Growth Hormone Deficiency Market Outlook 2025-2035:

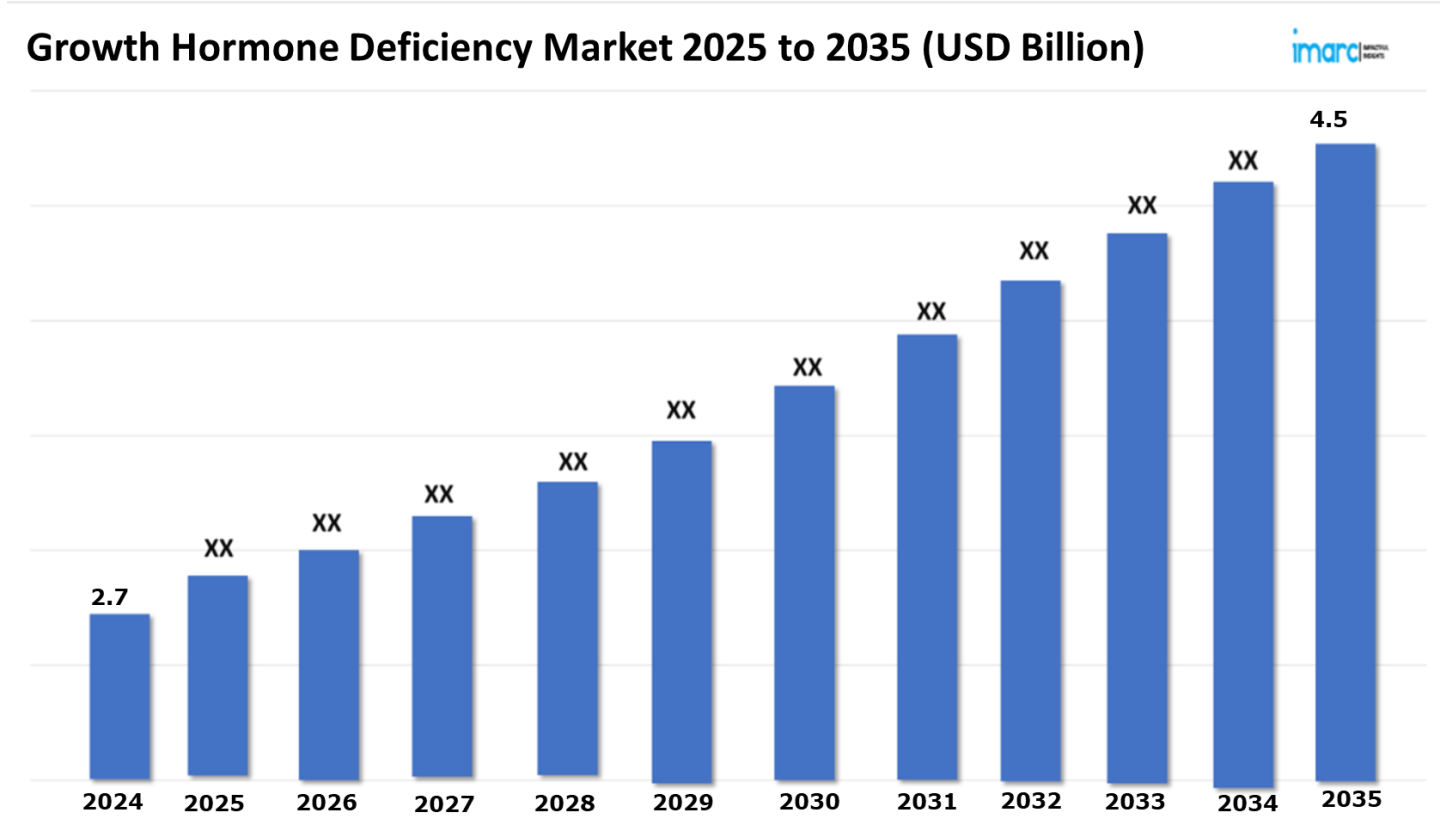

The 7 major growth hormone deficiency market reached a value of USD 2.7 Billion in 2024. Looking forward, IMARC Group expects the 7MM to reach USD 4.5 Billion by 2035, exhibiting a growth rate (CAGR) of 4.67% during 2025-2035. The main driver is emerging popularity of advanced formulations delivered via the subcutaneous route, based on its key advantages including long-lasting action within the body and allowing once a week injections instead of daily dosing. Advanced delivery systems improve bioavailability while maintaining steady levels of growth hormone, thereby ensuring patient compliance. Even injection discomfort is reduced by needle-free and auto-injector technologies, further supporting adherence. The market is expanding as more and more patients adopt subcutaneous long-acting growth hormone therapies, thereby offering better quality of life to patients through the most effective, patient-friendly treatment options.

Advances in Early Detection and Diagnostic Technologies: Driving the Growth Hormone Deficiency Market

Advancements in early detection and diagnostic technologies are very significant drivers in the growth hormone deficiency market because they allow early diagnosis, result in better outcomes from treatment, and reduce the risk of complications that may appear long after diagnosis. One such advancement in diagnostics in GHD is the newer, more sensitive, and more specific GH stimulation tests. Classical stimulation tests such as insulin tolerance and arginine tests have shortcomings due to variable GH secretion. However, new biomarker-based tests, such as GH-releasing hormone (GHRH) and macimorelin-based diagnostic assays, have been developed with greater reliability and patient convenience. The FDA-approved macimorelin test, an oral GH secretagogue, has become a non-invasive alternative to traditional methods that enhance diagnostic accuracy while reducing patient discomfort. Also, with the recent advancements in the imaging techniques in MRI, improved detection of the pituitary abnormalities has assisted in better evaluation of structural GHD causes. AI-based diagnosing tools assist in further developing accuracy by diagnosing patient details and predicting hormones deficiency with utmost precision. Adding molecular and genetic testing to identification, clinicians nowadays can identify patients with genetic mutation linked to GHD, setting the stage for personalized treatment programs. As early detection technologies continue to improve, the growth hormone deficiency market is expanding to better patient outcomes, increased treatment adoption, and enhanced healthcare access. These are the factors pushing the market toward growth by encouraging early intervention and optimizing therapeutic strategies for affected patients.

Request a PDF Sample Report: https://www.imarcgroup.com/growth-hormone-deficiency-market/requestsample

Development of Novel Therapies and Pharmacological Treatments: Contributing to Market Expansion

Newer therapies and pharmaceuticals for treating growth hormone deficiency are considerably propelling the market expansion as new formulations can now provide higher effectiveness of the treatments, compliance from the patient’s side, and better long-term results. An important achievement in the field of GHD is the invention of long-acting rhGH formulations. Formerly, the standard treatment with rhGH consisted of daily subcutaneous injections and usually did not allow the desired level of patient compliance. However, new long-acting GH preparations have significantly improved patient compliance and outcomes with treatment. Somapacitan and lonapegsomatropin have been prepared to ensure that the GH levels are stable for longer time frames; the frequency of injections may be reduced, and treatment efficacy is improved. Further, improvement in drug delivery technologies, such as needle-free devices and auto-injector systems, is facilitating GH therapy in patients. These innovations have minimized injection-related discomfort, which has made the treatment more accessible, especially in pediatric patients. Personalized medicine is another area where genetic and biomarker-based approaches are under development to fine-tune GH therapy based on the individual patient’s needs. Other areas under investigation include alternative GH-stimulating agents and combination therapies that will expand treatment options. Advances in biotechnology will drive further innovation for novel formulations in the GHD market. It is likely to see growth expand significantly due to increased awareness on GHD as well as favorable regulatory approvals, thereby ensuring constant growth in clinical outcomes with a better patient compliance rate.

Buy Full Report: https://www.imarcgroup.com/checkout?id=7637&method=809

Marketed Therapies in Growth Hormone Deficiency Market

Humatrope (Somatropin): Eli Lilly and Company

Humatrope (Somatropin), manufactured by Eli Lilly and Company, is recombinant human growth hormone administered for the treatment of growth hormone deficiency. Humatrope exerts its mechanism of action to mimic the activity of natural GH, stimulating growth, cell reproduction, and regeneration. It causes the release of IGF-1 from the liver, upon binding to the GH receptors on target tissues, which enhances bone growth, development of muscles, and metabolic control. Additionally, Humatrope improves protein synthesis, fat metabolism, and glucose homeostasis. With this product, it allows the normalization of growth in children and restoration of metabolic functions in adults who are deficient with GH, leading to general improvement of their health condition.

Macrilen (Macimorelin): AEterna Zentaris

Macrilen (Macimorelin) is a medicine that treats adult growth hormone deficiency. Macimorelin works as a growth hormone secretagogue receptor agonist, which means it mimics the natural hormone ghrelin by binding to the pituitary gland’s growth hormone secretagogue receptor (GHSR), stimulating the release of growth hormone into the bloodstream and allowing the diagnosis of growth hormone deficiency by measuring the resulting GH levels. It causes the pituitary gland to release more growth hormone when taken orally.

Sogroya (Somapacitan): Novo Nordisk

Sogroya (Somapacitan) is a human growth hormone analog that is administered subcutaneously to individuals who have a growth hormone deficiency. Somapacitan interacts with the growth hormone receptor, causing intracellular signaling to increase insulin-like growth factor I (IGF-1). IGF-1 stimulates the formation of bone and muscular tissues. Growth hormones more directly trigger the fusion of myoblasts and myotubes, which causes muscle fiber growth, activates neural stem cells, and induces chondrocyte proliferation.

Emerging Therapies in Growth Hormone Deficiency Market

LUM-201: Lumos Pharma/Merck

LUM-201, also known as Ibutamoren, works as an oral growth hormone secretagogue, which means it stimulates the pituitary gland to release more endogenous GH by acting as an agonist on the GH secretagogue receptor (GHSR1a), effectively mimicking the natural pulsatile pattern of GH secretion and increasing the body’s production of growth hormone, rather than directly supplying it like injectable GH therapies. This method is very useful in treating growth hormone deficiency by restoring normal GH pulsatility.

GX-H9: Genexine/Handok

GX-H9, developed by Genexine and Handok, functions as a long-acting growth hormone by utilizing hyFc fusion protein technology, which essentially attaches a modified fragment of the immunoglobulin G (IgG) protein to recombinant human growth hormone, significantly extending its half-life in the body and allowing for less frequent administration than standard GH injections. Once administered, GX-H9 binds to growth hormone receptors, prompting the liver to create insulin-like growth factor-1 (IGF-1), the principal mediator of growth promotion in the body, therefore treating growth hormone deficiency in patients by maintaining stable levels of IGF-1 in the blood.

Drug Name | Company Name | MOA | ROA |

LUM-201 | Lumos Pharma/Merck | Growth hormone releasing factor agonists; Insulin-like growth factor I stimulants | Oral |

GX-H9 | Genexine/Handok | Somatotropin receptor agonists | Subcutaneous |

Detailed list of emerging therapies in Growth Hormone Deficiency is provided in the final report…

Leading Companies in the Growth Hormone Deficiency Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global growth hormone deficiency market, several leading companies are at the forefront of developing integrated platforms to enhance the management of growth hormone deficiency. Some of the major players include Eli Lilly and Company, AEterna Zentaris, and Novo Nordisk. These companies are driving innovation in the growth hormone deficiency market through continuous research, diagnostic tools, and expanding their product offerings to meet the growing demand for the illness.

In March 2024, Aeterna Zentaris Inc. announced the completion of recruitment in its ongoing Phase 3 safety and efficacy study AEZS-130-P02 (the DETECT-trial), which is testing macimorelin for the diagnosis of Childhood Onset Growth Hormone Deficiency (CGHD).

In April 2023, Novo Nordisk announced that the United States FDA had approved a new indication for Sogroya (somapacitan-beco) injection 5 mg, 10 mg, or 15 mg for the treatment of children aged 2.5 years and older with growth failure caused by insufficient secretion of endogenous growth hormone.

Key Players in Growth Hormone Deficiency Market:

The key players in the Growth Hormone Deficiency market who are in different phases of developing different therapies are Eli Lilly and Company, AEterna Zentaris, Novo Nordisk, Genentech, Ferring Pharmaceuticals, Lumos Pharma, Merck, Genexine, Handok, and Others.

Regional Analysis:

The major markets for growth hormone deficiency include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for growth hormone deficiency while also representing the biggest market for its treatment. This can be attributed to the emerging popularity of pediatric screening programs and advancements in diagnostic technologies, such as GH stimulation tests and genetic profiling, that are leading to earlier detection and timely treatment initiation.

Moreover, one of the primary market drivers is the shift towards long-acting recombinant human growth hormone formulations. Traditional daily injections often led to poor adherence, but new weekly and monthly formulations, such as somapacitan and lonapegsomatropin, are improving patient compliance and treatment outcomes. The FDA’s approval of long-acting GH therapies is accelerating market growth, offering more convenient options for patients.

Besides this, the U.S. healthcare system’s strong research funding and clinical trial activity are further contributing to market growth. The presence of major pharmaceutical companies, academic institutions, and government support has led to continuous innovation in GH therapies. Additionally, insurance coverage and reimbursement policies for GHD treatments in the U.S. are making therapies more accessible.

Recent Developments in Growth Hormone Deficiency Market:

- In March 2024, Handok and Genexine announced that their long-acting growth hormone for children, HL2356 (GX-H9), had been designated as an orphan drug during development by the Ministry of Food and Drug Safety.

- In November 2023, Lumos Pharma, Inc. reported that the topline results of its Phase 2 OraGrowtH210 dose-finding trial and Phase 2 OraGrowtH212 Pharmacokinetic/Pharmacodynamic (PK/PD) trial met all primary and secondary goals. Data from the OraGrowtH210 Trial demonstrated annualized height velocity (AHV) on the 1.6 mg/kg dose of orally administered LUM-201 of 8.2 cm/yr at six months and 8.0 cm/yr at 12 months of treatment, in line with historical data in moderate pediatric growth hormone deficiency patients and within the targeted 2 cm/yr margin of the comparator injectable recombinant growth hormone arm.

Key information covered in the report.

Base Year: 2024

Historical Period: 2019-2024

Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

Analysis Covered Across Each Country

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the growth hormone deficiency market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the growth hormone deficiency market

- Reimbursement scenario in the market

- In-market and pipeline drugs

Competitive Landscape:

This report offers a comprehensive analysis of current growth hormone deficiency marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Late-Stage Pipeline Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/growth-hormone-deficiency-market/toc

IMARC Group Offer Other Reports:

Congenital Hyperinsulinism Market: The 7 major congenital hyperinsulinism markets reached a value of US$ 112.3 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 180.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.43% during 2024-2034.

Gastritis Market: The 7 major gastritis markets are expected to exhibit a CAGR of 2.69% during 2024-2034.

Mucopolysaccharidoses Market: The 7 major mucopolysaccharidoses markets are expected to exhibit a CAGR of 5.9% during 2024-2034.

Sickle Cell Disease Market: The 7 major Sickle Cell Disease markets reached a value of US$ 775.7 Million in 2023, and projected the 7MM to reach US$ 1,904.2 Million by 2034, exhibiting a growth rate (CAGR) of 8.5% during 2024-2034.

Hypogonadism Market: The 7 major hypogonadism markets reached a value of US$ 6.6 Billion in 2023, and projected the 7MM to reach US$ 9.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.43% during 2024-2034.

Somatotropin Deficiency Market: The 7 major somatotropin deficiency markets are expected to exhibit a CAGR of 3.99% during 2024-2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800