated strengths in translational small molecule and biologics discovery, including three platform technologies: multi-specific antibodies, chimeric degradation activation compounds (CDACs), and antibody-drug conjugates (ADCs). For NMEs entering the clinic, BeiGene has industry leading preclinical, dose escalation cohort and dose escalation to dose expansion timings. Two examples of the Company’s speed advantage resulting from its internal innovation at scale:

- CDK4i entered the clinic in December 2023; 6.4 weeks on average for dose-escalation cohorts with more than 100 patients;

- B7H4 ADC entered the clinic in April 2024; 6.6 weeks on average for dose-escalation cohorts with 30 patients enrolled.

Hematology

Sonrotoclax (BCL2 inhibitor)

- More than 1,300 patients enrolled to date across the program;

- Continued enrollment in global Phase 2 trial in Waldenström’s macroglobulinemia (WM) and global Phase 3 CELESTIAL trial in combination with BRUKINSA in TN CLL with enrollment completion estimated in the first quarter of 2025;

- Anticipate enrolling first subjects in global Phase 3 programs in R/R CLL and R/R mantle cell lymphoma (MCL) in the first half of 2025; and

- Announced upcoming oral presentation at ASH 2024 of Phase 1 study in combination with BRUKINSA for patients with TN CLL/SLL highlighting continued deep and durable responses and manageable tolerability.

BGB-16673 (BTK CDAC)

- More than 350 patients enrolled to date across the program; continued to enroll potentially registration enabling expansion cohort in R/R CLL;

- Anticipate initiation of Phase 3 trial in R/R CLL in the first half of 2025; and

- Granted US FDA Fast Track Designation for R/R CLL/SLL.

Solid Tumors

Lung Cancer

- BG-T187 (EGFR x MET trispecific antibody): Initiated dose escalation; EGFR and MET dual targeting to address large EGFR-mutated NSCLC population and other EGFR- or MET-driven populations such as colorectal cancer; differentiated MET biparatopic design with optimal MET inhibitory activity to pursue best-in-class opportunity;

- BGB-58067 (MTA-cooperative PRMT5 inhibitor): on track to enter the clinic in the fourth quarter of 2024; selectively kills MTAP-deletion tumor cells that are present in approximately 15% of all tumor types; designed to avoid on-target hematological toxicity seen with first-generation inhibitors; best-in-class potential with high potency, selectivity, and brain penetrability; and

- BG-60366 (EGFR CDAC): on track to enter the clinic in the fourth quarter of 2024: differentiated degrader mechanism to completely abolish EGFR signaling; highly potent across osimertinib-sensitive and resistant EGFR mutations; strong preclinical efficacy data with oral and daily dosing;

Breast and Gynecologic Cancers

- BGB-43395 (CDK4 inhibitor): continued dose escalation in monotherapy and in combination with fulvestrant and letrozole in the anticipated efficacious dose range; more than 100 patients enrolled to date;

- BG-68501 (CDK2 inhibitor) and BG-C9074 (B7H4 ADC): continued monotherapy dose escalation, with pharmacokinetics as expected and no dose-limiting toxicities observed; and

- Four abstracts accepted for presentation at San Antonio Breast Cancer Symposium (SABCS), including preclinical characterization and data from first-in-human Phase 1 dose escalation study of BGB-43395.

Gastrointestinal Cancers

-

NMEs entered into the clinic in the third quarter include:

- BGB-B2033 (GPC3 x 4-1BB bispecific antibody): initiated dose escalation in GPC3 highly expressing tumors; best-in-class potential due to highly potent 4-1BB agonist antibody via simultaneous binding to two 4-1BB molecules for better receptor clustering and T-cell activation;

- BG-C477 (CEA ADC): highly expressed tumor-associated antigen in multiple cancer types; differentiated ADC design enables broad targeting including in patients with medium to low target expression; potent anti-tumor activity in preclinical models of colorectal and gastric cancer and NSCLC; and

- BGB-B3227 (MUC-1 x CD16A bispecific antibody): initiated dose expansion for MUC-1 highly upregulated tumors, including lung, gastrointestinal and breast cancers; differentiated MUC-1 antibody targeting SEA domain to reduce sink effect of soluble MUC-1; potential first-in-class natural killer (NK) cell engager acting through CD16A, an NK activating receptor highly expressed in MUC-1 positive tumors;

-

NMEs on track to enter the clinic in the fourth quarter of 2024:

- BGB-53038 (PanKRAS inhibitor): highly potent and selective with broad activity against KRAS mutations in multiple tumor types; limits toxicity by sparing other RAS proteins; and

- BG-C137 (FGFR2b ADC): potential first-in-class ADC for a validated target in upper gastrointestinal and breast cancers; potential superior efficacy compared to leading monoclonal antibody in both high- and medium-expression models.

Inflammation and Immunology

BGB-45035 (IRAK4 CDAC): Currently in dose escalation in both SAD and MAD cohorts; potent and selective degrader that targets both kinase and scaffold functions of IRAK4 for complete target degradation; deep and fast degradation that leads to stronger cytokine inhibition and superior efficacy in vivo.

Corporate Updates

Strengthened global leadership team with appointments of Matt Shaulis as General Manager of North America and Shalini Sharp to Board of Directors.

Third Quarter 2024 Financial Highlights

Revenue for the three months ended September 30, 2024, was $1,002 million, compared to $781 million in the same period of 2023, driven primarily by growth in BRUKINSA product sales in the U.S. and Europe of 87% and 217% respectively. The reacquisition of the full global commercial rights to ociperlimab and TEVIMBRA in the third quarter of 2023 resulted in the recognition of the remaining deferred revenues from the former Novartis collaborations, which contributed $183 million of the total revenue in the prior year period.

Product Revenue for the three months ended September 30, 2024, was $993 million, compared to $595 million in the same period of 2023, representing an increase of 67%. The increase in product revenue was primarily attributable to increased sales of BRUKINSA. For the three months ended September 30, 2024, the U.S. was the Company’s largest market, with product revenue of $504 million, compared to $270 million in the prior year period. In addition to BRUKINSA revenue growth, product revenues were positively impacted by growth from in-licensed products from Amgen and tislelizumab.

Gross Margin as a percentage of global product revenue for the third quarter of 2024 was 83%, compared to 84% in the prior-year period on a GAAP basis and 85%, compared to 84% in the prior-year period on an adjusted basis. The GAAP gross margin percentage decrease compared to the prior-year period was the result of accelerated depreciation expense of $17 million resulting from the move to more efficient, larger scale production lines for tislelizumab, and with a similar amount to be incurred in the fourth quarter related to this move. The adjusted gross margin percentage, which does not include the accelerated depreciation, increased primarily due to proportionally higher sales mix of global BRUKINSA compared to other products in the portfolio.

Operating Expenses

The following table summarizes operating expenses for the third quarter 2024 and 2023, respectively:

|

| GAAP |

|

|

| Non-GAAP |

|

| ||||||||||

(unaudited, in thousands, except percentages) |

| Q3 2024 |

| Q3 2023 |

| % Change |

| Q3 2024 |

| Q3 2023 |

| % Change | ||||||

Research and development |

| $ | 496,179 |

| $ | 453,259 |

| 9 | % |

| $ | 405,545 |

| $ | 396,146 |

| 2 | % |

Selling, general and administrative |

| $ | 455,223 |

| $ | 365,708 |

| 24 | % |

| $ | 380,737 |

| $ | 308,493 |

| 23 | % |

Total operating expenses |

| $ | 951,402 |

| $ | 818,967 |

| 16 | % |

| $ | 786,282 |

| $ | 704,639 |

| 12 | % |

The following table summarizes operating expenses for the year-to-date period ended September 30, 2024 and 2023, respectively:

|

| GAAP |

|

|

| Non-GAAP |

|

| ||||||||||

(unaudited, in thousands, except percentages) |

| Q3 YTD 2024 |

| Q3 YTD 2023 |

| % Change |

| Q3 YTD 2024 |

| Q3 YTD 2023 |

| % Change | ||||||

Research and development |

| $ | 1,411,283 |

| $ | 1,284,607 |

| 10 | % |

| $ | 1,193,494 |

| $ | 1,121,577 |

| 6 | % |

Selling, general and administrative |

| $ | 1,326,379 |

| $ | 1,089,616 |

| 22 | % |

| $ | 1,116,805 |

| $ | 923,254 |

| 21 | % |

Total operating expenses |

| $ | 2,737,662 |

| $ | 2,374,223 |

| 15 | % |

| $ | 2,310,299 |

| $ | 2,044,831 |

| 13 | % |

Research and Development (R&D) Expenses increased for the third quarter of 2024 compared to the prior-year period on both a GAAP and adjusted basis, primarily due to advancing preclinical programs into the clinic and early clinical programs into late stage. Upfront fees and milestone payments related to in-process R&D for in-licensed assets totaled $5 million in the third quarter of 2024, compared to $15 million in the prior-year period. Included within GAAP research and development expense for the third quarter of 2024 is $24.9 million of accelerated depreciation expense related to the move of clinical production to larger, more efficient production lines with approximately $2.0 million remaining to be incurred in the fourth quarter.

Selling, General and Administrative (SG&A) Expenses increased for the third quarter of 2024 compared to the prior-year period on both a GAAP and adjusted basis due to continued investment to support the global commercial launch of BRUKINSA, primarily in the U.S. and Europe. SG&A expenses as a percentage of product sales were 46% for the third quarter of 2024 compared to 61% in the prior year period.

GAAP Income (Loss) from Operations in the third quarter of 2024 operating loss decreased 10% compared to the prior-year-period primarily due to increased operating leverage. On an adjusted basis, we generated operating income of $66 million, an increase of $82 million from the prior year period. GAAP and adjusted loss from operations in the prior year period benefited from the recognition of the remaining deferred revenues from the Novartis collaboration agreements.

GAAP Net Loss for the quarter ended September 30, 2024 was $121 million, compared to net income of $215 million in the prior-year period. Net income in the prior year period benefited from the non-operating gain of $363 million (pre and after-tax) related to the BMS arbitration settlement and the recognition of the remaining deferred revenues from the Novartis collaboration agreements. Net loss in the period continued to improve sequentially, as our product revenue growth and management of expenses is driving increased operating leverage.

For the quarter ended September 30, 2024, net loss per basic ordinary share was $(0.09) and net loss per basic American Depositary Share (ADS) was $(1.15), compared to net income per basic ordinary share of $0.16 and net income per basic ADS of $2.06 in the prior-year period.

Cash Provided by Operations for the quarter ended September 30, 2024 was $188 million, an increase of $267 million over the prior-year period. The improvement in operating cash flows in the period was primarily driven by improved non-GAAP operating income and favorability in the period from working capital seasonality.

For further details on BeiGene’s Third Quarter 2024 Financial Statements, please see BeiGene’s Quarterly Report on Form 10-Q for the third quarter of 2024 filed with the U.S. Securities and Exchange Commission.

About BeiGene

BeiGene is a global oncology company that is discovering and developing innovative treatments that are more affordable and accessible to cancer patients worldwide. With a broad portfolio, we are expediting development of our diverse pipeline of novel therapeutics through our internal capabilities and collaborations. We are committed to radically improving access to medicines for far more patients who need them. Our growing global team of nearly 11,000 colleagues spans five continents. To learn more about BeiGene, please visit www.beigene.com and follow us on LinkedIn, X (formerly known as Twitter), Facebook and Instagram.

BeiGene intends to use the Investors section of its website, its X (formerly known as Twitter) account at x.com/BeiGeneGlobal, its LinkedIn account at linkedin.com/company/BeiGene, its Facebook account at facebook.com/BeiGeneGlobal, and its Instagram account at instagram.com/BeiGeneGlobal to disclose material information and to comply with its disclosure obligations under Regulation FD. Accordingly, investors should monitor BeiGene’s website, its X account, its LinkedIn account, its Facebook account, and its Instagram account in addition to BeiGene’s press releases, SEC filings, public conference calls, presentations, and webcasts.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws, including statements regarding the expansion of TEVIMBRA for patients worldwide; the future and success of BeiGene’s pipeline; and BeiGene’s plans, commitments, aspirations and goals under the caption “About BeiGene”. Actual results may differ materially from those indicated in the forward-looking statements as a result of various important factors, including BeiGene’s ability to demonstrate the efficacy and safety of its drug candidates; the clinical results for its drug candidates, which may not support further development or marketing approval; actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials and marketing approval; BeiGene’s ability to achieve commercial success for its marketed medicines and drug candidates, if approved; BeiGene's ability to obtain and maintain protection of intellectual property for its medicines and technology; BeiGene’s reliance on third parties to conduct drug development, manufacturing, commercialization, and other services; BeiGene’s limited experience in obtaining regulatory approvals and commercializing pharmaceutical products; BeiGene’s ability to obtain additional funding for operations and to complete the development of its drug candidates and achieve and maintain profitability; and those risks more fully discussed in the section entitled “Risk Factors” in BeiGene’s most recent quarterly report on Form 10-Q, as well as discussions of potential risks, uncertainties, and other important factors in BeiGene’s subsequent filings with the U.S. Securities and Exchange Commission. All information in this press release is as of the date of this press release, and BeiGene undertakes no duty to update such information unless required by law.

Condensed Consolidated Statements of Operations (U.S. GAAP) | ||||||||||||||||

(Amounts in thousands of U.S. dollars, except for shares, American Depositary Shares (ADSs), per share and per ADS data) | ||||||||||||||||

| Three Months Ended September 30, |

| Nine Months Ended September 30, | |||||||||||||

| 2024 |

| 2023 |

| 2024 |

| 2023 | |||||||||

|

|

|

|

|

|

|

| |||||||||

| (Unaudited) |

| (Unaudited) | |||||||||||||

Revenues |

|

|

|

|

|

|

| |||||||||

Product revenue, net | $ | 993,447 |

|

| $ | 595,290 |

|

| $ | 2,661,511 |

|

| $ | 1,559,326 |

| |

Collaboration revenue |

| 8,152 |

|

|

| 186,018 |

|

|

| 20,906 |

|

|

| 265,044 |

| |

Total revenues |

| 1,001,599 |

|

|

| 781,308 |

|

|

| 2,682,417 |

|

|

| 1,824,370 |

| |

Cost of sales - products |

| 170,462 |

|

|

| 96,309 |

|

|

| 433,529 |

|

|

| 274,088 |

| |

Gross profit |

| 831,137 |

|

|

| 684,999 |

|

|

| 2,248,888 |

|

|

| 1,550,282 |

| |

Operating expenses: |

|

|

|

|

|

|

| |||||||||

Research and development |

| 496,179 |

|

|

| 453,259 |

|

|

| 1,411,283 |

|

|

| 1,284,607 |

| |

Selling, general and administrative |

| 455,223 |

|

|

| 365,708 |

|

|

| 1,326,379 |

|

|

| 1,089,616 |

| |

Total operating expenses |

| 951,402 |

|

|

| 818,967 |

|

|

| 2,737,662 |

|

|

| 2,374,223 |

| |

Loss from operations |

| (120,265 | ) |

|

| (133,968 | ) |

|

| (488,774 | ) |

|

| (823,941 | ) | |

Interest income, net |

| 10,643 |

|

|

| 26,649 |

|

|

| 40,028 |

|

|

| 57,735 |

| |

Other income, net |

| 11,318 |

|

|

| 336,657 |

|

|

| 1,096 |

|

|

| 291,142 |

| |

(Loss) income before income taxes |

| (98,304 | ) |

|

| 229,338 |

|

|

| (447,650 | ) |

|

| (475,064 | ) | |

Income tax expense |

| 23,046 |

|

|

| 13,925 |

|

|

| 45,255 |

|

|

| 39,091 |

| |

Net (loss) income |

| (121,350 | ) |

|

| 215,413 |

|

|

| (492,905 | ) |

|

| (514,155 | ) | |

|

|

|

|

|

|

|

| |||||||||

(Loss) earnings per share |

|

|

|

|

|

|

| |||||||||

Basic |

| (0.09 | ) |

|

| 0.16 |

|

|

| (0.36 | ) |

|

| (0.38 | ) | |

Diluted |

| (0.09 | ) |

|

| 0.15 |

|

|

| (0.36 | ) |

|

| (0.38 | ) | |

Weighted-average shares outstanding—basic |

| 1,376,751,873 |

|

|

| 1,360,716,279 |

|

|

| 1,361,216,763 |

|

|

| 1,358,392,470 |

| |

Weighted-average shares outstanding—diluted |

| 1,376,751,873 |

|

|

| 1,390,331,833 |

|

|

| 1,361,216,763 |

|

|

| 1,358,392,470 |

| |

|

|

|

|

|

|

|

| |||||||||

(Loss) earnings per American Depositary Share (“ADS”) |

|

|

|

|

|

|

| |||||||||

Basic |

| (1.15 | ) |

|

| 2.06 |

|

|

| (4.71 | ) |

|

| (4.92 | ) | |

Diluted |

| (1.15 | ) |

|

| 2.01 |

|

|

| (4.71 | ) |

|

| (4.92 | ) | |

Weighted-average ADSs outstanding—basic |

| 105,903,990 |

|

|

| 104,670,483 |

|

|

| 104,708,982 |

|

|

| 104,491,728 |

| |

Weighted-average ADSs outstanding—diluted |

| 105,903,990 |

|

|

| 106,948,603 |

|

|

| 104,708,982 |

|

|

| 104,491,728 |

| |

Contacts

Investors

Liza Heapes

+1 857-302-5663

ir@beigene.com

Media

Kyle Blankenship

+1 667-351-5176

media@beigene.com

Read full story here