According to Precedence Research, the global digital therapeutics market size was estimated at USD 7.88 billion in 2024 and is expected to hit around USD 56.76 billion by 2034, poised to grow at a CAGR of 21.83% from 2024 to 2034.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1128

Digital Therapeutics Market Key Takeaways

• North America contributed the largest market share of 44.03% in 2023.

• By product, the devices segment has held a major market share of 87.38% in 2023.

• By sales channel, the business-to-business (B2B) segment captured the biggest market share of 65.29% in 2023.

• By application, the diabetes application segment held a higher market share of 26.46% in 2023.

The digital therapeutics market deals with digital technology solutions such as medical devices, sensors, software or hardware applications, the Internet of Things, virtual reality, and other tools to deliver digitalized therapeutic interventions. In biomedical research and healthcare, digital therapeutics plays a significant role in supporting patients and caregivers to prevent, manage, or treat several diseases like Alzheimer’s disease, anxiety, depression, heart failure, and type II diabetes. The New German Digital Healthcare Act (DiGA) regulates specific requirements for using digital therapeutics on a national level. The quality of data along with its protection or security by keeping confidentiality in clinical research and patient health information are considerable factors when using digital technology solutions.

The European Medicines Agency (EMA) and the European Commission are the regulatory bodies of the European Union at the European level dedicated to clinical investigation and sale of medical devices for human use. Moreover, the U.S. Food and Drug Administration (USFDA) offers a comprehensive pre-certification program on digital therapeutics. Click Therapeutics Inc., Fitbit Health Solutions, Omada Health Inc., Medtronic Plc, etc. are emerging as impactful industrial players in this market with their remarkable innovations.

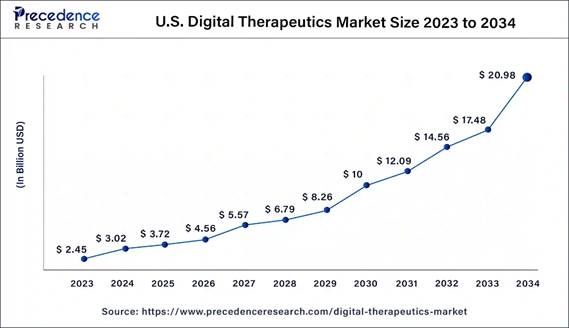

U.S. Digital Therapeutics Market Size, Industry Report, 2034

The U.S. digital therapeutics market size was valued at USD 3.02 billion in 2024 and is expected to reach USD 20.98 billion by 2034, growing at a CAGR of 21.38% from 2024 to 2034.

North America dominated the digital therapeutics market in 2023 due to rising government regulations and rising healthcare expenditure. There are a large number of digital therapeutics providers in this region. With the new start-ups, reimbursement policies, increasing investments, and growing government initiatives, the growth of this market is reaching high levels in this region. The users can acquire a 30-second single-lead electrocardiogram (ECG) and can take an assessment of heart rhythm, sinus rhythm, and atrial fibrillation based on FDA cleared software algorithm of Fitbit Health Solutions. The Fitbit irregular heart rhythm notifications feature helps to analyze pulse rate data. Moreover, the Fitbit wearable helps to detect low or high heart rates.

• In January 2024, Omada Health Inc. announced a partnership with Amazon Health Services to enhance awareness and promote discoveries of its cardiometabolic programs through Amazon’s new Health Condition Programs.

• Over 15,000 Fitbit users donated up to 13 years of Fitbit data and electronic health record data to the National Institute of Health (NIH) in the U.S. and All Of Us Research Program.

Asia Pacific is anticipated to be the fastest-growing region in the digital therapeutics market during the forecast period due to a large consumer base and the enlarging geriatric population across this region. Several countries in this region widely accepted the new and innovative technologies along with the rising investments through funding. The increasing government investments and mergers and acquisitions are fueling the growth of this market in the Asia Pacific region. Fitbit Health Solutions also offers the Nighttime SpO2 oxygen saturation feature which is derived from optical sensors. Moreover, the Active Zone Minutes feature allows users to track moderate to vigorous physical activity. These Fitbit products also allow one to track sleep duration and improve sleep consistency.

• The Digital Health Center of Excellence aims to empower stakeholders to promote healthcare through responsible and high-quality digital health innovations. It also aims to build partnerships, share knowledge, and innovate regulatory approaches.

• The Asian and Pacific Centre for Transfer of Technology focuses on digital innovation for sustainable development and provides up-to-date knowledge about technology advancements, technology innovations, and technology policies.

Digital Therapeutics Market Report Scope

|

Report Attribute |

Details |

|

The market size value in 2025 |

USD 9. 73 billion |

|

The revenue forecast in 2034 |

USD 56.76 billion |

|

Growth rate |

CAGR of 21.83% from 2024 to 2034 |

|

Actual data |

2018 - 2024 |

|

Forecast data |

2024 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2034 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

By Product, By Application, and By Sales Channel, By Region |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

OMADA HEALTH, INC.; Welldoc, Inc.; 2Morrow, Inc; Teladoc Health, Inc.; Propeller Health (ResMed); Fitbit LLC; CANARY HEALTH; Noom, Inc.; Pear Therapeutics, Inc.; Akili Interactive Labs, Inc.; HYGIEIA; DarioHealth Corp.; BigHealth; GAIA AG; Limbix Health, Inc.; Mango Health |

Digital Therapeutics Market Current Trends

• Digital Therapeutics in Diabetes Mellitus Management: The incorporation of information and communication technology (ICT) in digital health, digital medicine, and digital therapeutics enhanced the management of chronic diseases including diabetes mellitus. There is a vast range of solutions like telephonic consultations, short message service websites, remote monitoring devices, mobile health applications, etc. which are strongly adopted by healthcare systems. The mobile health programs and mobile health technologies are emerging as promising initiatives to promote better healthcare among the population. The International Panel on Diabetes Digital Technologies recommended the use of novel diabetes mellitus care delivery methods to expand the accessibility to healthcare services.

• Expansion of Government Regulatory Authorities to Support Digital Therapeutics: The National Medical Products Administration (NMPA) is responsible as the approval committee for medicines to launch in China, Japan, Korea, etc. A joint collaboration between the European Association for the Study of Diabetes (EASD) and the American Diabetes Association (ADA) is responsible for conducting a joint review of digital health technologies for diabetes and the practices of regulatory authorities and organizations.

• Digital Therapeutics to Improve Patient Outcomes: Software products are widely used in the treatment of medical conditions. the growing start-ups and well-established technology companies are presenting innovative applications to enable patients to take control of their health. These applications are analogous to customer wellness applications that deliver improved clinical outcomes. They offer the best guidance regarding the techniques to overcome insomnia or manage first aid. They can work in conjunction with a drug regimen to address cancer, asthma, and other complex health conditions. They also use cognitive or motivational stimulation to promote behavioral changes and provide preventive measures to treat certain conditions.

Digital Therapeutics Market in Role of Artificial Intelligence

The insertion of artificial intelligence simplified diagnostics, personalized treatments through genomics, and real-time patient health monitoring. The modern technologies like predictive analytics, machine learning, and big data transformed medicinal research in the true sense. AI and related technologies are contributing to the predictive analysis of potential health risks associated with diseases and the use of proper medicinal interventions to fight against them. AI is applicable in drug discovery, and next-generation telemedicine is enabling scientists to develop innovative products. It also enables them to meet the current and future challenges and needs in the healthcare system.

Digital Therapeutics Market Segmentation:

Product Insights

By product, the devices segment dominated the digital therapeutics market due to the growing applications of wearable devices and monitoring tools among physicians and patients. The rising incidence of several health disorders including chronic, diabetic, respiratory, cardiac, and other diseases enhances the need for regular health monitoring and remote healthcare. According to the World Health Organization (WHO), cardiovascular diseases are the leading causes of death in the world which raises the demand for medical devices in healthcare sectors and personal care.

Global Digital Therapeutics Market Revenue, By Product, 2022-2023(USD Million)

|

Product |

2022 |

2023 |

|

Devices |

4,489.61 |

5,559.01 |

|

Softwares |

632.49 |

802.64 |

Sales Channel Insights

By sales channel, the business-to-business segment dominated the digital therapeutics market due to the effectiveness of digital therapeutic solutions in managing chronic diseases such as diabetes, hypertension, and mental health disorders. B2B customers like healthcare providers and employers need strong incentives to adopt these advanced technologies efficiently. Data analytics capabilities, personalized treatment plans, improved health outcomes, etc. contribute to fueling the growth of this segment. The integration of these modernized solutions in existing healthcare IT systems like electronic health records (EHRs) and health information exchange (HIEs) facilitates the seamless data flow and enhances the quality of overall patient care.

Application Insights

By application, the diabetes segment dominated the digital therapeutics market due to the rising incidence of diabetes and the growing number of diabetic treatments. According to the American Diabetes Association, the United States accounts for the largest incidence rates of diabetes, and some of the diabetic cases remain undiagnosed every year. The rise of digital therapies and their effectiveness in healthcare are booming their uses for this segment significantly.

By application, the obesity segment is anticipated to be the fastest-growing in the digital therapeutics market due to the growing concerns related to obesity with the changing lifestyles of people. The consumption of packaged foods with heavy fat contents by children and people of all age groups surges the demand for digital therapies to treat and manage obesity conditions. The growing shift towards the use of online assistance for fitness and healthcare routines also propels the need for digitalization in healthcare settings.

Global Digital Therapeutics Market Revenue, By Application, 2022-2023(USD Million)

|

Application |

2022 |

2023 |

|

Obesity |

909.72 |

1,145.22 |

|

Diabetes |

1,361.66 |

1,683.53 |

|

CNS Disorders |

623.75 |

776.32 |

|

Gastrointestinal Disorders |

580.40 |

723.58 |

|

CVD Disease |

685.62 |

847.21 |

|

Smoking Cessation |

229.47 |

282.54 |

|

Respiratory Diseases |

422.58 |

527.63 |

|

Others |

308.91 |

375.61 |

Related Report

Digital Health Market ; The global digital health market size was valued at USD 309.93 billion in 2023 and it is anticipated to surpass around USD 1,019.89 billion by 2033 and expanding at a CAGR of 12.19% over the forecast period 2024 to 2033.

Digital PCR Market ; The global digital PCR market size accounted for USD 7.12 billion in 2024 and is expected to be worth around USD 17.33 billion by 2034, at a CAGR of 9.3% from 2024 to 2034.

Peptide Therapeutics Market ; The global peptide therapeutics market size was valued at USD 45.67 billion in 2023 and is expected to surpass around USD 80.44 billion by 2033 with a noteworthy CAGR of 5.63% from 2024 to 2033.

Targeted Therapeutics Market; The global targeted therapeutics market size was USD 74.90 billion in 2023, estimated at USD 80.14 billion in 2024 and is anticipated to reach around USD 155.20 billion by 2034, expanding at a CAGR of 6.83% from 2024 to 2034.

Anti-Inflammatory Therapeutics Market ; The global anti-inflammatory therapeutics market size was estimated at USD 101.8 billion in 2023 and is expected to hit USD 152.16 billion by 2033, with a registered CAGR of 4.15% from 2024 to 2033.

Digital Biomarkers Market ; The global digital biomarkers market size was estimated at US$ 1.57 billion in 2021 and is expected to reach over US$ 14.58 billion by 2030, poised to grow at a compound annual growth rate (CAGR) of 28.1% from 2022 to 2030.

Digital Therapeutics Market Companies

• Medtronic Plc.

• Livongo Health, Inc.

• Pear Therapeutics, Inc.

• Omada Health, Inc.

• Resmed, Inc. (Propeller Health)

• Proteus Digital Health, Inc.

• Welldoc, Inc.

• Voluntis, Inc.

• Canary Health Inc.

• Noom, Inc.

• Mango Health Inc.

• Dthera Sciences

Recent Developments

• In September 2023, Fitbit introduced Fitbit Charge 6 to track heart rate during workouts.

• In September 2023, 2Morrow and FIT HR entered into a partnership to bring evidence-based digital wellness solutions to more than 120 local and national small to midsize organizations.

• In January 2024, Omada Health Inc. presented itself as the first virtual diabetes prevention, diabetes, and hypertension provider available in Amazon’s Health Condition Programs that will help individuals discover and enroll in virtual care benefits.

• In October 2023, Fitbit Health Solutions, Google Health Researchers, and a third-party research organization conducted the analysis of peer-reviewed studies that used Fitbit medical devices.

Segments Covered in the Report

By Product

• Device

• Software

By Sales Channel

• Business-to-Consumer (B2C)

o Caregiver

o Patient

• Business-to-Business (B2B)

o Healthcare Provider

o Employer

o Others

By Application

• Obesity

• Diabetes

• Central Nervous System (CNS) Disease

• Gastrointestinal Disorder (GID)

• Cardiovascular Disease (CVD)

• Smoking Cessation

• Respiratory Disease

• Others

By Geography

• North America

• Asia Pacific

• Europe

• Latin America

• Middle East and Africa

Immediate Delivery Available | Buy This Premium Research https://www.precedenceresearch.com/checkout/1128

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com| +1 804 441 9344

Web: https://www.precedenceresearch.com