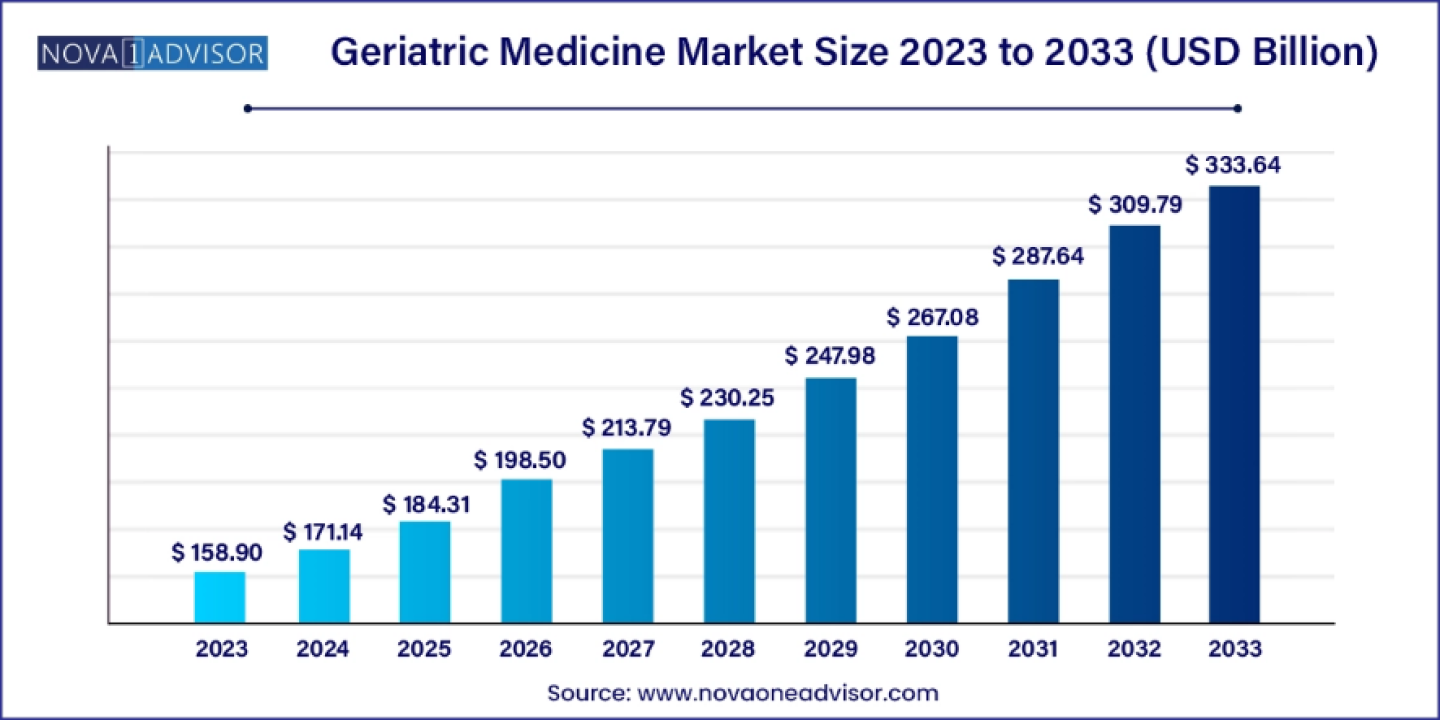

According to Nova One Advisor, the global geriatric medicine market size was USD 158.90 billion in 2023, calculated at USD 171.14 billion in 2024 and is expected to reach around USD 333.64 billion by 2033, expanding at a CAGR of 7.7% from 2024 to 2033.

The increasing geriatric population is expected to drive the growth of the geriatric medicine market. The increasing focus of pharmaceutical companies on improving specialized medicines for aging care is supporting the market growth, increasing need for improved medication management, increasing prevalence of chronic diseases, and increasing prevalence of stroke among the geriatric population are further expected to drive the market growth.

Full Report is Ready | Ask here for Sample Copy@ https://www.novaoneadvisor.com/report/sample/8748

Geriatric Medicine Market Key Takeaways

The growing government initiatives are driving the market growth. Public companies and government agencies are significantly providing and investing in insurance policies to consumers. The government is also offering tax advantages to the manufacturers of geriatric medicines. Those advantages are subsidies and incentives. These major factors are supporting the growth and demand for the market.

In addition, the major market players are adopting strategies such as acquisition, merger, business, product launch, partnership, and joint venture. Furthermore, rising healthcare spending, increasing government support, rapidly expanding medical infrastructure, and rising technological advancements are further expected to enhance the growth of the geriatric medicine market during the forecast period.

Immediate Delivery is Available | Get Full Report Access@ https://www.novaoneadvisor.com/report/checkout/8748

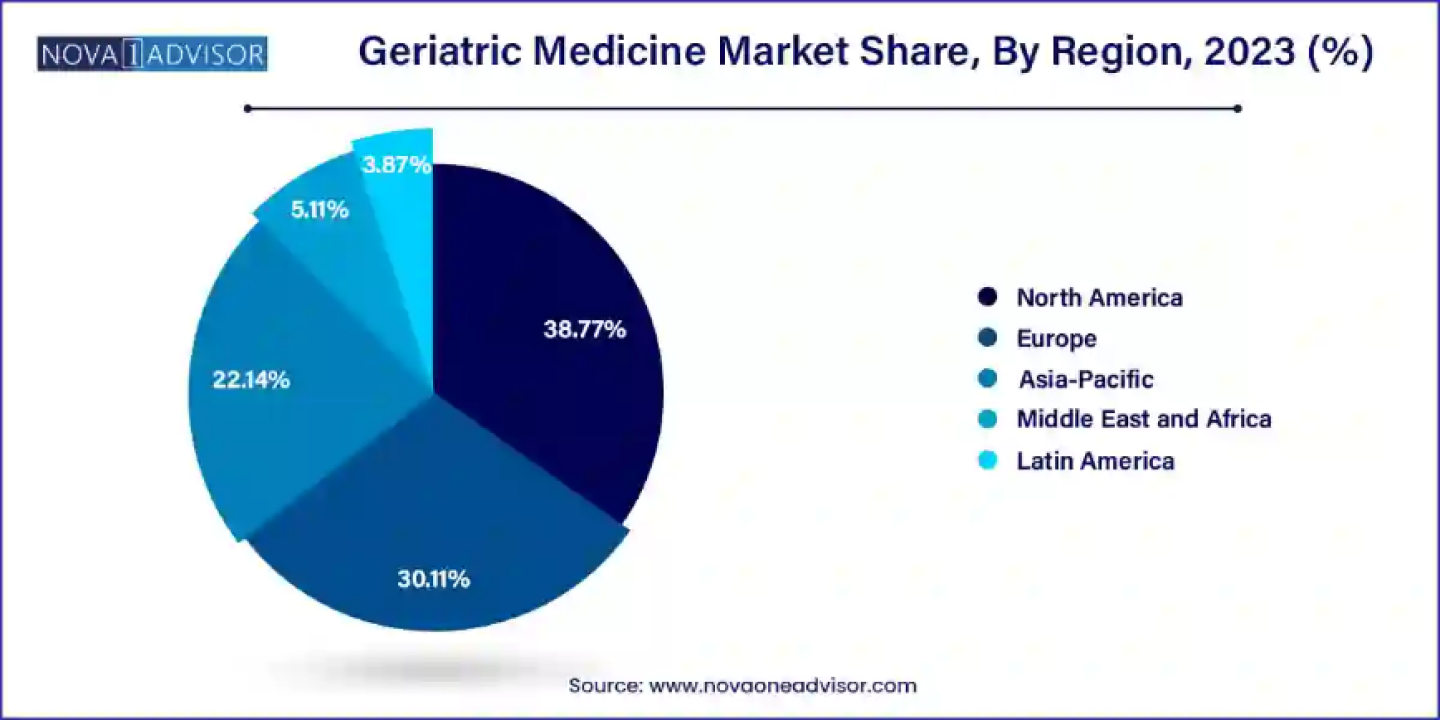

North America to Sustain as a Leader in the Market

The U.S. geriatric medicine market size was exhibited at USD 43.12 billion in 2023 and is projected to hit around USD 93.76 billion by 2033, growing at a CAGR of 8.1% during the forecast period 2024 to 2033.

The market is driven by various major factors such as rising established healthcare infrastructure in the region, high awareness across the vastly susceptible cohort related to the need for timely treatment, and increasing early adoption of analgesics such as paracetamol, opioids, and aspirin. In addition, high healthcare expenditure, growing FDA drug approvals, and favorable reimbursement policies further contributed to propel the growth of the geriatric medicine market in North America. The U.S. and Canada are the major countries in the region.

U.S Geriatric Medicine Market Trends

The geriatric medicine market in the U.S. dominated the market with a share of 89.83% in 2023. The primary drivers for the U.S. market include the higher prevalence and increasing awareness about the elderly population related to diabetes, cardiovascular disorders, and other risks. The U.S. is experiencing a significant growth in the elderly population is an important aspect. The prevalence of chronic conditions such as diabetes, arthritis, and cardiac diseases is more common in elderly groups. Moreover, advancements in medical technology, including telemedicine, healthcare systems, remote monitoring devices, and highly equipped medical diagnostics are increasing the quality of geriatric care. These factors account for the rise in the geriatric medicine market in projected years.

Europe Geriatric Medicine Market Trends

Europe geriatric medicine market is a significant market for geriatric medicine & ranked second position in 2023, with substantial variations across countries, high awareness of geriatric medications, and implementation of robot-assisted surgical processes. Another major reason is that elderly people (≥65 years) comprise a substantial and increasing proportion of the European population and it is expected that they will make up 30% by 2050. Due to the increased illness of multiple chronic and acute diseases, older people are the main users of healthcare resources, and it has been estimated that over 10% of the older population receives 10 or more related medicines. In addition, the support of government initiatives also boosts the growth of the geriatric medicines market. Moreover, government agencies and public companies are investing in and providing insurance policies to the people.

In the UK geriatric medicine market, the rising prevalence of cardiovascular diseases and diabetes in the geriatric, uplift in government funding, rising healthcare infrastructure developments, and the rising count of specialty clinics are driving the market growth. Some factors that may lead to the growth include growth in disposable income, the launch of many generic and patented drugs, and the growth of private and public healthcare expenses. Most geriatricians work as part of a multidisciplinary team in an acute hospital. Geriatric is in turn typically placed within a medical division beside specialties such as diabetes and respiratory medicine. Geriatricians work in smaller groups of hospitals as community geriatricians. The rising incidence of medication-related issues among older adults and the urgent requirement for palliative care are the determining factors fueling the regional market growth.

The geriatric medicine market in Germany is witnessing a rise, driven by an increasing old-age population and a high demand for specialized clinical services. Also, the growth is boosted by various factors, such as advancements in therapeutics, the assistance of governments and NGOs for elderly groups, and increasing emphasis on personalized medicine. Furthermore, rapid enhancements and improvements in healthcare infrastructure and investments support market growth.

Asia Pacific Geriatric Medicine Market Trends

Asia Pacific geriatric medicine market is anticipated to witness significant growth with a 9.1% CAGR in the forecast period. The rapidly growing older population in countries such as China, Japan, and India propel the demand for geriatric drugs and enhanced healthcare services and medications. This can be attributed to the developing healthcare infrastructure and facilities, government assistance, rising geriatric population, and increasing awareness about healthy lifestyles.

China geriatric medicine market is dominant because of a mix of factors that fuel the demand here. A major driver of the geriatric medicine market is the increasing aging population as China accounts for a significant share of the elderly population. The government has also been implementing reforms in healthcare to improve healthcare services for the elderly, with insurance coverage and investments in elder care.

India is also a significant market for geriatric medicines, factors that propel are- urbanization, insurance penetration, healthcare investments in the country made by governments, policy assistance, pharmaceutical demands aiming at the treatment of chronic diseases, and other age-related issues.

Prevalence of Chronic Diseases to Boost the Market’s Growth

Rapid populations are witnessing an unprecedented growth in the number of geriatric people, as the average human lifespan continues to increase across the globe. Geriatric population leads to increased susceptibility to several chronic health diseases that often need lifelong or long-term management.

§ Diseases such as Parkinson’s, Alzheimer’s, arthritis, diabetes, cancer, cardiovascular diseases, and others are highly prevalent among geriatric people.

The physiological changes related to advancing age such as declined ability and immunity and reduced organ function to heal present treatment. In addition, this growing prevalence of chronic diseases drives the need for a specialized variety of pharmaceutical products that are coupled with the innovative medical needs of the geriatric population and can help to improve quality of life. These factors are expected to enhance the growth of the geriatric medicine market.

Side Effects, to Hamper the Market’s Growth

One of the major challenges in the market is the side effects associated with geriatric medicines. The side effects of geriatric medicines such as regular use cause several side effects such as weight gain, weight loss, dizziness, confusion, and headache but long-term use is serious. They may even worsen or trigger skin diseases, in some rare cases. In addition, some serious side effects such as delirium, heart failure, and orthostatic hypotension. These factors can create significant challenges and are expected to restrain the growth of the geriatric medicine market.

Various Therapeutic Approaches to Open Doors to the Market

The rise in therapeutic approaches is a major factor in the global market for geriatric medicines. The global market has been witnessing significant growth over the last few years, due to the prevalence of therapeutic approaches to treat psychiatric and emotional diseases such as depression for geriatric people. For example, geriatric group therapy reduces camaraderie, support, and social isolation.

In addition, geriatric drug therapy is multidisciplinary as it includes caregivers, nurses, pharmacists, physicians, and geriatricians who guide and provide patient therapy according to people's needs. Additionally, support from the regulatory authorities and healthcare system in making the necessary framework of resources and support has accelerated such therapeutic approaches. These factors are expected to enhance the growth of the geriatric medicine market in the coming years.

Healthcare Investments to Promote Asia’s Growth

The increasing awareness about healthy lifestyles, the rising geriatric population, and increasingly developed healthcare facilities and infrastructure are expected to drive the growth of the geriatric medicine market in the region. The rapidly growing geriatric population in developing countries enhanced healthcare medications and services and propelled the demand for geriatric drugs. In addition, China, India, South Korea, and Japan are the major countries in the region. China and India have significant markets for geriatric medicines. In China, the growing aging population is the major driver for the market. In India, factors such as healthcare investments, insurance penetration, and urbanization in this country made by policy assistance and governments are expected to enhance the market growth.

Geriatric Medicine Market Segments

By therapeutics type, the analgesics segment led the market.

In the therapeutic category, antihypertensive therapeutics accounted for a share of 20.77% in 2023. Due to the growing medicines and drug sales through the sales of prescription drugs and an increasing number of pain-related diseases among aging people above 60 years, are expected to drive the growth of the therapeutics segment in the market.

Antidiabetic therapeutics witnessed to grow at a CAGR of 9.4% in projected years. The rise in diabetes at an old age is driven by lifestyle-related risk factors i.e. smoking, less physical activity, alcohol consumption, high cholesterol levels, and obesity. With an increase in the prevalence of diabetes in the geriatric population, the market for antidiabetic drugs is projected to grow high in the forthcoming years.

By condition type, the cardiovascular segment led the market growth.

In the condition segment, cardiovascular diseases were leading and accounted for the largest market share of 32.76% in 2023. Cardiovascular diseases are more common in aging people who are above 65. Age is an individual cause of cardiovascular diseases, such as diabetes and obesity, in the geriatric population. These factors are expected to accelerate the growth of the cardiovascular segment in the market.

Diabetes and metabolic disorders experienced exponential growth in projected years with a CAGR of 9.8%. These disorders are chronic and quite progressive, and their prevalence rises with aging. Adults commonly suffer less or lower risk for physical or cognitive dysfunction, though some deal with critical clinical circumstances. However, their older counterparts mostly face more challenges beyond diabetes-related issues, due to the correspondence with the aging process and age-related or age-dependent disease factors. The overall cause for geriatric medicine market growth is led by enhancement in healthcare facilities and advanced healthcare infrastructure and equipment, reimbursement policy, and the rising number of old people suffering from several target diseases.

By distribution channel, the retail pharmacies segment led the market growth.

In distribution channel segments, retail pharmacies dominated the market with 45.79% market share in 2023. In this segment, retail pharmacy exhibits various dominating factors led by the growing elderly population and the increasing prevalence of age-related health conditions. Another key factor is that prescription medications are aligned to manage chronic disease risks, i.e. hypertension, diabetes, cardiovascular disorders, and arthritis. The retail sector in pharmaceutical distribution and the geriatric medicine market plays a vital role in availing such medications, displaying them as an important place for older patients to seek healthcare.

However, online pharmacies are experiencing significant growth in the distribution of geriatric medicine, with a projected CAGR of 10.7% over the forecast period. One of the main factors for the market growth is the easy accessibility and convenience & availability of geriatric medicines, which are inaccessible in retail pharmacy stores. The online platform offers several services, including discounts and free home delivery. In addition, the strong influence of social media and promotional advertisement also impacts segmental growth.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8748

Geriatric Medicine Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Geriatric Medicine market.

By Therapeutics

https://www.novaoneadvisor.com/report/checkout/8748

Browse More Insights:

Antidiabetics Market : The global antidiabetics market size was valued at USD 82.85 billion in 2023 and is anticipated to reach around USD 263.12 billion by 2033, growing at a CAGR of 12.25% from 2024 to 2033.

Compounding Pharmacies Market: The global compounding pharmacies market size was valued at USD 16.19 billion in 2023 and is anticipated to reach around USD 30.97 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

Generic Drugs Market: The global generic drugs market size was estimated at USD 465.19 billion in 2023 and is projected to hit around USD 779.68 billion by 2033, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Antibody Drug Conjugates Market : The global antibody drug conjugates market size was valued at USD 11.65 billion in 2023 and is anticipated to reach around USD 28.61 billion by 2033, growing at a CAGR of 9.4% from 2024 to 2033.

ePharmacy Market : The global ePharmacy market size was exhibited at USD 70.00 billion in 2023 and is projected to hit around USD 467.05 billion by 2033, growing at a CAGR of 20.9% during the forecast period 2024 to 2033.

Injectable Drug Delivery Market : The global injectable drug delivery market size was valued at USD 695.19 billion in 2023 and is anticipated to reach around USD 1,630.73 billion by 2033, growing at a CAGR of 8.9% from 2024 to 2033.

U.S. Aesthetic Medicine Market : The U.S. aesthetic medicine market size was valued at USD 38.19 billion in 2023 and is anticipated to reach around USD 136.69 billion by 2033, growing at a CAGR of 13.6% from 2024 to 2033.

U.S. Pain Management Drugs Market : The U.S. pain management drugs market size was valued at USD 31.12 billion in 2023 and is projected to surpass around USD 46.51 billion by 2033, registering a CAGR of 4.1% over the forecast period of 2024 to 2033.

U.S. Precision Medicine Market : The U.S. precision medicine market size was valued at USD 24.95 billion in 2023 and is projected to reach around USD 76.12 billion by 2033, registering a CAGR of 11.80% from 2024 to 2033.

U.S. Asthma Drugs Market : The U.S. asthma drugs market size was valued at USD 8.95 billion in 2023 and is projected to surpass around USD 14.75 billion by 2033, registering a CAGR of 5.12% over the forecast period of 2024 to 2033.

U.S. Nuclear Medicine Market : The U.S. nuclear medicine market size was valued at USD 5.85 billion in 2023 and is projected to surpass around USD 19.34 billion by 2033, registering a CAGR of 12.7% over the forecast period of 2024 to 2033.

U.S. Generic Drugs Market: The U.S. generic drugs market size was valued at USD 133.59 billion in 2023 and is projected to surpass around USD 188.44 billion by 2033, registering a CAGR of 3.5% over the forecast period of 2024 to 2033.

U.S. Compounding Pharmacies Market : The U.S. compounding pharmacies market size is projected to be worth around USD 10.76 billion by 2033 from USD 6.31 billion in 2024, at a CAGR of 6.1% from 2024 to 2033.

U.S. Pharmaceutical Market : The U.S. pharmaceutical market size was valued at USD 602.19 billion in 2023 and is projected to surpass around USD 1,093.79 billion by 2033, registering a CAGR of 6.15% over the forecast period of 2024 to 2033.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

The increasing geriatric population is expected to drive the growth of the geriatric medicine market. The increasing focus of pharmaceutical companies on improving specialized medicines for aging care is supporting the market growth, increasing need for improved medication management, increasing prevalence of chronic diseases, and increasing prevalence of stroke among the geriatric population are further expected to drive the market growth.

Full Report is Ready | Ask here for Sample Copy@ https://www.novaoneadvisor.com/report/sample/8748

Geriatric Medicine Market Key Takeaways

- The North America geriatric medicine market registered 38.77% of the market share.

- The geriatric medicine market in the U.S. dominated the market with a share of 89.83% in 2023.

- Asia Pacific geriatric medicine market is anticipated to witness significant growth with a 9.1% CAGR in the forecast period.

- The geriatric medicine market in the U.S. dominated the market with a share of 89.83% in 2023.

- In the therapeutic category, antihypertensive therapeutics accounted for a share of 20.77% in 2023.

- Antidiabetic therapeutics witnessed to grow at a CAGR of 9.4% in projected years.

- In the condition segment, cardiovascular diseases were leading and accounted for the largest market share of 32.76% in 2023.

- Diabetes and metabolic disorders experienced exponential growth in projected years with a CAGR of 9.8%.

- In distribution channel segments, retail pharmacies dominated the market with 45.79% market share in 2023.

The growing government initiatives are driving the market growth. Public companies and government agencies are significantly providing and investing in insurance policies to consumers. The government is also offering tax advantages to the manufacturers of geriatric medicines. Those advantages are subsidies and incentives. These major factors are supporting the growth and demand for the market.

In addition, the major market players are adopting strategies such as acquisition, merger, business, product launch, partnership, and joint venture. Furthermore, rising healthcare spending, increasing government support, rapidly expanding medical infrastructure, and rising technological advancements are further expected to enhance the growth of the geriatric medicine market during the forecast period.

Immediate Delivery is Available | Get Full Report Access@ https://www.novaoneadvisor.com/report/checkout/8748

North America to Sustain as a Leader in the Market

The U.S. geriatric medicine market size was exhibited at USD 43.12 billion in 2023 and is projected to hit around USD 93.76 billion by 2033, growing at a CAGR of 8.1% during the forecast period 2024 to 2033.

The market is driven by various major factors such as rising established healthcare infrastructure in the region, high awareness across the vastly susceptible cohort related to the need for timely treatment, and increasing early adoption of analgesics such as paracetamol, opioids, and aspirin. In addition, high healthcare expenditure, growing FDA drug approvals, and favorable reimbursement policies further contributed to propel the growth of the geriatric medicine market in North America. The U.S. and Canada are the major countries in the region.

- For instance, In March 2023, for potentially inappropriate medication use in older adults, the American Geriatrics Society updated AGS beers criteria.

- In June 2023, a new geriatric division was launched by UC Davis Health due to the number of Americans living longer and their complex health challenges increasing. A geriatrician and researcher who has dedicated her life to the care of this population, to lead the new committed effort is Rebecca Boxer.

U.S Geriatric Medicine Market Trends

The geriatric medicine market in the U.S. dominated the market with a share of 89.83% in 2023. The primary drivers for the U.S. market include the higher prevalence and increasing awareness about the elderly population related to diabetes, cardiovascular disorders, and other risks. The U.S. is experiencing a significant growth in the elderly population is an important aspect. The prevalence of chronic conditions such as diabetes, arthritis, and cardiac diseases is more common in elderly groups. Moreover, advancements in medical technology, including telemedicine, healthcare systems, remote monitoring devices, and highly equipped medical diagnostics are increasing the quality of geriatric care. These factors account for the rise in the geriatric medicine market in projected years.

Europe Geriatric Medicine Market Trends

Europe geriatric medicine market is a significant market for geriatric medicine & ranked second position in 2023, with substantial variations across countries, high awareness of geriatric medications, and implementation of robot-assisted surgical processes. Another major reason is that elderly people (≥65 years) comprise a substantial and increasing proportion of the European population and it is expected that they will make up 30% by 2050. Due to the increased illness of multiple chronic and acute diseases, older people are the main users of healthcare resources, and it has been estimated that over 10% of the older population receives 10 or more related medicines. In addition, the support of government initiatives also boosts the growth of the geriatric medicines market. Moreover, government agencies and public companies are investing in and providing insurance policies to the people.

In the UK geriatric medicine market, the rising prevalence of cardiovascular diseases and diabetes in the geriatric, uplift in government funding, rising healthcare infrastructure developments, and the rising count of specialty clinics are driving the market growth. Some factors that may lead to the growth include growth in disposable income, the launch of many generic and patented drugs, and the growth of private and public healthcare expenses. Most geriatricians work as part of a multidisciplinary team in an acute hospital. Geriatric is in turn typically placed within a medical division beside specialties such as diabetes and respiratory medicine. Geriatricians work in smaller groups of hospitals as community geriatricians. The rising incidence of medication-related issues among older adults and the urgent requirement for palliative care are the determining factors fueling the regional market growth.

The geriatric medicine market in Germany is witnessing a rise, driven by an increasing old-age population and a high demand for specialized clinical services. Also, the growth is boosted by various factors, such as advancements in therapeutics, the assistance of governments and NGOs for elderly groups, and increasing emphasis on personalized medicine. Furthermore, rapid enhancements and improvements in healthcare infrastructure and investments support market growth.

Asia Pacific Geriatric Medicine Market Trends

Asia Pacific geriatric medicine market is anticipated to witness significant growth with a 9.1% CAGR in the forecast period. The rapidly growing older population in countries such as China, Japan, and India propel the demand for geriatric drugs and enhanced healthcare services and medications. This can be attributed to the developing healthcare infrastructure and facilities, government assistance, rising geriatric population, and increasing awareness about healthy lifestyles.

China geriatric medicine market is dominant because of a mix of factors that fuel the demand here. A major driver of the geriatric medicine market is the increasing aging population as China accounts for a significant share of the elderly population. The government has also been implementing reforms in healthcare to improve healthcare services for the elderly, with insurance coverage and investments in elder care.

India is also a significant market for geriatric medicines, factors that propel are- urbanization, insurance penetration, healthcare investments in the country made by governments, policy assistance, pharmaceutical demands aiming at the treatment of chronic diseases, and other age-related issues.

Prevalence of Chronic Diseases to Boost the Market’s Growth

Rapid populations are witnessing an unprecedented growth in the number of geriatric people, as the average human lifespan continues to increase across the globe. Geriatric population leads to increased susceptibility to several chronic health diseases that often need lifelong or long-term management.

§ Diseases such as Parkinson’s, Alzheimer’s, arthritis, diabetes, cancer, cardiovascular diseases, and others are highly prevalent among geriatric people.

The physiological changes related to advancing age such as declined ability and immunity and reduced organ function to heal present treatment. In addition, this growing prevalence of chronic diseases drives the need for a specialized variety of pharmaceutical products that are coupled with the innovative medical needs of the geriatric population and can help to improve quality of life. These factors are expected to enhance the growth of the geriatric medicine market.

Side Effects, to Hamper the Market’s Growth

One of the major challenges in the market is the side effects associated with geriatric medicines. The side effects of geriatric medicines such as regular use cause several side effects such as weight gain, weight loss, dizziness, confusion, and headache but long-term use is serious. They may even worsen or trigger skin diseases, in some rare cases. In addition, some serious side effects such as delirium, heart failure, and orthostatic hypotension. These factors can create significant challenges and are expected to restrain the growth of the geriatric medicine market.

Various Therapeutic Approaches to Open Doors to the Market

The rise in therapeutic approaches is a major factor in the global market for geriatric medicines. The global market has been witnessing significant growth over the last few years, due to the prevalence of therapeutic approaches to treat psychiatric and emotional diseases such as depression for geriatric people. For example, geriatric group therapy reduces camaraderie, support, and social isolation.

In addition, geriatric drug therapy is multidisciplinary as it includes caregivers, nurses, pharmacists, physicians, and geriatricians who guide and provide patient therapy according to people's needs. Additionally, support from the regulatory authorities and healthcare system in making the necessary framework of resources and support has accelerated such therapeutic approaches. These factors are expected to enhance the growth of the geriatric medicine market in the coming years.

Healthcare Investments to Promote Asia’s Growth

The increasing awareness about healthy lifestyles, the rising geriatric population, and increasingly developed healthcare facilities and infrastructure are expected to drive the growth of the geriatric medicine market in the region. The rapidly growing geriatric population in developing countries enhanced healthcare medications and services and propelled the demand for geriatric drugs. In addition, China, India, South Korea, and Japan are the major countries in the region. China and India have significant markets for geriatric medicines. In China, the growing aging population is the major driver for the market. In India, factors such as healthcare investments, insurance penetration, and urbanization in this country made by policy assistance and governments are expected to enhance the market growth.

- For instance, In May 2023, a geriatric risk assessment clinic for geriatric cancer patients was launched by PD Hinduja Hospital in India. The aim behind this launch was to provide the best possible care to elderly cancer patients.

- In November 2022, an exclusive facility for the elderly, a Geriatric Care Clinic Unit was launched by one of Mumbai’s most credible healthcare institutions, Holy Family Hospital. The hospital served the needs of all patients over 60 years of age and offered two levels of care Home Care and Hospital Care.

Geriatric Medicine Market Segments

By therapeutics type, the analgesics segment led the market.

In the therapeutic category, antihypertensive therapeutics accounted for a share of 20.77% in 2023. Due to the growing medicines and drug sales through the sales of prescription drugs and an increasing number of pain-related diseases among aging people above 60 years, are expected to drive the growth of the therapeutics segment in the market.

Antidiabetic therapeutics witnessed to grow at a CAGR of 9.4% in projected years. The rise in diabetes at an old age is driven by lifestyle-related risk factors i.e. smoking, less physical activity, alcohol consumption, high cholesterol levels, and obesity. With an increase in the prevalence of diabetes in the geriatric population, the market for antidiabetic drugs is projected to grow high in the forthcoming years.

By condition type, the cardiovascular segment led the market growth.

In the condition segment, cardiovascular diseases were leading and accounted for the largest market share of 32.76% in 2023. Cardiovascular diseases are more common in aging people who are above 65. Age is an individual cause of cardiovascular diseases, such as diabetes and obesity, in the geriatric population. These factors are expected to accelerate the growth of the cardiovascular segment in the market.

Diabetes and metabolic disorders experienced exponential growth in projected years with a CAGR of 9.8%. These disorders are chronic and quite progressive, and their prevalence rises with aging. Adults commonly suffer less or lower risk for physical or cognitive dysfunction, though some deal with critical clinical circumstances. However, their older counterparts mostly face more challenges beyond diabetes-related issues, due to the correspondence with the aging process and age-related or age-dependent disease factors. The overall cause for geriatric medicine market growth is led by enhancement in healthcare facilities and advanced healthcare infrastructure and equipment, reimbursement policy, and the rising number of old people suffering from several target diseases.

By distribution channel, the retail pharmacies segment led the market growth.

In distribution channel segments, retail pharmacies dominated the market with 45.79% market share in 2023. In this segment, retail pharmacy exhibits various dominating factors led by the growing elderly population and the increasing prevalence of age-related health conditions. Another key factor is that prescription medications are aligned to manage chronic disease risks, i.e. hypertension, diabetes, cardiovascular disorders, and arthritis. The retail sector in pharmaceutical distribution and the geriatric medicine market plays a vital role in availing such medications, displaying them as an important place for older patients to seek healthcare.

However, online pharmacies are experiencing significant growth in the distribution of geriatric medicine, with a projected CAGR of 10.7% over the forecast period. One of the main factors for the market growth is the easy accessibility and convenience & availability of geriatric medicines, which are inaccessible in retail pharmacy stores. The online platform offers several services, including discounts and free home delivery. In addition, the strong influence of social media and promotional advertisement also impacts segmental growth.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8748

Geriatric Medicine Market Top Key Companies:

- F. Hoffmann-La Roche Ltd.

- Novartis AG

- AbbVie Inc.

- Johnson & Johnson, Inc.

- Merck & Co., Inc.

- Pfizer, Inc.

- Bristol-Myers Squibb Company

- Sanofi

- GSK Plc.

- Takeda Pharmaceuticals Company Ltd.

- In August 2024, an integrated healthcare provider in India, Aster DM Healthcare launched two groundbreaking facilities at Aster MIMS Calicut such as a Geriatric Emergency Department and a Pediatric Emergency Department

- In December 2023, in the State capital, at the Government Medical College Hospital (MCH)in Thiruvananthapuram, a geriatric department was launched in the government sector.

- In June 2024, Sun Pharmaceutical Industries inked a licensing pact with Takeda Pharmaceutical Company to commercialize a novel gastrointestinal drug in India. The company has entered into a non-exclusive patent licensing agreement with Takeda Pvt. Ltd to commercialize Vonoprazan tablets in volumes of 10 and 20 mg in India.

- In May 2023, Pfizer Inc. announced that the U.S. Food and Drug Administration (FDA) has approved ABRYSVO (Respiratory Syncytial Virus Vaccine), the company’s bivalent RSV prefusion F (RSVpreF) vaccine, for the prevention of lower respiratory tract disease caused by RSV in individuals 60 years and older.

- In June 2024, at the Global Campus in Velappanchavadi, the most trusted private hospital across generations, Dr. Mehta’s Hospitals launched the Geriatric Long-Term Care Ward. This facility enabled clinicians to provide and monitor in-patient treatments for geriatric people with chronic diseases and age-related disabilities.

- In December 2022, to address rising mental health issues among geriatric people, PGI Chandigarh launched a geriatric clinic. Postgraduate Institute of Medical Education and Research, Chandigarh dedicated their expertise and time to senior citizens, feeling comfortable in reaching out to the doctor, encouraging them to communicate, and lending a patient ear to their issues.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Geriatric Medicine market.

By Therapeutics

- Analgesics

- Antihypertensive

- Statins

- Antidiabetic

- Proton Pump Inhibitors

- Anticoagulant

- Antipsychotic

- Others

- Cardiovascular Diseases

- Arthritis & Bone Health

- Neurological Disorders

- Cancer

- Diabetes and Metabolic Disorders

- Respiratory Diseases

- Others

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

https://www.novaoneadvisor.com/report/checkout/8748

Browse More Insights:

Antidiabetics Market : The global antidiabetics market size was valued at USD 82.85 billion in 2023 and is anticipated to reach around USD 263.12 billion by 2033, growing at a CAGR of 12.25% from 2024 to 2033.

Compounding Pharmacies Market: The global compounding pharmacies market size was valued at USD 16.19 billion in 2023 and is anticipated to reach around USD 30.97 billion by 2033, growing at a CAGR of 6.7% from 2024 to 2033.

Generic Drugs Market: The global generic drugs market size was estimated at USD 465.19 billion in 2023 and is projected to hit around USD 779.68 billion by 2033, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Antibody Drug Conjugates Market : The global antibody drug conjugates market size was valued at USD 11.65 billion in 2023 and is anticipated to reach around USD 28.61 billion by 2033, growing at a CAGR of 9.4% from 2024 to 2033.

ePharmacy Market : The global ePharmacy market size was exhibited at USD 70.00 billion in 2023 and is projected to hit around USD 467.05 billion by 2033, growing at a CAGR of 20.9% during the forecast period 2024 to 2033.

Injectable Drug Delivery Market : The global injectable drug delivery market size was valued at USD 695.19 billion in 2023 and is anticipated to reach around USD 1,630.73 billion by 2033, growing at a CAGR of 8.9% from 2024 to 2033.

U.S. Aesthetic Medicine Market : The U.S. aesthetic medicine market size was valued at USD 38.19 billion in 2023 and is anticipated to reach around USD 136.69 billion by 2033, growing at a CAGR of 13.6% from 2024 to 2033.

U.S. Pain Management Drugs Market : The U.S. pain management drugs market size was valued at USD 31.12 billion in 2023 and is projected to surpass around USD 46.51 billion by 2033, registering a CAGR of 4.1% over the forecast period of 2024 to 2033.

U.S. Precision Medicine Market : The U.S. precision medicine market size was valued at USD 24.95 billion in 2023 and is projected to reach around USD 76.12 billion by 2033, registering a CAGR of 11.80% from 2024 to 2033.

U.S. Asthma Drugs Market : The U.S. asthma drugs market size was valued at USD 8.95 billion in 2023 and is projected to surpass around USD 14.75 billion by 2033, registering a CAGR of 5.12% over the forecast period of 2024 to 2033.

U.S. Nuclear Medicine Market : The U.S. nuclear medicine market size was valued at USD 5.85 billion in 2023 and is projected to surpass around USD 19.34 billion by 2033, registering a CAGR of 12.7% over the forecast period of 2024 to 2033.

U.S. Generic Drugs Market: The U.S. generic drugs market size was valued at USD 133.59 billion in 2023 and is projected to surpass around USD 188.44 billion by 2033, registering a CAGR of 3.5% over the forecast period of 2024 to 2033.

U.S. Compounding Pharmacies Market : The U.S. compounding pharmacies market size is projected to be worth around USD 10.76 billion by 2033 from USD 6.31 billion in 2024, at a CAGR of 6.1% from 2024 to 2033.

U.S. Pharmaceutical Market : The U.S. pharmaceutical market size was valued at USD 602.19 billion in 2023 and is projected to surpass around USD 1,093.79 billion by 2033, registering a CAGR of 6.15% over the forecast period of 2024 to 2033.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/