Polycythemia Vera Market Outlook 2025-2035:

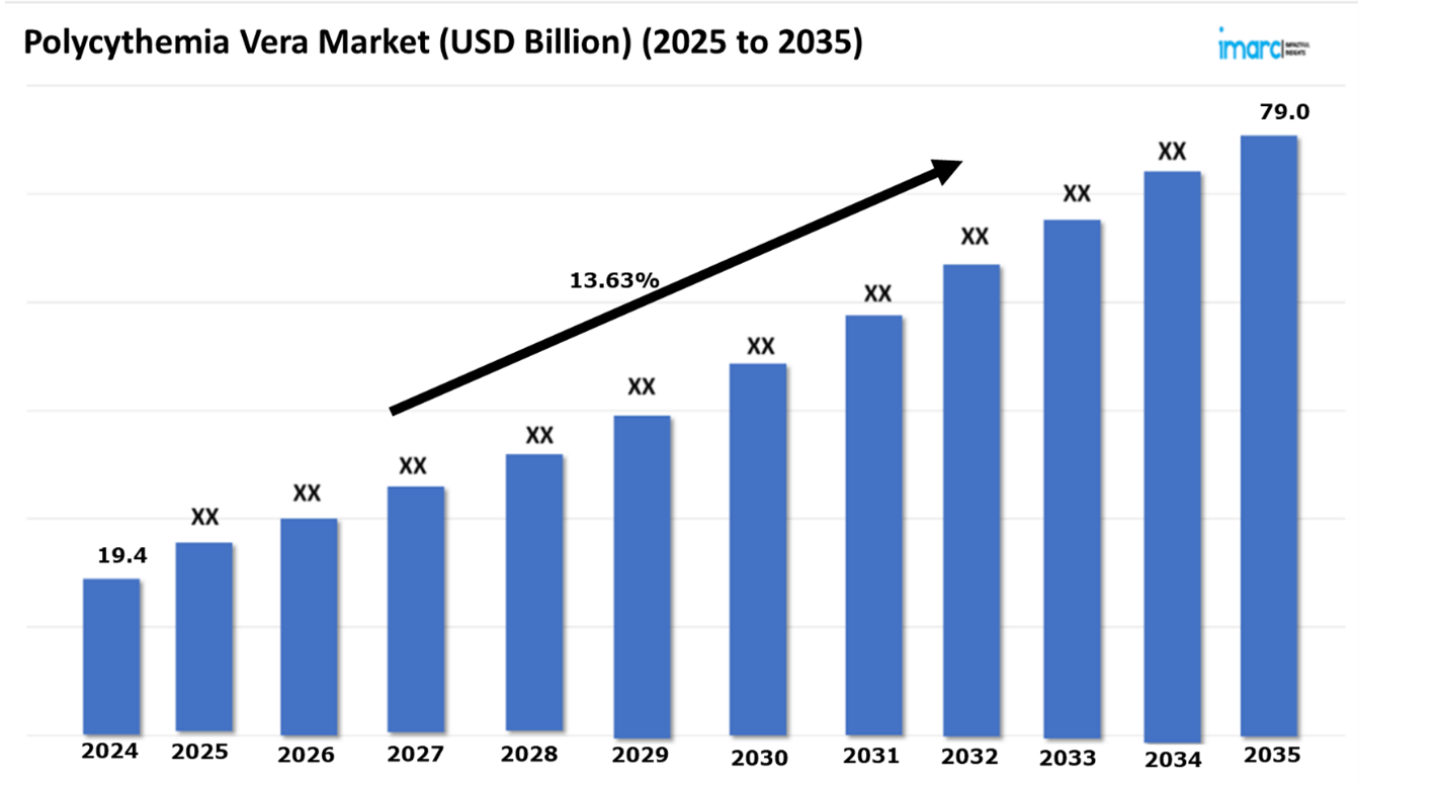

The Polycythemia vera market reached a value of USD 19.4 Billion in 2024. Looking forward, IMARC Group expects the 7MM to reach USD 79.0 Billion by 2035, exhibiting a growth rate (CAGR) of 13.63% during 2025-2035. The Polycythemia Vera (PV) treatment market is experiencing significant changes because of recent developments in diagnostic approaches as well as therapeutic solutions. Treatment strategies along with early diagnosis methods receive heightened priority within the PV treatment market. The combination of genetic testing for JAK2 mutations and artificial intelligence (AI) predictive models improves PV identification which allows patients to receive early intervention through personalized management strategies. The new approach has the power to enable patients along with health practitioners to take needed steps in disease management which leads to better treatment results. The therapy for managing Polycythemia Vera now includes new therapeutic approaches. New pharmacological approaches have introduced JAK inhibitors and next-generation interferons together with cytoreductive medications which enhance disease management and result in lower medication side effects. Long-lasting interferons and combination therapy medicine designs help patients through improved drug adherence and better treatment outcome results. Furthermore, modern treatment strategies contain the integration of non-pharmacological approaches that use therapeutic phlebotomy protocols along with lifestyle modifications as key elements for PV patient management.

Transforming the Diagnosis and Management of Polycythemia Vera

The healthcare environment surrounding Polycythemia Vera (PV) diagnosis and management has been transformed through enhanced knowledge among hematologists oncologists and general practitioners. Doctors need a better understanding of this uncommon but dangerous blood disease because timely interventions improve patient results and minimize risks of thrombosis alongside cardiovascular events and subsequent myelofibrosis or acute leukemia development. Healthcare professionals demonstrate a better understanding of genetic elements alongside hematological and systemic factors that cause PV which enables them to discover PV earlier and customize treatment approaches for each patient. Additionally, early proactive disease management helps to improve both patient disease outcomes and long-term survival rates. The early detection of Polycythemia Vera becomes possible through advancements in diagnostic technologies that include JAK2 mutation testing as well as hematocrit monitoring and predictive modeling with AI assistance. Healthcare providers now use biomarker-driven diagnostics together with next-generation sequencing and advanced imaging techniques to properly distinguish PV from other myeloproliferative disorders thus improving diagnostic accuracy. These tools enable healthcare providers to deliver more accurate treatment strategies by combining cytoreductive therapies with JAK inhibitors and phlebotomy and interferon-based treatments as well as lifestyle modifications. The ongoing evolution of medical science leads to better precision medicine practices and patient-focused care which results in improved Polycythemia Vera treatment effectiveness and enhanced patient quality of life.

Request a PDF Sample Report:

https://www.imarcgroup.com/polycythemia-vera-market/requestsample

Growing Use of Phlebotomy and Cytoreductive Therapies in Polycythemia Vera (PV)

Phlebotomy remains the cornerstone of Polycythemia Vera (PV) treatment, as it effectively reduces hematocrit levels and decreases the risk of thrombotic complications. However, as research advances and treatment strategies evolve, the increasing adoption of cytoreductive therapies is significantly expanding the therapeutic landscape for PV management. The treatments function as key components for patients who face a high risk of blood clots demonstrate phlebotomy complications or present disease evolution despite normal hematocrit levels. Hydroxyurea stands as the primary therapeutic agent for high-risk PV patients and controls red blood cell production together with preventing vascular complications. Besides this, the rising utilization of interferon-based therapies emerges because of patient-related safety concerns resistance properties, and intolerance reactions. Additionally, the acceptance of pegylated interferons (peginterferon alfa-2a and peginterferon alfa-2b) increases because they achieve both hematocrit and platelet control and reduce JAK2 mutant allele burden which potentially changes disease progression.

Buy Full Report:

https://www.imarcgroup.com/checkout?id=7506&method=809

Marketed Therapies in the Polycythemia Vera Market

Besremi (ropeginterferon alfa-2b-njft) - AOP Orphan Pharmaceuticals/PharmaEssentia Corporation

The Pegylated interferon Ropeginterferon Alfa-2b known as Besremi has proved to be an advanced therapeutic option for Polycythemia Vera (PV). The primary advantage of Besremi stands out against traditional therapies since it modifies PV through active targeting of JAK2 mutation-related excessive red blood cell production.

Jakafi (Ruxolitinib) - Incyte Corporation/Novartis

The JAK1/JAK2 inhibitor Jakafi (Ruxolitinib) receives regulatory approval for Polycythemia Vera (PV) treatment among patients who show resistance or intolerance to hydroxyurea. The JAK-STAT signaling pathway offers a viable treatment approach for PV because Jakafi blocks this signaling pathway to control blood cell production while reducing spleen size and relieving PV symptoms.

Emerging Therapies in the Polycythemia Vera Market

Givinostat – Italfarmaco

Givinostat, developed by Italfarmaco, is an investigational histone deacetylase (HDAC) inhibitor being studied for the treatment of Polycythemia Vera (PV). It works by targeting abnormal blood cell proliferation and inflammation associated with PV, potentially offering a disease-modifying approach.

PTG300 - Protagonist Therapeutics

PTG-300, developed by Protagonist Therapeutics, is an investigational hepcidin mimetic for the treatment of Polycythemia Vera (PV). It regulates iron metabolism and red blood cell production, aiming to reduce the need for therapeutic phlebotomy.

Bomedemstat - Imago BioSciences

Bomedemstat, developed by Imago BioSciences, is an investigational Lysine-Specific Demethylase 1 (LSD1) inhibitor for the treatment of Polycythemia Vera (PV). It targets abnormal blood cell production and inflammatory pathways, aiming to control hematocrit levels and reduce spleen size without the need for phlebotomy.

Detailed list of emerging therapies in Polycythemia Vera is provided in the final report…

Leading Companies in the Polycythemia Vera Market:

The Polycythemia Vera (PV) treatment market is a rapidly evolving landscape, driven by intense competition and continuous advancements from major pharmaceutical and biotechnology companies. Market analysis indicates that industry leaders such as AOP Orphan Pharmaceuticals/PharmaEssentia Corporation, Incyte Corporation/Novartis, Italfarmaco, Protagonist Therapeutics, and Imago BioSciences are at the forefront, investing heavily in novel therapeutic development and personalized approaches to PV management. These companies are exploring a wide range of innovative treatment modalities, including JAK inhibitors (e.g., Ruxolitinib), hepcidin mimetics (e.g., Rusfertide), HDAC inhibitors (e.g., Givinostat), and LSD1 inhibitors (e.g., Bomedemstat). Additionally, the growing focus on disease-modifying therapies, rather than just symptom control, highlights the industry's commitment to targeting the underlying pathology of PV. The development of next-generation treatments that reduce thrombotic risks, control hematocrit levels, and potentially slow disease progression is shaping the future of PV management.

In March 2021, The Italfarmaco Group published the first interim analysis results in the Blood Cancer Journal, reporting findings from a mean four-year follow-up of 51 patients with Polycythemia Vera (PV), a type of BCR-ABL1-negative chronic myeloproliferative neoplasm (MPN).

Key Players in the Polycythemia Vera Market:

The key players in the Polycythemia Vera market who are in different phases of developing different therapies are AOP Orphan Pharmaceuticals/PharmaEssentia Corporation, Incyte Corporation/Novartis, Italfarmaco, Protagonist Therapeutics, Imago BioSciences, and others.

Regional Analysis:

The market for Polycythemia Vera (PV) treatment is primarily concentrated in developed countries, including the United States, Germany, the United Kingdom, France, Italy, Spain, and Japan, where advancements in hematology and oncology are driving innovation. The U.S. plays a crucial role due to its high prevalence of PV cases and its leadership in both diagnostic advancements and therapeutic developments for the disease. While research continues to explore more effective treatment strategies, current approaches focus on symptom management through phlebotomy, cytoreductive therapies (e.g., hydroxyurea, interferons), and JAK inhibitors (e.g., Ruxolitinib). However, significant progress is being made in understanding the molecular mechanisms and genetic factors underlying PV, leading to improved diagnostic tools, risk stratification models, and more personalized treatment approaches. Additionally, increased investments in hematologic research, regulatory support for novel therapies, and collaborations between pharmaceutical companies, healthcare providers, and research institutions are fueling growth in the PV treatment market. These efforts aim to expand therapeutic options, improve long-term disease management, and enhance the overall quality of life for individuals affected by Polycythemia Vera.

Recent Developments in Polycythemia Vera Market:

· In March 2021, The Italfarmaco Group published the first interim analysis results in the Blood Cancer Journal, reporting findings from a mean four-year follow-up of 51 patients with Polycythemia Vera (PV), a type of BCR-ABL1-negative chronic myeloproliferative neoplasm (MPN).

· In June 2021, Protagonist Therapeutics received Breakthrough Therapy Designation from the U.S. Food and Drug Administration (FDA) for its main investigational drug rusfertide within the treatment of Polycythemia Vera (PV). The classification applies to PV patients seeking erythrocytosis reduction but does not require extra medication to manage thrombocytosis or leucocytosis.

Key information covered in the report.

Base Year: 2024

Historical Period: 2019-2024

Market Forecast: 2025-2035

Countries Covered

This report offers a comprehensive analysis of current Polycythemia Vera-marketed drugs and late-stage pipeline drugs.

In-Market Drugs

https://www.imarcgroup.com/polycythemia-vera-market/toc

IMARC Group Offer Other Reports:

Ocular Hypertension Market- The 7 major ocular hypertension markets reached a value of US$ 3,054.0 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 4,538.6 Million by 2034, exhibiting a growth rate (CAGR) of 3.67% during 2024-2034.

Idiopathic Pulmonary Fibrosis (IPF) Market - The 7 major Idiopathic Pulmonary Fibrosis (IPF) markets reached a value of US$ 3,586.4 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 6,906.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.1% during 2024-2034.

Hemophilia A Market- The 7 major Hemophilia-A market reached a value of US$ 10,288.7 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 28,447.2 Million by 2034, exhibiting a growth rate (CAGR) of 9.69% during 2024-2034.

Ankylosing Spondylitis Market- The 7 major Ankylosing Spondylitis market reached a value of US$ 4.8 Billion in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 9.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.3% during 2024-2034.

Cone Rod Dystrophy Market: The 7 major Cone rod dystrophy market reached a value of US$ 114.5 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 179.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.15% during 2024-2034.

Fuchs Dystrophy Market: The 7 major Fuchs dystrophy market reached a value of US$ 148.3 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 292.9 Million by 2034, exhibiting a growth rate (CAGR) of 6.38% during 2024-2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

The Polycythemia vera market reached a value of USD 19.4 Billion in 2024. Looking forward, IMARC Group expects the 7MM to reach USD 79.0 Billion by 2035, exhibiting a growth rate (CAGR) of 13.63% during 2025-2035. The Polycythemia Vera (PV) treatment market is experiencing significant changes because of recent developments in diagnostic approaches as well as therapeutic solutions. Treatment strategies along with early diagnosis methods receive heightened priority within the PV treatment market. The combination of genetic testing for JAK2 mutations and artificial intelligence (AI) predictive models improves PV identification which allows patients to receive early intervention through personalized management strategies. The new approach has the power to enable patients along with health practitioners to take needed steps in disease management which leads to better treatment results. The therapy for managing Polycythemia Vera now includes new therapeutic approaches. New pharmacological approaches have introduced JAK inhibitors and next-generation interferons together with cytoreductive medications which enhance disease management and result in lower medication side effects. Long-lasting interferons and combination therapy medicine designs help patients through improved drug adherence and better treatment outcome results. Furthermore, modern treatment strategies contain the integration of non-pharmacological approaches that use therapeutic phlebotomy protocols along with lifestyle modifications as key elements for PV patient management.

Transforming the Diagnosis and Management of Polycythemia Vera

The healthcare environment surrounding Polycythemia Vera (PV) diagnosis and management has been transformed through enhanced knowledge among hematologists oncologists and general practitioners. Doctors need a better understanding of this uncommon but dangerous blood disease because timely interventions improve patient results and minimize risks of thrombosis alongside cardiovascular events and subsequent myelofibrosis or acute leukemia development. Healthcare professionals demonstrate a better understanding of genetic elements alongside hematological and systemic factors that cause PV which enables them to discover PV earlier and customize treatment approaches for each patient. Additionally, early proactive disease management helps to improve both patient disease outcomes and long-term survival rates. The early detection of Polycythemia Vera becomes possible through advancements in diagnostic technologies that include JAK2 mutation testing as well as hematocrit monitoring and predictive modeling with AI assistance. Healthcare providers now use biomarker-driven diagnostics together with next-generation sequencing and advanced imaging techniques to properly distinguish PV from other myeloproliferative disorders thus improving diagnostic accuracy. These tools enable healthcare providers to deliver more accurate treatment strategies by combining cytoreductive therapies with JAK inhibitors and phlebotomy and interferon-based treatments as well as lifestyle modifications. The ongoing evolution of medical science leads to better precision medicine practices and patient-focused care which results in improved Polycythemia Vera treatment effectiveness and enhanced patient quality of life.

Request a PDF Sample Report:

https://www.imarcgroup.com/polycythemia-vera-market/requestsample

Growing Use of Phlebotomy and Cytoreductive Therapies in Polycythemia Vera (PV)

Phlebotomy remains the cornerstone of Polycythemia Vera (PV) treatment, as it effectively reduces hematocrit levels and decreases the risk of thrombotic complications. However, as research advances and treatment strategies evolve, the increasing adoption of cytoreductive therapies is significantly expanding the therapeutic landscape for PV management. The treatments function as key components for patients who face a high risk of blood clots demonstrate phlebotomy complications or present disease evolution despite normal hematocrit levels. Hydroxyurea stands as the primary therapeutic agent for high-risk PV patients and controls red blood cell production together with preventing vascular complications. Besides this, the rising utilization of interferon-based therapies emerges because of patient-related safety concerns resistance properties, and intolerance reactions. Additionally, the acceptance of pegylated interferons (peginterferon alfa-2a and peginterferon alfa-2b) increases because they achieve both hematocrit and platelet control and reduce JAK2 mutant allele burden which potentially changes disease progression.

Buy Full Report:

https://www.imarcgroup.com/checkout?id=7506&method=809

Marketed Therapies in the Polycythemia Vera Market

Besremi (ropeginterferon alfa-2b-njft) - AOP Orphan Pharmaceuticals/PharmaEssentia Corporation

The Pegylated interferon Ropeginterferon Alfa-2b known as Besremi has proved to be an advanced therapeutic option for Polycythemia Vera (PV). The primary advantage of Besremi stands out against traditional therapies since it modifies PV through active targeting of JAK2 mutation-related excessive red blood cell production.

Jakafi (Ruxolitinib) - Incyte Corporation/Novartis

The JAK1/JAK2 inhibitor Jakafi (Ruxolitinib) receives regulatory approval for Polycythemia Vera (PV) treatment among patients who show resistance or intolerance to hydroxyurea. The JAK-STAT signaling pathway offers a viable treatment approach for PV because Jakafi blocks this signaling pathway to control blood cell production while reducing spleen size and relieving PV symptoms.

Emerging Therapies in the Polycythemia Vera Market

Givinostat – Italfarmaco

Givinostat, developed by Italfarmaco, is an investigational histone deacetylase (HDAC) inhibitor being studied for the treatment of Polycythemia Vera (PV). It works by targeting abnormal blood cell proliferation and inflammation associated with PV, potentially offering a disease-modifying approach.

PTG300 - Protagonist Therapeutics

PTG-300, developed by Protagonist Therapeutics, is an investigational hepcidin mimetic for the treatment of Polycythemia Vera (PV). It regulates iron metabolism and red blood cell production, aiming to reduce the need for therapeutic phlebotomy.

Bomedemstat - Imago BioSciences

Bomedemstat, developed by Imago BioSciences, is an investigational Lysine-Specific Demethylase 1 (LSD1) inhibitor for the treatment of Polycythemia Vera (PV). It targets abnormal blood cell production and inflammatory pathways, aiming to control hematocrit levels and reduce spleen size without the need for phlebotomy.

| Drug Name | Company Name | MOA | ROA |

| Givinostat | Italfarmaco | Histone deacetylase inhibitors | Oral |

| PTG300 | Protagonist Therapeutics | Hepcidin replacements; Iron modulators | Oral |

| Bomedemstat | Imago BioSciences | Lysine-specific demethylase 1 inhibitors | Oral |

Leading Companies in the Polycythemia Vera Market:

The Polycythemia Vera (PV) treatment market is a rapidly evolving landscape, driven by intense competition and continuous advancements from major pharmaceutical and biotechnology companies. Market analysis indicates that industry leaders such as AOP Orphan Pharmaceuticals/PharmaEssentia Corporation, Incyte Corporation/Novartis, Italfarmaco, Protagonist Therapeutics, and Imago BioSciences are at the forefront, investing heavily in novel therapeutic development and personalized approaches to PV management. These companies are exploring a wide range of innovative treatment modalities, including JAK inhibitors (e.g., Ruxolitinib), hepcidin mimetics (e.g., Rusfertide), HDAC inhibitors (e.g., Givinostat), and LSD1 inhibitors (e.g., Bomedemstat). Additionally, the growing focus on disease-modifying therapies, rather than just symptom control, highlights the industry's commitment to targeting the underlying pathology of PV. The development of next-generation treatments that reduce thrombotic risks, control hematocrit levels, and potentially slow disease progression is shaping the future of PV management.

In March 2021, The Italfarmaco Group published the first interim analysis results in the Blood Cancer Journal, reporting findings from a mean four-year follow-up of 51 patients with Polycythemia Vera (PV), a type of BCR-ABL1-negative chronic myeloproliferative neoplasm (MPN).

Key Players in the Polycythemia Vera Market:

The key players in the Polycythemia Vera market who are in different phases of developing different therapies are AOP Orphan Pharmaceuticals/PharmaEssentia Corporation, Incyte Corporation/Novartis, Italfarmaco, Protagonist Therapeutics, Imago BioSciences, and others.

Regional Analysis:

The market for Polycythemia Vera (PV) treatment is primarily concentrated in developed countries, including the United States, Germany, the United Kingdom, France, Italy, Spain, and Japan, where advancements in hematology and oncology are driving innovation. The U.S. plays a crucial role due to its high prevalence of PV cases and its leadership in both diagnostic advancements and therapeutic developments for the disease. While research continues to explore more effective treatment strategies, current approaches focus on symptom management through phlebotomy, cytoreductive therapies (e.g., hydroxyurea, interferons), and JAK inhibitors (e.g., Ruxolitinib). However, significant progress is being made in understanding the molecular mechanisms and genetic factors underlying PV, leading to improved diagnostic tools, risk stratification models, and more personalized treatment approaches. Additionally, increased investments in hematologic research, regulatory support for novel therapies, and collaborations between pharmaceutical companies, healthcare providers, and research institutions are fueling growth in the PV treatment market. These efforts aim to expand therapeutic options, improve long-term disease management, and enhance the overall quality of life for individuals affected by Polycythemia Vera.

Recent Developments in Polycythemia Vera Market:

· In March 2021, The Italfarmaco Group published the first interim analysis results in the Blood Cancer Journal, reporting findings from a mean four-year follow-up of 51 patients with Polycythemia Vera (PV), a type of BCR-ABL1-negative chronic myeloproliferative neoplasm (MPN).

· In June 2021, Protagonist Therapeutics received Breakthrough Therapy Designation from the U.S. Food and Drug Administration (FDA) for its main investigational drug rusfertide within the treatment of Polycythemia Vera (PV). The classification applies to PV patients seeking erythrocytosis reduction but does not require extra medication to manage thrombocytosis or leucocytosis.

Key information covered in the report.

Base Year: 2024

Historical Period: 2019-2024

Market Forecast: 2025-2035

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the Polycythemia Vera market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the Polycythemia Vera market

- Reimbursement scenario in the market

- In-market and pipeline drugs

This report offers a comprehensive analysis of current Polycythemia Vera-marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

https://www.imarcgroup.com/polycythemia-vera-market/toc

IMARC Group Offer Other Reports:

Ocular Hypertension Market- The 7 major ocular hypertension markets reached a value of US$ 3,054.0 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 4,538.6 Million by 2034, exhibiting a growth rate (CAGR) of 3.67% during 2024-2034.

Idiopathic Pulmonary Fibrosis (IPF) Market - The 7 major Idiopathic Pulmonary Fibrosis (IPF) markets reached a value of US$ 3,586.4 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 6,906.1 Million by 2034, exhibiting a growth rate (CAGR) of 6.1% during 2024-2034.

Hemophilia A Market- The 7 major Hemophilia-A market reached a value of US$ 10,288.7 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 28,447.2 Million by 2034, exhibiting a growth rate (CAGR) of 9.69% during 2024-2034.

Ankylosing Spondylitis Market- The 7 major Ankylosing Spondylitis market reached a value of US$ 4.8 Billion in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 9.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.3% during 2024-2034.

Cone Rod Dystrophy Market: The 7 major Cone rod dystrophy market reached a value of US$ 114.5 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 179.0 Million by 2034, exhibiting a growth rate (CAGR) of 4.15% during 2024-2034.

Fuchs Dystrophy Market: The 7 major Fuchs dystrophy market reached a value of US$ 148.3 Million in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 292.9 Million by 2034, exhibiting a growth rate (CAGR) of 6.38% during 2024-2034.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800