Digital Pathology Market Outlook 2024-2032:

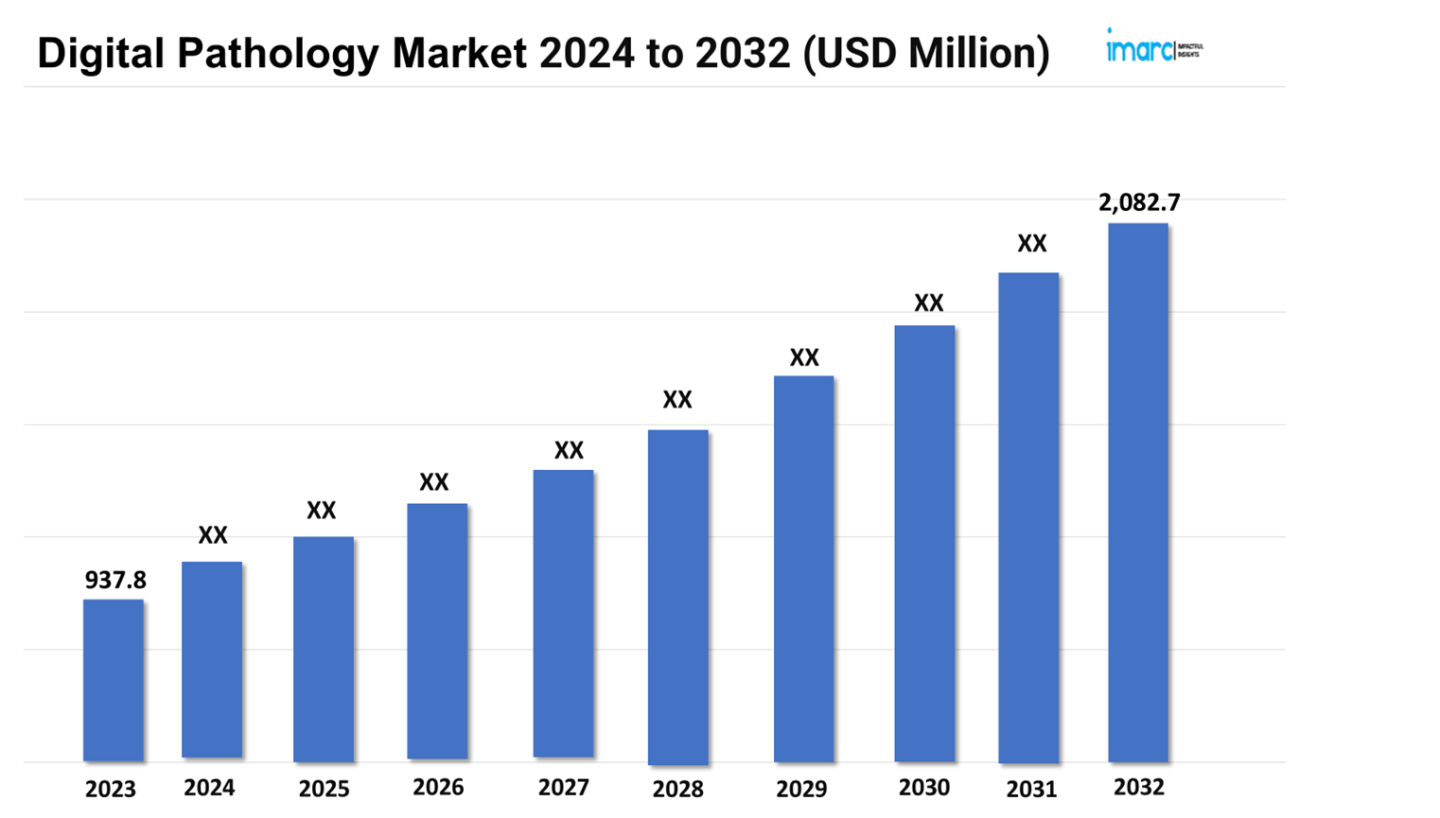

The digital pathology market size reached a value of USD 937.8 Million in 2023. Looking forward, the market is expected to reach USD 2,082.7 Million by 2032, exhibiting a growth rate (CAGR) of 9% during 2024-2032.

The market is driven by advancements in imaging technology and digital scanners, the increasing prevalence of chronic diseases and cancer, and the growing adoption of telepathology and remote diagnostics, numerous innovations by leading companies, considerable rise in healthcare infrastructure investments, an enhanced emphasis on personalized medicine, and the implementation of supportive government initiatives.

Advancements in Imaging Technology and Digital Scanners are Increasing the Adoption

Improvements in imaging technology and the development of high-performance digital scanners mainly propel the growth of the market. High-resolution image acquisition and advanced digital scanning solutions help pathologists capture details of accurate images of pathology slides, thereby changing traditional microscopy practices. These technologies facilitate digitization of the whole slides, which can be stored, analyzed, and shared electronically. Such high-quality resolution and imaging help examiners get a closer view for accurate diagnosis, hence decreasing the margin of error and increasing the accuracy of disease detection and classification.

Request a PDF Sample Report: https://www.imarcgroup.com/digital-pathology-market/requestsample

Moreover, the integration of artificial intelligence and machine learning algorithms with such advanced technologies in image acquisitions is magnifying diagnostic capability by providing automated analysis and predictions that assist the pathologist in reaching more accurate decisions. For instance, PathAI, a global leader in AI-powered pathology introduced AISightTM, PathAI's digital pathology platform, and the AIM-PD-L1 NSCLC RUO algorithm1, which quantitates the percent of PD-L1 positive tumor and immune cells in non-small cell lung cancer (NSCLC) samples across the whole slide image, in 13 leading academic medical centers, health systems, reference laboratories, and independent pathology organizations across the United States.

Advanced digital scanners are also adopted at pathology laboratories for enhanced efficiency and productivity of the workflow. Digital scanners permit the fast digitization of slides for remote consultation and telepathology where there is a deficiency of specialized pathologists. Such accessibility ensures collaboration and knowledge sharing across borders between healthcare professionals to ensure better patient outcomes. Moreover, digital scanners with their cloud storage solutions ensure safe and easy access to digital slides for the long-term management of data and archiving process. This improvement in technology is removing flaws in operational efficiency and saving money by reducing physical storage requirement and the threats to slides from getting damaged or destroyed. This thereby makes the incessant innovation in imaging technology and digital scanners a key driver of growth and adoption of digital pathology, revolutionizing the field and improving quality patient care.

Increasing Prevalence of Chronic Diseases and Cancer Contributing to Market Growth

One of the major drivers of the market is the increasing prevalence of chronic diseases, such as diabetes and cancer. About 422 million people worldwide have diabetes, the majority living in low-and middle-income countries, and 1.5 million deaths are directly attributed to diabetes each year. Both the number of cases and the prevalence of diabetes have been steadily increasing over the past few decades according to the World Health Organization. The occurrence of chronic diseases, particularly cancer, has been rising globally, which has increased the demand for diagnostic methods that offer better accuracy and work proficiently.

Traditional pathology methods often involve time-consuming processes that can delay diagnosis and treatment. Digital pathology, however, provides a faster and more accurate alternative, as pathologists are able to digitize tissue samples and work with advanced image analytics. This rapid and precise diagnosis becomes important for managing chronic diseases and cancer, for which it can greatly improve patient outcomes through early detection and timely intervention. In addition, the ease of sharing digital slides with the world's experts instantly facilitates the review of challenging cases and further contributes to diagnostic accuracy, improving patient care.

Increasing cases of chronic diseases together with cancer burdens have also been one of the factors leading to the investments made in healthcare infrastructure and technology. Such health challenges are compelling governments and associated health bodies to appreciate the need for sophisticated diagnostic solutions. Digital pathology is becoming an inseparable part of modern healthcare systems with its potential to smooth workflows, reduce diagnostic errors, and large-scale screening programs.

For example, in oncology, digital pathology applies all the methods of genetic and molecular profiling to traditional histopathological analysis within a comprehensive strategy for the diagnosis of cancer and personalization of treatment plans. Scalability and efficiency in digital pathology have proved useful in issuing a high number of diagnostic tests for chronic disease management. Moreover, the rising incidence of chronic diseases and cancer is therefore increasing the importance of digital pathology for diagnostic accuracy, improvement in patient outcomes, and developing the healthcare systems in a number of requirements.

Growing Adoption of Telepathology and Remote Diagnostics: A Key Market Driver

The growing adoption of telepathology and remote diagnostics majorly drives the market, revolutionizing diagnostic medicine. Telepathology is one of the technologies that integrates advanced digital imaging tools along with high-end communication tools to permit a pathologist to examine slides that are at physically removed locations. This is particularly advantageous in underserved areas where specialist pathology services are not available. Telepathology facilitates real-time consultation and collaboration between pathologists and healthcare providers around the world, increasing diagnostic accuracy while reducing turnaround times, ensuring patients get accurate diagnoses. This is especially invaluable in emergencies where timely intervention is highly critical to treatment efficacy and eventual survival rates for a proper diagnosis to be made from a distance.

The incorporation of telepathology into digital pathology platforms confers several operational and logistical advantages. Centralization of pathology enables a central, specialized team to digitize and examine pathology slides from different locations. It optimizes resource use, reduces the number of physical transports of slides, saves time, and minimizes damage to or loss of slides in transit. Advancements in artificial intelligence (AI) and machine learning (ML) further increase diagnostic accuracy with image analysis and decision support automated tools, which can help pathologists detect patterns and anomalies that might be missing from a manual examination of slides. Hence, diagnostic precision is increased while continuous education and training for pathologists are supported.

It is in public health emergencies, such as the COVID-19 pandemic, that convenience and efficiency in telepathology assume paramount importance for reducing physical contact while ensuring diagnostic services are uninterrupted. A remote patient monitoring (RPM) program was developed for ambulatory management of COVID-19, utilizing existing technology and resources. According to a report published in NPJ Digital Medicine in 2021 by Jordan D. Coffey, 7074 patients across 41 US states were evaluated, finding a 78.9% engagement rate with RPM technology. Emergency department visits and hospitalizations within 30 days were 11.4% and 9.4%, respectively, with a 30-day mortality rate of 0.4%. The RPM program proved feasible, safe, and effective, suggesting potential for expansion to other acute illnesses. As healthcare systems across the globe strive to address disparities in access to medical care, the widespread adoption of telepathology emerges as a key solution for extending high-quality diagnostic services to remote and under-resourced masses.

Buy Full Report: https://www.imarcgroup.com/checkout?id=1836&method=502

Leading Companies in the Digital Pathology Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Some of the players are DHISTECH, Apollo Enterprise Imaging, Corista, Hamamatsu Photonics, Huron Digital Pathology, Indica Labs, Koninklijke Philips, Leica Biosystems, Objective Pathology Services, Ventana Medical Systems, Visiopharm, and XIFIN.

Microsoft has announced that the company is building a foundation model for pathology in collaboration with Providence and the University of Washington. More precisely, using its hard work and progress in the domain of generative AI, the company has announced GigaPath—the very first whole-slide foundation model for digital pathology, which is pretrained with real-world data.

SigTuple, a medtech company that develops artificial intelligence (AI)-powered digital microscopy solutions, has received U.S. FDA 510(k) clearance for its device -- AI100 with Shonit (a peripheral blood smear application). The device is the premier solution for AI-assisted digital pathology, wherein a physical sample is digitally imaged through a microscopic lens, and the AI models extract each cell and then classify it into over 30 different cell types.

Agilent Technologies Inc. partnered with Hamamatsu Photonics K.K., a leading provider of whole slide imaging systems, to integrate its NanoZoomer range including the S360MD Slide scanner system into the Agilent end-to-end digital pathology solution. With the addition of the NanoZoomer Slide scanner systems, which converts glass slides into high-resolution digital data by high-speed scanning, Agilent completes its offering of an open and agnostic digital pathology workflow designed to accelerate breakthroughs in precision medicine.

4DMedical, the leader in advanced lung function imaging software, has been granted FDA clearance for its CT-based ventilation product, CT LVAS. CT LVAS is indicated for computed tomography scans and is the second product from 4D Medical to be cleared by the FDA for use in the United States with fluoroscopy imaging software, XV LVAS®. The FDA clearance for CT LVAS aligns with the next product that 4DMedical will have available in its portfolio: CT:VQ. CT:VQ enables quantitative perfusion data and visualization from CT scans.

Thermo Fisher Scientific has launched the KingFisher Apex Dx system and Applied Biosystems MagMax Dx Isolation Kit. The KingFisher Apex Dx platform is an automated nucleic acid purification instrument, and the MagMax Dx Isolation Kit is developed for the isolation and purification of viral and bacterial pathogens from respiratory biological specimens. Together, these two products provide laboratories with in vitro diagnostic (IVD) and in vitro diagnostic regulation (IVDR) approved automated sample preparation solutions for clinical laboratories.

Request for customization: https://www.imarcgroup.com/request?type=report&id=1836&flag=E

Regional Analysis:

Rapid technological advancements and increasing adoption of digital pathology solutions drive market growth in Asia Pacific. Expanding healthcare infrastructure, rising awareness of digital health, and government initiatives supporting technological innovation further accelerate the demand for digital pathology systems in this region.

In Europe, the market benefits from strong regulatory frameworks and significant investments in healthcare IT. Advanced research capabilities, increasing emphasis on personalized medicine, and growing adoption of digital solutions in hospitals and laboratories contribute to the region's market expansion.

North America leads in digital pathology due to advanced healthcare infrastructure, high adoption rates of cutting-edge technologies, and significant research and development activities. Supportive government policies, increasing demand for efficient diagnostic solutions, and a focus on personalized medicine drive market growth in this region.

In Latin America, the market is driven by growing healthcare investments, increasing awareness of digital health solutions, and a rising need for efficient diagnostic tools. Expanding healthcare facilities and government initiatives to improve healthcare infrastructure support the adoption of digital pathology technologies.

The market in the Middle East and Africa is propelled by increasing healthcare investments, growing adoption of advanced technologies, and expanding healthcare infrastructure. Rising demand for efficient diagnostic solutions and government initiatives to enhance healthcare services drive market growth in this region.

Key information covered in the report

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2032

IMARC Group Offer Other Reports:

India Biotechnology Market: The India biotechnology market size is projected to exhibit a growth rate (CAGR) of 18.50% during 2024-2032.

India immunoassay Market: The India immunoassay market size is projected to exhibit a growth rate (CAGR) of 6.70% during 2024-2032.

India Biosimilar Market: The India biosimilar market size is projected to exhibit a growth rate (CAGR) of 18.10% during 2024-2032.

India Healthcare IT Market: The India healthcare IT market size is projected to exhibit a growth rate (CAGR) of 21.60% during 2024-2032.

India Diagnostic Imaging Market: The India diagnostic imaging market size reached US$ 768.2 Million in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,567.9 Million by 2032, exhibiting a growth rate (CAGR) of 8.20% during 2024-2032.

India Diagnostic Labs Market: The India diagnostic labs market size is projected to exhibit a growth rate (CAGR) of 11.80% during 2024-2032.

India Molecular Diagnostics Market: The India molecular diagnostics market size is projected to exhibit a growth rate (CAGR) of 8.50% during 2024-2032.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

The market is driven by advancements in imaging technology and digital scanners, the increasing prevalence of chronic diseases and cancer, and the growing adoption of telepathology and remote diagnostics, numerous innovations by leading companies, considerable rise in healthcare infrastructure investments, an enhanced emphasis on personalized medicine, and the implementation of supportive government initiatives.

Advancements in Imaging Technology and Digital Scanners are Increasing the Adoption

Improvements in imaging technology and the development of high-performance digital scanners mainly propel the growth of the market. High-resolution image acquisition and advanced digital scanning solutions help pathologists capture details of accurate images of pathology slides, thereby changing traditional microscopy practices. These technologies facilitate digitization of the whole slides, which can be stored, analyzed, and shared electronically. Such high-quality resolution and imaging help examiners get a closer view for accurate diagnosis, hence decreasing the margin of error and increasing the accuracy of disease detection and classification.

Request a PDF Sample Report: https://www.imarcgroup.com/digital-pathology-market/requestsample

Moreover, the integration of artificial intelligence and machine learning algorithms with such advanced technologies in image acquisitions is magnifying diagnostic capability by providing automated analysis and predictions that assist the pathologist in reaching more accurate decisions. For instance, PathAI, a global leader in AI-powered pathology introduced AISightTM, PathAI's digital pathology platform, and the AIM-PD-L1 NSCLC RUO algorithm1, which quantitates the percent of PD-L1 positive tumor and immune cells in non-small cell lung cancer (NSCLC) samples across the whole slide image, in 13 leading academic medical centers, health systems, reference laboratories, and independent pathology organizations across the United States.

Advanced digital scanners are also adopted at pathology laboratories for enhanced efficiency and productivity of the workflow. Digital scanners permit the fast digitization of slides for remote consultation and telepathology where there is a deficiency of specialized pathologists. Such accessibility ensures collaboration and knowledge sharing across borders between healthcare professionals to ensure better patient outcomes. Moreover, digital scanners with their cloud storage solutions ensure safe and easy access to digital slides for the long-term management of data and archiving process. This improvement in technology is removing flaws in operational efficiency and saving money by reducing physical storage requirement and the threats to slides from getting damaged or destroyed. This thereby makes the incessant innovation in imaging technology and digital scanners a key driver of growth and adoption of digital pathology, revolutionizing the field and improving quality patient care.

Increasing Prevalence of Chronic Diseases and Cancer Contributing to Market Growth

One of the major drivers of the market is the increasing prevalence of chronic diseases, such as diabetes and cancer. About 422 million people worldwide have diabetes, the majority living in low-and middle-income countries, and 1.5 million deaths are directly attributed to diabetes each year. Both the number of cases and the prevalence of diabetes have been steadily increasing over the past few decades according to the World Health Organization. The occurrence of chronic diseases, particularly cancer, has been rising globally, which has increased the demand for diagnostic methods that offer better accuracy and work proficiently.

Traditional pathology methods often involve time-consuming processes that can delay diagnosis and treatment. Digital pathology, however, provides a faster and more accurate alternative, as pathologists are able to digitize tissue samples and work with advanced image analytics. This rapid and precise diagnosis becomes important for managing chronic diseases and cancer, for which it can greatly improve patient outcomes through early detection and timely intervention. In addition, the ease of sharing digital slides with the world's experts instantly facilitates the review of challenging cases and further contributes to diagnostic accuracy, improving patient care.

Increasing cases of chronic diseases together with cancer burdens have also been one of the factors leading to the investments made in healthcare infrastructure and technology. Such health challenges are compelling governments and associated health bodies to appreciate the need for sophisticated diagnostic solutions. Digital pathology is becoming an inseparable part of modern healthcare systems with its potential to smooth workflows, reduce diagnostic errors, and large-scale screening programs.

For example, in oncology, digital pathology applies all the methods of genetic and molecular profiling to traditional histopathological analysis within a comprehensive strategy for the diagnosis of cancer and personalization of treatment plans. Scalability and efficiency in digital pathology have proved useful in issuing a high number of diagnostic tests for chronic disease management. Moreover, the rising incidence of chronic diseases and cancer is therefore increasing the importance of digital pathology for diagnostic accuracy, improvement in patient outcomes, and developing the healthcare systems in a number of requirements.

Growing Adoption of Telepathology and Remote Diagnostics: A Key Market Driver

The growing adoption of telepathology and remote diagnostics majorly drives the market, revolutionizing diagnostic medicine. Telepathology is one of the technologies that integrates advanced digital imaging tools along with high-end communication tools to permit a pathologist to examine slides that are at physically removed locations. This is particularly advantageous in underserved areas where specialist pathology services are not available. Telepathology facilitates real-time consultation and collaboration between pathologists and healthcare providers around the world, increasing diagnostic accuracy while reducing turnaround times, ensuring patients get accurate diagnoses. This is especially invaluable in emergencies where timely intervention is highly critical to treatment efficacy and eventual survival rates for a proper diagnosis to be made from a distance.

The incorporation of telepathology into digital pathology platforms confers several operational and logistical advantages. Centralization of pathology enables a central, specialized team to digitize and examine pathology slides from different locations. It optimizes resource use, reduces the number of physical transports of slides, saves time, and minimizes damage to or loss of slides in transit. Advancements in artificial intelligence (AI) and machine learning (ML) further increase diagnostic accuracy with image analysis and decision support automated tools, which can help pathologists detect patterns and anomalies that might be missing from a manual examination of slides. Hence, diagnostic precision is increased while continuous education and training for pathologists are supported.

It is in public health emergencies, such as the COVID-19 pandemic, that convenience and efficiency in telepathology assume paramount importance for reducing physical contact while ensuring diagnostic services are uninterrupted. A remote patient monitoring (RPM) program was developed for ambulatory management of COVID-19, utilizing existing technology and resources. According to a report published in NPJ Digital Medicine in 2021 by Jordan D. Coffey, 7074 patients across 41 US states were evaluated, finding a 78.9% engagement rate with RPM technology. Emergency department visits and hospitalizations within 30 days were 11.4% and 9.4%, respectively, with a 30-day mortality rate of 0.4%. The RPM program proved feasible, safe, and effective, suggesting potential for expansion to other acute illnesses. As healthcare systems across the globe strive to address disparities in access to medical care, the widespread adoption of telepathology emerges as a key solution for extending high-quality diagnostic services to remote and under-resourced masses.

Buy Full Report: https://www.imarcgroup.com/checkout?id=1836&method=502

Leading Companies in the Digital Pathology Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Some of the players are DHISTECH, Apollo Enterprise Imaging, Corista, Hamamatsu Photonics, Huron Digital Pathology, Indica Labs, Koninklijke Philips, Leica Biosystems, Objective Pathology Services, Ventana Medical Systems, Visiopharm, and XIFIN.

Microsoft has announced that the company is building a foundation model for pathology in collaboration with Providence and the University of Washington. More precisely, using its hard work and progress in the domain of generative AI, the company has announced GigaPath—the very first whole-slide foundation model for digital pathology, which is pretrained with real-world data.

SigTuple, a medtech company that develops artificial intelligence (AI)-powered digital microscopy solutions, has received U.S. FDA 510(k) clearance for its device -- AI100 with Shonit (a peripheral blood smear application). The device is the premier solution for AI-assisted digital pathology, wherein a physical sample is digitally imaged through a microscopic lens, and the AI models extract each cell and then classify it into over 30 different cell types.

Agilent Technologies Inc. partnered with Hamamatsu Photonics K.K., a leading provider of whole slide imaging systems, to integrate its NanoZoomer range including the S360MD Slide scanner system into the Agilent end-to-end digital pathology solution. With the addition of the NanoZoomer Slide scanner systems, which converts glass slides into high-resolution digital data by high-speed scanning, Agilent completes its offering of an open and agnostic digital pathology workflow designed to accelerate breakthroughs in precision medicine.

4DMedical, the leader in advanced lung function imaging software, has been granted FDA clearance for its CT-based ventilation product, CT LVAS. CT LVAS is indicated for computed tomography scans and is the second product from 4D Medical to be cleared by the FDA for use in the United States with fluoroscopy imaging software, XV LVAS®. The FDA clearance for CT LVAS aligns with the next product that 4DMedical will have available in its portfolio: CT:VQ. CT:VQ enables quantitative perfusion data and visualization from CT scans.

Thermo Fisher Scientific has launched the KingFisher Apex Dx system and Applied Biosystems MagMax Dx Isolation Kit. The KingFisher Apex Dx platform is an automated nucleic acid purification instrument, and the MagMax Dx Isolation Kit is developed for the isolation and purification of viral and bacterial pathogens from respiratory biological specimens. Together, these two products provide laboratories with in vitro diagnostic (IVD) and in vitro diagnostic regulation (IVDR) approved automated sample preparation solutions for clinical laboratories.

Request for customization: https://www.imarcgroup.com/request?type=report&id=1836&flag=E

Regional Analysis:

Rapid technological advancements and increasing adoption of digital pathology solutions drive market growth in Asia Pacific. Expanding healthcare infrastructure, rising awareness of digital health, and government initiatives supporting technological innovation further accelerate the demand for digital pathology systems in this region.

In Europe, the market benefits from strong regulatory frameworks and significant investments in healthcare IT. Advanced research capabilities, increasing emphasis on personalized medicine, and growing adoption of digital solutions in hospitals and laboratories contribute to the region's market expansion.

North America leads in digital pathology due to advanced healthcare infrastructure, high adoption rates of cutting-edge technologies, and significant research and development activities. Supportive government policies, increasing demand for efficient diagnostic solutions, and a focus on personalized medicine drive market growth in this region.

In Latin America, the market is driven by growing healthcare investments, increasing awareness of digital health solutions, and a rising need for efficient diagnostic tools. Expanding healthcare facilities and government initiatives to improve healthcare infrastructure support the adoption of digital pathology technologies.

The market in the Middle East and Africa is propelled by increasing healthcare investments, growing adoption of advanced technologies, and expanding healthcare infrastructure. Rising demand for efficient diagnostic solutions and government initiatives to enhance healthcare services drive market growth in this region.

Key information covered in the report

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2032

- Breakup by Product:

- Scanners

- Software

- Storage Systems

- Communication Systems

- Human Pathology

- Veterinary Pathology

- On-premises

- Hosted

- Training and Education

- Consulting Services

- Intraoperative Consultation

- Routine Diagnostic Consultation Services

- Others

- Pharmaceutical & Biotechnology Companies

- Hospitals and Reference Laboratories

- Academic & Research Institutes

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Others

- Middle East and Africa

- Turkey

- Saudi Arabia

- Iran

- United Arab Emirates

- Others

IMARC Group Offer Other Reports:

India Biotechnology Market: The India biotechnology market size is projected to exhibit a growth rate (CAGR) of 18.50% during 2024-2032.

India immunoassay Market: The India immunoassay market size is projected to exhibit a growth rate (CAGR) of 6.70% during 2024-2032.

India Biosimilar Market: The India biosimilar market size is projected to exhibit a growth rate (CAGR) of 18.10% during 2024-2032.

India Healthcare IT Market: The India healthcare IT market size is projected to exhibit a growth rate (CAGR) of 21.60% during 2024-2032.

India Diagnostic Imaging Market: The India diagnostic imaging market size reached US$ 768.2 Million in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,567.9 Million by 2032, exhibiting a growth rate (CAGR) of 8.20% during 2024-2032.

India Diagnostic Labs Market: The India diagnostic labs market size is projected to exhibit a growth rate (CAGR) of 11.80% during 2024-2032.

India Molecular Diagnostics Market: The India molecular diagnostics market size is projected to exhibit a growth rate (CAGR) of 8.50% during 2024-2032.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800