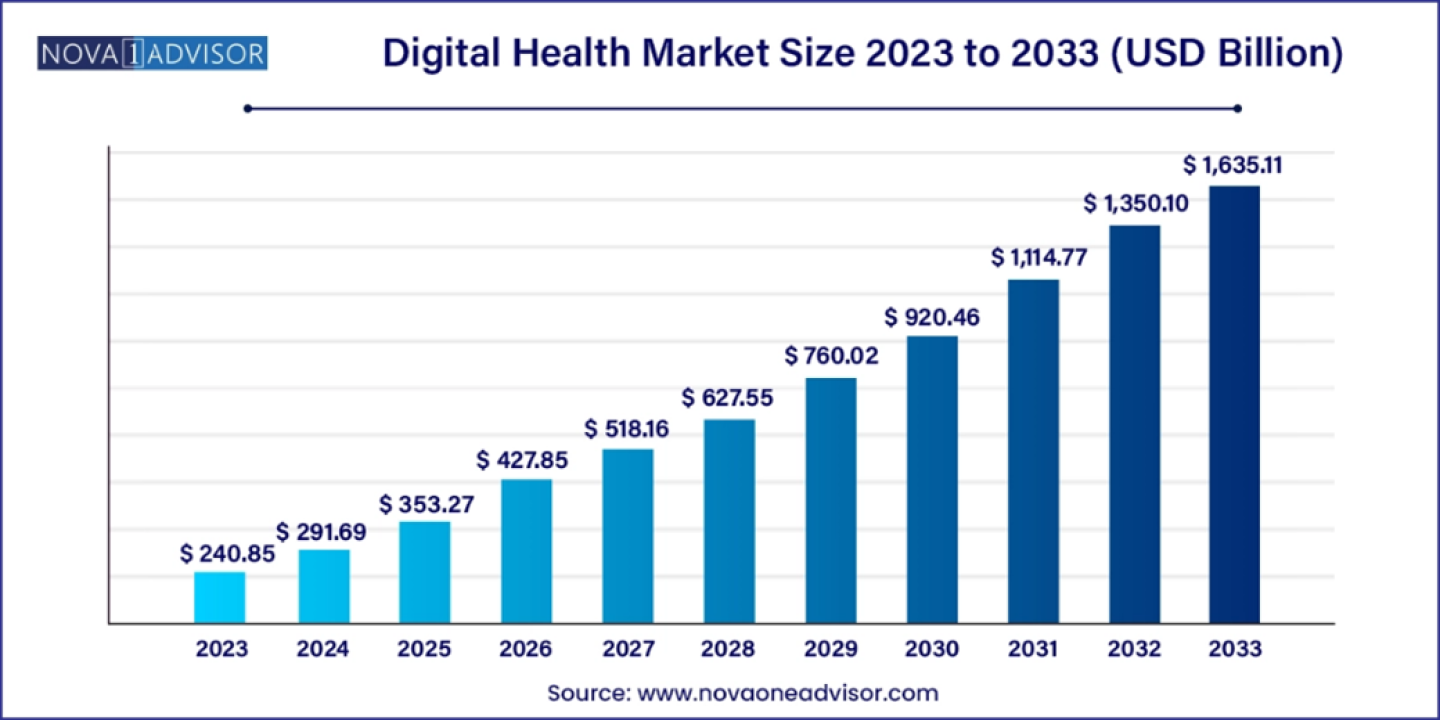

According to Nova One Advisor, the global digital health market size was exhibited at USD 240.85 billion in 2023 and is projected to hit around USD 1,635.11billion by 2033, growing at a CAGR of 21.11% during the forecast period 2024 to 2033.

Full Report is Ready | Ask here for Sample Copy@ https://www.novaoneadvisor.com/report/sample/5756

The increasing prevalence of chronic diseases is expected to drive the growth of the digital health market. The digital health market deals with the use of technology, such as electronic health records, wearables, and smartphones, to improve health outcomes, patient engagement, and healthcare delivery. Digital health involves digital care programs, which combine digital technologies with society, living, healthcare, and health to increase the efficiency of healthcare delivery to make medicine more personalized and precise.

Digital health has transformed the world with the rising development of digital health platforms such as wireless solutions, mobile health, and telehealth software across nursing homes and hospitals to offer patients real-time healthcare services. The market for digital health is driven by various factors such as the increasing presence of e-prescription systems, wearable device manufacturers, mHealth app providers, and a rising strong domestic market for telehealthcare platform developers.

Digital Health Market Report Highlights

Digital Health Market at a Glance

Due to the supportive government initiatives across all regions, the healthcare industry exhibits high growth potential for the IT industry. The rising funding for mHealth startups and the rising trend of preventive healthcare. The increasing prevalence of chronic diseases such as cancer, heart disease, and diabetes is driving the demand for management solutions and remote monitoring. Digital health devices can help patients communicate with healthcare providers, adhere to treatment plans, and track their health more effectively.

The ongoing R&D initiatives have raised the development of innovative digital technologies with innovative features at affordable costs. In addition, digital technology is helping maintain affordability across the sector as the healthcare ecosystems improve. Moreover, the rising technological advancements in the form of the emergence of robotics, the Internet of Things, and artificial intelligence are further expected to drive the growth of the digital health market.

Some Statistics Related To Chronic Conditions:

Increasing demand for personalized healthcare facilities to fuel market growth.

Due to the increasing demand for personalized healthcare solutions, digital health technologies are being adopted that can provide patients with treatment plans and individualized care. Personalized healthcare is a process of offering care that generates treatment plans, particularly for every patient by taking into account their traits such as environmental influences, lifestyle, and genetics. Digital health technologies such as machine learning technologies, health information exchanges, and electronic health records can enable personalized healthcare, by giving healthcare providers access to patient information and giving them the devices to detect that data to find individualized treatment options. This can guide medical professionals in an efficient condition. Thus, these factors are expected to enhance the growth of the digital health market during the forecast period.

However, limited access to technology may restrain the market growth

Due to issues such as availability or affordability, access to smartphones and other devices may be restricted. Patient use of mobile health applications or wearables designed to support self-care, and remote monitoring may be a major challenge. If there is poor internet connectivity, accessing digital health technologies may also be difficult. It may be difficult for healthcare professionals and patients to share health data and access telemedicine services remotely due to insufficient internet infrastructure in remote or rural areas. This could make digital health applications more difficult to treat patients. These factors are expected to restrain the growth of the digital health market.

Government regulations and initiatives to revolutionize market growth.

Governments are providing support and funding for digital health initiatives, including the implementation of digital health solutions, pilot programs, and research and development activities. Governments are improving regulatory frameworks to ensure the safety, security, and effectiveness of digital health solutions, which can help to develop trust between medical professionals and patients. They are also providing subsidies, grants, tax credits, and other incentives to encourage the adoption of digital health technologies.

Governments are developing interoperability standards, to guarantee that various health solutions can work together. This can help to improve the efficiency and effectiveness of healthcare services. To develop trust between healthcare professionals and patients, governments are putting regulations to protect the privacy and security of patient data. These factors are expected to enhance the growth of the digital health market.

Europe dominated the digital health market in 2023.

The increasing government campaigns to support digital healthcare solutions, rising technological improvements, growing aging population, and rising healthcare expenditure are expected to drive market growth in the region. There has been significant growth in the market for European digital health. In Europe, people can monitor several health metrics with these applications, such as sleep patterns, physical activity, and heart rate. Germany is the dominating and fastest-growing country in the region. In Germany, digital health products and medical applications fall under the regulations of the In Vitro Diagnostics Regulation and the EU’s Medical Devices Regulation. These applications are applicable in Germany.

· For instance, In June 2024, in Copenhagen, Denmark, Europe/WHO announced the launch of its first-ever Strategic Partners’ Initiative for Data and Digital Health (SPI-DDH). This newly developed initiative commences its collaborative work to address and identify gaps in digital health and data ecosystems to help build affordable and safe health systems in the WHO European Region.

Asia Pacific is expected to grow fastest during the forecast period.

The increasing government initiatives, increasing awareness of the benefits of healthcare management, and rising healthcare costs are expected to enhance the growth of the digital health market in the region. Healthcare facilities are continuously implementing healthcare IT solutions, including electronic health records, hospital information systems, and practice management software to enhance operational effectiveness and patient care. In the region, governments are putting supportive regulations and laws to motivate the adoption of digital health. The U.S. and Canada are the major countries in the region.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/5756

Digital Health Market Segments

By component, the services segment led the market

The services segment accounted for the largest market share in 2023. The segment is attributed to the notable growth in software development with advancements in various hardware and software. These services involve upgradation, installation, and integration & training. The increasing need for training and upgradation to run software solutions and growing demand for advanced software platforms and solutions are expected to enhance the growth of the services segment.

By technology, the telehealthcare led the market

The telehealthcare segment accounted for the largest market share in 2023. The telehealthcare segment is attributed to rising innovation and investment, government policies and support, the growing need for remote care, and increasing demand for telehealth. In addition, telehealth also provides an accurate, quick, and cost-effective way to access healthcare services contributing to propel the growth of the telehealthcare segment.

By Component, the services led the market

Based on component, the services segment led the market with the largest revenue share 48.0% in 2023, owing to the growing demand for services, such as installation, staffing, training, maintenance, and other services. Market players are either providing these services as standalone or in packages. The growing demand for advanced software solutions and platforms, such as Electronic Medical Records (EMRs), EHR, and the increasing need for upgradation & training required to run these software solutions, are contributing to segment growth. As per 2021 HealthIT.gov report, nearly 88% of U.S. office-based doctors use EHRs, within that 78% using certified EHRs. Key players provide a wide array of pre- & post-installation services, covering project planning, staffing, implementation, training, and resource allocation & optimization.

The software segment is anticipated to register the fastest CAGR of 23.2% from 2024 to 2033, due to rapid adoption of software systems among patients, healthcare facilities, providers, and insurance payers. Growing healthcare expenses and the trend of healthcare digitalization are contributing to the growth of the software segment. Growing consumer demand for personalized medicine and the transition to value-based care is driving segment growth. In emerging economies, healthcare facilities readily adopt these advanced software solutions and platforms to streamline their organizational workflows and enhance their clinical, operational, & financial outcomes.

By End-use, the patient led the market

Based on end-use, the patient segment held the market with the largest revenue share of 34.11 % in 2023 and is expected to witness the fastest CAGR from 2024 to 2033, owing to the shift toward patient-centered care and high awareness of managing health among individuals. Digital health technologies have revolutionized the healthcare landscape by providing patients with tools for remote monitoring, self-management, and access to health information. From mobile health apps that track vital signs to telehealth platforms facilitating virtual consultations, the focus on the patient segment reflects the industry's commitment to enhancing patient engagement, promoting proactive health management, and fostering a more collaborative and informed healthcare experience.

The providers segment holds a significant share of the global market and is expected to maintain their market share over the forecast period. The growth is propelled by the widespread adoption of innovative technologies, such as telemedicine and digital therapeutics. Healthcare providers are increasingly leveraging digital solutions to offer remote consultations, personalized treatment plans, and evidence-based therapies outside traditional care settings. The integration of digital tools allows providers to deliver more accessible and tailored care, contributing to improved patient outcomes.

Related report

Telehealth Market : The global telehealth market size was valued at USD 112.08 billion in 2023 and is anticipated to reach around USD 1,002.82 billion by 2033, growing at a CAGR of 24.5% from 2024 to 2033.

Telemedicine Market: The global telemedicine market size was estimated at USD 115.19 billion in 2023 and is projected to hit around USD 601.35 billion by 2033, growing at a CAGR of 17.97% during the forecast period from 2024 to 2033.

Immediate Delivery Available | Buy This Premium Research

https://www.novaoneadvisor.com/report/checkout/5756

Some of the prominent players in the Digital health market include:

· In March 2024, the Indian Institute of Technology Bombay (IIT Bombay) and the International Institute of Health Management Research (IIHMR) Delhi, UNICEF India launched digital health courses such as the Digital Health Enterprise Planning Course. This course is equipped with healthcare professionals, such as pharmacists, nurses, and doctors.

· In February 2024, a platform for sharing knowledge and digital products among countries, the Global Initiative on Digital Health (GIDH) virtually was launched by the World Health Organization (WHO). India’s representative and Union Health Minister Mansukh Mandaviya to the UN Arindam Bagchi addressed the gathering at the launch of GIDH.

· In April 2024, Ahead of World Health Day, the World Health Organization (WHO) on Tuesday announced the launch of S.A.R.A.H., a digital health promoter prototype with enhanced empathetic response powered by generative artificial intelligence (AI).

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the digital health market

By Technology

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Full Report is Ready | Ask here for Sample Copy@ https://www.novaoneadvisor.com/report/sample/5756

The increasing prevalence of chronic diseases is expected to drive the growth of the digital health market. The digital health market deals with the use of technology, such as electronic health records, wearables, and smartphones, to improve health outcomes, patient engagement, and healthcare delivery. Digital health involves digital care programs, which combine digital technologies with society, living, healthcare, and health to increase the efficiency of healthcare delivery to make medicine more personalized and precise.

Digital health has transformed the world with the rising development of digital health platforms such as wireless solutions, mobile health, and telehealth software across nursing homes and hospitals to offer patients real-time healthcare services. The market for digital health is driven by various factors such as the increasing presence of e-prescription systems, wearable device manufacturers, mHealth app providers, and a rising strong domestic market for telehealthcare platform developers.

Digital Health Market Report Highlights

- The U.S. digital health market size is predicted to grow from USD 81.45 billion in 2023 to USD 487.76 billion by 2033. It is anticipated to grow at a compound annual growth rate (CAGR) of 19.6% from 2024 to 2033.

- The Asia Pacific digital health market size was exhibited at USD 60.15 billion in 2023 and is projected to hit around USD 488.50 billion by 2033, growing at a CAGR of 23.3% during the forecast period 2024 to 2033.

- The Europe digital health market size was exhibited at USD 66.75 billion in 2023 and is projected to hit around USD 507.94 billion by 2033, growing at a CAGR of 22.5% during the forecast period 2024 to 2033.

- The germany digital health market size was estimated at USD 8.84 billion in 2023 and is projected to hit around USD 38.66 billion by 2033, registering a CAGR of 15.9% during the forecast period from 2024 to 2033.

- The Saudi Arabia digital health market size was estimated at USD 2.45 billion in 2023 and is expected to surpass around USD 14.43 billion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 19.4% during the forecast period 2024 to 2033.

- The North America digital health market size was exhibited at USD 94.55 billion in 2023 and is projected to hit around USD 478.34 billion by 2033, growing at a CAGR of 17.6% during the forecast period 2024 to 2033.

- North America dominated the market with a revenue share of 38.45% in 2023 due to the rapidly developing healthcare IT infrastructure, emergence of startups, growing funding options, and improving technological literacy

- Based on component, the services segment accounted for largest revenue share of 48.0% in 2023, owing to the growing demand for services, such as installation, staffing, training, maintenance, and other services

- Based on technology, the tele-healthcare segment led the market with the largest revenue share of 43.12% in 2023, due to increasing preference for remote patient monitoring services and shortage of healthcare professionals

- Based on the application, the diabetes segment led the market with the largest share of 24.13% in 2023 and is expected to register the fastest CAGR over the forecast period. The obesity segment is the second largest in applications of the digital health market

- Based on the end-use, the patient segment held the largest market share of 34.11% in 2023 and is expected to witness the fastest CAGR during the forecast period

Digital Health Market at a Glance

Due to the supportive government initiatives across all regions, the healthcare industry exhibits high growth potential for the IT industry. The rising funding for mHealth startups and the rising trend of preventive healthcare. The increasing prevalence of chronic diseases such as cancer, heart disease, and diabetes is driving the demand for management solutions and remote monitoring. Digital health devices can help patients communicate with healthcare providers, adhere to treatment plans, and track their health more effectively.

The ongoing R&D initiatives have raised the development of innovative digital technologies with innovative features at affordable costs. In addition, digital technology is helping maintain affordability across the sector as the healthcare ecosystems improve. Moreover, the rising technological advancements in the form of the emergence of robotics, the Internet of Things, and artificial intelligence are further expected to drive the growth of the digital health market.

Some Statistics Related To Chronic Conditions:

- Global Statistics: According to the WHO Non-communicable diseases cause 41 million deaths annually, constituting 74% of global fatalities. 17 million of these deaths occur before the age of 70, with 86% transpiring in low- and middle-income countries, and the majority of NCD deaths (77%) are concentrated in these regions. The leading contributors to NCD-related deaths include cancers (9.3 million), chronic respiratory diseases (4.1 million), diabetes (2.0 million, including diabetes-induced kidney disease deaths), and cardiovascular diseases (17.9 million)

- Economic Impact: The National Center for Chronic Disease Prevention and Health Promotion (NCCDPHP) in the U.S highlights the substantial economic impact of chronic diseases. Annually, heart disease and stroke, claiming over 877,500 lives, represent one-third of all deaths and generate a USD 216 billion economic burden on the healthcare system. Cancer, diagnosed in 1.7 million people yearly, ranks as the second leading cause of death, anticipating a cost exceeding USD 310 billion by 2033. Diabetes, affecting 37 million Americans with an additional 96 million at risk, incurred a total estimated cost of USD 327 billion in 2017, encompassing medical expenses and lost productivity

- Individual Impact: Beyond the economic factors, chronic conditions significantly impact patients' quality of life. These conditions necessitate daily management, demanding ongoing attention, lifestyle modifications, and adherence to treatment plans. The continuous effort required to cope with chronic illnesses can lead to physical and emotional challenges, affecting not only the individuals but also their families and support networks. Moreover, if left unmanaged, chronic conditions often give rise to complications, further escalating the overall burden on patients and potentially diminishing their overall well-being

- Remote Monitoring: Digital tools such as wearable devices and connected sensors allow patients to track vital signs, blood sugar levels, or other critical data in real-time, empowering them to manage their health proactively

- Improved Adherence: Medication reminders, educational resources, and personalized coaching apps can help patients stay on track with treatment plans, leading to better health outcomes

- Enhanced Communication: Telehealth platforms and secure messaging apps facilitate seamless communication between patients and healthcare providers, allowing for timely consultations, adjustments to treatment plans, and addressing concerns without physical visits

- Empowerment & Engagement: By providing patients with accessible tools and information, digital health fosters a sense of control and engagement in their own health journey, motivating them to actively participate in their care

Increasing demand for personalized healthcare facilities to fuel market growth.

Due to the increasing demand for personalized healthcare solutions, digital health technologies are being adopted that can provide patients with treatment plans and individualized care. Personalized healthcare is a process of offering care that generates treatment plans, particularly for every patient by taking into account their traits such as environmental influences, lifestyle, and genetics. Digital health technologies such as machine learning technologies, health information exchanges, and electronic health records can enable personalized healthcare, by giving healthcare providers access to patient information and giving them the devices to detect that data to find individualized treatment options. This can guide medical professionals in an efficient condition. Thus, these factors are expected to enhance the growth of the digital health market during the forecast period.

However, limited access to technology may restrain the market growth

Due to issues such as availability or affordability, access to smartphones and other devices may be restricted. Patient use of mobile health applications or wearables designed to support self-care, and remote monitoring may be a major challenge. If there is poor internet connectivity, accessing digital health technologies may also be difficult. It may be difficult for healthcare professionals and patients to share health data and access telemedicine services remotely due to insufficient internet infrastructure in remote or rural areas. This could make digital health applications more difficult to treat patients. These factors are expected to restrain the growth of the digital health market.

Government regulations and initiatives to revolutionize market growth.

Governments are providing support and funding for digital health initiatives, including the implementation of digital health solutions, pilot programs, and research and development activities. Governments are improving regulatory frameworks to ensure the safety, security, and effectiveness of digital health solutions, which can help to develop trust between medical professionals and patients. They are also providing subsidies, grants, tax credits, and other incentives to encourage the adoption of digital health technologies.

Governments are developing interoperability standards, to guarantee that various health solutions can work together. This can help to improve the efficiency and effectiveness of healthcare services. To develop trust between healthcare professionals and patients, governments are putting regulations to protect the privacy and security of patient data. These factors are expected to enhance the growth of the digital health market.

Europe dominated the digital health market in 2023.

The increasing government campaigns to support digital healthcare solutions, rising technological improvements, growing aging population, and rising healthcare expenditure are expected to drive market growth in the region. There has been significant growth in the market for European digital health. In Europe, people can monitor several health metrics with these applications, such as sleep patterns, physical activity, and heart rate. Germany is the dominating and fastest-growing country in the region. In Germany, digital health products and medical applications fall under the regulations of the In Vitro Diagnostics Regulation and the EU’s Medical Devices Regulation. These applications are applicable in Germany.

· For instance, In June 2024, in Copenhagen, Denmark, Europe/WHO announced the launch of its first-ever Strategic Partners’ Initiative for Data and Digital Health (SPI-DDH). This newly developed initiative commences its collaborative work to address and identify gaps in digital health and data ecosystems to help build affordable and safe health systems in the WHO European Region.

Asia Pacific is expected to grow fastest during the forecast period.

The increasing government initiatives, increasing awareness of the benefits of healthcare management, and rising healthcare costs are expected to enhance the growth of the digital health market in the region. Healthcare facilities are continuously implementing healthcare IT solutions, including electronic health records, hospital information systems, and practice management software to enhance operational effectiveness and patient care. In the region, governments are putting supportive regulations and laws to motivate the adoption of digital health. The U.S. and Canada are the major countries in the region.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/5756

Digital Health Market Segments

By component, the services segment led the market

The services segment accounted for the largest market share in 2023. The segment is attributed to the notable growth in software development with advancements in various hardware and software. These services involve upgradation, installation, and integration & training. The increasing need for training and upgradation to run software solutions and growing demand for advanced software platforms and solutions are expected to enhance the growth of the services segment.

By technology, the telehealthcare led the market

The telehealthcare segment accounted for the largest market share in 2023. The telehealthcare segment is attributed to rising innovation and investment, government policies and support, the growing need for remote care, and increasing demand for telehealth. In addition, telehealth also provides an accurate, quick, and cost-effective way to access healthcare services contributing to propel the growth of the telehealthcare segment.

By Component, the services led the market

Based on component, the services segment led the market with the largest revenue share 48.0% in 2023, owing to the growing demand for services, such as installation, staffing, training, maintenance, and other services. Market players are either providing these services as standalone or in packages. The growing demand for advanced software solutions and platforms, such as Electronic Medical Records (EMRs), EHR, and the increasing need for upgradation & training required to run these software solutions, are contributing to segment growth. As per 2021 HealthIT.gov report, nearly 88% of U.S. office-based doctors use EHRs, within that 78% using certified EHRs. Key players provide a wide array of pre- & post-installation services, covering project planning, staffing, implementation, training, and resource allocation & optimization.

The software segment is anticipated to register the fastest CAGR of 23.2% from 2024 to 2033, due to rapid adoption of software systems among patients, healthcare facilities, providers, and insurance payers. Growing healthcare expenses and the trend of healthcare digitalization are contributing to the growth of the software segment. Growing consumer demand for personalized medicine and the transition to value-based care is driving segment growth. In emerging economies, healthcare facilities readily adopt these advanced software solutions and platforms to streamline their organizational workflows and enhance their clinical, operational, & financial outcomes.

By End-use, the patient led the market

Based on end-use, the patient segment held the market with the largest revenue share of 34.11 % in 2023 and is expected to witness the fastest CAGR from 2024 to 2033, owing to the shift toward patient-centered care and high awareness of managing health among individuals. Digital health technologies have revolutionized the healthcare landscape by providing patients with tools for remote monitoring, self-management, and access to health information. From mobile health apps that track vital signs to telehealth platforms facilitating virtual consultations, the focus on the patient segment reflects the industry's commitment to enhancing patient engagement, promoting proactive health management, and fostering a more collaborative and informed healthcare experience.

The providers segment holds a significant share of the global market and is expected to maintain their market share over the forecast period. The growth is propelled by the widespread adoption of innovative technologies, such as telemedicine and digital therapeutics. Healthcare providers are increasingly leveraging digital solutions to offer remote consultations, personalized treatment plans, and evidence-based therapies outside traditional care settings. The integration of digital tools allows providers to deliver more accessible and tailored care, contributing to improved patient outcomes.

Related report

Telehealth Market : The global telehealth market size was valued at USD 112.08 billion in 2023 and is anticipated to reach around USD 1,002.82 billion by 2033, growing at a CAGR of 24.5% from 2024 to 2033.

Telemedicine Market: The global telemedicine market size was estimated at USD 115.19 billion in 2023 and is projected to hit around USD 601.35 billion by 2033, growing at a CAGR of 17.97% during the forecast period from 2024 to 2033.

Immediate Delivery Available | Buy This Premium Research

https://www.novaoneadvisor.com/report/checkout/5756

Some of the prominent players in the Digital health market include:

- Telefónica S.A.

- Epic Systems Corporation

- QSI Management, LLC

- AT&T

- AirStrip Technologies

- Google, Inc.

- Hims & Hers Health, Inc.

- Orange

- Softserve

- Computer Programs and Systems, Inc.

- Vocera Communications

- IBM Corporation

- CISCO Systems, Inc.

- Apple Inc.

- Oracle Cerner

- Veradigm

- Mckesson Corporation

- Hims & Hers Health, Inc.

- Vodafone Group

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

· In March 2024, the Indian Institute of Technology Bombay (IIT Bombay) and the International Institute of Health Management Research (IIHMR) Delhi, UNICEF India launched digital health courses such as the Digital Health Enterprise Planning Course. This course is equipped with healthcare professionals, such as pharmacists, nurses, and doctors.

· In February 2024, a platform for sharing knowledge and digital products among countries, the Global Initiative on Digital Health (GIDH) virtually was launched by the World Health Organization (WHO). India’s representative and Union Health Minister Mansukh Mandaviya to the UN Arindam Bagchi addressed the gathering at the launch of GIDH.

· In April 2024, Ahead of World Health Day, the World Health Organization (WHO) on Tuesday announced the launch of S.A.R.A.H., a digital health promoter prototype with enhanced empathetic response powered by generative artificial intelligence (AI).

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the digital health market

By Technology

- Tele-healthcare

- Tele-care

- Activity Monitoring

- Remote Medication Management

- Tele-health

- LTC Monitoring

- Video Consultation

- mHealth

- Wearables & Connected Medical Devices

- Vital Sign Monitoring Device

- Heart Rate Monitors

- Activity Monitors

- Electrocardiographs

- Pulse Oximeters

- Spirometers

- Blood Pressure Monitors

- Others

- Sleep Monitoring Devices

- Sleep trackers

- Wrist Actigraphs

- Polysomnographs

- Others

- Electrocardiographs Fetal & Obstetric Devices

- Neuromonitoring Devices

- Electroencephalographs

- Electromyographs

- Others

- mHealth Apps

- Medical Apps

- Women's Health

- Fitness & Nutrition

- Menstrual Health

- Pregnancy Tracking & Postpartum Care

- Menopause

- Disease Management

- Others

- Chronic Disease Management Apps

- Diabetes Management Apps

- Blood Pressure & ECG Monitoring Apps

- Mental Health Management Apps

- Cancer Management Apps

- Obesity Management Apps

- Other Chronic Disease Management Apps

- Personal Health Record Apps

- Medication Management Apps

- Diagnostic Apps

- Remote Monitoring Apps

- Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education

- Fitness Apps

- Services

- Monitoring Services

- Independent Aging Solutions

- Chronic Disease Management & Post-Acute Care Services

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Others

- Digital Health Systems

- EHR

- E-prescribing Systems

- Healthcare Analytics

- Software

- Hardware

- Services

- Obesity

- Diabetes

- Cardiovascular

- Respiratory Diseases

- Others

- Patients

- Providers

- Payers

- Others

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/