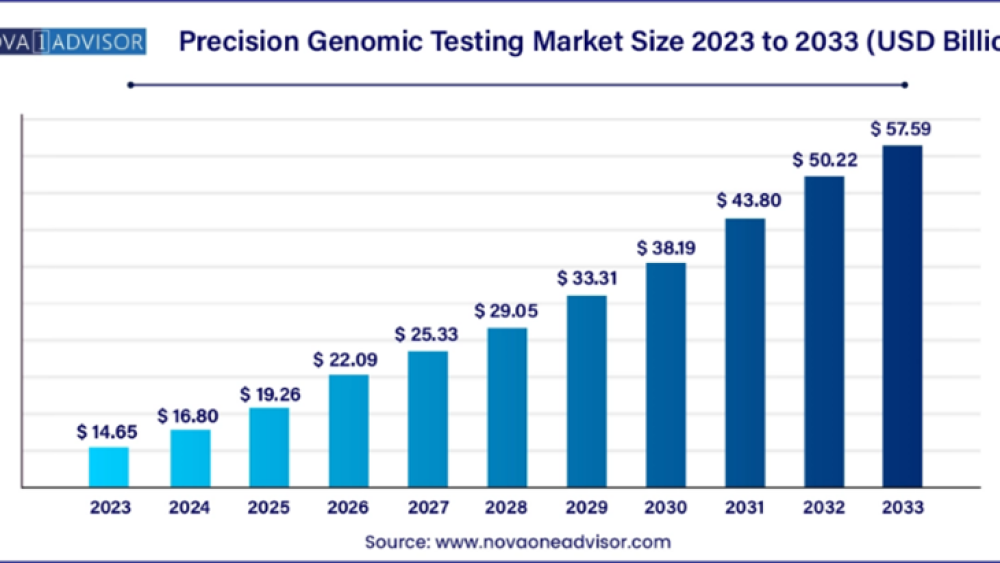

According to Nova One Advisor, the global precision genomic testing market size was USD 14.65 billion in 2023, calculated at USD 16.80 billion in 2024 and is expected to reach around USD 57.59 billion by 2033, expanding at a CAGR of 14.67% from 2024 to 2033.

Full Report is Ready | Ask here for Sample Copy@ https://www.novaoneadvisor.com/report/sample/8669

The market is driven by an increasing emphasis on personalized medicine and rising advancements in genomic technologies. The market contributes a range of diagnostic techniques and tools used to detect genetic information, owing to improved patient outcomes, targeted therapies, and more accurate diagnosis.

The precision genomic testing market includes the analysis of an individual’s unique genetic makeup via advanced genomic testing technologies such as next-generation sequencing, microarrays, and PCR. It allows personalized healthcare by empowering lifestyle changes to reduce disease risk, screening for early diagnosis, selecting appropriate therapies, and identifying predispositions to diseases. The insights derived from genomic testing are used across applications such as reproductive health, wellness, precision medicine, and molecular diagnostics to assist healthcare decisions tailored to the individual. Moreover, the precision genomic testing market has witnessed significant growth leading to greater consumer interest, the rise of precision medicine approaches, and declining sequencing costs.

In addition, the increasing demand for precision genomic testing is fueled by the need for better management of chronic conditions, effective treatment planning, and early disease detection. The market is further driven by increasing partnerships and collaborations between biotechnology companies, healthcare providers, research organizations, and academic institutions, rising integration with digital health infrastructure, and an emphasis on data privacy and security.

Precision Genomic Testing Market Key Takeaways

U.S. Precision Genomic Testing Market Size, Industry Report, 2033

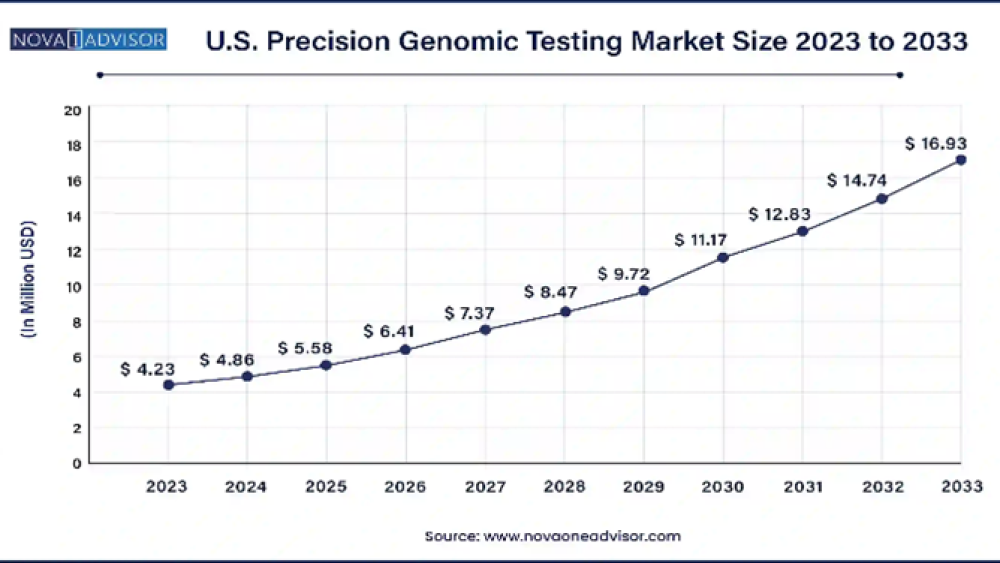

The U.S. Precision genomic testing market size was exhibited at USD 4.23 billion in 2023 and is projected to hit around USD 16.93 billion by 2033, growing at a CAGR of 14.87% during the forecast period 2024 to 2033.

North America dominated the precision genomic testing market in 2023. The region is dominated by robust participation from major players such as QIAGEN, Thermo Fisher Scientific, and Illumina. The rising innovation in next-generation sequencing bioinformatics and technologies is boosting market growth in the region and enabling personalized medicine applications and genomic analysis. The region is catering to increasing demands for tailored and accurate healthcare solutions and remains at the forefront of advancing precision genomic testing capabilities. The U.S. and Canada are the major countries in the market.

U.S. precision genomic testing market trends

The market for precision genomic testing is expected to grow during the estimated period with increased partnerships between research institutions and industry leaders. For instance, in May 2023, Thermos Fisher Scientific Inc. And Pfizer announced a partnership to expand the local availability of next-generation sequencing testing for patients with breast cancer and lung cancer. These collaborations accelerate the development and foster innovation of advanced genomic technologies, accelerating personalized treatment options and diagnostic capabilities for patients.

Europe Precision Genomic Testing Market Trends

The precision genomic testing market in Europe is anticipated to grow over the forecast period, driven by robust investments in research and development. Increased funding supports advancements in genomic technologies, fostering innovation in diagnostics and personalized medicine across the continent.

UK precision genomic testing market is expected to grow over the forecast period due to technological innovations. In June 2024, in the UK, robotic technology is employed to aid genomic testing for cancer patients through a collaboration between The Royal Marsden NHS Foundation Trust and Automata Technologies, an automation company specializing in life sciences lab automation. These advancements include next-generation sequencing (NGS) and CRISPR gene editing technologies, enhancing the accuracy and efficiency of genetic analysis for personalized medicine applications.

The precision genomic testing market in Germany is expected to grow over the forecast period with cutting-edge technological improvements in genomic sequencing. These advancements, including next-generation sequencing (NGS) technologies, are enhancing the precision and scope of genetic analysis, driving innovation in personalized medicine and healthcare solutions. For instance, in April 2023, CENTOGENE introduced CentoGenome, a new whole genome sequencing solution designed for diagnosing rare and neurodegenerative diseases. This innovative tool enables healthcare professionals to access more extensive diagnostic information, potentially expediting access to treatment options for patients.

Asia Pacific is expected to grow fastest during the forecast period.

The precision genomic testing market is driven by significant investments in research and development. These efforts are accelerating technological innovations in diagnostics and genomic sequencing, enhancing the capabilities of healthcare solutions and personalized medicine in the region. China, India, Japan, and South Korea are the major countries driving the market growth in the region.

China precision genomic testing market trends

The market growth is driven by strategic partnerships with international companies and global expansion efforts. For instance, in July 2022, Adicon Holdings Limited, a leading independent clinical laboratory company, and Guardant Health, Inc., a leading precision oncology company based in China announced strategic partnerships. In China, this partnership offered Guardant Health's comprehensive genomic profiling (CGP) tests to biopharmaceutical companies conducting clinical trials. These partnerships improve access to advanced genomic expertise and technologies. The aim behind this partnership was to strengthen its position in healthcare innovation and personalized medicine on a global scale.

The precision genomic testing market in Japan is expected to witness a rapid growth over the forecast period with advancements in technology, particularly through AI interventions. These developments are enhancing the accuracy and efficiency of genomic testing and analysis, positioning Japan at the forefront of personalized medicine and healthcare innovation. For instance, in July 2024, SoftBank Group formed a joint venture named "SB TEMPUS" with Tempus to advance healthcare in Japan by leveraging medical data and AI. The venture aims to offer precision medicine services, including genetic testing and AI-driven treatment recommendations.

Middle East & Africa Precision Genomic Testing Market Trends

The precision genomic testing market in the Middle East & Africa is poised to grow amid a rise in genetic disorders. Increased investment in research and development is driving advancements in genomic technologies, improving diagnostic accuracy and personalized treatment options across the region. These efforts are crucial in addressing the growing healthcare needs and enhancing genomic healthcare capabilities in Middle Eastern and African countries.

Saudi Arabia precision genomic testing market is expected to grow over the forecast period due to government funding and healthcare investments. These initiatives aim to enhance diagnostic capabilities, promote personalized medicine, and address healthcare challenges through advanced genomic technologies and research.

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/8669

Precision Genomic Testing Market Segment Insights

By product type

The consumables segment dominated the market share in 2023 and was driven by rising advancements in technology and new product launches. Market players are introducing advanced consumables including assay components, kits, and reagents tailored for genomic analysis and sequencing. These advancements involve high throughput sequencing technologies and improved sample preparation methods, enhancing the accuracy and efficiency of genomic testing. For instance, in December 2023, the commercial launch of its ASPYRE®-Lung RUO reagent product was announced by Biofidelitely. ASPYRE-Lung dramatically accelerates and simplifies the detection of genomic biomarkers and enables localized testing of genomic testing.

By application type

The oncology segment dominated the precision genomic testing market. The segment is driven by rising innovations in cancer genomics. Advances such as targeted therapy development, comprehensive genomic profiling, and liquid biopsy techniques are accelerating early detection, personalized treatment of cancers, and diagnosis. For instance, in June 2024, the UK’s first-ever genome testing facility at the Sharjah Clinical Genomics Laboratory in the National Institute for Health and Care Research’s Centre was launched by the Royal Marsden NHS Foundation Trust. The aim behind this launch was to increase genomic testing capacity for cancer patients. Companies are heavily investing in research to develop precise genomic tests identify novel biomarkers and enable tailored treatment plans for cancer patients.

By technology type

The next-generation sequencing held the highest market growth in 2023. The segment growth is driven by strategic partnerships and continuous innovation. The rising advances in NGS technologies are enhancing sequencing cost-effectiveness, accuracy, and speed and enable comprehensive genomic profiling. The increasing collaborations between healthcare providers, research institutions, and biotech companies are improving the adoption and development of NGS-based tests. For instance, in April 2022, the next-generation sequencing and automated NGS platform, the CE-IVD marked Ion Torrent Genexus Dx Integrated Sequencer was launched by Thermo Fisher Scientific. The platform enables users to perform clinical research and diagnostic testing on a single application and is designed for clinical laboratories. This launch facilitates the translation of advanced research into clinical applications, improving personalized medicine approaches and driving market expansion.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8669

The precision genomic testing market company insights

Some of the major players operating in the market are Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Color Genomics, Inc., 24 Genetics, Amgen, Inc., Circle DNA, and many others. These major players are undertaking various initiatives to increase the reach of their services and products and strengthen their market presence. Strategies such as partnerships and expansion activities are important in driving market growth.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Precision Genomic Testing market.

By Product

https://www.novaoneadvisor.com/report/checkout/8669

Browse More Insights:

Genomics Market : The global genomics market size was estimated at USD 33.90 billion in 2023 and is projected to hit around USD 157.47 billion by 2033, growing at a CAGR of 16.6% during the forecast period from 2024 to 2033.

Oncology Market : The global oncology market size was estimated at USD 222.36 billion in 2023 and is projected to hit around USD 521.60 billion by 2033, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

Biologics Market : The global biologics market size was estimated at USD 511.04 billion in 2023 and is projected to hit around USD 1,374.51 billion by 2033, growing at a CAGR of 10.4% during the forecast period from 2024 to 2033.

Biotechnology Market : The global biotechnology market size was estimated at USD 1.54 Trillion in 2023 and is projected to hit around USD 5.68 Trillion by 2033, growing at a CAGR of 13.95% during the forecast period from 2024 to 2033.

U.S. Precision Medicine Market : The U.S. precision medicine market size was valued at USD 24.95 billion in 2023 and is projected to reach around USD 76.12 billion by 2033, registering a CAGR of 11.80% from 2024 to 2033.

Next Generation Sequencing Market : The global next generation sequencing market size was estimated at USD 9.19 billion in 2023 and is projected to hit around USD 66.04 billion by 2033, growing at a CAGR of 21.8% during the forecast period from 2024 to 2033.

Pharmaceutical CDMO Market : The global pharmaceutical CDMO market size was estimated at USD 146.29 billion in 2023 and is projected to hit around USD 295.95 billion by 2033, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Full Report is Ready | Ask here for Sample Copy@ https://www.novaoneadvisor.com/report/sample/8669

The market is driven by an increasing emphasis on personalized medicine and rising advancements in genomic technologies. The market contributes a range of diagnostic techniques and tools used to detect genetic information, owing to improved patient outcomes, targeted therapies, and more accurate diagnosis.

The precision genomic testing market includes the analysis of an individual’s unique genetic makeup via advanced genomic testing technologies such as next-generation sequencing, microarrays, and PCR. It allows personalized healthcare by empowering lifestyle changes to reduce disease risk, screening for early diagnosis, selecting appropriate therapies, and identifying predispositions to diseases. The insights derived from genomic testing are used across applications such as reproductive health, wellness, precision medicine, and molecular diagnostics to assist healthcare decisions tailored to the individual. Moreover, the precision genomic testing market has witnessed significant growth leading to greater consumer interest, the rise of precision medicine approaches, and declining sequencing costs.

In addition, the increasing demand for precision genomic testing is fueled by the need for better management of chronic conditions, effective treatment planning, and early disease detection. The market is further driven by increasing partnerships and collaborations between biotechnology companies, healthcare providers, research organizations, and academic institutions, rising integration with digital health infrastructure, and an emphasis on data privacy and security.

Precision Genomic Testing Market Key Takeaways

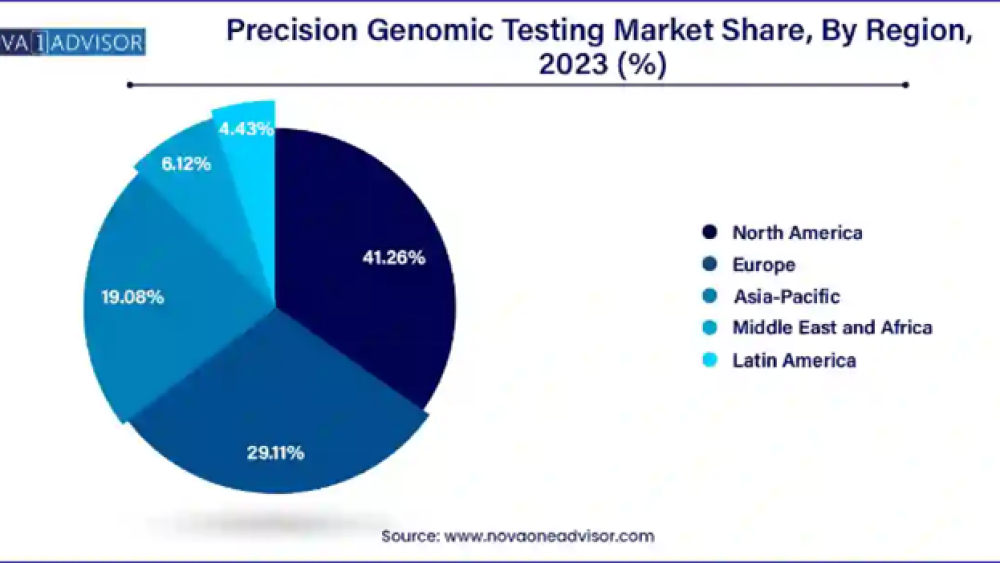

- North America precision genome testing market dominated the global industry and accounted for a 41.26% share in 2023

- The precision genomic testing market in Asia Pacific is expected to experience rapid growth, with a projected CAGR of 19.79% from 2024 to 2033

- The consumables segment dominated the market in 2023 and is anticipated to grow at the fastest CAGR of 15.58% from 2024 to 2033

- The oncology segment dominated the market and accounted for a 31.86% share in 2023

- The neurological disorders segment is anticipated to grow at the highest CAGR of 16.34% from 2024 to 2033

- The next-generation sequencing segment held the largest market share of 34.6% in 2023

- The microarray technology segment is expected to grow at the fastest CAGR of 17.22% over the forecast period.

- Hospitals and clinics dominated the market with the largest revenue share of 51.4% in 2023

- Diagnostic laboratories are anticipated to grow at the highest CAGR over the forecast period

U.S. Precision Genomic Testing Market Size, Industry Report, 2033

The U.S. Precision genomic testing market size was exhibited at USD 4.23 billion in 2023 and is projected to hit around USD 16.93 billion by 2033, growing at a CAGR of 14.87% during the forecast period 2024 to 2033.

North America dominated the precision genomic testing market in 2023. The region is dominated by robust participation from major players such as QIAGEN, Thermo Fisher Scientific, and Illumina. The rising innovation in next-generation sequencing bioinformatics and technologies is boosting market growth in the region and enabling personalized medicine applications and genomic analysis. The region is catering to increasing demands for tailored and accurate healthcare solutions and remains at the forefront of advancing precision genomic testing capabilities. The U.S. and Canada are the major countries in the market.

U.S. precision genomic testing market trends

The market for precision genomic testing is expected to grow during the estimated period with increased partnerships between research institutions and industry leaders. For instance, in May 2023, Thermos Fisher Scientific Inc. And Pfizer announced a partnership to expand the local availability of next-generation sequencing testing for patients with breast cancer and lung cancer. These collaborations accelerate the development and foster innovation of advanced genomic technologies, accelerating personalized treatment options and diagnostic capabilities for patients.

Europe Precision Genomic Testing Market Trends

The precision genomic testing market in Europe is anticipated to grow over the forecast period, driven by robust investments in research and development. Increased funding supports advancements in genomic technologies, fostering innovation in diagnostics and personalized medicine across the continent.

UK precision genomic testing market is expected to grow over the forecast period due to technological innovations. In June 2024, in the UK, robotic technology is employed to aid genomic testing for cancer patients through a collaboration between The Royal Marsden NHS Foundation Trust and Automata Technologies, an automation company specializing in life sciences lab automation. These advancements include next-generation sequencing (NGS) and CRISPR gene editing technologies, enhancing the accuracy and efficiency of genetic analysis for personalized medicine applications.

The precision genomic testing market in Germany is expected to grow over the forecast period with cutting-edge technological improvements in genomic sequencing. These advancements, including next-generation sequencing (NGS) technologies, are enhancing the precision and scope of genetic analysis, driving innovation in personalized medicine and healthcare solutions. For instance, in April 2023, CENTOGENE introduced CentoGenome, a new whole genome sequencing solution designed for diagnosing rare and neurodegenerative diseases. This innovative tool enables healthcare professionals to access more extensive diagnostic information, potentially expediting access to treatment options for patients.

Asia Pacific is expected to grow fastest during the forecast period.

The precision genomic testing market is driven by significant investments in research and development. These efforts are accelerating technological innovations in diagnostics and genomic sequencing, enhancing the capabilities of healthcare solutions and personalized medicine in the region. China, India, Japan, and South Korea are the major countries driving the market growth in the region.

China precision genomic testing market trends

The market growth is driven by strategic partnerships with international companies and global expansion efforts. For instance, in July 2022, Adicon Holdings Limited, a leading independent clinical laboratory company, and Guardant Health, Inc., a leading precision oncology company based in China announced strategic partnerships. In China, this partnership offered Guardant Health's comprehensive genomic profiling (CGP) tests to biopharmaceutical companies conducting clinical trials. These partnerships improve access to advanced genomic expertise and technologies. The aim behind this partnership was to strengthen its position in healthcare innovation and personalized medicine on a global scale.

The precision genomic testing market in Japan is expected to witness a rapid growth over the forecast period with advancements in technology, particularly through AI interventions. These developments are enhancing the accuracy and efficiency of genomic testing and analysis, positioning Japan at the forefront of personalized medicine and healthcare innovation. For instance, in July 2024, SoftBank Group formed a joint venture named "SB TEMPUS" with Tempus to advance healthcare in Japan by leveraging medical data and AI. The venture aims to offer precision medicine services, including genetic testing and AI-driven treatment recommendations.

Middle East & Africa Precision Genomic Testing Market Trends

The precision genomic testing market in the Middle East & Africa is poised to grow amid a rise in genetic disorders. Increased investment in research and development is driving advancements in genomic technologies, improving diagnostic accuracy and personalized treatment options across the region. These efforts are crucial in addressing the growing healthcare needs and enhancing genomic healthcare capabilities in Middle Eastern and African countries.

Saudi Arabia precision genomic testing market is expected to grow over the forecast period due to government funding and healthcare investments. These initiatives aim to enhance diagnostic capabilities, promote personalized medicine, and address healthcare challenges through advanced genomic technologies and research.

Buy Now Full Report: https://www.novaoneadvisor.com/report/checkout/8669

Precision Genomic Testing Market Segment Insights

By product type

The consumables segment dominated the market share in 2023 and was driven by rising advancements in technology and new product launches. Market players are introducing advanced consumables including assay components, kits, and reagents tailored for genomic analysis and sequencing. These advancements involve high throughput sequencing technologies and improved sample preparation methods, enhancing the accuracy and efficiency of genomic testing. For instance, in December 2023, the commercial launch of its ASPYRE®-Lung RUO reagent product was announced by Biofidelitely. ASPYRE-Lung dramatically accelerates and simplifies the detection of genomic biomarkers and enables localized testing of genomic testing.

By application type

The oncology segment dominated the precision genomic testing market. The segment is driven by rising innovations in cancer genomics. Advances such as targeted therapy development, comprehensive genomic profiling, and liquid biopsy techniques are accelerating early detection, personalized treatment of cancers, and diagnosis. For instance, in June 2024, the UK’s first-ever genome testing facility at the Sharjah Clinical Genomics Laboratory in the National Institute for Health and Care Research’s Centre was launched by the Royal Marsden NHS Foundation Trust. The aim behind this launch was to increase genomic testing capacity for cancer patients. Companies are heavily investing in research to develop precise genomic tests identify novel biomarkers and enable tailored treatment plans for cancer patients.

By technology type

The next-generation sequencing held the highest market growth in 2023. The segment growth is driven by strategic partnerships and continuous innovation. The rising advances in NGS technologies are enhancing sequencing cost-effectiveness, accuracy, and speed and enable comprehensive genomic profiling. The increasing collaborations between healthcare providers, research institutions, and biotech companies are improving the adoption and development of NGS-based tests. For instance, in April 2022, the next-generation sequencing and automated NGS platform, the CE-IVD marked Ion Torrent Genexus Dx Integrated Sequencer was launched by Thermo Fisher Scientific. The platform enables users to perform clinical research and diagnostic testing on a single application and is designed for clinical laboratories. This launch facilitates the translation of advanced research into clinical applications, improving personalized medicine approaches and driving market expansion.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8669

The precision genomic testing market company insights

Some of the major players operating in the market are Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Illumina, Inc., Color Genomics, Inc., 24 Genetics, Amgen, Inc., Circle DNA, and many others. These major players are undertaking various initiatives to increase the reach of their services and products and strengthen their market presence. Strategies such as partnerships and expansion activities are important in driving market growth.

- For instance, in August 2022, CE-IVD (IVDD) next-generation sequencing test and analysis software was launched by Thermo Fisher Scientific. The aim behind this launch was to expand access to precision oncology biomarker testing.

- For instance, in November 2023, a global leader in DNA sequencing and array-based technologies, Illumina Inc. announced a new generation of its distributed liquid biopsy assay for genomic profiling TruSight™ Oncology 500 ctDNA v2. This genomic profiling was a research assay that allows noninvasive comprehensive genomic profiling.

- Illumina, Inc.

- Color Genomics, Inc.

- Amgen, Inc.

- 24 genetics

- Circle DNA

- F. Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- AncestryDNA

- Agilent Technologies, Inc.

- QIAGEN N.V.

- In April 2024, Ambry Genetics and collaborators launched the Inter-Organization Cancer Genetics Clinical Evidence Coalition. The aim behind this launch was to increase access to specialized genetic testing for people with, or at risk of hereditary cancers.

- In September 2022, an integrated end-to-end personalized genetic testing service, AVGEN Diagnostics was launched by Avesthagen Limited. The platform employs the latest in AI-driven precision analytics and NGS sequencing technology that improves diagnostic testing services at B2C, and B2B levels forging partnerships with health insurers, B2B and B2C.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Precision Genomic Testing market.

By Product

- Consumables

- Kits

- Reagents

- Plasmids

- Equipment

- Services

- Oncology

- Cardiovascular Diseases

- Neurological Disorders

- Reproductive Health

- Rare Diseases

- Others

- Next-Generation Sequencing

- Polymerase Chain Reaction

- Microarray Technology

- Sanger Sequencing

- CRISPR/Cas Systems

- Others

- Hospitals and Clinics

- Diagnostic Laboratories

- Research & Academic Institutes

- Others

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

https://www.novaoneadvisor.com/report/checkout/8669

Browse More Insights:

Genomics Market : The global genomics market size was estimated at USD 33.90 billion in 2023 and is projected to hit around USD 157.47 billion by 2033, growing at a CAGR of 16.6% during the forecast period from 2024 to 2033.

Oncology Market : The global oncology market size was estimated at USD 222.36 billion in 2023 and is projected to hit around USD 521.60 billion by 2033, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

Biologics Market : The global biologics market size was estimated at USD 511.04 billion in 2023 and is projected to hit around USD 1,374.51 billion by 2033, growing at a CAGR of 10.4% during the forecast period from 2024 to 2033.

Biotechnology Market : The global biotechnology market size was estimated at USD 1.54 Trillion in 2023 and is projected to hit around USD 5.68 Trillion by 2033, growing at a CAGR of 13.95% during the forecast period from 2024 to 2033.

U.S. Precision Medicine Market : The U.S. precision medicine market size was valued at USD 24.95 billion in 2023 and is projected to reach around USD 76.12 billion by 2033, registering a CAGR of 11.80% from 2024 to 2033.

Next Generation Sequencing Market : The global next generation sequencing market size was estimated at USD 9.19 billion in 2023 and is projected to hit around USD 66.04 billion by 2033, growing at a CAGR of 21.8% during the forecast period from 2024 to 2033.

Pharmaceutical CDMO Market : The global pharmaceutical CDMO market size was estimated at USD 146.29 billion in 2023 and is projected to hit around USD 295.95 billion by 2033, growing at a CAGR of 7.3% during the forecast period from 2024 to 2033.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/