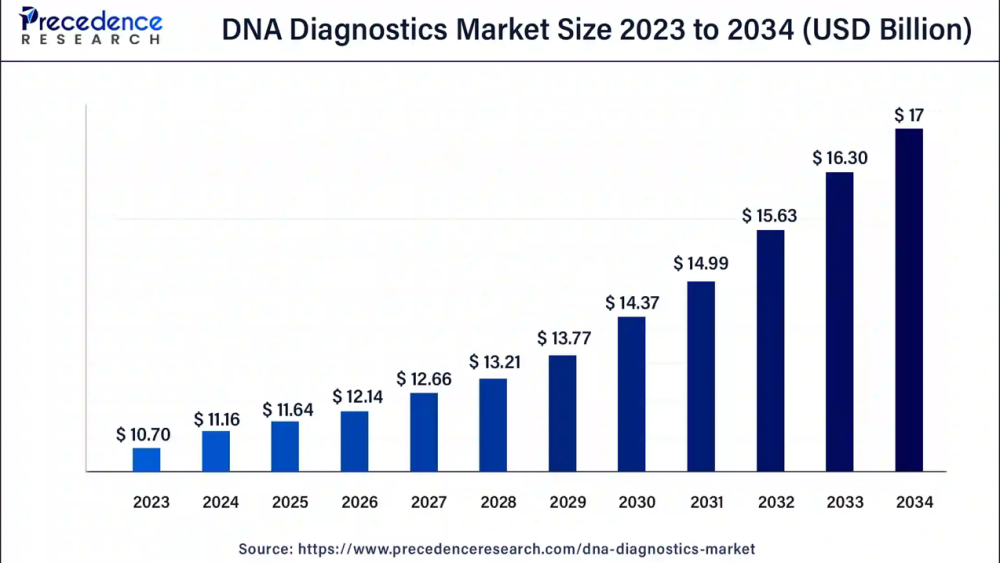

The global DNA diagnostics market size was valued at USD 10.70 billion in 2023 and is projected to be worth around USD 17 billion by 2034, expanding at a CAGR of 4.3% over the forecast period 2024 to 2034. The U.S. DNA diagnostics market size was valued at USD 3.53 billion in 2023. The DNA testing market is growing because it is widely used in forensics for legal and medical purposes such as paternity testing, consolidating evidence in suspicious cases, tracking a person’s genetics, and screening a fetes for any genetic disease during pregnancy.

The DNA diagnostics market has grown due to the rapid development of genetic testing, a type of gene analysis used to examine DNA sequences to test for various purposes, including disease testing or proving paternity for legal purposes. Genetic testing involves examining a person’s blood or other tissue to determine changes in the person’s genetic material.

Ask here for Sample Pages of report@ https://www.precedenceresearch.com/sample/3240

The development of “DNA chip technology” uses nanotechnology to increase the speed and resolution of DNA evidence analysis. The technology saves time spent in analysis from hours to minutes.

Top Growth Factors in DNA Diagnostics Market

North America dominated the global DNA diagnostics market in 2023 due to the increasing number of genetic diseases in North America. 3,097 new diagnoses will be made in the United States in 2022 alone. More than 90% of the tests can be used for diagnosis in laboratories in the United States. As genetic testing becomes more important in healthcare, awareness of genetic testing continues to increase in the United States. Rising healthcare spending has also fueled the growth of the DNA diagnostics market. By November 2022, American doctors be able to choose from 129,624 genetic tests. The increasing demand for early cancer diagnosis is a clear reflection of the increase in genetic diagnostics market.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Advances in genetics and genomic technology are rapidly changing how healthcare is delivered in the Asia-Pacific region's low- and middle-income countries. China bears the largest burden of rare genetic diseases in the world. Current estimates suggest that more than 10 million people suffer from chromosomal syndromes and more than 1 million suffer from single diseases, so the Asia-Pacific region has seen growth as genetic services are increasingly used in medical and clinical settings. The healthcare sector in Asia-Pacific has huge growth potential, and companies are driving innovation.

DNA Diagnostics as Advanced Forensic DNA Analysis Tools

The field of forensic DNA analysis is evolving rapidly, with a focus on research and development aimed at increasing the speed and efficiency of DNA analysis in criminal investigations. The emergence of smaller, faster, and more efficient testing equipment is critical to reducing capital costs and expanding the laboratory’s ability to solve more problems. In addition, the development of robust methods for identifying degraded, obsolete, or damaged evidence is driving the growth of the DNA testing industry. By meeting these needs, the industry has improved DNA sample analysis time and led to the DNA diagnostics market.

Integrating artificial intelligence into healthcare is rapidly evolving, providing transformative capabilities for diagnosis and treatment management. The role of intelligence in personalized medicine, especially in complex disease risks, presents great opportunities for the DNA diagnostics market. By improving the diagnostic process (reducing time, cost, and effort), AI can facilitate early diagnosis, allow for timely treatment, and improve patient outcomes.

Privacy Concerns and Data Security Challenges

The use of genetic information in DNA testing offers great opportunities but also raises serious concerns about privacy and data security. Genetic information contains important information about an individual’s health, characteristics, genetics, and family, and poses risks when misused. Potential misuse of genetic data can infringe upon individual and familial privacy, creating substantial risks. Privacy attacks are still problematic even for homomorphically encrypted data, highlighting the on-going challenges in data protection. These privacy and security concerns are major issues that can limit the growth of the DNA diagnostics market by destroying consumer trust and impacting compliance.

Recent Breakthroughs in DNA Diagnostics Market

Partnership of iMeUsWe and MapMyGenome in DNA Diagnostics Market

The partnership of Oxford Nanopore Technologies plc and bioMérieux SA in DNA Diagnostics Market

Ginkgo Bioworks Launched New Tool in DNA Diagnostics Market

Report Highlights

Recent News in the DNA Diagnostics Market

By Product Type

USA : +1 804 441 9344

APAC : +61 485 981 310 or +91 87933 22019

Europe : +44 7383 092 044

Email : sales@precedenceresearch.com

The DNA diagnostics market has grown due to the rapid development of genetic testing, a type of gene analysis used to examine DNA sequences to test for various purposes, including disease testing or proving paternity for legal purposes. Genetic testing involves examining a person’s blood or other tissue to determine changes in the person’s genetic material.

Ask here for Sample Pages of report@ https://www.precedenceresearch.com/sample/3240

The development of “DNA chip technology” uses nanotechnology to increase the speed and resolution of DNA evidence analysis. The technology saves time spent in analysis from hours to minutes.

- In May 2024, QIAGEN announced that it had entered into a Cooperative Research and Development Agreement with the FBI to develop a new test for the QIAcuity digital PCR, a device that would enable scientific research by improving the adjustment of DNA quantity in human samples.

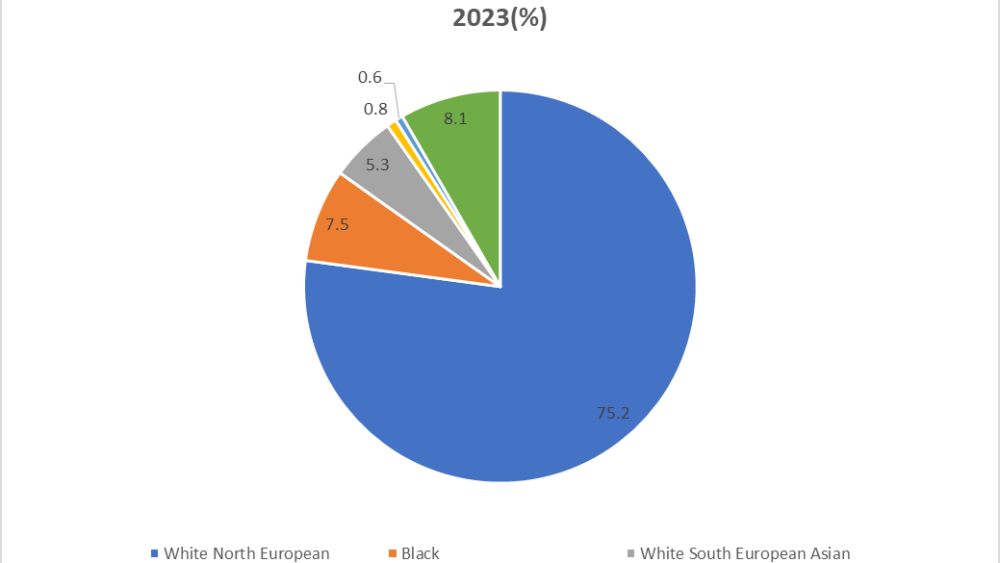

- North America has captured largest market share of 44% in 2023.

- By technology, the PCR segment has accounted market share of 50.3% in 2023.

- By product type, the instruments segment has captured highest market share in 2023.

- By end-user, the diagnostic center segment has accounted highest market share in 2023.

Top Growth Factors in DNA Diagnostics Market

- Forensics and Criminal Investigations: Forensic and criminal investigations derive their basic foundations from DNA testing. It is an important tool for researchers. DNA is admitted as evidence; it can stimulate research that has led to the growth of the DNA diagnostics market.

- Immigration: DNA testing can be an important step towards citizenship for immigrants. DNA testing can prove that immigrants have family members who are already citizens, which has led to the growth of the DNA testing market.

- Paternity testing: DNA testing can be necessary in divorce or custody cases.

North America dominated the global DNA diagnostics market in 2023 due to the increasing number of genetic diseases in North America. 3,097 new diagnoses will be made in the United States in 2022 alone. More than 90% of the tests can be used for diagnosis in laboratories in the United States. As genetic testing becomes more important in healthcare, awareness of genetic testing continues to increase in the United States. Rising healthcare spending has also fueled the growth of the DNA diagnostics market. By November 2022, American doctors be able to choose from 129,624 genetic tests. The increasing demand for early cancer diagnosis is a clear reflection of the increase in genetic diagnostics market.

Asia Pacific is expected to grow at the highest CAGR during the forecast period. Advances in genetics and genomic technology are rapidly changing how healthcare is delivered in the Asia-Pacific region's low- and middle-income countries. China bears the largest burden of rare genetic diseases in the world. Current estimates suggest that more than 10 million people suffer from chromosomal syndromes and more than 1 million suffer from single diseases, so the Asia-Pacific region has seen growth as genetic services are increasingly used in medical and clinical settings. The healthcare sector in Asia-Pacific has huge growth potential, and companies are driving innovation.

DNA Diagnostics as Advanced Forensic DNA Analysis Tools

The field of forensic DNA analysis is evolving rapidly, with a focus on research and development aimed at increasing the speed and efficiency of DNA analysis in criminal investigations. The emergence of smaller, faster, and more efficient testing equipment is critical to reducing capital costs and expanding the laboratory’s ability to solve more problems. In addition, the development of robust methods for identifying degraded, obsolete, or damaged evidence is driving the growth of the DNA testing industry. By meeting these needs, the industry has improved DNA sample analysis time and led to the DNA diagnostics market.

- In May 2024, Promega Corporation launched the PowerPlex 18E System, which uses eight-color short tandem repeat analytical chemistry to extract more useful information from complex samples. This kit contains all DNA markers approved by the European Net work of Forensic Science Institutes

Integrating artificial intelligence into healthcare is rapidly evolving, providing transformative capabilities for diagnosis and treatment management. The role of intelligence in personalized medicine, especially in complex disease risks, presents great opportunities for the DNA diagnostics market. By improving the diagnostic process (reducing time, cost, and effort), AI can facilitate early diagnosis, allow for timely treatment, and improve patient outcomes.

Privacy Concerns and Data Security Challenges

The use of genetic information in DNA testing offers great opportunities but also raises serious concerns about privacy and data security. Genetic information contains important information about an individual’s health, characteristics, genetics, and family, and poses risks when misused. Potential misuse of genetic data can infringe upon individual and familial privacy, creating substantial risks. Privacy attacks are still problematic even for homomorphically encrypted data, highlighting the on-going challenges in data protection. These privacy and security concerns are major issues that can limit the growth of the DNA diagnostics market by destroying consumer trust and impacting compliance.

Recent Breakthroughs in DNA Diagnostics Market

Partnership of iMeUsWe and MapMyGenome in DNA Diagnostics Market

| Company Name | iMeUsWe and MapMyGenome |

| Headquarters | India |

| Recent Development | In May 2024, iMeUsWe partnered with MapMyGenome to provide DNA testing services to users. The collaboration with MapMyGenome leverages decades of genomic research and innovation to deliver unique DNA insights |

The partnership of Oxford Nanopore Technologies plc and bioMérieux SA in DNA Diagnostics Market

| Company Name | Oxford Nanopore Technologies plc and bioMérieux SA |

| Headquarters | United Kingdom |

| Recent Development | In April 2023, Oxford Nanopore Technologies plc and bioMérieux SA announced that they had joined forces to explore unique opportunities to bring nanopore sequencing to the infectious disease industry to improve global health. The two companies are working together to explore unique opportunities to advance patient care by providing nanopore research and in vitro diagnostics (IVD) solutions. Nanopore-based sequencing is a new technology that can identify long fragments of DNA or RNA. |

Ginkgo Bioworks Launched New Tool in DNA Diagnostics Market

| Company Name | Ginkgo Bioworks |

| Headquarters | United States |

| Recent Development | In February 2024, Ginkgo Bioworks, a developer of a cellular and biosecurity platform, announced the acquisition of Proof Diagnostics, a novel life science tools, diagnostics, and computational discovery company that uncovered genome engineering tools for treatment and diagnosis, while also creating a smart, portable system. |

Report Highlights

| By Product Type | Based on the product type, the instruments segment is expected to capture the largest market share over the forecast period as it helps identify genetic alterations and diseases. |

| By Technology | Based on the technology, the PCR segment is expected to dominate the market during the forecast period because PCR detects specific genes from genetic material (DNA or RNA) in a sample. |

| By Application | According to the application, the oncology segment should be the leader in the industry during the forecast period, as DNA diagnostics can help identify tumors by identifying genetic differences in DNA. |

| By End User | Based on end users, the diagnostic center segment is expected to hold the largest market share during the forecast period as it facilitates early detection and prevention of genetic diseases. |

Recent News in the DNA Diagnostics Market

- In June 2024, Devyser Diagnostics AB announced that it had expanded its exclusive partnership and distribution agreement with Thermo Fisher Scientific. The agreement grants Thermo Fisher exclusive access to commercialize Devyser’s post-transplant NGS portfolio globally as a joint venture.

- In November 2023, Illumina Inc. announced the launch of its next-generation decentralized liquid bioanalysis genomic analysis. The new TruSight Oncology 500 ctDNA v2 (TSO 500 ctDNA v2) is a research assay that enables noninvasive comprehensive genomic profiling of circulating tumor DNA from blood when tissue testing is unavailable or to complement tissue-based testing.

- Thermo Fisher Scientific Inc.

- QIAGEN

- Beckman Coulter Inc.

- Agilent Technologies Inc.

- GE Healthcare

- Illumina Inc.

- Cepheid.

- Hologic, Inc.

- Siemens HealthcareGmbH

- F. Hoffmann-La Roche

- Abbott

- Bio-Rad Laboratories, Inc.

By Product Type

- Instruments

- Reagents

- Service & Software

- PCR

- Microarray

- In-situ Hybridization

- Sequencing Technology

- Mass Spectrometry

- Others

- Oncology

- Prostate Cancer

- Breast Cancer

- Colorectal Cancer

- Others

- Infectious Disease

- Hepatitis B Virus

- Hepatitis C Virus

- HIV

- TB

- Chlamydia Trachomatic and Neisseria Gonorrhea (CT/NG)

- HPV

- Methiciline Resistant Staphylococcus Aureus (MRSA)

- Others

- Myogenic Disorder

- Clinical Diagnostic Confirmation

- Prenatal Diagnostics

- Pre-implantation Diagnostics

- Others

- Point of Care

- Diagnostic Center

- Self Testing/OTC

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

USA : +1 804 441 9344

APAC : +61 485 981 310 or +91 87933 22019

Europe : +44 7383 092 044

Email : sales@precedenceresearch.com