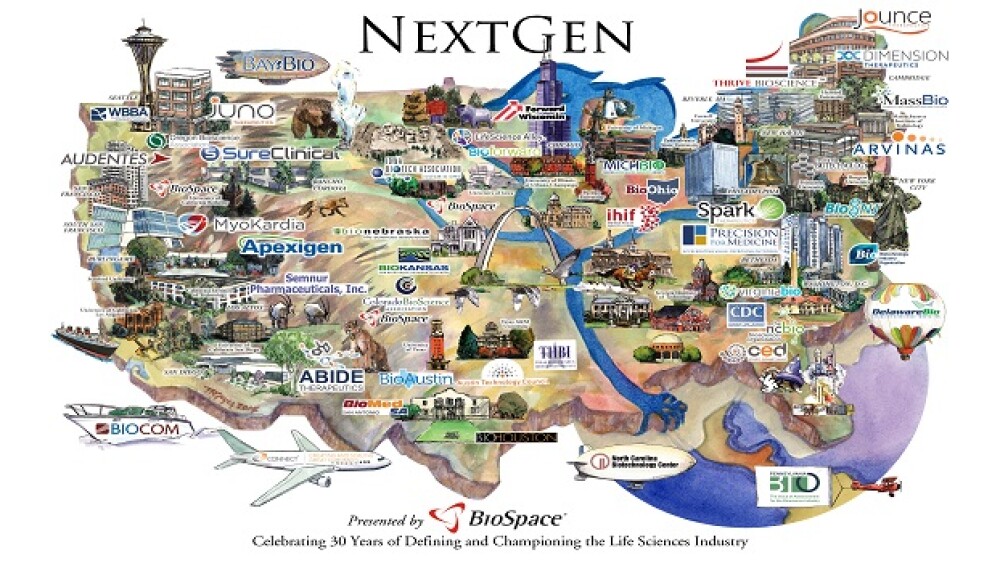

BioSpace is delighted to present its NextGen Bio “Class of 2015.” This list contains 30 life science companies that were launched no earlier than in 2011 and are headquartered in the United States.

BioSpace is delighted to present its NextGen Bio “Class of 2015.” This list contains 30 life science companies that were launched no earlier than in 2011 and are headquartered in the United States. Once the companies were sorted into that group, they were then weighted by a number of different categories and ranked in a cumulative fashion based on the points awarded each category. Those categories are: Finance, Collaborations, Pipeline, Sales and Editorial (view methodology).

The NextGen Bio Class of 2015 is filled with a stellar group of companies that are making an enormous impact on the industry now and in the future. Congratulations!

“This recognition is a testament to how hard we are working to bring transformative cancer therapies to market. Being named the most promising biopharma startup speaks to the milestones we have achieved in less than a year, including two funding rounds and significant progress in clinical development. It has been an exciting year, but we are even more excited about the progress still to come,” Hans Bishop, chief executive officer of Juno Therapeutics, Inc., told BioSpace.

Top 30 Life Science Startups to Watch in the U.S.

Points: 43

Founded: 2013

Location: Seattle, Wash.

Notable:

• Juno Therapeutics is partnered with Fred Hutchinson Cancer Research Center, the Memorial Sloan-Kettering Cancer Center, and Seattle Children’s Research Institute. In addition to the three cancer centers, additional investors included Arch Venture Partners and Crestline (Alaska Permanent Fund invested through CLAlaska LP, a partnership managed by Crestline Investors).

• Currently has at least three clinical trials ongoing: 4-1BB; CD29; and 4-1BB.

• The initial Series A investment was $120 million.

• A secondary Series A round was completed in April 2014 with $176 million in fully committed funds additional investment came from founding investors as well as investments from Bezos Expeditions, Venrock, and others.

• Two of the company’s founders, Drs. Michel Saelain and Renier J. Brentjens won the New York Intellectual Property Law Association’s “Inventor of the Year” award for their work in the design of chimeric antigen receptors (CARs), a major part of the company’s therapeutic platform.

• In August 2014, the company closed its Series round with $134 million in new investment (between the Series A and B rounds, the company has raised more than $300 million in less than 12 months).

2. MyoKardia

Points: 38

Founded: 2012

Location: San Francisco, Calif.

Notable:

• MyoKardia had raised $52 million in three rounds from a single investor. The most recent round was for $10 million in August 2014.

• In May 2014, the company announced the launch of the Sarcomeric Human Cardiomyopathy Registry (ShaRe), a multi-center, international repository of clinical data on individuals with genetic heart disease.

• In September 2014, MyoKardia signed an agreement with Sanofi to collaborate to discover and develop first-of-its-kind targeted therapeutics for heritable heart diseases known as cardiomyopathies. The collaboration provides up to $200 million in equity investments, milestone payments and R&D services through 2018, of which $45 million has already been received in an upfront licensing fee and an initial equity investment.

3. Spark Therapeutics

Points: 33

Founded: 2013

Location: Philadelphia, Penn.

Notable:

• The company was launched in 2013 with a $50 million capital commitment from The Children’s Hospital of Philadelphia (CHOP) to advance and commercialize multiple ongoing gene therapy programs, including its lead candidate for RPE65-related blindness, currently in Phase 3 clinical trials.

• Raised $122.8 million in two rounds from 7 investors.

• Spark has a Phase 1 & 2 program in hemophilia B.

• Spark has a preclinical program to look at neurodegenerative diseases and other inherited retinal dystrophies and hematologic disorders.

• In March 2014, Spark announced a collaboration agreement with Genable Technologies for Genable’s lead therapeutic to treat rhodopsin-linked autosomal dominant retinitis pigmentosa (RHO adRP), GT038.

• In May 2014, Spark completed a Series B financing round worth $72.8 million led by Sofinnova Ventures. It was joined by Brookside Capital, Deerfield Management Company, Rock Springs Capital and others.

4. Apexigen

Points: 27

Founded: 2013

Location: Burlingame, Calif.

Notable:

• Of the company’s seven candidates, four are currently the subject of development partnerships with leading life science companies. The partnerships are with: Simcere Pharmaceutical Group; 3Sbio, Inc.; Jiangsu T-mab Biotechnology, Ltd.; Shanghai Duyiwei Biotechnology Ltd.; Janssen Biotech (a Johnston & Johnston Company); Alcon Research (a division of Novartis); and TORAY Industries.

• In August 2013, Apexigen secured $20 million in Series A1 financing led by Amkey Ventures LLC, WSR Capital, China Development Industrial Bank, Themese Investment Partners, and Sycamore Ventures.

• In 2012, Apexigen signed a manufacturing supply agreement with Boehringer Ingelheim.

5. Audentes Therapeutics

Points: 25

Founded: 2013

Location: San Francisco, Calif.

Notable:

• In July 2013, the company received $30 million in Series A financing from Versant Ventures, 5AM Ventures, and OrbiMed Advisors.

• For its lead programs, Audentes is collaborating with Genethon, Joshua Frase Foundation, myotubular trust, University of Florida, Children’s Hospital Boston and ReGenX Biosciences.

• In July 2013, Audentes entered into an agreement with REGENX Biosciences, LLC for the development and commercialization of their lead products.

6. Aerpio Therapeutics

Points: 24

Founded: 2011

Location: Cincinnati, OH

Notable:

• Received $5 million in undisclosed seed financing in 2012.

• Raised $27 million in Series A financing in August 2012 from five investors.

• Raised $9 million in Series A financing in November 2013 from five investors.

• Raised $22 million in venture capital in April 2014.

7. Alector

Points: 23

Founded: 2013

Location: San Francisco, Calif.

Notable:

• In October 2013, Alector closed on Series A financing led by Polaris Venture Partners and OrbiMed Advisors for an undisclosed amount.

• In March 2014, Janssen Pharmaceuticals, the pharmaceutical arm of Johnson & Johnson, agreed to help fund Alector’s efforts to develop new therapies for Alzheimer’s. No financial terms were disclosed.

8. Dimension Therapeutics

Points: 22

Founded: 2013

Location: Cambridge, MA

Notable:

• In conjunction with its launch, Dimension has entered into an exclusive license and collaboration with REGENX Biosciences. REGENX holds exclusive rights to a portfolio of over 100 patents and patent applications pertaining to its NAV vector technology and related applications.

• The company raised $35 million in two rounds from two investors in 2014.

• Dimension entered into a collaboration in June 2014 with Bayer HealthCare for the development and commercialization of a novel gene therapy for the treatment of hemophilia A.

9. Abide Therapeutics

Points: 17

Founded: 2011

Location: San Diego, Calif.

Notable:

• In 2013, Abide entered into a collaboration agreement with Merck to discover, develop and commercialize small-molecule therapies directed against three novel targets to treat metabolic diseases with a focus on type 2 diabetes. Milestone payments for the three products could reach $430 million.

• In February 2014, Abide entered into a strategic collaboration with Celgene Corporation to discover and develop new drugs in inflammation and immunology.

• In 2011, the company received $2.3 million in seed financing.

10. NextCode Health

Points: 17

Founded: 2013

Location: Cambridge, Mass.

Notable:

• The company launched in 2013 as a spinout from deCODE genetics. It also secured $15 million Series A financing from Polaris Partners and ARCH Venture Partners.

• The company has several service agreements with clinical centers, including Queensland University (Australia), Boston Children’s Hospital (U.S.), Newcastle University (U.K.) and Saitama University (Japan).

11. Precision For Medicine

Points: 17

Founded: 2012

Location: Bethesda, MD

Notable:

• In March 2014, the company announced the acquisition of Hobart Group Holdings, LLC, a market access firm.

• Originally financed by $150 million in equity capital from J.H. Whitney and Oak Investment Partners. Some of the money was used to acquire a state-of-the-art biobanking biorespository, which stores and manages human tissues. The samples are tested to provide information about the patient’s history, genetics, and individual needs.

12. Navitor Pharmaceuticals

Points: 16

Founded: 2014

Location: Cambridge, Mass.

Notable:

• Navitor launched with $32.5 million Series A financing with investors including Polaris Partners, Atlas Venture, Johnson & Johnson Development Corporation, SR One, and The Longevity Fund.

13. Arcturus Therapeutics

Points: 15

Founded: 2013

Location: San Diego, Calif.

Notable:

• In June 2013, Arcturus raised $1.3 million from multiple individual investors.

• In August 2013, the company acquired usiRNA Technology and UNA Patent Estate from Marina Biotech.

• In October 2013, Arcturus raised $5 million in a Series A funding round.

14. Jounce Therapeutics

Points: 14

Founded: 2013

Location: Cambridge, Mass.

Notable:

• Launched in 2013 with $47 million in Series A venture capital financing by Third Rock Ventures.

• Company founder Jim Allison won the Breakthrough Prize in Life Sciences in December 2013 for his research on the biology of T cells; in 2014, the National Foundation for Cancer Research (NFCR) awarded him the Szent-Gyorgyi Prize for Progress in Cancer Research that led to the successful development of “immune checkpoint therapy,” and the first FDA-approved drug for the treatment of metastatic melanoma.

• In January 2014, Jounce announced a partnership with Adimab, LLC, a leader in the discovery of monoclonal and biospecific antibodies.

15. Editas Medicine

Points: 13

Founded: 2013

Location: Cambridge, Mass.

Notable:

• The company was founded in 2013 with $43 million in Series A venture capital provided by Flagship Ventures, Polaris Partners, Third Rock Ventures, and the Partners Innovation Fund.

• In April 2014, The Broad Institute and MIT announced the first patent in the U.S. for an engineered CRISPR-Cas9 system that allows scientists to modify genes and better understand the biology of living cells and organisms. One of the co-founders of Editas, Feng Zhang, is a Broad core member and inventor, as well as the senior author of the 2013 “Science” paper that showed that Cas9 can be harnessed to modify DNA in mammalian cells.

16. Middle Peak Medical

Points: 12

Founded: 2011

Location: Palo Alto, Calif.

Notable:

• Middle Peak raised $8.5 million in Series A financing in June 2013, co-led by Wellington Partners and Seventure Partners, along with High-Tech Grunderfonds Management GmbH (HTGF).

• In October 2013, the company raised an additional $3 million in a second closing. Additional investors included bioMedInvest II LP and Edwards LifeSciences.

17. Thesan Pharmaceuticals

Points: 12

Founded: 2011

Location: Carlsbad, Calif.

Notable:

• Thesan Pharmaceuticals raised $65 million in two rounds from seven investors. The most recent was in February 2014, with $49 million in Series B financing.

• Investors include Novo Ventures, Novartis Venture Funds, SV Life Sciences and Lundbeckfond Ventures.

18. Scioderm

Points: 11

Founded: 2012

Location: Durham, NC

Notable:

• In 2013, Scioderm closed a $16 million Series A financing round.

• In 2013, the FDA allowed the IND for SD-101 to proceed.

• In December 2013, the Committee for Orphan Medicinal Products (COMP) gave a positive opinion on the company’s application for orphan status for SD-101.

• In January 2014, SD-101 received Orphan Designation in Europe.

• In September 2014, the company presented positive data on Orblisa (SD-101) from its recently completed Phase 2b study.

19. Sitari Pharmaceuticals

Points: 11

Founded: 2013 (Spinoff from Avalon Ventures and GSK)

Location: San Diego, Calif.

Notable:

• Sitari raised $10 million in Series A financing and R&D support from Avalon and GSK for the development of novel treatments for celiac disease.

• Avalon had also established COI Pharmaceuticals, a venture-pharma entity that will provide operational support and a fully equipped R&D facility, as well as an experienced leadership team to Sitari and future companies the collaboration might develop.

20. Alcresta

Points: 7

Founded: 2011

Location: Newton, Mass.

Notable:

• The company has raised $20 million in two rounds from three investors.

• In April 2014, the company signed an agreement with Cystic Fibrosis Foundation Therapeutics (CFFT) to accelerate the development of the company’s enzyme-based point-of-care products to support the nutritional status of people with CF.

21. SureClinical

Points: 7

Founded: 2012

Location: Rancho Cordova, Calif.

Notable:

• In August 2013, SureClinical successfully completed an FDA 21 CFR Part 11 compliance audit on its SureTrial eTMF clinical trials content management application.

• SSAE-16 Type I and Type II Attestation, PCI Compliance, FDA CFR Part 11 Application Certification, U.S. Commerce Department Safe Harbor Certifications.

22. Syros Pharmaceuticals

Points: 7

Founded: 2013

Location: Watertown, Mass.

Notable:

• The company launched in 2013 with $30 million in Series A financing.

• In December 2013, company founder Nathanael Gray was the sole recipient of the 2013 Meyenburg Cancer Research Award, recognized for his work in developing first-in-class chemical inhibitors for wild-type and mutant forms of protein kinases, which can be used to validate new potential targets to treat cancer and other diseases.

23. Global Blood Therapeutics

Points: 6

Founded: 2012

Location: San Francisco, Calif.

Notable:

• The company was founded in 2012 with a $40.7 million Series A financing round backed by Third Rock Ventures.

• In November 2013, the company announced data on its lead program in sickle cell disease to the 55th American Society of Hematology (ASH) Annual Meeting and Exposition.

24. Semnur Pharmaceuticals

Points: 6

Founded: 2013

Location: Los Altos, Calif.

Notable:

• The company raised $6 million in venture capital in August 16, 2013.

25. Synchroneuron

Points: 5

Founded: 2011

Location: Duxbury, Mass.

Notable:

• In 2012, the company raised $6 million in Series A financing from Morningside Technology Ventures.

• In February 2014, the company started a Phase 2, multi-center clinical trial for SNC-102.

• In July 2014, the company raised $20 million in Series B financing with Morningside Technology Advisory LLC.

26. Thrive Biosciences

Points: 5

Founded: 2014

Location: Beverly, Mass.

Notable:

• The company was founded by entrepreneurs and life sciences veterans Gary Paul Magnant, Thomas Forest Farb, and Dr. Alan P. Blanchard.

• Magnant is co-founder and current advisor to the Life Science Consortium of the North Shore, as well as former CEO of Sage Science.

27. Cerephex

Points: 3

Founded: 2012

Location: Los Gatos, Calif.

Notable:

• In 2012, the company raised $5.9 million in Series A financing from three investors.

• In 2010, the company was granted a patent for its foundational signal modulation technology (also patented in Australia).

• In 2012, the company published data from its clinical trials for its RINCE cortical stimulation technology, which showed significant improvement in key fibromyalgia symptoms.

28. Cibiem

Points: 3

Founded: 2012

Location: Los Altos, Calif.

Notable:

• The company launched in 2010 with a $10 million Series A round led by SV Life Sciences and Third Rock Ventures.

• The company’s technology is being tested in first-in-man clinical trials.

29. Cydan

Points: 3

Founded: 2013

Location: Cambridge, Mass.

Notable:

• Cydan launched in 2013 with $26 million in financing led by New Enterprise Associates (NEA), Pfizer Venture Investments, Lundbeckfond Ventures and Bay City Capital with participation from Alexandria Real Estate Equities, Inc.

30. Arvinas

Points: 2

Founded: 2013

Location: New Haven, Conn.

Notable:

• Arvinas was launched with $15 million in Series A financing. Investors included Elm Street ventures, 5AM Ventures, Connecticut Innovations, and Canaan Partners. It raised $4.25 million in financial support, $1 million which was in the form of equity from the Connecticut Department of Economic and Community Development and Connecticut Innovations.

|