The Dementia Discovery Fund (DDF), a venture capital fund focused solely on dementia-related investments, completed $350 million of fundraising. The initial target was $200 million.

The Dementia Discovery Fund (DDF), a London-based venture capital fund focused solely on dementia-related investments, completed $350 million of fundraising. The initial target was $200 million.

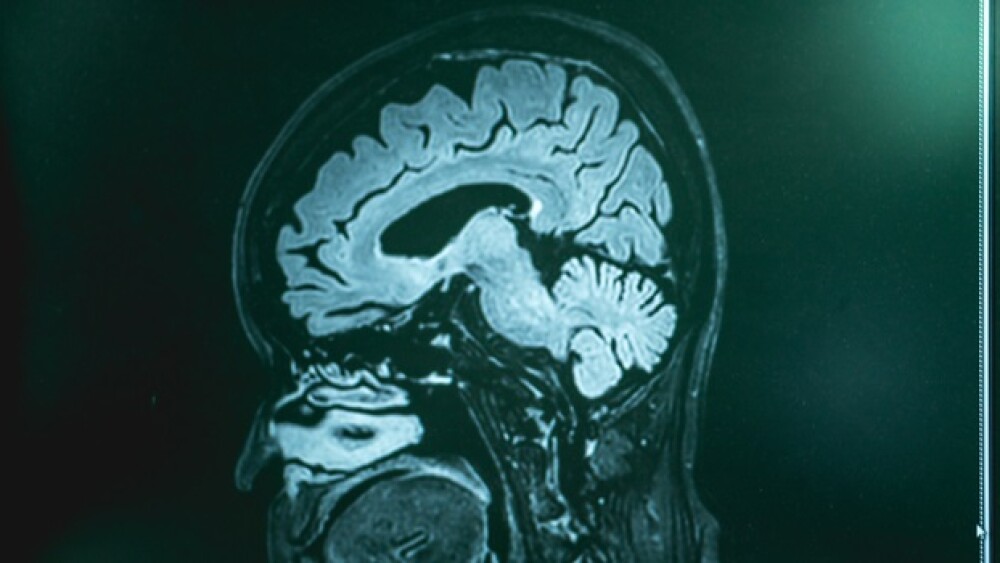

Managed by SV Health, DDF makes early-stage venture capital investments into companies that are working on novel disease-modifying therapies for all types of dementia, including Alzheimer’s disease. It was formed via a collaboration of Biogen, Eli Lilly and Company, GlaxoSmithKline, Johnson & Johnson, Otsuka (Astex), Pfizer and Takeda, the UK Department of Health and Social Care, and the charity Alzheimer’s Research UK (ARUK). It has already invested in 16 organizations looking at new approaches to treating dementia.

The fund hit its goal with a $60 million from the U.S. AARP, specifically AARP’s Brain Health Fund. It also has commitments from new investors UnitedHealth Group, Aegon, Quest Diagnostics, British Patient Capital and several others. Its investor base includes Bill Gates, Woodford Investment Management via Woodford Patient Capital Trust (WPCT), and the NFL Players Association.

“Since we first launched the DDF, we have made significant progress in identifying and supporting some of the most impressive science in neurodegeneration,” said Kate Bingham, managing partner of SV Health Investors, in a statement. “The investment from the AARP is further recognition of the potential of our unique approach to finding important treatments for dementia that alter the course of disease and, potentially, a broad range of associated neurodegenerative disorders.”

She added, “The investment will also provide the DDF with broader reach, access and visibility to the older community, for whom dementia is a growing risk. At the DDF, we are focused on scientific approaches that look beyond the amyloid beta pathway into other areas, such as inflammation, mitochondrial function and the preservation and enhancement of healthy brain cells. These areas are highly likely to be important to chronic traumatic encephalopathy or traumatic brain injury, leading to renewed hope for treatment of these terrible disorders.”

In addition to the fundraising, the DDF appointed Angus Grant as chief executive officer. Grant was most recently corporate vice president, Business Development at Celgene. Before joining Celgene, he held various business development and regulatory affairs positions at Novartis, Merck KGaA/EMD, RPR/Gencell and SmithKline Beecham. Before joining the industry, Grant held positions at the U.S. National Institutes of Health (NIH) and the U.S. Food and Drug Administration (FDA).

AARP is the largest non-profit, nonpartisan organization in the U.S., with a focus on empowering individuals 50 years and older to “choose how they live as they age.” It has almost 38 million members.

In its own statement, AARP said, “For six decades, AARP has focused on finding solutions that improve the lives of older Americans, and we will continue to do so as the challenges that each generation faces change. Only 12 years from now, the first millennials will be turning 49, Gen Xers will begin turning 65 and the first boomers will be turning 84—an age at which dementia is most prevalent. By making this investment, our hope is that, by then, we can add finding a treatment and ultimately a cure for dementia to the list of battles we have won.”