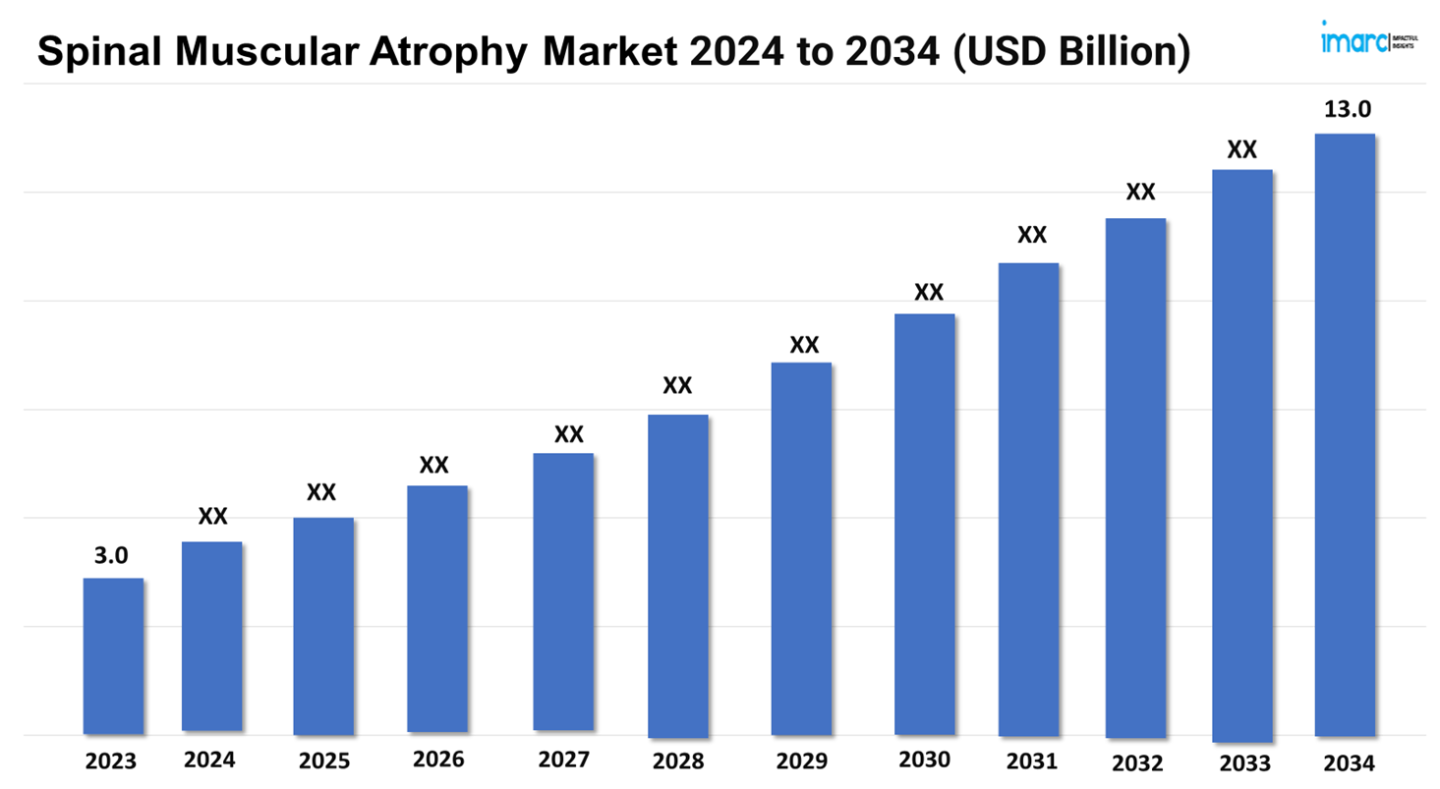

The spinal muscular atrophy market size reached a value of US$ 3.0 Billion in 2023. Looking forward, IMARC Group expects the 7MM to reach US$ 13.0 Billion by 2034, exhibiting a growth rate (CAGR) of 14.28% during 2024-2034.

The market is driven by advancements in gene therapy and the increasing availability of targeted treatments. Key drugs like Spinraza and Zolgensma dominate the market due to their effectiveness and widespread adoption, supported by favorable reimbursement policies. Additionally, the oral drug Evrysdi is gaining traction for its ease of administration, which further propels the market expansion.

Advancements in Gene Therapy: Driving the Spinal Muscular Atrophy Market

Advancements in gene therapy are a prominent trend in the Spinal Muscular Atrophy (SMA) industry, transforming the treatment landscape for this devastating condition. The most remarkable achievement is the development and approval of Zolgensma (Onasemnogene abeparvovec-xioi), a gene therapy that has significantly improved the prognosis for SMA patients. Zolgensma, approved by the US FDA in 2019, is intended to treat the genetic root cause of SMA by delivering a functioning copy of the SMN1 gene to motor neuron cells, restoring normal function and improving patient outcomes. Zolgensma's influence on the market is significant. It provides a single intravenous infusion that replaces the faulty or missing SMN1 gene with a new, functional copy, effectively stopping the disease's development. Clinical trials have demonstrated that Zolgensma significantly improves motor function and survival rates in babies, making it a game-changing alternative for early intervention. This therapy has set a new standard for SMA treatment, changing the focus from symptom management to possibly curative treatments.

Request a PDF Sample Report: https://www.imarcgroup.com/spinal-muscular-atrophy-market/requestsample

Companies like Biogen and Novartis, along with smaller biotech firms, are investing heavily in advancing gene therapy technologies to expand their treatment portfolios. The promising results from ongoing trials are expected to lead to more approvals, offering hope to SMA patients and their families. Moreover, the market growth is fueled by supportive reimbursement policies and increasing accessibility. In regions like North America and Europe, Zolgensma is fully reimbursed, enhancing its availability to patients. This positive reimbursement environment is expected to drive the adoption of gene therapies, further boosting market expansion. Advancements in gene therapy, epitomized by the success of Zolgensma, are a major trend in the SMA market, offering transformative treatment options that address the genetic underpinnings of the disease, improving patient outcomes, and driving significant market growth.

Expanding Drug Pipeline and Approvals: Contributing to Market Expansion

The expanding drug pipeline and increasing number of approvals are pivotal trends in the Spinal Muscular Atrophy (SMA) market, significantly enhancing treatment options and outcomes for patients. Over the past few years, the development of novel therapeutics has accelerated, driven by a deeper understanding of the disease's genetic basis and advancements in biotechnology. Key drugs like Spinraza (Nusinersen) and Evrysdi (Risdiplam) have already transformed the treatment landscape, providing effective management options for various SMA types. Spinraza, developed by Biogen, was the first FDA-approved treatment for SMA and has been a cornerstone in SMA management. Administered intrathecally, Spinraza has shown significant efficacy in improving motor function and survival rates across different SMA types. Its success has paved the way for further innovations in SMA therapeutics. Following Spinraza, Roche’s Evrysdi, an oral medication, gained FDA approval, offering a more convenient administration route, which has been particularly beneficial for pediatric and adult patients. Evrysdi's approval marked a significant milestone, providing a non-invasive alternative that enhances patient compliance and accessibility.

The drug pipeline for SMA is robust, with several promising candidates in various stages of clinical trials. Companies like Novartis, Biogen, and Roche are at the forefront, developing new treatments that aim to improve upon existing therapies. For instance, SRK-015 by Scholar Rock, a muscle-directed therapy, is in late-stage trials and has shown potential to enhance muscle strength and function in SMA patients. Additionally, gene therapy advancements are also contributing to the expanding pipeline. The success of Zolgensma has encouraged further research in gene replacement and editing technologies, aiming to provide long-term solutions for SMA. The competitive landscape is vibrant, with numerous collaborations, licensing agreements, and mergers and acquisitions driving innovation and market growth. Moreover, the expanding drug pipeline and increasing approvals are transforming the SMA market by introducing more effective and accessible treatments, ultimately improving the quality of life for patients and driving substantial market growth.

Buy Full Report: https://www.imarcgroup.com/checkout?id=6930&method=587

Increased Accessibility and Reimbursement:

Increased accessibility and favorable reimbursement policies are critical trends driving the growth of the Spinal Muscular Atrophy (SMA) market. These factors have significantly improved patient access to high-cost, life-saving treatments, thereby enhancing the overall quality of care for individuals with SMA. In regions like North America and Europe, comprehensive reimbursement frameworks have been established for key SMA treatments such as Spinraza (Nusinersen) and Zolgensma (Onasemnogene abeparvovec). These frameworks ensure that the majority of patients can afford these expensive therapies, which can cost upwards of $2 million for a single treatment course. For instance, Zolgensma, a one-time gene therapy, is fully reimbursed in several countries, including the United States, Japan, and certain European nations, making it accessible to a broader patient population. Similarly, Spinraza is covered by many national health services and private insurers, further expanding its reach.

The trend towards increased accessibility is also evident in the Asia-Pacific region, where countries like Japan and China are enhancing their healthcare infrastructure and reimbursement policies to accommodate these advanced therapies. In Japan, Zolgensma was approved with reimbursement coverage, significantly boosting its accessibility. China is also progressing towards implementing supportive reimbursement schemes, reflecting a global shift towards better access to SMA treatments. Moreover, pharmaceutical companies are engaging in strategic partnerships with healthcare providers and insurance companies to facilitate better access. These collaborations often involve risk-sharing agreements, where payment is contingent on the treatment's effectiveness, thus reducing the financial burden on healthcare systems and ensuring that patients receive necessary care without prohibitive costs.

Public and private funding initiatives are further supporting this trend. Governments and non-profit organizations are increasingly providing financial assistance and grants to support SMA patients, particularly in low-income regions. This financial support is crucial for ensuring that all patients, regardless of economic status, can access the latest SMA therapies. Moreover, increased accessibility and favorable reimbursement policies are key trends driving the SMA market, ensuring that life-saving treatments are available to a wider patient population and fostering significant market growth.

Request for Customization: https://www.imarcgroup.com/request?type=report&id=6930&flag=E

Leading Companies in the Spinal Muscular Atrophy Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global spinal muscular atrophy market, several leading companies are at the forefront of developing innovative therapies and treatments that significantly improve the quality of life for patients. Some of the major players include Biogen, Novartis, PTC Therapeutics, and Roche. These companies have made substantial investments in research and development, leading to groundbreaking advancements in the field.

Biogen has partnered with Alcyone Therapeutics to develop an implantable device aimed at improving the delivery of Spinraza. This device, the ThecaFlex DRx System, is designed to allow subcutaneous administration of the drug, making the treatment process less burdensome for patients who currently require lumbar punctures for drug delivery. This development is expected to enhance patient comfort and adherence to the treatment regimen.

Moreover, Novartis has recently shared significant advancements and positive results related to their gene therapy, Zolgensma, for treating Spinal Muscular Atrophy (SMA). New long-term data presented in 2023 highlight the sustained benefits of Zolgensma up to 7.5 years post-dosing. Children treated with Zolgensma prior to symptom onset achieved and maintained all assessed motor milestones, including independent walking. Furthermore, Novartis continues to expand the global reach of Zolgensma, now approved in over 51 countries, with more than 3,700 patients treated worldwide.

Besides this, PTC Therapeutics, in collaboration with Roche, has developed Evrysdi (Risdiplam), which underscores its significant role in the SMA market. Additionally, the U.S. FDA granted Priority Review for Evrysdi, acknowledging the drug's significant impact on treating pre-symptomatic infants with SMA. The interim data from the RAINBOWFISH study showed that 80% of these infants achieved motor milestones such as sitting without support, rolling, crawling, and even walking independently after at least 12 months of treatment.

Regional Analysis:

The major markets for spinal muscular atrophy include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for spinal muscular atrophy while also representing the biggest market for its treatment. This can be attributed to the country's advanced healthcare infrastructure, which facilitates the early diagnosis and treatment of SMA.

Moreover, the availability of cutting-edge medical technologies and specialized healthcare professionals enhances patient care and management, contributing to a larger identified patient pool. Additionally, extensive public awareness and screening programs help in the early detection of SMA, further increasing the patient count. The United States also benefits from substantial investment in medical research and development, leading to the rapid introduction and adoption of innovative SMA therapies.

Additionally, the high prevalence of SMA in the U.S. is supported by robust insurance coverage and reimbursement policies, which make expensive treatments more accessible to a broader population. The presence of leading pharmaceutical companies and numerous clinical trials in the country also drives the market for SMA treatment.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

This report offers a comprehensive analysis of current spinal muscular atrophy marketed drugs and late-stage pipeline drugs.

In-Market Drugs

IMARC Group Offer Other Reports:

Antipsychotic Drugs Market: The global antipsychotic drugs market size reached US$ 16.3 Billion in 2023, and projected to reach US$ 28.2 Billion by 2032, exhibiting a growth rate (CAGR) of 6.2% during the forecast period from 2024 to 2032.

Autologous Stem Cell and Non-Stem Cell Based Therapies Market: The global autologous stem cell and non-stem cell based therapies market size reached US$ 7.7 Billion in 2023, and projected to reach US$ 21.6 Billion by 2032, exhibiting a growth rate (CAGR) of 11.87% during the forecast period from 2024 to 2032.

Cell and Gene Therapy Market: The global cell and gene therapy market size reached US$ 18.8 Billion in 2023. , and projected to reach US$ 60.1 Billion by 2032, exhibiting a growth rate (CAGR) of 15.66% during the forecast period from 2024 to 2032.

Dermatology Devices Market: The global dermatology devices market size reached US$ 16.1 Billion in 2023, and projected to reach US$ 34.4 Billion by 2032, exhibiting a growth rate (CAGR) of 8.6% during the forecast period from 2024 to 2032.

Emergency Contraceptive Pills Market: The global emergency contraceptive pills market size reached US$ 585.9 Million in 2023, and projected to reach US$ 814.3 Million by 2032, exhibiting a growth rate (CAGR) of 3.5% during the forecast period from 2024 to 2032.

G-Protein Coupled Receptors (GPCRs) Market: The global G-protein coupled receptors (GPCRs) market size reached US$ 3.4 Billion in 2023, and projected to reach US$ 5.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.69% during the forecast period from 2024 to 2032.

Healthcare Business Intelligence Market: The global healthcare business intelligence market size reached US$ 9.0 Billion in 2023, and projected to reach US$ 27.4 Billion by 2032, exhibiting a growth rate (CAGR) of 13.1% during the forecast period from 2024 to 2032.

Heart Health Ingredients Market: The global heart health ingredients market size reached US$ 17.9 Billion in 2023, and projected to reach US$ 30.1 Billion by 2032, exhibiting a growth rate (CAGR) of 5.94% during the forecast period from 2024 to 2032.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800

The market is driven by advancements in gene therapy and the increasing availability of targeted treatments. Key drugs like Spinraza and Zolgensma dominate the market due to their effectiveness and widespread adoption, supported by favorable reimbursement policies. Additionally, the oral drug Evrysdi is gaining traction for its ease of administration, which further propels the market expansion.

Advancements in Gene Therapy: Driving the Spinal Muscular Atrophy Market

Advancements in gene therapy are a prominent trend in the Spinal Muscular Atrophy (SMA) industry, transforming the treatment landscape for this devastating condition. The most remarkable achievement is the development and approval of Zolgensma (Onasemnogene abeparvovec-xioi), a gene therapy that has significantly improved the prognosis for SMA patients. Zolgensma, approved by the US FDA in 2019, is intended to treat the genetic root cause of SMA by delivering a functioning copy of the SMN1 gene to motor neuron cells, restoring normal function and improving patient outcomes. Zolgensma's influence on the market is significant. It provides a single intravenous infusion that replaces the faulty or missing SMN1 gene with a new, functional copy, effectively stopping the disease's development. Clinical trials have demonstrated that Zolgensma significantly improves motor function and survival rates in babies, making it a game-changing alternative for early intervention. This therapy has set a new standard for SMA treatment, changing the focus from symptom management to possibly curative treatments.

Request a PDF Sample Report: https://www.imarcgroup.com/spinal-muscular-atrophy-market/requestsample

Companies like Biogen and Novartis, along with smaller biotech firms, are investing heavily in advancing gene therapy technologies to expand their treatment portfolios. The promising results from ongoing trials are expected to lead to more approvals, offering hope to SMA patients and their families. Moreover, the market growth is fueled by supportive reimbursement policies and increasing accessibility. In regions like North America and Europe, Zolgensma is fully reimbursed, enhancing its availability to patients. This positive reimbursement environment is expected to drive the adoption of gene therapies, further boosting market expansion. Advancements in gene therapy, epitomized by the success of Zolgensma, are a major trend in the SMA market, offering transformative treatment options that address the genetic underpinnings of the disease, improving patient outcomes, and driving significant market growth.

Expanding Drug Pipeline and Approvals: Contributing to Market Expansion

The expanding drug pipeline and increasing number of approvals are pivotal trends in the Spinal Muscular Atrophy (SMA) market, significantly enhancing treatment options and outcomes for patients. Over the past few years, the development of novel therapeutics has accelerated, driven by a deeper understanding of the disease's genetic basis and advancements in biotechnology. Key drugs like Spinraza (Nusinersen) and Evrysdi (Risdiplam) have already transformed the treatment landscape, providing effective management options for various SMA types. Spinraza, developed by Biogen, was the first FDA-approved treatment for SMA and has been a cornerstone in SMA management. Administered intrathecally, Spinraza has shown significant efficacy in improving motor function and survival rates across different SMA types. Its success has paved the way for further innovations in SMA therapeutics. Following Spinraza, Roche’s Evrysdi, an oral medication, gained FDA approval, offering a more convenient administration route, which has been particularly beneficial for pediatric and adult patients. Evrysdi's approval marked a significant milestone, providing a non-invasive alternative that enhances patient compliance and accessibility.

The drug pipeline for SMA is robust, with several promising candidates in various stages of clinical trials. Companies like Novartis, Biogen, and Roche are at the forefront, developing new treatments that aim to improve upon existing therapies. For instance, SRK-015 by Scholar Rock, a muscle-directed therapy, is in late-stage trials and has shown potential to enhance muscle strength and function in SMA patients. Additionally, gene therapy advancements are also contributing to the expanding pipeline. The success of Zolgensma has encouraged further research in gene replacement and editing technologies, aiming to provide long-term solutions for SMA. The competitive landscape is vibrant, with numerous collaborations, licensing agreements, and mergers and acquisitions driving innovation and market growth. Moreover, the expanding drug pipeline and increasing approvals are transforming the SMA market by introducing more effective and accessible treatments, ultimately improving the quality of life for patients and driving substantial market growth.

Buy Full Report: https://www.imarcgroup.com/checkout?id=6930&method=587

Increased Accessibility and Reimbursement:

Increased accessibility and favorable reimbursement policies are critical trends driving the growth of the Spinal Muscular Atrophy (SMA) market. These factors have significantly improved patient access to high-cost, life-saving treatments, thereby enhancing the overall quality of care for individuals with SMA. In regions like North America and Europe, comprehensive reimbursement frameworks have been established for key SMA treatments such as Spinraza (Nusinersen) and Zolgensma (Onasemnogene abeparvovec). These frameworks ensure that the majority of patients can afford these expensive therapies, which can cost upwards of $2 million for a single treatment course. For instance, Zolgensma, a one-time gene therapy, is fully reimbursed in several countries, including the United States, Japan, and certain European nations, making it accessible to a broader patient population. Similarly, Spinraza is covered by many national health services and private insurers, further expanding its reach.

The trend towards increased accessibility is also evident in the Asia-Pacific region, where countries like Japan and China are enhancing their healthcare infrastructure and reimbursement policies to accommodate these advanced therapies. In Japan, Zolgensma was approved with reimbursement coverage, significantly boosting its accessibility. China is also progressing towards implementing supportive reimbursement schemes, reflecting a global shift towards better access to SMA treatments. Moreover, pharmaceutical companies are engaging in strategic partnerships with healthcare providers and insurance companies to facilitate better access. These collaborations often involve risk-sharing agreements, where payment is contingent on the treatment's effectiveness, thus reducing the financial burden on healthcare systems and ensuring that patients receive necessary care without prohibitive costs.

Public and private funding initiatives are further supporting this trend. Governments and non-profit organizations are increasingly providing financial assistance and grants to support SMA patients, particularly in low-income regions. This financial support is crucial for ensuring that all patients, regardless of economic status, can access the latest SMA therapies. Moreover, increased accessibility and favorable reimbursement policies are key trends driving the SMA market, ensuring that life-saving treatments are available to a wider patient population and fostering significant market growth.

Request for Customization: https://www.imarcgroup.com/request?type=report&id=6930&flag=E

Leading Companies in the Spinal Muscular Atrophy Market:

The market research report by IMARC encompasses a comprehensive analysis of the competitive landscape in the market. Across the global spinal muscular atrophy market, several leading companies are at the forefront of developing innovative therapies and treatments that significantly improve the quality of life for patients. Some of the major players include Biogen, Novartis, PTC Therapeutics, and Roche. These companies have made substantial investments in research and development, leading to groundbreaking advancements in the field.

Biogen has partnered with Alcyone Therapeutics to develop an implantable device aimed at improving the delivery of Spinraza. This device, the ThecaFlex DRx System, is designed to allow subcutaneous administration of the drug, making the treatment process less burdensome for patients who currently require lumbar punctures for drug delivery. This development is expected to enhance patient comfort and adherence to the treatment regimen.

Moreover, Novartis has recently shared significant advancements and positive results related to their gene therapy, Zolgensma, for treating Spinal Muscular Atrophy (SMA). New long-term data presented in 2023 highlight the sustained benefits of Zolgensma up to 7.5 years post-dosing. Children treated with Zolgensma prior to symptom onset achieved and maintained all assessed motor milestones, including independent walking. Furthermore, Novartis continues to expand the global reach of Zolgensma, now approved in over 51 countries, with more than 3,700 patients treated worldwide.

Besides this, PTC Therapeutics, in collaboration with Roche, has developed Evrysdi (Risdiplam), which underscores its significant role in the SMA market. Additionally, the U.S. FDA granted Priority Review for Evrysdi, acknowledging the drug's significant impact on treating pre-symptomatic infants with SMA. The interim data from the RAINBOWFISH study showed that 80% of these infants achieved motor milestones such as sitting without support, rolling, crawling, and even walking independently after at least 12 months of treatment.

Regional Analysis:

The major markets for spinal muscular atrophy include the United States, Germany, France, the United Kingdom, Italy, Spain, and Japan. According to projections by IMARC, the United States has the largest patient pool for spinal muscular atrophy while also representing the biggest market for its treatment. This can be attributed to the country's advanced healthcare infrastructure, which facilitates the early diagnosis and treatment of SMA.

Moreover, the availability of cutting-edge medical technologies and specialized healthcare professionals enhances patient care and management, contributing to a larger identified patient pool. Additionally, extensive public awareness and screening programs help in the early detection of SMA, further increasing the patient count. The United States also benefits from substantial investment in medical research and development, leading to the rapid introduction and adoption of innovative SMA therapies.

Additionally, the high prevalence of SMA in the U.S. is supported by robust insurance coverage and reimbursement policies, which make expensive treatments more accessible to a broader population. The presence of leading pharmaceutical companies and numerous clinical trials in the country also drives the market for SMA treatment.

Key information covered in the report.

Base Year: 2023

Historical Period: 2018-2023

Market Forecast: 2024-2034

Countries Covered

- United States

- Germany

- France

- United Kingdom

- Italy

- Spain

- Japan

- Historical, current, and future epidemiology scenario

- Historical, current, and future performance of the spinal muscular atrophy market

- Historical, current, and future performance of various therapeutic categories in the market

- Sales of various drugs across the spinal muscular atrophy market

- Reimbursement scenario in the market

- In-market and pipeline drugs

This report offers a comprehensive analysis of current spinal muscular atrophy marketed drugs and late-stage pipeline drugs.

In-Market Drugs

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

- Drug Overview

- Mechanism of Action

- Regulatory Status

- Clinical Trial Results

- Drug Uptake and Market Performance

IMARC Group Offer Other Reports:

Antipsychotic Drugs Market: The global antipsychotic drugs market size reached US$ 16.3 Billion in 2023, and projected to reach US$ 28.2 Billion by 2032, exhibiting a growth rate (CAGR) of 6.2% during the forecast period from 2024 to 2032.

Autologous Stem Cell and Non-Stem Cell Based Therapies Market: The global autologous stem cell and non-stem cell based therapies market size reached US$ 7.7 Billion in 2023, and projected to reach US$ 21.6 Billion by 2032, exhibiting a growth rate (CAGR) of 11.87% during the forecast period from 2024 to 2032.

Cell and Gene Therapy Market: The global cell and gene therapy market size reached US$ 18.8 Billion in 2023. , and projected to reach US$ 60.1 Billion by 2032, exhibiting a growth rate (CAGR) of 15.66% during the forecast period from 2024 to 2032.

Dermatology Devices Market: The global dermatology devices market size reached US$ 16.1 Billion in 2023, and projected to reach US$ 34.4 Billion by 2032, exhibiting a growth rate (CAGR) of 8.6% during the forecast period from 2024 to 2032.

Emergency Contraceptive Pills Market: The global emergency contraceptive pills market size reached US$ 585.9 Million in 2023, and projected to reach US$ 814.3 Million by 2032, exhibiting a growth rate (CAGR) of 3.5% during the forecast period from 2024 to 2032.

G-Protein Coupled Receptors (GPCRs) Market: The global G-protein coupled receptors (GPCRs) market size reached US$ 3.4 Billion in 2023, and projected to reach US$ 5.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.69% during the forecast period from 2024 to 2032.

Healthcare Business Intelligence Market: The global healthcare business intelligence market size reached US$ 9.0 Billion in 2023, and projected to reach US$ 27.4 Billion by 2032, exhibiting a growth rate (CAGR) of 13.1% during the forecast period from 2024 to 2032.

Heart Health Ingredients Market: The global heart health ingredients market size reached US$ 17.9 Billion in 2023, and projected to reach US$ 30.1 Billion by 2032, exhibiting a growth rate (CAGR) of 5.94% during the forecast period from 2024 to 2032.

Contact US

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Phone Number: - +1 631 791 1145, +91-120-433-0800