RareCyte, Inc. (“RareCyte” or “the Company”) a Life Sciences company creating liquid and tissue biopsy analysis platforms with emphasis on rare cell detection announced today the completion of a $22M financing from new and existing investors.

|

SEATTLE, Dec. 19, 2019 /PRNewswire/ -- RareCyte, Inc. ("RareCyte" or "the Company") a Life Sciences company creating liquid and tissue biopsy analysis platforms with emphasis on rare cell detection announced today the completion of a $22M financing from new and existing investors. The funding will drive a global sales expansion for its instrument and consumables platform used in research and clinical markets. The $22M investment was led by HealthQuest Capital, with participation from 5AM Ventures and company founder, Ron Seubert.

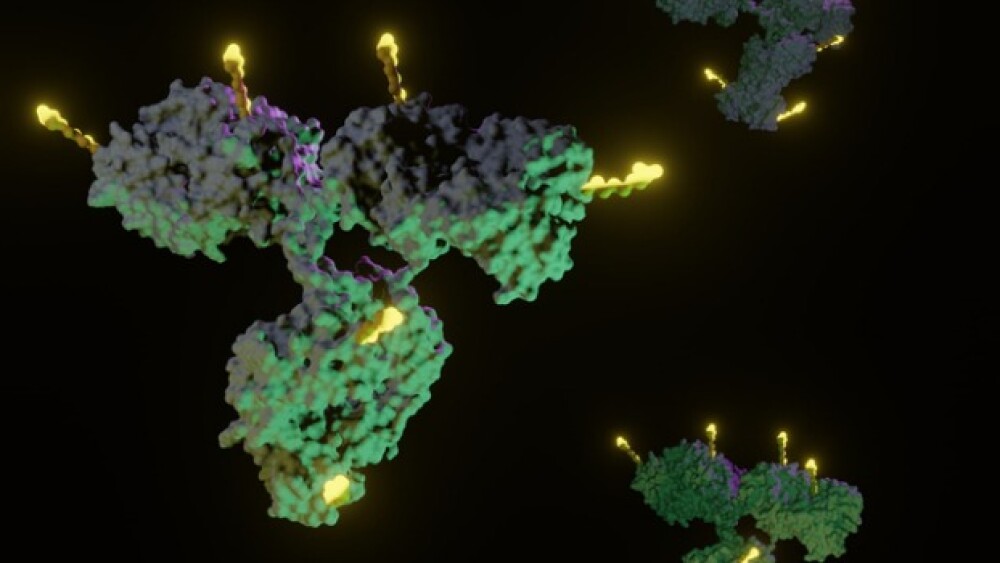

The Company recently broadened product offerings to include the CyteFinder II platform that includes whole slide high-parameter tissue analysis in addition to its foundational liquid biopsy applications. This technology now enables high resolution tissue multiplexing for diverse applications driven by growth in translational research fields, particularly immuno-oncology. "We are excited to have HealthQuest Capital lead this new funding; their team's healthcare expertise and ecosystem will be a valuable addition to our group of active and supportive investors. This funding will allow RareCyte to accelerate our global sales and marketing efforts, fund development of applications for our new tissue multiplexing platform, and release new liquid biopsy assays," said Joe Victor, RareCyte President and CEO. David Kabakoff, PhD, Partner at HealthQuest Capital and veteran of the life sciences industry has joined the RareCyte Board of Directors and commented, "HealthQuest Capital is committed to helping transformative healthcare companies like RareCyte grow. RareCyte's well-differentiated, integrated platform can be applied to both liquid biopsy and tissue samples and will enable next generation precision medicine applications in numerous life sciences market segments." Andy Schwab, Managing Partner at 5AM Ventures also joined the RareCyte Board and added, "RareCyte has validated its rare single-cell platform with research and biopharma customers for numerous liquid biopsy assays and those products plus the recently released tissue applications will be a catalyst for future growth. The company is poised to scale, and we are very pleased to have HealthQuest Capital join the investor syndicate." About RareCyte, Inc. RareCyte offers fully integrated solutions for high resolution multiplex rare cell analysis of blood and tissue samples from preclinical through clinical and translational research enabling development of next generation precision medicines for numerous therapeutic areas including immuno-oncology. The Company's platform which includes AccuCyte® Sample Preparation, RarePlex® Staining Kits, CyteFinder® Instruments, and the CytePicker® Retrieval Module, has been adopted by leading academic medical institutions and biopharma companies to gain a richer understanding of complex diseases, such as cancer. Leveraging microscope slides as the substrate, the platform fits seamlessly into clinical laboratory workflows and enables high-throughput processing of blood and tissue samples from clinical studies of all sizes. CyteFinder can analyze up to seven biomarker channels using immunofluorescent staining to facilitate deeper analysis of rare cell phenotypes. The integrated CytePicker retrieves single cells of interest, allowing customers to build unique phenotype and genotype datasets at the single cell level to advance their research and clinical programs. Our customers perform cutting-edge research at prestigious institutions worldwide and perform a wide-range of single cell applications in oncology, prenatal testing, and infectious disease. For more information about RareCyte, visit www.rarecyte.com. About HealthQuest Capital Based in the San Francisco Bay Area, HealthQuest Capital is a growth capital firm investing in commercial-stage companies that are optimizing value in healthcare by improving outcomes and reducing costs. With more than $850 million in capital under management, the firm focuses on fostering innovation across the healthcare spectrum, including medical technologies, diagnostics/tools, digital health and innovative services. The HealthQuest team combines decades of successful investing experience with deep domain expertise in all aspects of the healthcare industry. For more information, visit www.healthquestcapital.com. About 5AM Ventures Founded in 2002, 5AM actively invests in next-generation biotech companies. With approximately $1.5 billion raised since inception, 5AM has invested in 80 companies including Arvinas, Audentes Therapeutics, Crinetics Pharmaceuticals, Flexion Therapeutics, Homology Medicines, IDEAYA Biosciences, Ikaria (acquired by Mallinckrodt), Ilypsa (acquired by Amgen), Marcadia Biotech (acquired by Roche), Novira Therapeutics (acquired by J&J), Pearl Therapeutics (acquired by AstraZeneca), and Relypsa (acquired by Vifor Pharma). For more information, visit www.5amventures.com.

SOURCE RareCyte, Inc. |